cveltri/iStock Unreleased via Getty Images

Utz Brands, Inc. (NYSE:UTZ) is a world-renowned snack food company that specializes mainly in potato chips. The company has been around for over 100 years as it has navigated the ups and downs of becoming a beloved and highly popular brand. The company has solid fundamentals and has been consistently growing for an impressive number of years.

The company’s gross margin is particularly impressive as Utz is bringing in high-level profits. The possibility of an upcoming recession is not an imminent threat to the company as it has strong brand loyalty and the pricing power to be able to adjust to inflation and other developments. Utz has price action plans in order to offset the current levels of inflation and to set up the company to be successful even during market downturns. Utz has also proven to be successful during previous market downturns.

Because of all of this, and the current price the stock is trading at, Utz could be a great value pick for investors.

Revenue and Margins are Strong, But the Balance Sheet May Need Work

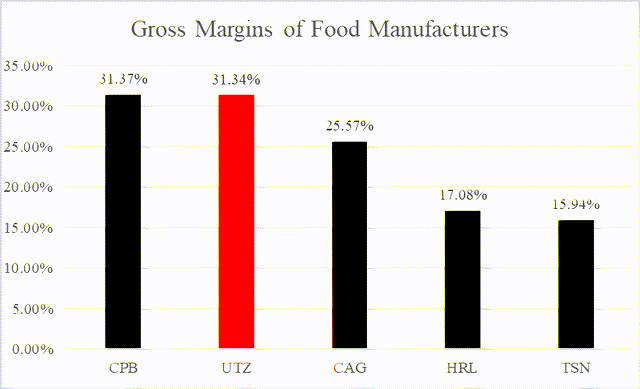

Since Utz went public in 2020, there is no sufficient data regarding the company’s fundamentals. However, since 2020, the company has posted impressive numbers. Over the past 3 fiscal years, total revenue has risen from $964.31 million to $1.18 billion. The gross profit margin currently sits at 31.34%, which shows how the company is still generating plenty of profit. When put into comparison with similar food manufacturers, Utz’s gross margin profit stands out to be among the top of the competitors.

Gross Margins of Food Manufacturers (Created by Author)

The company’s balance sheet may not be in the best position. Cash and equivalents have dropped from $46.83 million to $41.9 million over the same 3-year span. Debt has risen from $787.49 million to $876.63 million over these years. However, the company’s strong growth in revenue and high gross margin could help support the weak balance sheet.

First Quarter Beat Expectations But Still Saw Declined Earnings

Utz’s reported a strong 1Q22 earnings report and beat estimates for both revenue and earnings. 1Q22 reported sales grew 27% to $340.8 million. This beat analyst consensus estimates by 10.25%. Net income also beat expectations of $0.09 per share as the company reported an EPS of $0.11. However, the company’s EPS is down from last year, which was reported to be $0.13 per share. Utz’s adjusted EBITDA declined 4% to $36.5 million.

CEO Dylan Lissette attributed the decline in earnings to the increased supply chain costs, pricing actions, and productivity momentum factors behind Utz’s outlook. Management expects the first half of the fiscal year to outperform the second half due to changes in price elasticity, meaning the company could face some issues in the next part of 2022.

Pricing Power and Customer Loyalty Creates Strong Flexibility During Recessions

A reason that Utz has been a company for over 100 years and has survived the ups and downs that it faced over time is due to its loyal customers. Utz has strong brand loyalty which keeps customers staying true to the Utz brand. If Utz needs to raise its prices, it can do so and consumers will still likely buy the products either way. Utz has already begun to utilize its pricing power this year, as management expects prices to rise an average of 10% this fiscal year. CEO Dylan Lissette believes the ongoing war in Ukraine and its impacts on inflation have built a need for Utz’s rise in prices.

