gesrey

The Vanguard ESG U.S. Stock ETF (BATS:ESGV) focuses on close to 1500 large, mid, and small-cap stocks which screen highly with regard to certain environmental, social, and corporate governance criteria. Even though ESGV has a fairly short trading history of a little over 4 years, it has already amassed assets under management (“AUM”) of over $5.6bn, which would likely be driven by the product’s competitive cost structure (an expense ratio of just 0.09%).

ESG – Much Ado About Nothing

I’m not particularly gung-ho about ESG-themed investing, and much of my skepticism was shared by Andy Puzder on the Lead-Lag Live portal, who felt that this was just a case of socialism in disguise.

Principally, one does have to question the merits of something like ESG in a capitalistic-driven society such as ours. It’s pertinent that fund managers prudently manage capital, trying to extract the highest value per dollar invested, rather than trying to take on the mantle of political activists, or trying to drive home their own social agendas falsely packaged under the guise of ESG. In effect, these large fund houses such as Vanguard, BlackRock, and State Street are forcing CEOs to put in place policies that add limited value, whilst also neglecting their primary responsibilities of generating profits for shareholders. In fact, you could argue that some facets of the recent energy crisis were driven by this undue focus on ESG.

According to Puzder, close to three-fourths of the S&P 500 stocks are now involved in some form of left-leaning political or social activism which has limited relevance to the goal of profits. I’d be all for ESG if we could see some concrete end results on account of this impetus, but a study from Bloomberg showed that even though more than 33% of the industry’s AUM is linked to ESG funds, global emissions continue to increase.

It’s also fair to say that there’s a lot of laziness involved with the way ESG tags have been loosely allocated, particularly within something like the technology sector. The sector has become an easy target as it helps address some social issues and also has a relatively low predilection towards carbon-heavy practices, but that doesn’t necessarily mean that every tech stock ought to screen highly with ESG practices.

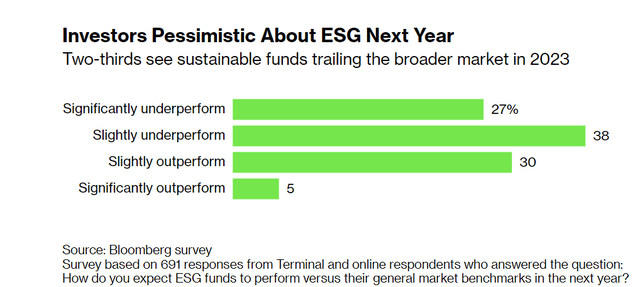

There’s a chance we see some of the ESG momentum ebb away, at least in the U.S. With Republicans retaking the house, there’s now a good chance that senators will push for legislation that penalizes organizations that prioritize ESG over profits. It’s also not a great sell for ESG when a recent survey conducted by Bloomberg showed that close to 66% of its respondents expect ESG to either slightly underperform or significantly underperform the broader markets in 2023.

It’s also not ideal that ESGV’s largest exposure is towards the tech sector; as noted in The Lead-Lag Report, these stocks typically outperform the S&P500 after an economic growth cycle is in place, but that will hardly be the case in 2023.

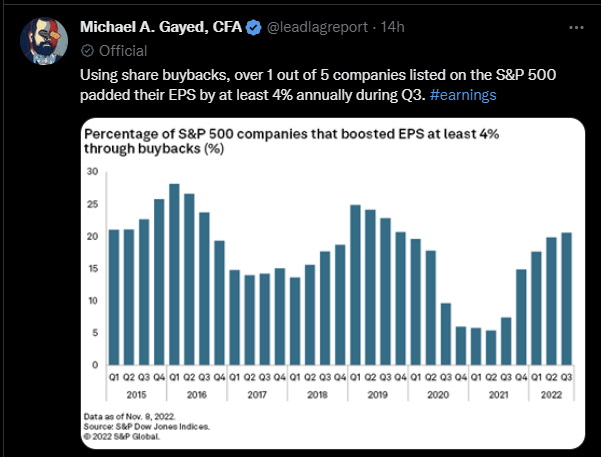

The stewards of these tech companies also recognize that they don’t quite have the wind in their sails, particularly in the face of a heightened cost of capital environment. As a result of that, to make their valuations more palatable, you’re likely to see a greater fervor of buybacks, which would help boost the EPS. As noted in The Lead-Lag Report, in Q3, at least 20% of the S&P500 companies resorted to this measure, and I would expect that trend to move up going forward. But addressing the valuation narrative solely through buybacks feels like a very disingenuous long-term strategy to me.

Twitter

Conclusion

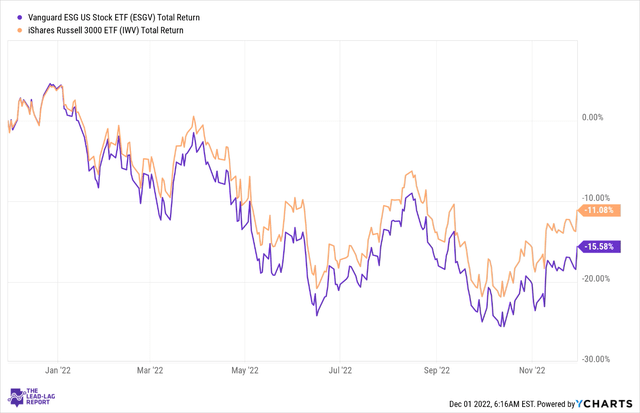

It hasn’t been a particularly great year for risk assets, and it doesn’t appear that a growth-heavy product (3 out of the top 5 sectors of ESGV are growth sectors) like ESGV will serve as a shining fund magnet in a deteriorating risk environment. We’ve already seen evidence of that this year, where this product had consistently underperformed its peers from the Russell 3000 ETF (IWV).

Besides, as noted in a tweet on the timeline of The Lead-Lag Report, I expect the risk-off environment to snowball, backed by what my inter-market signals have been telling me. The traditional safe haven – long-term treasuries – have begun exhibiting strength for over a month now, whilst other defensive options such as Utilities, and Gold too, have augmented the risk-off case.

Twitter

Also note that despite the year-long underperformance, ESGV still trades at an elevated P/E of nearly 19.4x, a 6% premium over the corresponding multiple of the Russell 3000. Interestingly enough, the constituents of the Russell 3000 also offer slightly better long-term earnings potential of 12.04% vs just 11.65% for our ESG option.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment