hernan4429/iStock via Getty Images

Introduction

Despite Valero Energy (NYSE:VLO) sustaining their dividends throughout the turmoil of 2020 and the bumpy start to 2021, they were still not worth buying earlier in 2022, as my previous article discussed. Since being published, their share price enjoyed a very strong rally that now sees it trading near-record highs and slightly more than 80% higher since only the beginning of 2022. Whilst this has been wonderful for their shareholders, it now leaves their shares exorbitantly expensive with the potential for large losses, as discussed within this follow-up analysis that also reviews their subsequently released results for the first quarter of 2022.

Executive Summary & Ratings

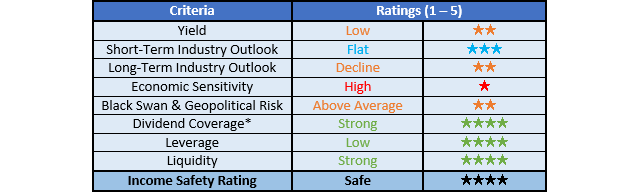

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

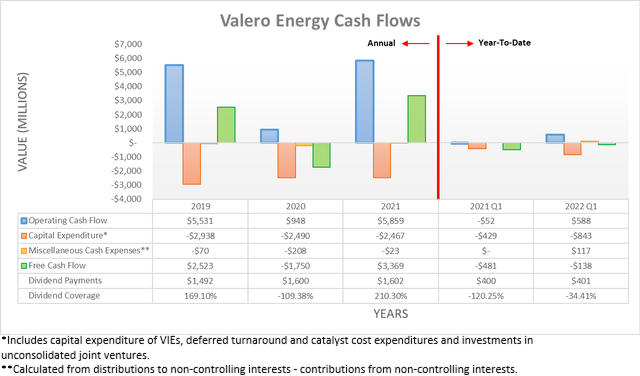

The difference that one year makes can be amazing, whilst 2021 started with a cash burn during the first quarter that saw operating cash flow of negative $52m, the first quarter of 2022 has seen the year start with a positive result of $588m. Despite being a day and night difference year-on-year, once again similar to their full-year 2021 results, their temporary working capital movements significantly skewed their results. Whilst their full-year 2021 results were helped by a significant working capital draw of $2.225b, rather unsurprisingly, this reversed thus far into 2022 with the first quarter seeing a working capital build of $722m, thereby seeing their underlying operating cash flow at a very strong $1.31b, if hypothetically removed. Despite causing negative free cash flow of $138m during the first quarter of 2022, they still seized upon the strength of their underlying results to ramp up their share buybacks, as per the commentary from management included below.

“And we continue to honor our commitment to stockholder returns with an annual target payout ratio of 40% to 50%.”

“We returned $545 million to our stockholders in the first quarter of 2022, with $401 million paid as dividends and $144 million of stock buybacks, resulting in a payout ratio of 44% of adjusted net cash provided by operating activities for the quarter.”

-Valero Energy Q1 2022 Conference Call.

It can be seen that management continues to target returning between 40% to 50% of their adjusted net cash provided by operating activities to their shareholders, which as a sidenote is effectively their operating cash flow excluding working capital movements. Apart from raising questions regarding their balance sheet repair, as subsequently discussed, this also helps to highlight how expensive their shares have now become and thus by extension, their significant downside risk when future operating conditions almost certainly revert lower once these booming operating conditions subside.

Whilst investors can debate whether these booming operating conditions will last throughout 2022 or even maybe into 2023, these record gasoline prices and refining margins are essentially guaranteed not to last well into the long-term, as was recently discussed in detail by a fellow author. This means that in my eyes, it would be wise for investors to consider whether their investment stacks up without these never before seen operating conditions, especially with the prospects of a Federal windfall profits tax in the United States being discussed.

If their very strong underlying operating cash flow of $1.31b during the first quarter of 2022 was theoretically maintained across every quarter perpetually into the future, it would annualize to $5.24b. Even if they were to return half of this underlying operating cash flow via dividends and share buybacks, thereby meeting the upper end of their targeted range, it would only provide a moderate circa 4.60% shareholder yield given their current market capitalization of approximately $57b.

The prospects of seeing a relatively lackluster amount of capital returned are not particularly desirable since it relies upon their booming operating conditions, which I feel makes their current share price exorbitantly expensive. Meanwhile, upon seeing their operating conditions and thus financial performance revert lower to a more common level, such as during 2021 when their underlying operating cash flow was $3.634b, their shareholder yield on current cost would only be a low circa 3.20%. In my view, this points to significant downside risks because such relatively low shareholder returns are incapable of justifying their current near-record high share price and thus following a circa 80%+ rally during 2022 alone, the potential for large losses of circa 25% to 50% are very real when the tide turns against the refining industry and drags their share price back towards its usual levels.

