utah778/iStock via Getty Images Vanda

Does the company have a short-range or long-range outlook in regard to profits? – Phillip Fisher

As you can see, I’m mostly focused on growth biotech. Nevertheless, there are special situations in which the company is both a growth and value play. As such, the stock would give you tremendous upsides once the market realizes the mismatch between the share price and intrinsic value. An example would be a growth stock that is generating a net profit while trading near its cash position.

That being said, Vanda Pharmaceuticals Inc. (NASDAQ:VNDA) best illustrates the aforesaid phenomenon. Having two approved drugs and generating increasing earnings, Vanda is still rapidly expanding its pipeline. Due to negative market sentiment, Vanda shares are trading at a deep bargain to their true worth. In this research, I’ll feature a fundamental analysis of Vanda and provide my expectation of this highly intriguing investment.

About The Company

As usual, I’ll provide a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the next section. Operating out of Washington, DC, Vanda Pharmaceuticals is focused on the innovation and commercialization of novel medicines to fit the unmet needs in psychiatry.

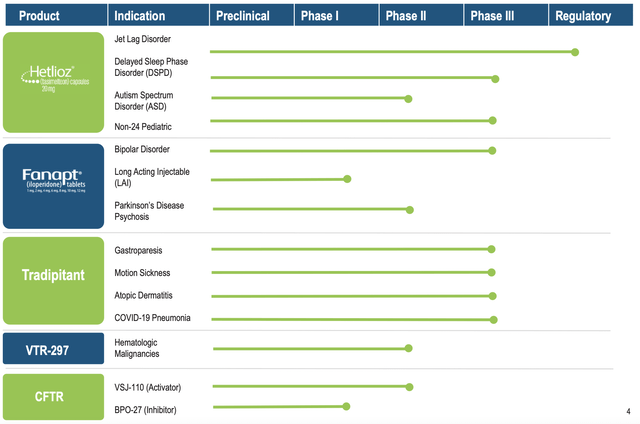

Viewing the figure below, you can see that Vanda is brewing a deep pipeline of highly promising drugs. Interestingly, the two therapeutics (Hetlioz and Fanapt) are already approved and generating a robust sales increase. And yet, Vanda is aggressively expanding their label indication, which is indicative of a prudent growth strategy. In other words, growing by label expansion is risk-deleveraged. Based on the vast number of label expansions, there is a good chance that at least one would become an investment bonanza.

Commercialized Products

Shifting gears, let us analyze the approved medicines. As you know, Hetlioz is being commercialized for Non-24-hour-sleep-wake disorder (i.e., Non-24) and sleep disturbances associated with Smith-Magenis Syndrome (SMS). As to Fanapt, it is currently being launched for the treatment of adults suffering from schizophrenia. Even with the aforesaid indications alone, the revenues of both Hetlioz and Fanapt are substantial.

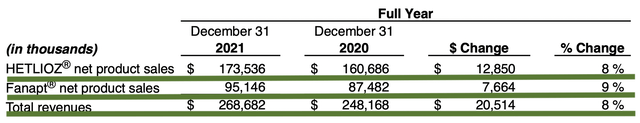

For Fiscal 2021, Hetlioz and Fanapt correspondingly generated $173.5M and $95.1M for a total of $268M. The total figure represents an 8% increase from the prior year. Notably, this is over a quarter of a $1B which is quite significant for a small company like Vanda.

From my prior research, you can see that sales growth has been increasing healthily year over year (YOY). Nevertheless, the latest quarterly sales have been essentially flat. That could mean two things. First, it’s likely that sales have been hampered by COVID. Second, it’s possible that revenue won’t increase further unless Vanda can gain more label expansion. Either that, or the company would need to advance other pipeline assets like tradipitant (i.e., Tradi)

According to the President and CEO (Dr. Mihael Polymeropoulos),

We are proud of the progress we have made this past year with our existing products and in bringing Hetlioz to patients with SMS, leading to a strong financial performance, even in the face of extraordinary challenges. We advanced our clinical products pipeline with a number of programs in early and late-stage clinical development and we believe that our recently completed Phase 3 study of tradipitant in gastroparesis gets us closer to being able to provide a new treatment option for patients with this significant unmet medical need, despite the study not meeting its pre-specified primary endpoint.

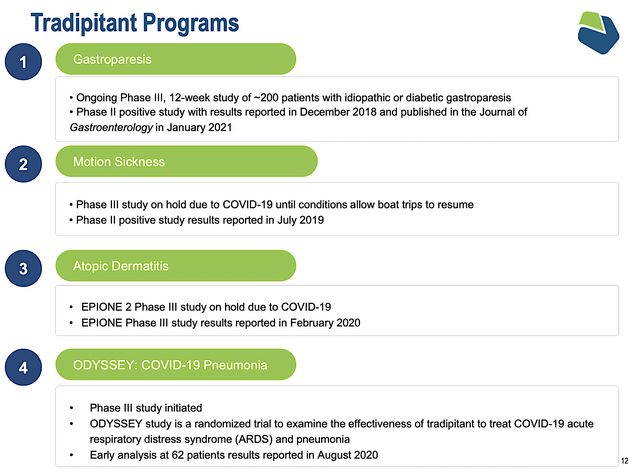

Tradipitant

Given that Tradi contributed significantly to sales, you should take a closer look at its development. In February, Vanda reported the results of the Phase 3 study of Tradi for gastroparesis. Disappointedly, the study did not meet its primary endpoint; that is, the change in nausea from baseline at Week12 between the drug and placebo. Now, both treatment arms demonstrated significant improvement in nausea and other core symptoms of the disease. In other words, while the two treatment arms showed improvement, the placebo also does the same.

In light of the said data, you must be wondering if there is something causing patients on the sugar pill to exhibit nausea improvement. It turned out that, after Vanda conducted further analysis, there were “confounders” (i.e., other factors) that biased the results. The first confounder is the “rescued medications” used on all treatment arms. The second is the “non-compliance” issue. When the researchers removed the confounding factors, they found a robust and meaningful difference.

Going forward, Vanda will present the analyzed results at medical conferences and to the FDA and regulatory agencies. Though I commend Vanda for not capitulating, I doubt that the FDA would approve Tradi based on the available results. Based on my Integrated System of Forecasting, I ascribe a -65% (less than favorable) chance of approval. My rationale is that you have to design your trial to minimize the effect of confounders from the gecko. You can’t just go back after the trial is done and remove them.

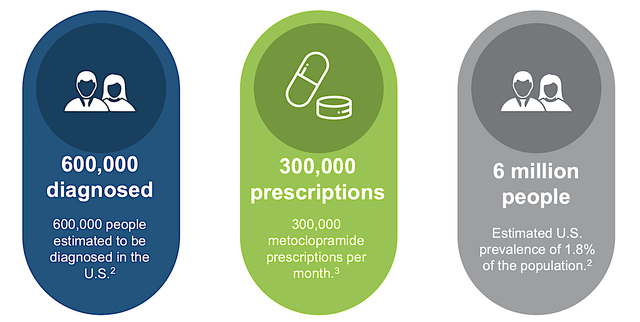

Despite not likely being approved soon, I strongly believe that Tradi would get the nod from the FDA once the company runs another Phase 3 study. Assuming it would clear the regulatory hurdles in the future, let us assess the market size of gastroparesis. View the figure below, there are 6M people in the U.S. afflicted by gastroparesis. Growing at a 4.7% CAGR, the gastroparesis market is projected to be $6.4B by 2023, which is quite meaningful.

Tradipitant Label Expansion

Following the same aggressive label expansion approach for Hetlioz and Fanapt, Vanda is also growing Tradi for several indications. As you can imagine, COVID is being subdued. Therefore, you can bet that Tradi’s utility for COVID-associated pneumonia won’t come into play. Notwithstanding, the combined market of both motion sickness and atopic dermatitis would be multi-billion dollars. Riding the 5.4% CAGR, the global atopic dermatitis market alone is anticipated to reach $7.4B in 2027.

Competitor Landscape

Regarding competition, the key competitor for Hetlioz is either generic melatonin or over-the-counter melatonin. Keep in mind that while docs can prescribe generic melatonin, they tend to err on the safe side and thereby prescribe Hetlioz. After all, Hetlioz is a pharmaceutical-grade drug with a specific dosage and clinical data. Simply put, we practice evidence-based medicine.

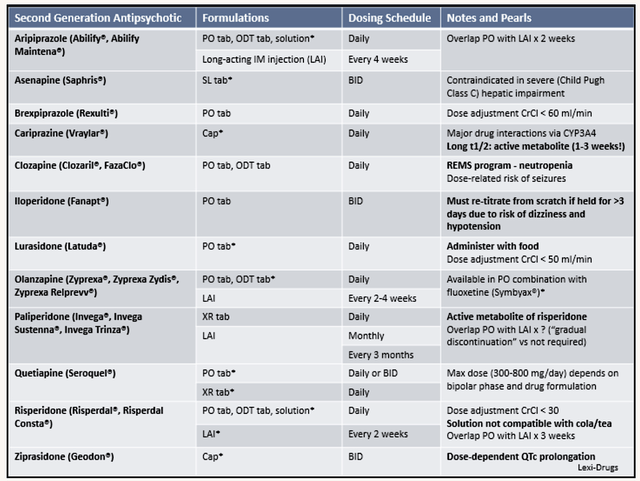

As shown below, the competition for Fanapt is much more intense due to the wide availability of other neuroleptics. That aside, you have novel medicines like Caplyta of Intra-Cellular Therapies (ITCI). If you’ve been following my work, you can see that Caplyta delivered unprecedented efficacy and safety for various neurological conditions.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 4Q2021 earnings report for the period that concluded on December 31.

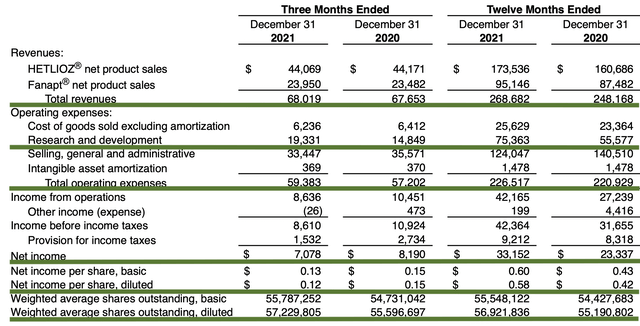

As follows, Vanda procured $68.0M compared to $67.7M for the same period a year prior. On an annual basis, the revenue registered at $268.6M versus $248.1M for the same comparison. As such, the sales improved by 8% annually. While the revenues increased, it seems like growth has cooled off due to COVID, which hampered sales/marketing activities. Perhaps the trend will reverse in the coming quarters as the pandemic is subsiding.

That aside, there were $19.3M and $14.8M in research & development (R&D) for the respective quarters. I view the R&D increase positively because the capital invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits

Additionally, there were $7.0M ($0.12 per share) in net income compared to $8.1M ($0.15 per share) net profit for the same comparison. The small bottom-line depreciation is likely due to the higher R&D investment. Despite the small decline, it’s great that you have a young company like Vanda – one that is growing robustly while banking a net profit from product sales for you.

About the balance sheet, there were $432.8M in cash, equivalents, and investments. Against the $59.3M quarterly OpEx, there should be adequate cash to fund operations indefinitely unless there is a major change. Already strong and sizable, you can expect the cash position to grow larger over time.

While on the balance sheet, you should check to see if Vanda is a “serial diluter.” A company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 55.5M to 57.2M, my math reveals a 3.0% annual dilution. At this rate, Vanda easily cleared my 30% dilution cutoff for a profitable investment.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the biggest concern for Vanda is whether the company can continue to ramp up sales for Hetlioz and Fanapt.

As you know, the latest quarterly results showed a plateauing in sales growth. Now, it’s important for the company to continue to increase its sales/marketing efforts while expanding the label. While the chances are favorable for Hetlioz and Fanapt, there are still risks of non-approval. The other concern is whether Vanda can gain approval for Tradi use in gastroparesis, to which I ascribe a -65% risk (i.e., very high).

Conclusion

In all, I maintain my buy recommendation on Vanda Pharmaceuticals with a five out of five stars rating. Amid this biotech bear market, Vanda Pharmaceuticals is a special company that you should consider because it’s both a growth and value play. From the growth perspective, two commercialized medicines (Hetlioz and Fanapt) are generating over a quarter of a billion dollars.

I believe that the sales cool-off is just temporary. The company is aggressively expanding the labels for its approved drugs. Specifically, Hetlioz is poised to gain approval as a treatment for DSPD. Fanapt is set for potential expansion into a long-acting formulation as well as a potential treatment for Parkinson’s and bipolar psychosis. Though met with an initial setback, you can expect Tradi to gain approval for gastroparesis in the long haul (i.e., after they run another Phase 3 trial). Additionally, Tradi also has a very good chance of gaining approval for other indications (like motion sickness and atopic dermatitis) to add more value to Vanda in the future.

It is quite interesting to note that Vanda currently has a market cap of $640.69M. And yet, the company has $432.8M in cash. At the same time, you have $268.6M in revenues and $7.0M in net profits. Taking those metrics together, it’s clear that Vanda is trading near its cash position with substantial upsides from earnings. At this valuation, you’re essentially getting a “cash cow” for free.

Be the first to comment