gladassfanny/E+ via Getty Images

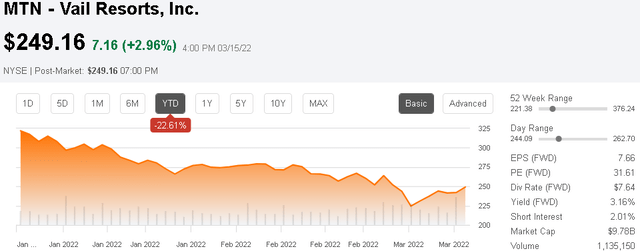

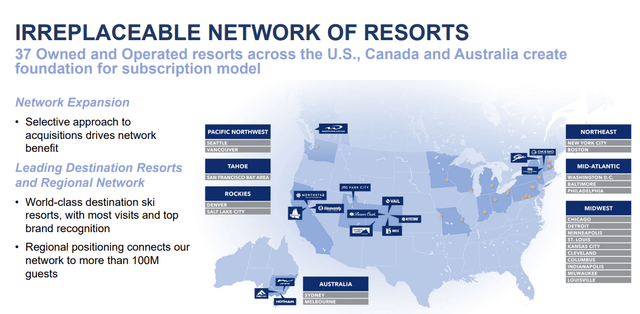

Vail Resorts, Inc. (NYSE:MTN) is the largest mountain ski resort operator in the United States with a portfolio of 37 destinations including hotels and real estate assets. The company just reported its latest quarterly result which missed expectations considering the period included the surge of Covid cases from the Omicron variant that impacted operations. Separately, elevated labor costs have also been pressured margins. That being said, we think the stock looks interesting following a 33% selloff from recent highs that has helped to balance the valuation while the outlook remains positive.

Vail Resorts benefits from its leadership position with the growing popularity of skiing as a recreational activity and is set to capture strong demand as operating conditions normalize through the next season. We are bullish on the stock which is supported by solid fundamentals and well-positioned to rebound. The company also announced a big dividend hike, more than doubling the quarterly rate, making MTN a compelling income pick.

MTN Earnings Recap

This was Vail Resort’s fiscal 2022 Q2 report with EPS of $5.47 which missed expectations by $0.28. Revenue of $906.5 million in the quarter climbed by 32% year-over-year but was $50 million below the consensus. Management mentioned that the spike in Omicron cases particularly during the peak holiday season created multiple challenges. At some resorts, 10% of all staff were unable to work as scheduled due to Covid which translated to some lost sales opportunities.

From a high level, the story continues to be an ongoing recovery from deeper pandemic disruptions in fiscal 2021. EBITDA of $398 million this quarter climbed 44% from $276 million in the period last which was defined by limited capacity and a greater number of Covid restrictions. Focusing just on the latest January and February results, season-to-date skier visits are up 2.8% over 2020 pre-Covid trends while ski lift revenue is up 10.3% on a 2-year stacked basis considering pricing increases implemented over the past year.

An update this quarter is a push towards higher employee compensation. Vail Resorts is committing to a $20.00 per hour minimum wage while also boosting pay for salaried positions. The effort is intended to enhance the customer experience through a more engaged workforce along while improving retention rates. Looking out towards the next ski season for fiscal 2023, management expects the increased staffing levels and pay bump to add approximately $175 million in labor expense.

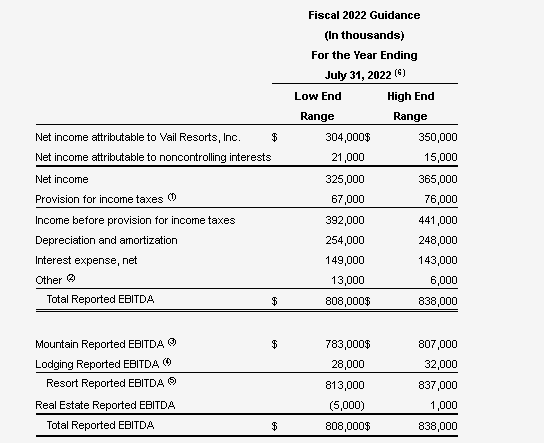

It’s encouraging to see a revision higher to full-year financial targets even considering the Q2 setbacks and cost pressures. Management now expects EBITDA between $808 million and $838 million, which is higher than the $807 million midpoint estimate from the Q1 report. Similarly, the target for net income between $325 million and $365 million has also been bumped higher from the old $335 million midpoint forecast. From the earnings conference call:

Despite the challenging start to the season through the holidays, we have increased the midpoint of our resort reported EBITDA guidance as compared to our original guidance provided in September, demonstrating the resilience of our business model and the benefits of our advanced commitment strategy. The update to guidance is primarily driven by the strong demand from destination guests at our Western U.S. resorts particularly with regard to lift ticket sales, which we expect will continue through the remainder of the season.

Simply put, the company expects to finish off this winter ski season with strong demand at its properties. Momentum in services like ski school and rentals are also supporting profitability. Furthermore, the lodging business is performing better than expected based on higher average daily rates (ADR) and occupancy levels.

source: company IR

Vail Resorts Dividend Analysis

Vail Resorts has announced a new quarterly dividend rate of $1.91 per share representing a 117% increase from the prior $0.88 amount. The forward yield on the stock is now 3.1%. The next dividend will be paid on April 14th to shareholders on record as of March 30, 2022.

Management explains that the strong liquidity position and higher earnings outlook provide some flexibility for the enhanced payout. For context, the annualized dividend rate of $7.64 represents a distribution of approximately $309 million, or 37% of the full-year EBITDA guidance.

The dividend is supported by an overall solid balance sheet. Vail Resorts ended the quarter with $1.4 billion in cash against $2.8 billion in total debt. Net debt to EBITDA leverage ratio on the full-year guidance around 1.7x is a strong point in the company’s investment profile.

MTN Stock Price Forecast

This was an otherwise tricky earnings release to dissect. The headline of Vail missing expectations along with the labor cost pressures explains some of the weakness in the stock that has likely also been caught up in the broader market volatility over the last several months. On the other hand, it’s fair to say that the revised guidance with positive comments from management, as well as the dividend hike is bullish.

A big theme for the company has been the shift towards a “subscription model” with the sale of season passes. The result provides a more consistent level of revenue and cash flow visibility which adds a layer of quality to the financials. For fiscal 2022, the unit growth of the pass product increased 47% year over year which means Vail has a larger customer base regardless of how many times the users visit the resorts. An expectation for high retention and gradual pricing increases over time sets a runway for long-term growth.

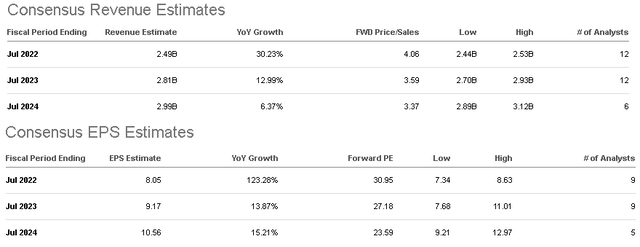

According to consensus estimates, the market is forecasting full-year revenue at $2.5 billion which represents a 30% increase over fiscal 2021. On the earnings side, this year’s EPS estimate of $8.05 is 123% higher than last year and also 8% above the result from back in fiscal 2019.

The takeaway here is that while the company is already on track for record revenues and earnings, there is still room to fully normalize operations during the next ski season into 2023 at full capacity. We believe there is an upside to these estimates as the market may simply be too conservative, particularly on the top-line trends.

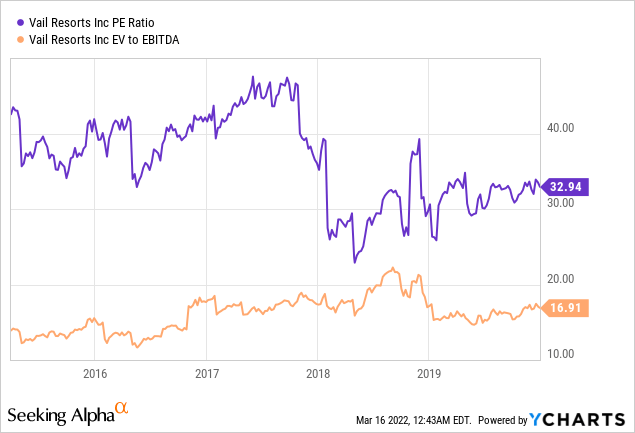

In terms of valuation, we believe MTN is undervalued at a forward P/E of 31x or 27X looking out into 2023. Considering management’s EBITDA guidance, the stock is also trading at an EV to forward EBITDA ratio of 14x. We highlight that both of these metrics are below the average for the stock pre-Covid between 2015 and 2019 and the P/E multiple was closer to 35x and the EV to EBITDA multiple averaged 17.5x over the period.

We argue that Vail Resorts deserves a higher valuation premium given its improved growth outlook from pricing gains along with the strength in the season pass model. Getting past the recent Covid disruptions, the next ski season should break more records for the company adding to operational and financial momentum. The 3.1% dividend yield also adds to the attraction in the stock.

Is MTN a Buy, Sell, or Hold?

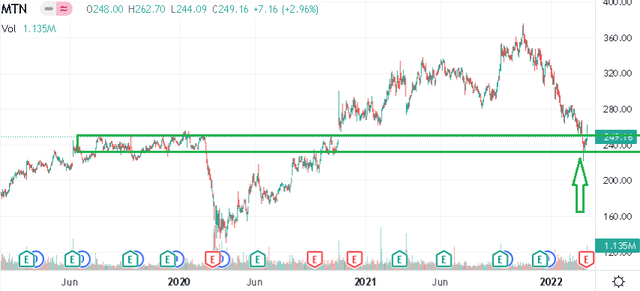

We rate shares of MTN as a buy with a price target of $325 representing a 35x multiple on the current consensus 2023 EPS. The stock traded at this level as recently as last December and we believe it can recover nothing that the current level of the stock around $250 appears to be an important area of technical support going back to 2019. The opportunity here is to pick up shares in a high-quality category leader that is beaten down but maintains a strong outlook. We see the company outperforming expectations through 2023.

Over the next few quarters, it will be important for management to execute its strategy of driving financial efficiencies heading into the 2023 ski season. The key risk for Vail is that the company remains exposed to macro trends including consumer spending conditions. With an eye on the ongoing Russia-Ukraine crisis, a deteriorating of the global growth outlook could limit demand for travel and leisure forcing a reassessment of Vail’s earnings outlook. Skier visits and the EBITDA margin will be important monitoring points.

Be the first to comment