Jitalia17

The Vanguard Long-Term Bond ETF (NYSEARCA:BLV) provides an extremely low-cost way to gain exposure to long-duration treasuries and investment grade corporate bonds.

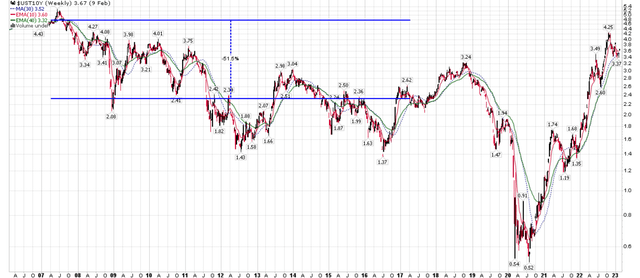

If investors believe inflation has peaked and the Fed has achieved a ‘soft landing’, then now may be a ‘fair price’ for the BLV ETF, as 10Yr treasury yields have essentially returned to the middle of the 2000 to 2017 ‘low inflation’ range.

However, I personally believe inflation may rebound in the coming months and that the Fed will maintain a ‘higher for longer’ policy stance. This means that there is an upwards bias to treasury yields, and a valuation headwind to the BLV ETF.

Fund Overview

The Vanguard Long-Term Bond ETF provides exposure to both long-duration treasuries and corporate bonds. It tracks the performance of the Bloomberg U.S. Long Government/Credit Float Adjusted Index (“Index”), an index designed to measure the performance of U.S. government, investment grade (“IG”) corporate, and IG international dollar-denominated bonds with maturity greater than 10 years.

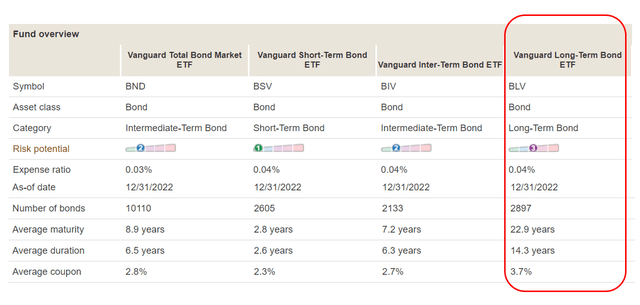

Across Vanguard’s portfolio of diversified bond ETFs, the BLV has the highest average duration, at 14.3 years (Figure 1).

Figure 1 – BLV has highest duration out of Vanguard’s diversified bond ETFs (vanguard.com)

The BLV ETF has $7.4 billion in assets and charges a Vanguard-like 0.04% expense ratio.

Portfolio Holdings

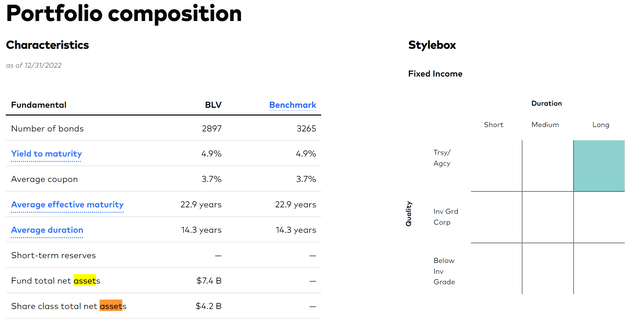

Figure 2 shows the portfolio composition of the BLV ETF. As mentioned above, it has an average duration of 14.3 years and contains almost 2900 securities. The average yield to maturity of the portfolio is 4.9%. Note that the ETF uses a ‘sampling’ methodology to track its index, so it does not hold all the securities of the index.

Figure 2 – BLV portfolio composition (vanguard.com)

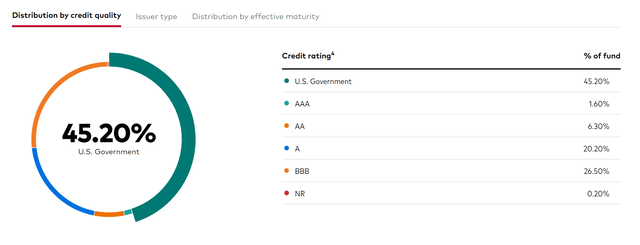

The BLV ETF has 45% of assets invested in U.S. government treasuries, and the rest in investment grade bonds (Figure 3).

