JHVEPhoto/iStock Editorial via Getty Images

We have always been believers that regardless of the economy and the general direction of the overall stock market, that there are always trades that can be found to generate positive returns. Throughout the current stock market rout, energy has performed well across the board. The E&P names have rallied and so too have the refiners, but after getting ahead of themselves, investors have seen many names experience pullbacks in their share prices. We have found a few names in the last few days which we have begun to trade, and today we want to point one out for readers which we think could see a bounce with earnings due out next week.

The Backstory

Usually, we do not invest in the pure-play refiners unless there is an event or situation that is, or has the potential, to drive share prices one way or another. So, generally speaking, the majority of the time that we have exposure to pure-play refiners is because we are using them to hedge other positions within our portfolios. Our thinking is that if you want energy exposure, it is best to invest in the energy producers which are much more correlated to energy prices. However, right now we do see a potential trade within the refinery space due to the tight supplies resulting from refinery conversions in the United States which has lowered overall production, China pulling back gasoline/refinery exports, the EU looking to import more refined products and overall gasoline demand (as well as other products such as diesel) returning to levels not seen since before the pandemic in the United States.

From our vantage point, until something changes, we have to believe that refiners will benefit from the current chaos in worldwide energy markets via high crack spreads. We doubt that the Europeans will instantly jump at the opportunity to buy energy of any kind from Vladimir Putin’s Russia – even if Ukraine reaches a peace deal. There is a supply issue on the European continent (and to a lesser extent in the U.S.), and we think that China is key when it comes to refined products as it has become the swing producer for the world. By deciding not to export refined products, Beijing is driving up prices, which could help the Chinese economy by hurting worldwide oil demand.

The Company

Valero Energy Corporation (NYSE:VLO) is the largest independent oil refiner, with 15 refineries that have 3.2 million barrels per day of throughput capacity. The company also owns ethanol plants and has been developing renewable diesel products to feed the California market. While all of that is great, we think investors should focus on the current state of the market and expectations for Q2 2022 quarterly results. The quarterly results should be strong for Valero, and we suspect that the company will report strong free cash flow, EPS, and revenue figures. Investors will probably also be impressed with the company’s ability to return capital to shareholders.

Valero is targeting a 40-50% annual payout ratio, and with the company previously focused on buying back debt while also paying dividends and repurchasing shares, we think that management may be preparing to shift their attention away from debt reduction and towards more share repurchases in the quarters ahead. Why do we think this? Well, a big hint came from the company’s Form 8-K which was filed on July 7, 2022 (Seeking Alpha reported the news here) where Valero’s board authorized a new share repurchase program of up to $2.5 billion. That is roughly 5% of the company’s shares outstanding (at the current share price), so not a large amount compared to what some other companies have recently announced, but still respectable and could always be increased if the company’s business remains strong.

We think that the major takeaway is that the company restarted buybacks in Q1, with $144 million in share buybacks and if the company does not increase the quarterly dividend, then we would expect this figure to grow significantly in Q2 and subsequent quarters.

It is also a safe bet that Valero is going to report higher cash reserves and lower debt levels, as those are two of management’s goals; but while we have seen some discuss these as if they are bad goals (for reasons varying from “cash is trash” to the timing is wrong to pay down debt), we actually think that they are prudent moves to strengthen the balance sheet for when world energy markets return to a more normalized environment. So our expectation is that share buybacks increase, debt repurchases cool off a bit from the past two quarters (roughly $2 billion in total) and the dividend could be increased at some point in the next 2-3 quarters. Couple all of that with analyst estimates which indicate a Forward P/E of around 5 and one can begin to see why we think Valero might be a ‘Buy’ in the short term.

The Play

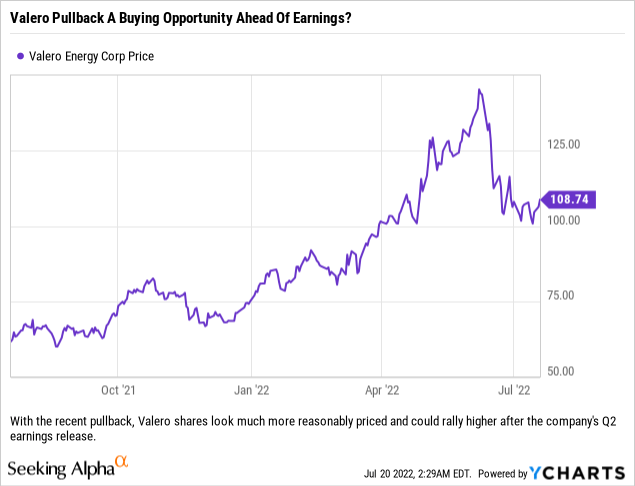

It is our opinion that Valero makes for an interesting trade ahead of earnings, with the potential for a 10% or greater move higher from current levels. We think that there are two ways to enter the trade, and we will leave it up to readers to decide their risk profile and how they would want to set up a trade.

Buying the shares outright at the current price of $108.74/share makes sense for those who are bullish and want to get the exposure and lock in a potential dividend yield of roughly 3.60% (the company’s shares go ex-dividend on 8/4/2022). Since we think that the potential upside from current levels is about 10%, we think that it would be prudent to simultaneously sell the August 5, 2022 $120 Calls for $1.25/share or $125 per contract in option premiums. This leads to some interesting outcomes:

- Shares go lower, the investor gets to keep the $1.25/share option premium and $0.98/share dividend (2.05% yield).

- Shares go higher, but stay below $120, again the investor gets to keep the $1.25/share option premium and $0.98/share dividend (2.05% yield plus capital gain).

- Shares go higher and finish above $120/share at the exercise date but are not called ahead of the ex-dividend date, so again the investor gets to keep the $1.25/share option premium and $0.98/share dividend (2.05% yield plus capital gain of 10.35%).

- Shares go higher and finish above $120/share and are called ahead of the ex-dividend date, in which case the investor gets to keep the $1.25/share option premium but does not get to collect the $0.98/share dividend (10.35% capital gain plus 1.15% yield from option premium).

That might be too cute for some, but it is a good exercise for looking to lock in gains while getting paid to do so.

Instead of buying the shares outright today, investors who believe that the shares could pull back some this week might look to utilize the company’s puts to create their entry. Selling the July 22, 2022 $108 Puts for roughly $1.67/share or $167 per contract in order to create a cash flow for entering the trade looks promising as it gives an investor the cash flow plus some optionality depending on how events play out.

The risk here is that the stock moves higher and the contract does not result in shares getting assigned at the end of this week, which results in a 3-day gain of 1.55% – which is not great but is 15% of the total gain we were targeting. After 3 days, the decision would have to be made (this is the optionality we just discussed above) of whether to purchase the shares above $108/share or walk away with the 1.55% gain in hand (for us, it would depend on where the shares closed the week – if close to $108/share then we would buy shares outright, but is significantly higher than we would just pocket the gain).

Conclusion

While we are not interested in getting caught up in a long-term trade that could blow up if China starts exporting refined products again, we do want to trade Valero in the short term because we believe that investors are going to be impressed with the company’s Q2 results and what should be solid Q3 guidance. We do not necessarily believe Valero has an extremely long runway, but for this quarter, and possibly the upcoming Q3, we do see potential upside from share repurchases, debt reduction, and a possible dividend increase in the next few quarters.

Be the first to comment