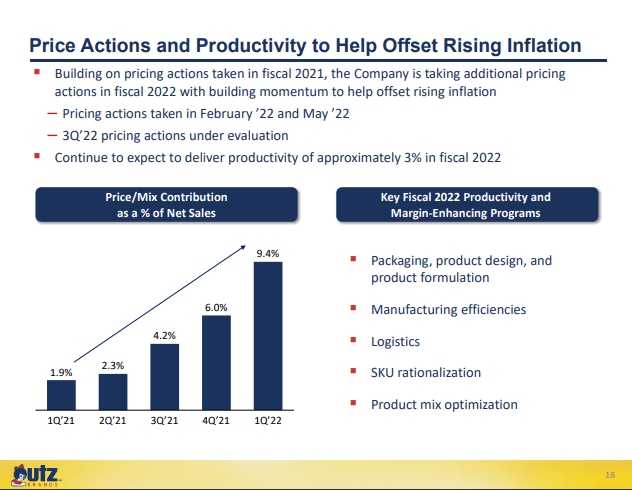

Since we last reported, the ongoing Russia and Ukraine conflict is impacting certain input costs meaningfully… The step-up that we are seeing is significant on cooking oils, all the different oils that we use in our products. And then there is a step-up on wheat flour, as well as packaging; some of our packaging costs are really tied to what happens with crude oil prices. Fuel … that has stepped up as well. Transportation rates, freight rates, they stepped up… It’s very important to note that as inflation continues to rise, we continue to take pricing actions and drive our productivity initiatives to fully offset these increased costs, all while making the necessary investments to support the strong growth of our brands. With this continued momentum, we believe that our Q2 pricing will be greater than the 9.4% pricing we achieved in Q1. In addition to this, we have incremental pricing actions under evaluation for the second half of the year to help offset any new inflation impact beyond our current expectations.

Utz utilized its pricing power in 1Q21 as the company took pricing actions which totaled 9.4% and still managed to generate an increase in volume of over 11%. Price inelasticity is proving to be strong for the company, as consumers are sticking to Utz’s quality foods through rises in prices.

Utz’s Price Actions Plans (Company Presentation)

Utz has Shown Consistency Through Downturns

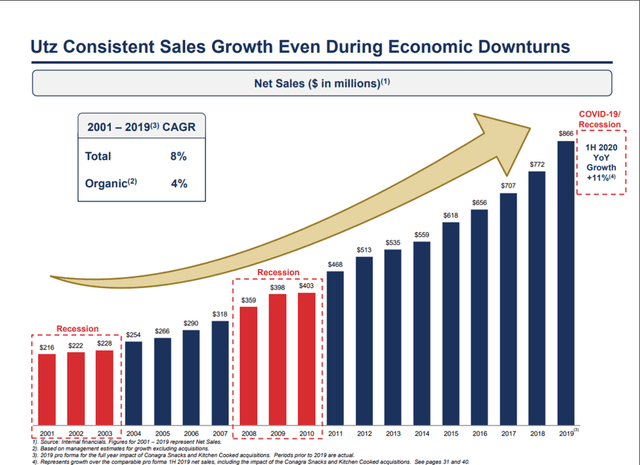

Utz is a proven and trusted company which has been successful through recessions in the past. Net sales for the company have been growing consistently over the past two decades. Most notably, Utz grew its net sales by $43 million during the span of the Great Recession. Utz managed to consistently grow its net sales during all three recessions of the 21st century. This consistency throughout times of uncertainty proves that the company knows how to operate effectively when the economy is in a bad state. Utz is seemingly set up to do well if another recession comes.

Utz Consistency Throughout Recessions (Company Presentation)

Growing sales is a great way that Utz can come out of a recession in good shape. Currently, Utz believes that expanding into dollar stores such as Dollar General (DG), Family Dollar, and Dollar Tree (DLTR) will return promising growth in sales. Net sales have been growing strong for many years, and this recent expansion is another way to continue this trend of sales growth. Expanding into these stores can give Utz an edge when it comes to sales during a possible upcoming recession.

Valuation

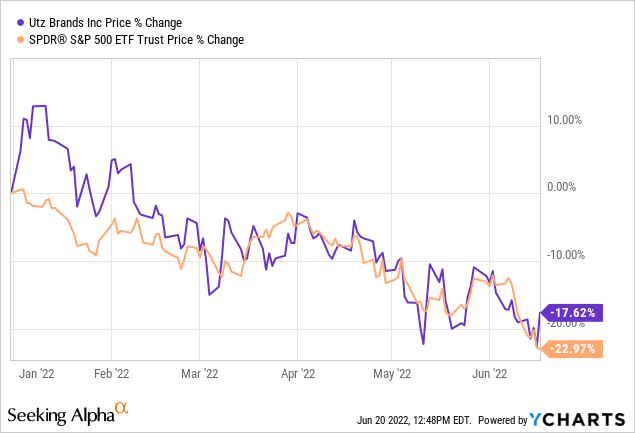

The share price of Utz has dropped almost 18% this year, but it is still ahead of the market by over 5%. This drop could give investors great value for the future, but getting in at the right price is very important.

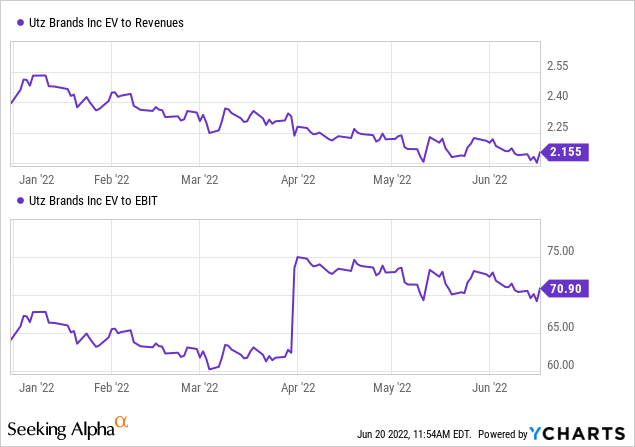

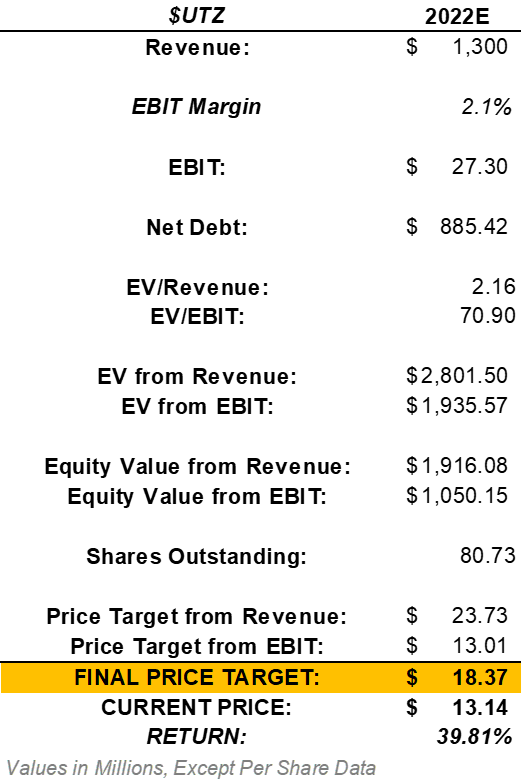

Utz currently trades at an EV/Revenue of 2.155 and EV/EBIT of 70.9. Management’s current guidance places revenue for FY22 between $1.3 billion and $1.34 billion. For a conservative estimate for this valuation, I will use $1.3 billion. Over the past two years, the company has had an average EBIT margin of 2.1%. After multiplying this margin by the expected revenue, FY22 EBIT is projected to be $27.3 million. After multiplying these projections by the mentioned valuation multiples, estimates for the company’s future enterprise value can be calculated.

After adjusting the company’s projected enterprise values for net debt, we can find the company’s projected equity value from revenue and EBIT. After dividing the equity values by the current number of shares outstanding and averaging the price targets, a final price target of $18.37 is calculated. This means that the stock could see a potential return of 39.81%.

Valuation of UTZ Stock (Created by Author)

The Takeaway for Investors

Utz is a very strong company and has lasted in the food industry for over 100 years. The company has strong fundamentals, especially considering that the stock has just become public in 2020. The company has plenty of room to continue growing, as its net sales have been increasing consistently for over 20 years. The company is also set up to survive and do fairly well during a possible upcoming recession based upon its brand loyalty and pricing power. The stock is outperforming the market and has the potential to continue to do so in the future. The stock also appears to be slightly undervalued with room to grow. Due to the company likely having a bright future and the stock trading at a great price, I will apply a Buy rating.

Be the first to comment