nantonov

Valero Energy Corporation (NYSE:VLO) is a Gulf Coast refiner that has been raking in profits this year as lost Caucus refinery capacity has fallen out of Western markets and major products have become very valuable to crack from crude. There was some concern about run cuts as oil producers and refineries started seeing macroeconomic pressures, but with the winter coming we are likely to see restored demand for oil and gas products. Moreover, supply outages and strikes keep capacity very valuable, and the record diesel margin that should be sustained into the winter gives the optionality in VLO’s refineries lots of value. However, being valued beyond 2018 levels where they were benefiting from IMO 2020 dislocations, we think there isn’t much upside left.

Winter Is Coming

Diesel or gasoil prices have rocketed, and so have margins. This has been relatively dislocated from general movements in the price of oil, where some weeks ago speculators began being concerned about macro pressures on oil demand. This is because refining capacity is more limited, and some capacity that went down in COVID-19 lockdowns will never recover, or has been repurposed for renewable diesel production. The loss of the capacity in the Caucuses due to the invasion and the embargoes has likewise driven up product margins. These high diesel margins driven by high freight demand and the goods boom has been a boon to VLO and other refiners’ profits, but the upside from the goods cycle maybe coming to an end. However, with the coming of winter, even with macro pressures mounting on consumer demand, forced consumption of diesel, which is one of the major home heating oils, will pick up the slack on top of still resilient freight demand. Valero Energy Corporation has high complexity refineries that will be able to capture this margin easily among the various lighter products as they’ve been doing so far going from gasoline to gasoil, and at even higher margins than before thanks to declining oil prices and rocketing gasoil crack spreads that are way beyond previous all-time highs.

Outages

There have been fires at refineries in the US, and these outages have been important to keep the high margins going for a while longer. Similarly, French Total (TTE) refineries are pretty much shut down as workers strike, and these strikes, while dwindling, have gone into their third week. This has all contributed to multi-decade lows in product inventory and a real latent demand for product and refineries to run at high utilisation rates as winter approaches. Winter is usually a less exciting period for refiners as gasoline and summer traveling demand usually peaks margins while heating oil demand is downside protection for the winters. This year it may be the other way around, which means another half year of very well-supported supply and demand dynamics for refiners.

All Priced In

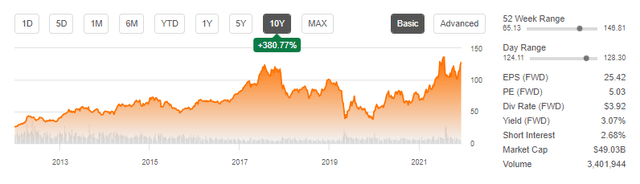

There are a lot of factors that are playing in support of VLO margins still, but we believe that it may all be priced in. The last time Valero traded around these levels was when they were able to capture all the margin from cracking high sulfur fuel, whose demand crashed with the IMO 2020 regulations for fuel standards in shipping. This rule was decided a year or so before COVID-19 and would come in effect in 2020.

VLO Stock Price (Seeking Alpha)

In some respects, Valero’s current situation is quite similar to then. They have the optionality to crack whatever products they want, and now that the gasoline cracking season is over they have very favourable S/D dynamics for the production of gasoil, with inventories at low levels and the invasion of Ukraine still keeping major Caucus capacity out from the reach of Western markets. The multiple is not excessive at around 5x, where cyclicality of refineries is being acknowledged by markets with a 20% earnings yield. On the other hand, the IMO issue wasn’t secular, so the cyclical valuation could appear compelling as the S/D dynamics could be favourable for a while now as they are being driven by non-market forces like war. Moreover, no one will invest in more refinery capacity due to stranded asset risk and the threat of the Green Agenda which has become such a cultural touchstone. The dislocation in LPGs and LNG is really bad, and the loss of the huge Russian production to Western markets is a pound of flesh off the European breast – Valero is a beneficiary here and to a relatively secular degree.

Demand is a bit of a question mark, as demand destruction will be real, but this winter is all but guaranteed to keep diesel margins elevated at almost the $90 mark per barrel, which is almost more than the straight price of oil implying about a 2x markup. Also, because of the cost of living issue becoming such a populist rallying cry, and also such a problem for Biden or the Democrat re-election chances, the probability of windfall taxes on US refiners including Valero or other moves that could limit their ability to profit should be acknowledged.

Bottom Line

Some of the favourable effects for the current quarter will dissipate, like outages and strikes. But the low inventory issue will mean a lot of potential to upfront profits. In a more secular horizon, baring government intervention high margins should be expected. A cyclical valuation may be a little unfair in that case, but the volatility in refinery earnings is something that cannot be underestimated, especially as lost refinery capacity is paired with lost oil production capacity from Russia, and therefore both the inputs and the outputs from refinery are scarce. Crack spreads should not be considered guaranteed, and a recession could unwind everything and see inventories rapidly replete. Overall, at almost all-time highs, we are wary of a stock like VLO which remains high in visibility and fundamentally volatile.

Be the first to comment