Figure 3 – BLV credit quality allocation (vanguard.com)

Distribution & Yield

The BLV ETF pays a decent distribution yield, with trailing 12 month distribution of $3.01 / share or 4.0% yield. BLV’s distribution yield has stayed fairly constant around ~4.0%, except for 2020, when the fund paid a substantial $3.13 / share special distribution after strong realized gains in that year (Figure 4).

Figure 4 – BLV distribution yield (Seeking Alpha)

Returns

However, due to BLV’s large duration exposure (14.3 years), a large percentage of BLV’s total returns are generated from the price appreciation / depreciation of the fund’s portfolio.

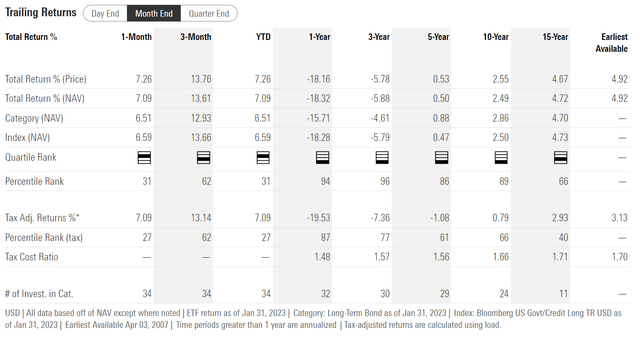

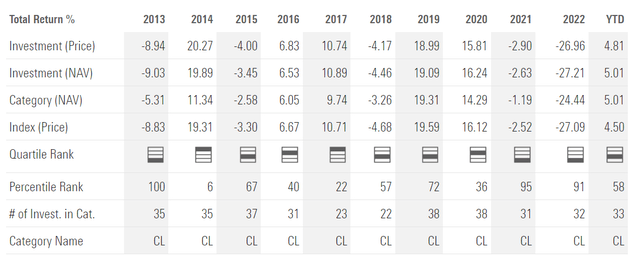

BLV’s historical performance in the past decade has been poor, with 3/5/10Yr average annual returns of -5.9%/0.5%/2.5% respectively to January 31, 2023 (Figure 5).

Figure 5 – BLV historical returns (morningstar.com)

The problem appears to be due to the absolute level of interest rates. BLV was incepted in 2007, and in the first decade of its existence, performance was solid, with total returns of ~97% from April 2007 to April 2017 or CAGR returns of ~7.0% (Figure 6).

Figure 6 – BLV total returns April 2007 to April 2017 (Seeking Alpha)

BLV’s decent performance was mostly driven by the Fed’s Quantitative Easing policies enacted after the 2008 Great Financial Crisis (“GFC”) that saw 10Yr yields decline from ~4.75% to 2.5% (Figure 7).

Figure 7 – 10Yr treasury yields declined after 2007 due to QE (stockcharts.com)

At 14 year average duration, the ~2.25% decrease in interest rates would have added 31.5% in price appreciation, or approximately 3.0% per annum. This 3% price appreciation combined with a 4% distribution yield adds up to BLV’s 7.0% CAGR return.

However, by the late 2010s, with long-term interest rates ~2.0%, it was near the lower bound and price returns on the ETF became increasingly erratic and driven by interest rate movements. For example, 2018 was a poor year for BLV when interest rates increased, while 2019 and 2020 were strong years, as interest rates declined, especially as a result of the COVID-19 pandemic when there was a mad dash for risk-free assets (Figure 8).

Figure 8 – BLV annual returns (morningstar.com)

Unfortunately, in 2020 with long-term interest rates sub-1.0%, there was literally nowhere for yields to go but up, and thus we saw poor returns in 2021 and a horrendous year in 2022.

Long-Term Bonds Vs. Inflation, What Regime Are We In?

After the terrible performance in 2022, where the BLV ETF declined 27.2% due to a steep rise in long-term interest rates, what is the outlook for treasury yields and thus total returns for BLV?

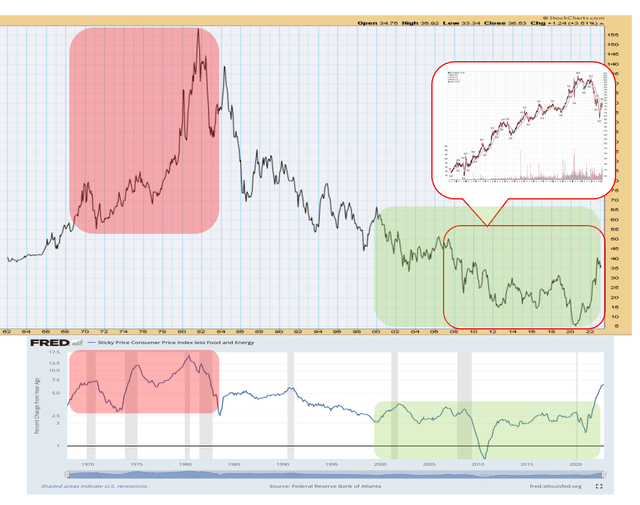

To answer that question, I think it’s best we take a step back and look at the 10Yr treasury yield from a historical perspective. In figure 9 below, I have overlaid 10Yr treasury yields with Core CPI Inflation, and highlighted the time period of BLV’s existence.

Figure 9 – Long-term interest rates track inflation rate (Author created with price chart from stockchart.com and inflation from St. Louis Fed)

Notice that BLV was incepted in 2007, and the ETF basically peaked at the nadir of long-term interest rates. When viewed on this time scale, it puts the ETF’s declines in the past year into context.

Choose Your Own Adventure

I believe there are two possible paths to long-term treasury yields, and hence total returns for BLV. First, if inflation has indeed peaked and is on a long-term decline back to the Fed’s 2% target, then from figure 9 above, we can see current 10Yr treasury yields of 3.5-4.0% is roughly ‘fair value’, for the period of low inflation from 2000 onwards (shaded green in figure above). This period saw 10Yr yields range from 6% in 2000 to 2% in 2017.

In this scenario, there is no bias to long-term treasury yields, so expected total returns for BLV would be ~4%, the distribution yield of the fund.

Secular Inflation Could Lead To Far Higher Interest Rates

On the other hand, I believe there is a non-zero risk that we have entered a period of secular inflation and core inflation rates will rebound in the coming years, similar to the 1970s (shaded red in figure 9 above). In this scenario, a rebound in inflation will cause higher long-term treasury yields, as central banks raise interest rates to fight stubbornly high inflation.

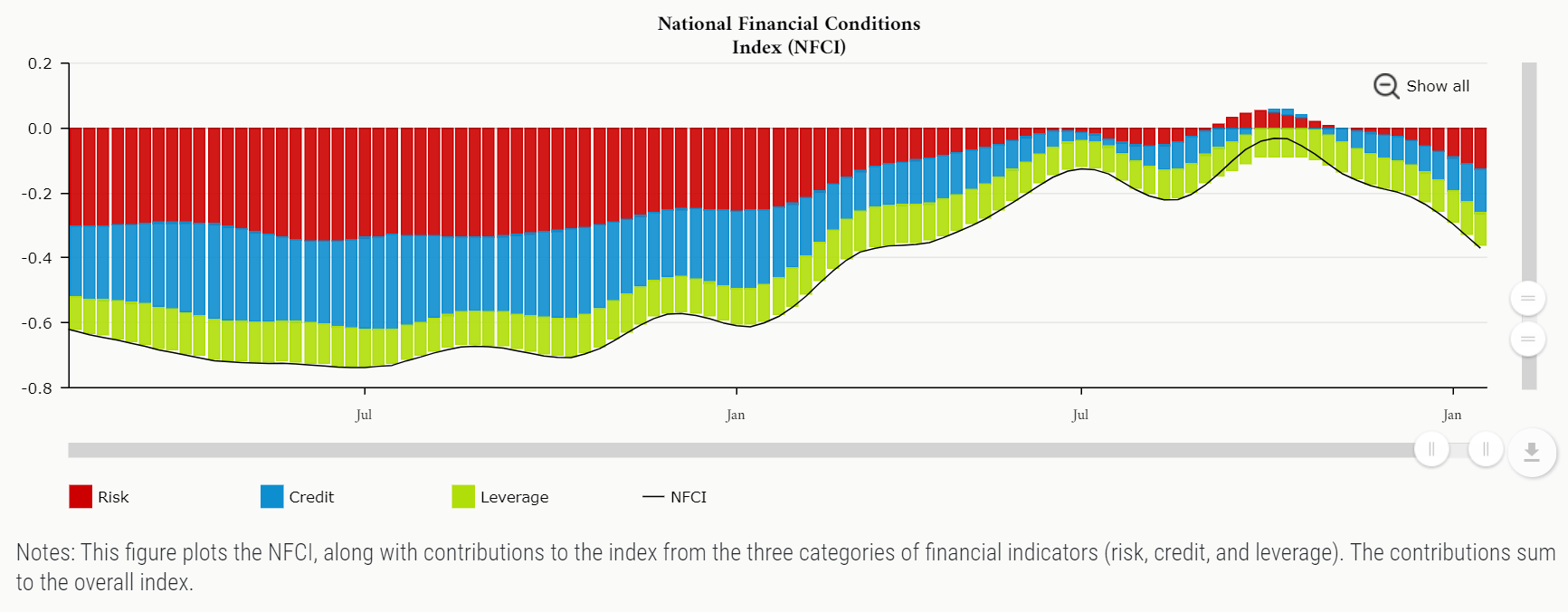

As I outlined in recent articles on the SPDR SSGA Multi-Asset Real Return ETF (RLY) and the Sprott Physical Gold and Silver Trust (CEF), financial conditions have eased considerably in the past few months as financial markets rebounded and investors price in a Fed rate cut in H2/2023. According to the Chicago Fed’s National Financial Conditions Index, financial conditions are now as loose as they were in early 2022 (Figure 10).

Figure 10 – Financial conditions are as loose as in early 2022 (Chicago Fed)

Already, we have seen a rebound in housing activity and used car prices surprisingly climbed in January, after many months of declines (Figure 11).

Figure 11 – Used car prices surprising climbed in January (Bloomberg.com)

Combined with a resurgence in energy prices, things do not bode well for inflation. In fact, revisions to January’s CPI figure showed headline inflation was actually +0.1% MoM in January, not the -0.1% that was originally reported, which boosted ‘soft landing’ expectations a few weeks ago.

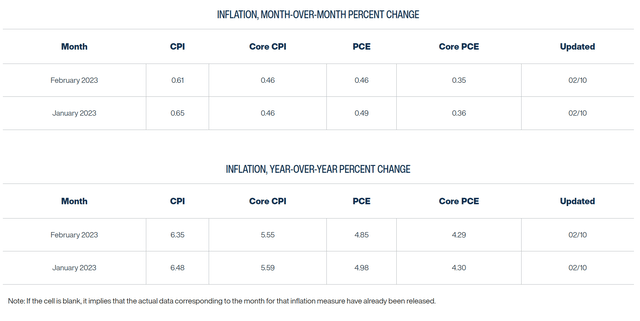

The Cleveland Fed has a useful tool called Inflation Nowcast that has been fairly accurate in forecasting inflation figures. Nowcast forecasted +0.1% MoM inflation in December, which after revisions, was actually spot on. For January and February, Nowcast is forecasting 0.7% and 0.6% MoM inflation, which will keep YoY headline inflation rates high at 6.5% and 6.4% respectively (Figure 12).

Figure 12 – Nowcast inflation stays high (Cleveland Fed)

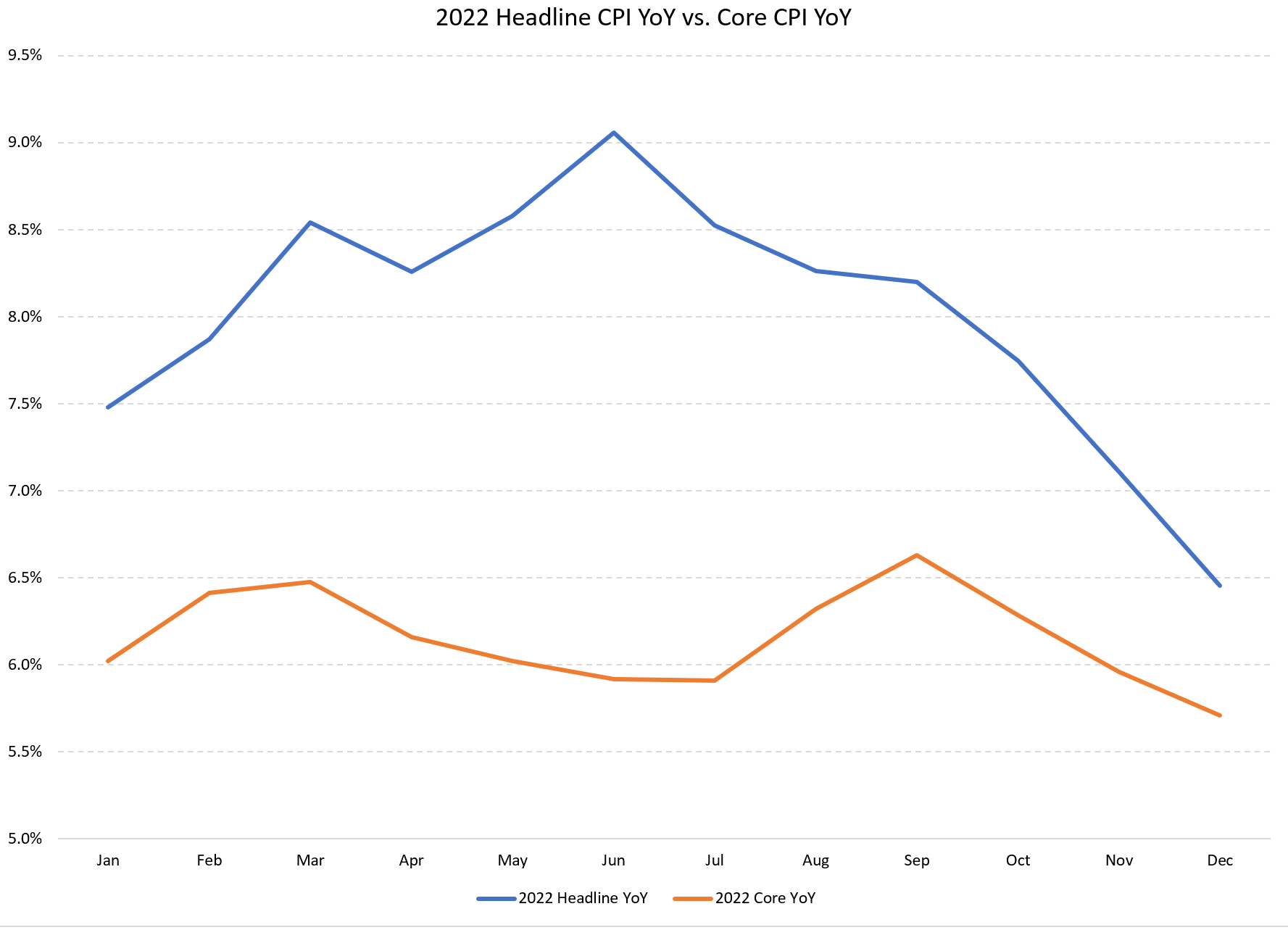

If we believe Nowcast, headline and core inflation has essentially flatlined in the past few months, and still far above the Fed’s 2% target (Figure 13).

Figure 13 – Core inflation remains stubbornly high (Author created with data from BLS)

So the Fed may have to stick to its promise of raising interest rates ‘higher for longer’, which will put upward pressure on long-term treasury yields and downward pressure on the BLV ETF.

Conclusion

The Vanguard Long-Term Bond ETF provides exposure to long-duration treasuries and corporate bonds. If investors believe inflation has peaked and the Fed has achieved a ‘soft landing’, then now may be a ‘fair price’ for the BLV ETF, as 10Yr treasury yields have essentially returned to the middle of the post-2000 ‘low inflation’ range.

However, I personally believe inflation may rebound in the coming months and quarters, and that the Fed will maintain a ‘higher for longer’ policy stance. This means that long-term treasury yields may rise further, in which case, there is a headwind to the BLV ETF.

Be the first to comment