Edwin Tan/E+ via Getty Images

Similar to other refiners, Valero (NYSE:VLO) posted stellar quarterly financial results. With record setting crack spreads, all refiners responded positively. But, again, the real story for investors is what to expect moving forward. Valero is the second largest refiner in the United States. Its refineries, located in vast regions of the United States. including Texas, Louisiana, Tennessee and yes, California, claim lowest cost producer position. The process of assessing includes comparing against others. Although we intend to exclude results from other competitors, reviewing general industry placement is invaluable. Comparisons reach past finances and must also include business resources and directions.

The Quarter

The assessment begins with the quarterly results. Management stated in its prepared remarks,

Our refinery utilization rate increased from the pandemic low of 74% in the second quarter of 2020, to 94% in the second quarter of 2022.

Operating at 94% generally translated into full rates. The report included statements referring to its competitive cost advantages in the world. Management, in particular, noted heavy product demand during the summer driving season and travel. With historically low inventories level, the company’s finances reached extremely positive levels. The refineries were operated toward taking full advantage of the market place.

With Valero incurring $4 billion in debt during the 2020 shutdown, much of the cash has been used to pay down $2.3 billion including $300 million in June. Deleveraging priorities remain.

The company generated $11.60 in earnings for the quarter compared to $0.40 during 2021. Refining throughput volumes increased by a meager 127,000 barrels per day year over year. The big change in financial came from crack spreads. Costs of operations were up by $1.00 primarily from higher natural gas prices.

Turning to a different business, the Renewable Diesel segment operating income equaled $152 million for the second quarter of 2022 compared to $248 million for the second quarter of 2021. Renewable diesel sales volumes averaged 2.2 million gallons per day in the second quarter of 2022, which was 1.3 million gallons per day higher than the second quarter of 2021. The higher sales volumes were attributed to DGD 2’s operations starting up in the fourth quarter of 2021.

The last segment, Ethanol, reported $101 million of operating income for the second quarter of 2022 compared to $99 million for the second quarter of 2021.

The dividend remained the same at $0.98 per quarter. The company returned 42% of its adjusted net cash to the stockholders at the low end of the 40%-50% target range.

The balance sheet contains $11 billion in debt with $5.4 billion cash.

The company also guided refining throughput expectations for the next quarter: Gulf Coast 1.75 million barrels per day, Mid Continent 425K barrels per day, West Coast at 250K barrels per day and lastly the North Atlantic at 450K barrels per day. Higher natural gas prices will add some costs quarter over quarter. Adding together the individual pieces, the rates in the U.S. represent full rates – at least, per Wikipedia.

Business Environment

The EIA continues to claim demand destruction from higher pricing of fuels. When asked by analysts about demand, the Executive Vice President and Chief Commercial Officer, Gary Simmons, answered,

I can tell you, through our wholesale channel there is really no indication of any demand destruction. In June, we actually set sales records; . . . We read a lot about demand destruction and mobility data showing in that range of 3% to 5% demand destruction.

Again, we’re not seeing in our system. We did see a bit of a lull the first couple of weeks of July, but our seven-day averages now are back to kind of that June level . . . .”

When asked about production potential losses from waning demand within the United States, Simmons simples reminded the analyst about the structure cost advantages, particularly with South America. Continuing, he added that outside of another pandemic type of destruction going through a recession wouldn’t be “anything remotely close to that.”

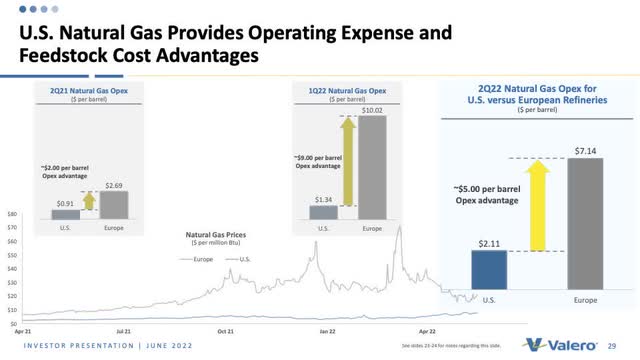

This next slide illustrates the magnitude of the American cost advantage vs. European Refineries.

Valero

Management expects high rates of operation, regardless. The real issue remains the crack spread environment, an environment that remains strong but moderating. Although capacity fell in the U.S. during 2021 to just under 18 million barrels per day and with little if any refining expansions coming, the stressed environment bodes well for continued higher spreads long-term. Finally, most of the capacity for Valero resides in the Gulf Coast area.

Renewable Products (Diesel Mainly)

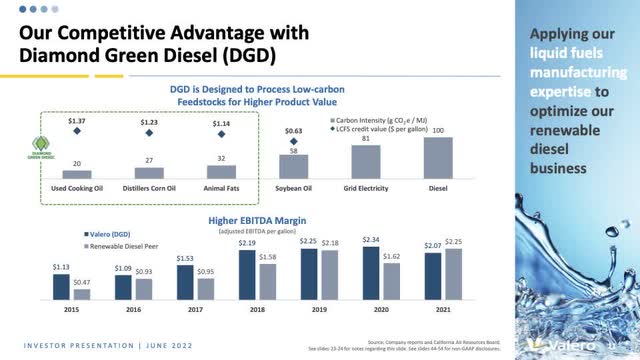

Management discussed its growth market in renewable products. Valero began operations at its DGD 2 unit in December of 2021. A slide within the presentation summarizes the company’s business advantage.

Valero

The DGD units are designed to avoid expensive feed stocks such as soy oil. The designed plant inputs include cooking oil, corn oil and animals fats (tallow). Yet, during the call, the company discussed negative impacts from pricing, $130 in the first quarter vs. $100 in the second for sales, plus impacts from significantly higher soybean pricing. In the 10-Q, the company stated,

An increase in the cost of the feedstocks that we process had an unfavorable impact of approximately $563 million.

We have to ask: what type of feed stocks are being inputted? Was it tallow, corn oil, cooking oil or soy oil? Regardless, the company expects prices to normalize in the back half of the year. With regard to other feeds, animal fats and cook oil, management stated that there were no problems sourcing. Sourcing the DGD-3 unit wasn’t an issue.

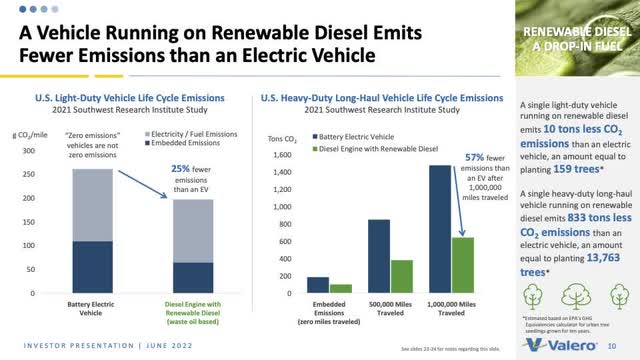

We found this interesting and more than worthwhile slide within its deck.

Valero

Renewable diesel emits fewer emission than an electric vehicle. In essence, Valero confirmed our belief that when the whole process is considered, strange or unexpected results surface.

Distribution Discussion

We conclude our assessment with distributions. Valero’s management still believes that debt must be lowered further expecting that to take several months before it considers other cash uses such as increases in distributions. Jason Fraser, Executive Vice President and Chief Financial Officer, stated,

We’re at a 42% payout so far this year, so we think we’re in good shape, and we’ll plan to continue doing more of the same, paying down our debt and honoring our return commitment . . . .

Investors seeking higher returns should look elsewhere.

Risks & Investment

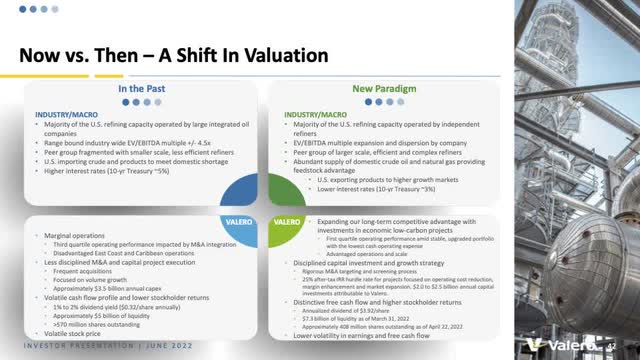

Valero investors might consider this company through the following slide.

Valero

A statement at the bottom, which is a little difficult to read, reads:

Lower volatility in earnings and free cash flow.

Those few simple words, in our view, highlight the most important description of Valero: low volatility. For investor seeking high yields, Valero isn’t the spot. But, for those who purchased the stock a few years back, their initial investment earns nicely. That isn’t true today.

Second, distributions will remain steady at $4.00 per year at least for a while. Deleveraging is still in progress. The renewable diesel portion of the company will grow, but the refining piece dwarfs the renewable growth, hiding its value. We recommend an alternative, Calumet Specialty Products (CLMT) for a far better play for a renewable growth story. Calumet’s pure renewable play, MRL, will more likely offer investors equity growth for the next few years, maybe 4-6 times growth.

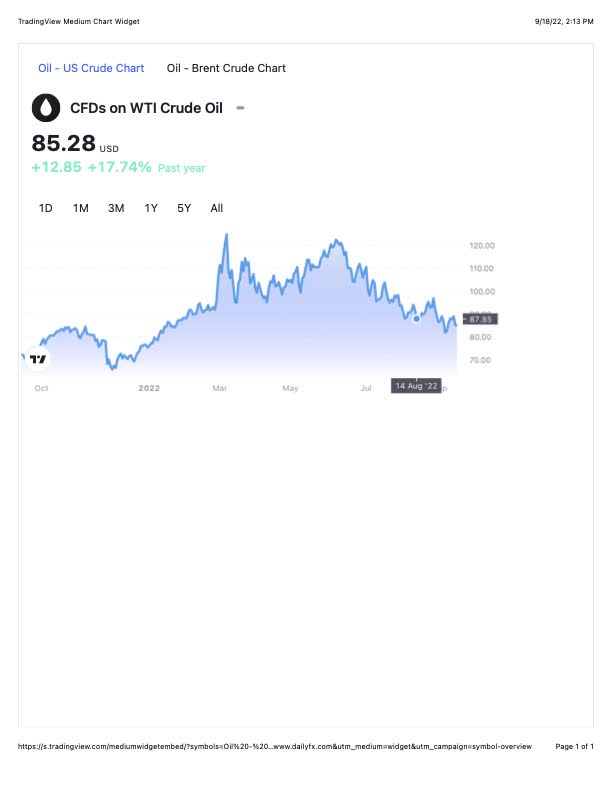

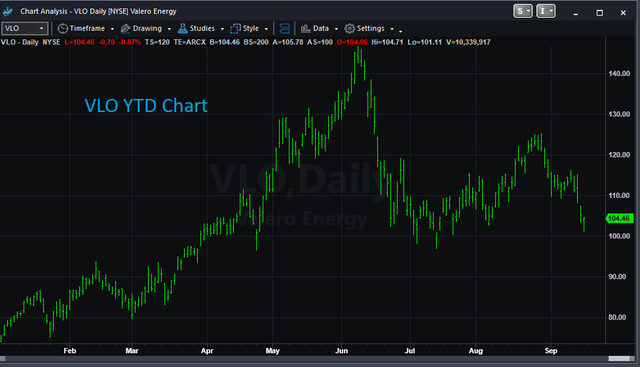

The negatives with Valero must not mask out the important of the company’s place in the market nor its steady financial performance. Investors need to understand what Valero is: a steady, nominal growth story in important and essential markets. We don’t own Valero, nor do we plan otherwise. The stock price will be market driven. Waiting on lower prices generated from a recession driven demand destruction might be a very good strategy. Assessing an investor place for Valero seems more a market play than a company play. Two slides, one from DFX, the next from TradeStation Security software, illustrate this market relationship.

DFX

TradeStation Securities

The two slides with similar time frames shows the relationship between crude oil pricing and Valero’s price tracking close in step. When we propose market driven, our thought reflects ones belief about the future price of crude oil. With the government selling off SPR crude at crazy rates without promoting drilling and production, a reasonable conclusion for higher crude oil prices seem certain. Our assessment concludes ownership for stability makes huge sense; possible ownership returns from higher crude might make good sense.

Be the first to comment