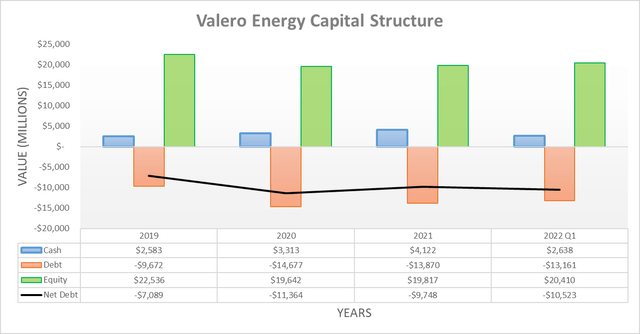

Following their negative free cash flow during the first quarter of 2022, it was no surprise to see their net debt increase and after funding their $401m of dividend payments along with a further $144m of share buybacks, it ultimately jumped from $9.748b at the end of 2021 to now sit at $10.523b. If not for their $722m working capital build, this $775m increase would have only been a very minor $53m.

When looking ahead, since management plans to allocate between 40% to 50% to their combined dividends and share buybacks, their net debt will likely remain broadly unchanged given the capital intensity of their industry that often sees capital expenditure consuming circa 50% of their operating cash flow, such as during 2019 and 2021 that saw 53% and 42% respectively. Interestingly, this runs contrary to their deleveraging target that was discussed within the previous analysis, which apparently still continues, as per the commentary from management included below.

“We want to continue to pay down debt. We paid down $2 billion over the past 6 months. And also to — definitely on our commitment to our shareholders with the buyback.”

“We’re pretty comfortable with our 20% to 30% range. It definitely gives us range to get a lot lower than we are now. I believe we’re at 34% now. So we still got a little ways to get down to our — the upper end of our target. And of course, we can do that by holding cash or paying down debt.”

-Valero Energy Q1 2022 Conference Call (previously linked).

Despite clearly allocating the majority of their cash inflows elsewhere, oddly enough, management continues to discuss deleveraging, which if nothing else is rather confusing with seemingly disjointed priorities. Whilst the prospects for limited deleveraging are not problematic for the time being with them generating ample free cash flow, it raises downside risks for the future when these booming operating conditions revert lower. Since there has only been one quarter elapsed following the previous analysis and their capital structure is not significantly different, it would be redundant to reassess their leverage and liquidity in detail.

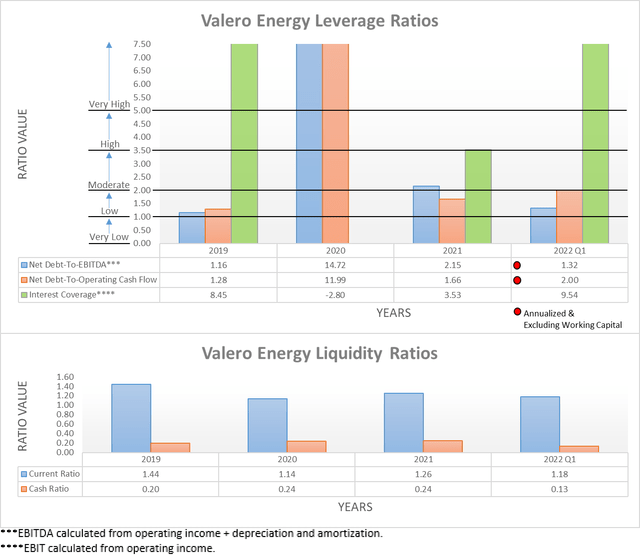

The two relevant graphs have still been included below to provide context for any new readers, which show a net debt-to-EBITDA of 1.32 and a net debt-to-operating cash flow of 2.00, thereby both sitting within the low territory of between 1.01 and 2.00. Meanwhile, their respective current and cash ratios of 1.18 and 0.13 continue indicating strong liquidity, despite slipping slightly lower versus their previous respective results of 1.26 and 0.24 at the end of 2021. If interested in further details regarding these two topics, please refer to my previously linked article.

Conclusion

Whilst their share price may continue climbing higher in the coming weeks and months, it would be wise for investors to remember that similar to trying to pick the bottom, it is also effectively impossible to pick the top. Since their expected shareholder returns even at the upper end of their targeted range are relatively lackluster despite these booming operating conditions, it leaves their shares looking exorbitantly expensive. When also considering the potential for large losses of circa 25% to 50% in the future when this refining boom almost certainly reverts lower, I now believe that downgrading to a sell rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Valero Energy’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment