Justin Sullivan/Getty Images News

The national average gas price has now surpassed $5.00 per gallon. While the overall cost of gasoline is certainly eye-popping, the extremely rapid pace at which it has climbed may be more critical. At the beginning of the year, gas was below $3.50 and was below $2.50 a year prior. Just two years ago, many oil and gasoline companies struggled to survive amid years of low to negative cash flow. Today, their profits are soaring, particularly for those firms with broader exposure to the energy supply chain.

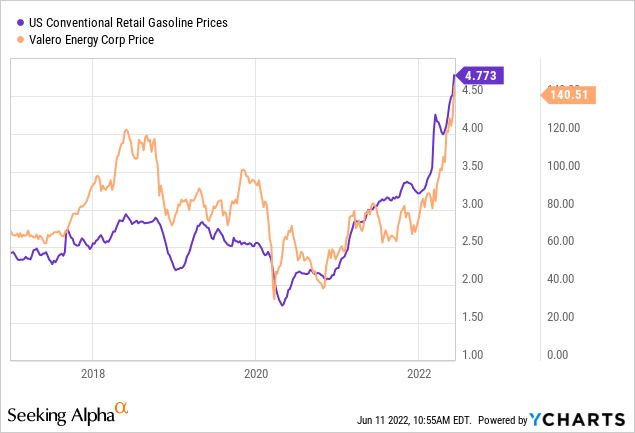

While crude oil is undoubtedly expensive at $120 per barrel, it is still well below its all-time high of $147 set fourteen years ago. On the other hand, gasoline is solidly above its price range from the 2008 period. Thus, it is clear that there is a supply-demand mismatch in both crude oil and downstream gasoline refineries, creating a Goldilocks environment for refined oil products like gasoline. Companies that operate the downstream market, such as the giant Valero Energy (NYSE:VLO), have seen their stock prices soar in line with the rise in gasoline. See below:

The robust correlation between VLO and gasoline implies that VLO may be an effective way for investors to bet on or hedge against higher retail gasoline prices. Today, the sharp rise in gas prices is perhaps the most immediate economic risk factor as higher gas prices impact not only the price at the pump but also the price of all goods due to the impact on freight costs. As higher energy costs lead to economic demand destruction, investors may want to consider particular energy companies such as Valero as a means of hedging against this risk.

Key Risks And Rewards Facing Valero

Valero, and its peers, are not risk-less firms. The sharp rise in energy prices could, under some circumstances, quickly become a sharp decline. For example, the last extensive period of rising energy prices occurred from 2006 to 2008 and was followed by extreme decreases as the economy eventually turned over. Today, the situation is a bit more complicated, since energy production remains significantly impaired following the long-term impacts of COVID restrictions. As such, the economy will likely need to slow dramatically for the crude oil shortage to end via demand declines.

Valero is a price-taker for crude oil since it does not have significant upstream oil-production operations like Exxon (XOM) and Chevron (CVX). In the recent past, Valero was a major crude oil importer from Russia but managed to shift its purchases to Latin America to offset the oil embargo. The company also refines oil extracted in the U.S. as well as the Middle East, so its upstream supply chain is relatively diverse. However, if crude oil prices rise while gasoline remains flat, Valero’s profitability will be impaired.

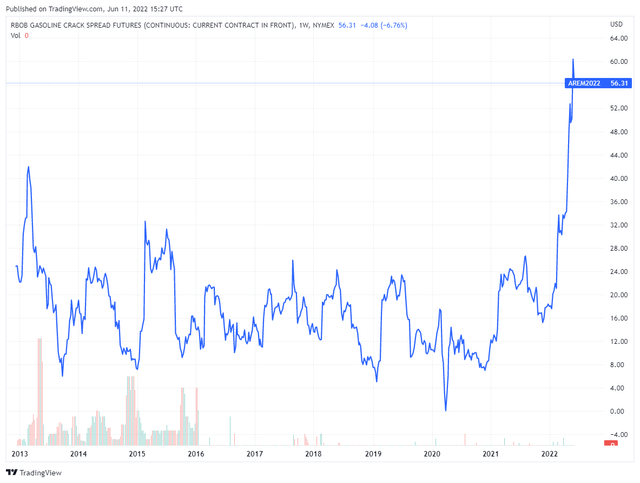

In reality, a large portion of Valero’s profits come not from energy prices but from the spread between refined petroleum products, such as diesel and gasoline, and oil. This measure is called the “Crack spread.” As mentioned in Valero’s recent investor call, the immense strength in crack spreads has been driven by diesel, notably the tremendous shortage of diesel inventories. That said, the RBOB gasoline crack spread is around twice as high as it is typically. See below:

RBOB Gasoline Crack Spread Futures (TradingView)

Over the past decade, the RBOB crack spread has generally ranged from $10 to $30. This figure means that, generally speaking, a company like Valero could earn a net revenue of around $10 to $30 by refining a barrel of crude oil into gasoline. Today, due to a flux of odd market and economic conditions, the spread is abnormally high, allowing Valero to generate immense profits by refining gasoline.

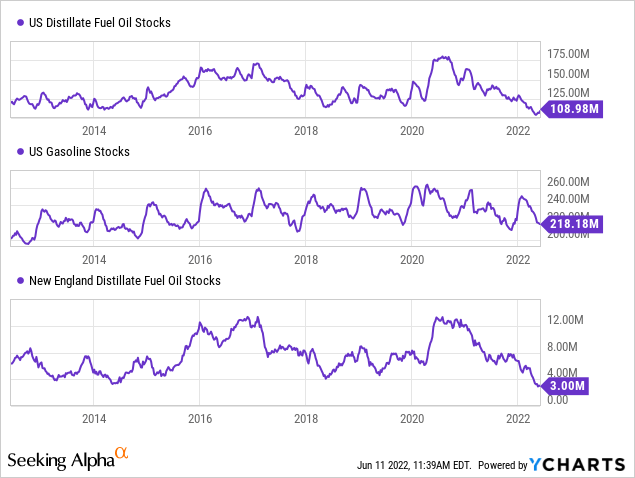

The stark shortage is the most significant pressure benefiting oil product prices and ongoing gasoline, and diesel fuel stocks decline. In particular areas, such as the North East, declines in diesel inventories have become very significant, leading to long-term record low inventory levels. See below:

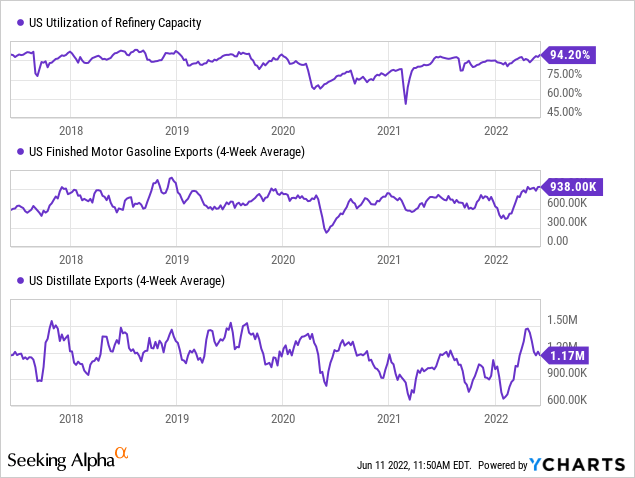

As inventories reach critically low levels, the crack spread is likely to rise. However, for Valero to be a worthwhile long-term investment, we must believe the crack spread will remain strong for a prolonged period. This begs the question, why are gasoline inventories falling at such an intense pace? Initially, this was due to low refinery productive capacity utilization and a substantial increase in demand for gasoline following COVID lockdowns. However, refiners, such as Valero have generally managed to return to full capacity and are now producing strong output levels. However, European refiners are faring far worse, primarily due to significant dependence on Russian crude oil feedstocks. As such, since the year began, total U.S. exports of petroleum products have risen dramatically. See below:

For now, this is an ideal short-term situation for Valero as it is able to not only sell products in the U.S. for a substantial spread but also export to Europe and other countries at a higher pace. However, this is a short-term factor – mainly driven by a severe market imbalance stemming from the Russian invasion and the subsequent embargo efforts. As mentioned in Valero’s recent investor call, Russia’s crude oil exports and production have not declined – with most exports being rebalanced toward the east. Developing nations, such as India, are voraciously purchasing energy at a discount from Russia and are highly unlikely to stop doing so since their populace does not have as much disposable income to afford expensive gasoline.

Benefits From Russian Sanctions May Not Last

In the short-run, this situation is good news for U.S. energy exporters that can offset declines in Russian imports, but the fundamental market structure remains essentially unchanged. In the long run, I suspect people in Europe and perhaps the U.S. will become more frustrated with the rising cost of gasoline and prices in general that leaders may re-think the embargo approach to Russia. Considering Russia’s current account surplus has skyrocketed in 2022, largely due to the spike in energy prices following sanctions, it is logical that a different approach from western nations toward Russia be taken since the current policy is indirectly benefiting the country while creating domestic strain.

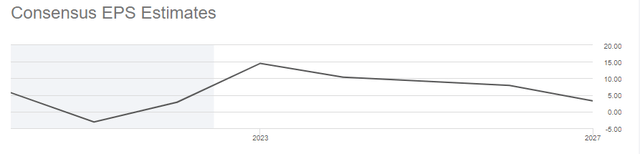

Of course, if more Russian oil eventually flows into the West, then Valero would lose the primary means of generating its current profit spike. VLO has nearly doubled in value (~75% rally) since Russia invaded Ukraine, as crack spreads and export demand have skyrocketed. However, this likely is a resoundingly short-term bullish factor but is unlikely to benefit the company in the long run. The current analyst consensus 2022 EPS for Valero is a strong $14.5, giving the company a low forward “P/E” of 9.6X. However, its earnings are expected to return toward normal levels, potentially falling back to $5 by 2027. See below:

Valero’s Analyst Consensus EPS Estimate 2022-2027 (Seeking Alpha)

Valero may seem cheap based on its current valuation, but if we consider its expected long-term earnings of $5-$10, its “P/E” would be around 14-28X, which is a bit high for the more cyclical energy sector.

Additionally, Valero has a bit of debt with total liabilities to assets of 66% and over $13B in financial debt. The company’s expected 2022 profits will likely be high compared to the debt burden, but these record cash flows are unlikely to last. Fundamentally speaking, oil refiners usually are extremely low-margin companies that face high competition. Competitors with greater upstream assets, such as Exxon and Chevron, may have an advantage as it seems that, while crude oil and gas may remain expensive, the spread between the two is unlikely to stay so wide in the long term.

Indeed, I would not be surprised to see Valero’s earnings spike reverse sooner than the consensus expects. On the one hand, considering that the energy embargo is not harming Russia’s trade balance while western people are struggling to pay at the pump, North American and European governments may re-think their approach to Russia sooner than anticipated. Even more, with energy prices as high as they are, economic demand destruction is accelerating, with U.S. consumer sentiment recently falling to a record low. Undoubtedly, as real incomes continue to tumble, the gasoline demand will eventually follow suit, likely driving the crack spread lower regardless of the “Russia factor.”

The Bottom Line

While I believe both gasoline and crude oil prices will remain high and may even rise much higher, I highly doubt the spreads between oil products and crude will remain so extreme. As such, it seems Valero may be a bit overvalued, since its current period of high profitability is unlikely to last. Most analysts believe Valero’s profits will reverse over the coming years, but I would not be surprised to see its expected earnings reverse by Q4. There are many short-term factors benefiting refiners, but in the long run, their lack of vertical integration puts them at a disadvantage – particularly considering the waning economy. Considering Valero’s valuation, I am slightly bearish on VLO and believe it would be more fairly valued at around $100 as that would bring its long-term forward “P/E” to the more reasonable 10-20X based on the current analyst long-term earnings outlook.

Be the first to comment