imaginima/iStock via Getty Images

We have generally had a favorable view of the utility sector in the last 12 months. It was here that we could find many reasonably priced plays that were not tainted with the hype we saw elsewhere. Some recent bullish picks included Canadian Utilities Limited (OTCPK:CDUAF) and TransAlta Corporation (TAC). We also held a favorable view of the closed end fund BlackRock Utility & Infrastructure Trust (NYSE:BUI) and had a buy rating on it. Today we go over where the sector stands and why we are downgrading BUI to a hold. We are also putting a sell rating on another famous utility play, Reaves Utility Income Fund (NYSE:UTG).

The Fundamentals

Utilities are designed to be boring yield plays and provide steady growth with low risk. Every now and then though, investors lose the plot. This can come by depressing utilities despite good fundamentals or putting them on a pedestal at lofty valuations. Guess which point we are at today? As we run our screeners, we see less and less that we like. A very small percentage of stocks here are in the buy zone and a vast majority are flirting in the sell zone.

We are going to visualize this first by looking at the Utilities Sector ETF (XLU). We are using this ETF to examine the fundamentals as it is uncomplicated. It lacks the leverage of UTG or the covered call selling of BUI. It also does not have a fluctuating NAV premium/discount. So we will look at XLU first and then extrapolate our findings to BUI and UTG.

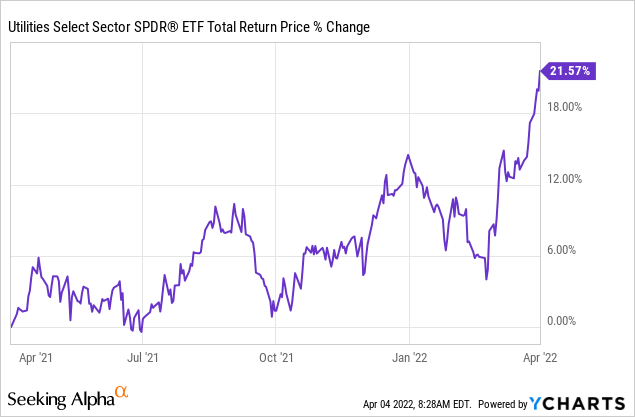

The first thing we are looking at is the price action. The rally of the recent bottom has this mimicking a growth play or perhaps a meme stock.

We get the concerns with Russia and the increased need to rely on non-hostile sources of energy. We think utilities are unlikely to benefit from that. In most cases they have a risk of getting hurt as the underlying energy commodities spike out of control. In short, we think the market is wrong in giving utilities the benefit of this. But it actually gets worse.

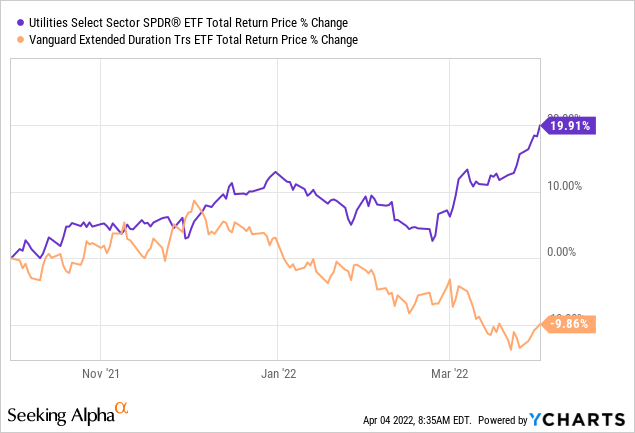

The rally in utilities has also come at a very unusual time as interest rates are spiking across the board. Historically utilities have been extremely sensitive to interest rate movements and strong interest rate spikes have generally at least capped upside moves. That is not what is happening today.

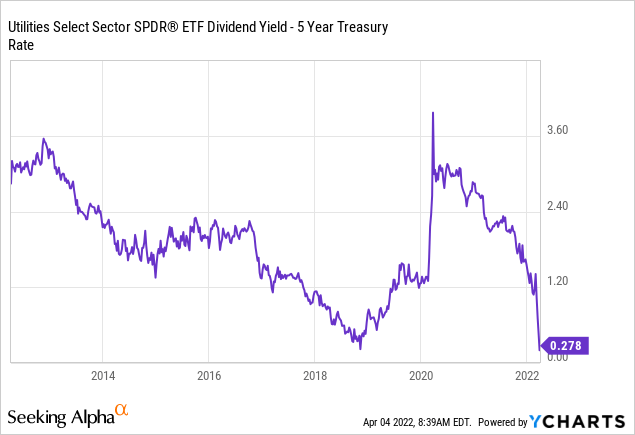

One other way to visualize this is to see the extreme drop in the spread between the yield on XLU and the 5-Year Treasury rate.

At 28 basis points, something is going to break over here. Of course the possibility is that Federal Reserve backs off the rate hikes and 5-year Treasury yields pull back. That is not our base case. We think we will see another 50 basis points rally in the 5-Year Treasury at the minimum and that should be soul crushing for XLU.

Extrapolating To BUI & UTG

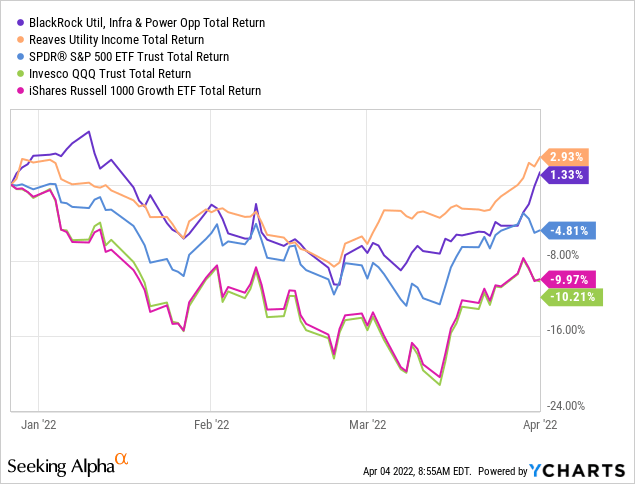

When we last covered these two closed end funds, we said we had a preference for the non-leveraged BUI. Since then both BUI and UTG had handily outperformed the broader S&P 500 (SPY). They also thrashed Invesco QQQ Trust (QQQ) and growth index ETFs like iShares Russell 1000 Growth ETF (IWF) where we maintain a sell rating.

So in that sense the defensive stance has played out well. BUI underperformed UTG primarily due to a lack of leverage and also due to high exposure to Europe where utilities are feeling more stress from commodity prices. We think the European utility exposure helps going forward as valuations are far more reasonable there. The covered calls will also protect against some downside. Hence despite the overall valuation strain on utilities we are only moving BUI to a hold/neutral.

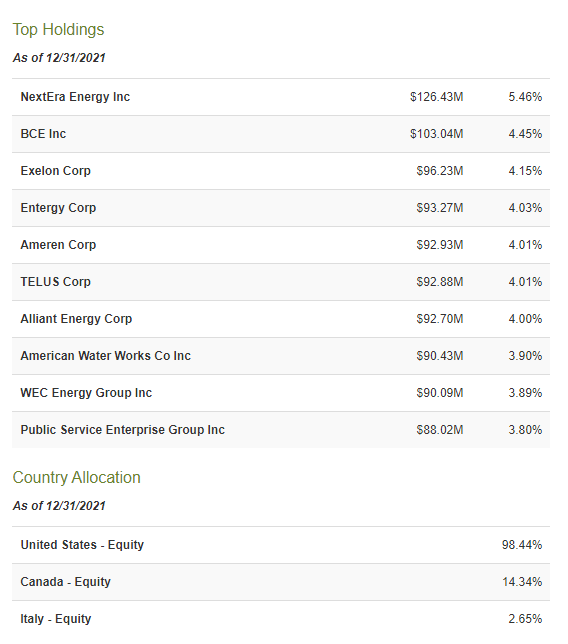

UTG is of course primarily a US play.

UTG Holdings (CEF Connect)

Even where it is going abroad, it is picking up some incredibly expensive plays like TELUS Corporation (TU) trading at the highest valuations we have seen. This gets messed up further by the leverage.

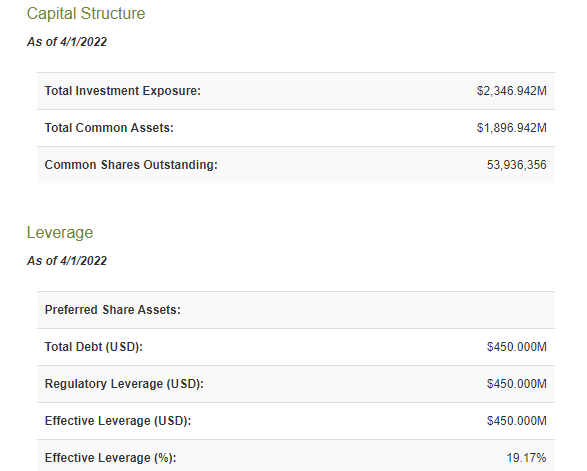

UTG Leverage (CEF Connect)

That number is presented as 19.17% on CEF Connect. You get to that by dividing total assets by debt. We like to calculate it as debt divided by equity, and that number comes to 23.73%. That is high for what we think is about to come. We are hence downgrading UTH to a Sell rating. We see the most likely outcome of a 15% drop in the fund NAV alongside a widening of the discount leading to negative 15-20% total returns. We will revisit when we believe the fundamentals have changed.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment