BONDART/iStock via Getty Images

It can often be frustrating to see headlines like “the rally in stocks fizzles because of higher oil prices” or “high oil prices raise growth concerns”. As a result, plagued with uncertainty relating to demand destruction and recession risks, you do not know whether to invest in oil stocks to take advantage of higher commodity prices, add to your existing position, or even divest entirely as most energy names have already appreciated by more than 50% during the last year.

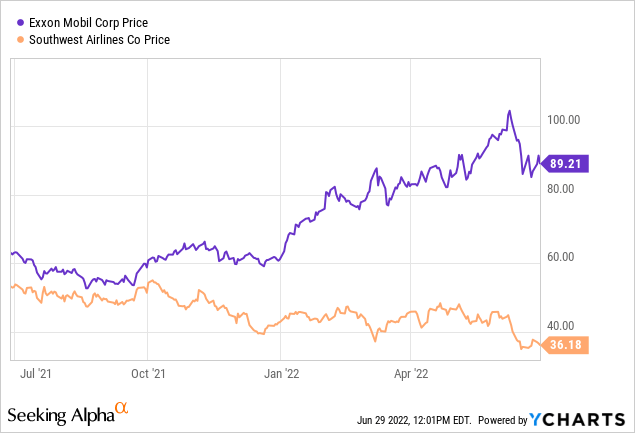

Now, there are tens of trading possibilities involving different demand and supply scenarios, and the aim of this thesis is not to go through each of them but rather to use market volatility induced by fluctuating oil prices to trade the Exxon Mobil (NYSE:XOM)-Southwest Airlines (NYSE:LUV) pair whose stock prices follow different paths as per the chart below.

These are inversely correlated, as the high oil prices which have propelled XOM’s stock higher have conversely dented airlines’ profitability, thereby sending LUV’s shares lower. Now, making a trading decision solely based on this chart is not recommended, and for this purpose, I identify the dollar returns out of stock price fluctuations.

The Returns and the Risks

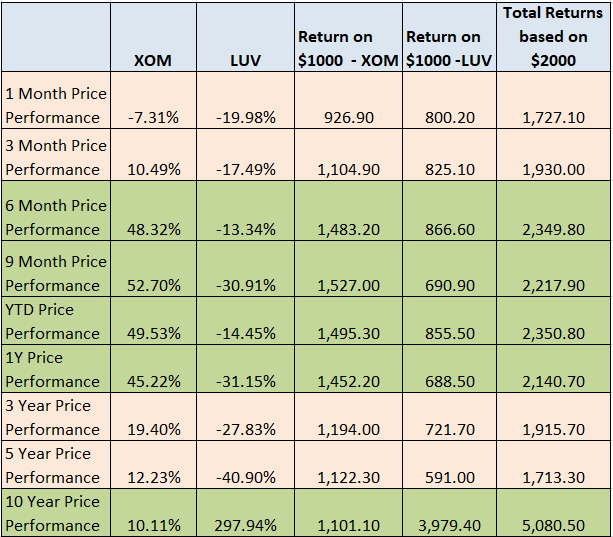

The table below considers a much longer time horizon spanning 10 years and considers dollar returns on investment of $1000 made in LUV and XOM respectively or a ratio of 1:1. Now, some could choose other ratios like investing more in the airline play since it is at a one-year low of 31% while XOM has already appreciated by a whopping 49.53% during this period. This said, the energy company makes for a good investment for income seekers due to its regular distributions to shareholders and also because of its stock appreciation during the last ten years.

Historical returns based on $1000 invested in each stock with table built using data from (www.seekingalpha.com)

Shifting to combined returns, historical performances indicate to us that during the last ten years, these have exceeded the $2000 mark five out of nine times, as shaded in green. Moreover, if someone had invested $2000 equally shared in XOM and LUV six months back, he would have made a profit of $349.80 excluding commissions and fees.

The combination also works for a one-year period and that 10-year price return of $3,080.50 for $2000 invested shows that over a long period of time, whopping gains are possible.

Adopting a more cautionary posture, using this pair strategy to make gains depending on market fluctuations is different from investing where you just buy and hold for the long term. It is, therefore, more synonymous with trading where the timing is key. Thus, as shown by the rows which are shaded in pink, if investors cash out at the wrong time, possibly at the first signs of a market turmoil, for example, they risk obtaining less than the amount they initially invested.

This is exemplified by the 3-month price-performance where both stocks have suffered from downsides mostly as a result of the risks constituted by high inflation to the economy. Moreover, there are three more such instances of losses as the market is increasingly pricing the risk of a recession impacting the economy in the coming six to twelve months. In view of these risks, the pair can also be used for hedging purposes.

The Hedging Rationale

Another aspect of this strategy is that it is based on two stocks that come from two different sectors of the economy, namely energy and transportation. This may be different from other pairs where stocks come from the same sectors of the economy and follow more or less the same trend.

Furthermore, and in addition to the inverse relationship I mentioned earlier, the objective is also to look for two stocks that are related by a common theme. In this particular case, the theme is the market dynamics around the energy supply chain and its central commodity, oil. Now, since oil is used as an input or raw material for an airplane, a reduction in energy prices will increase the profitability of the airline, thereby raising the probability of the stock going higher. Conversely, a rise in the price of oil means more profits for the energy company.

Thinking aloud, trading these two stocks together is somewhat analogous to hedging where investors put part of their money in a “backup” asset class, which is inversely correlated to their main investment. Most common examples of hedging are bonds, gold, or even leveraged inverse ETFs. However, as bond and gold investors are aware, neither of the two have provided much portfolio protection since the start of this year, a period that has been particularly volatile for stocks. For this matter, since the beginning of 2022, the Vanguard Total Bond Market (BND) is down by nearly 11% and the SPDR Gold Trust ETF (GLD) is up by only 0.69% while the SPDR S&P 500 Trust ETF (SPY) is down by more than 20%. Uncertainty relating to high inflation, recessionary concerns and demand does not allow analysts to have a clear idea about the future.

The Valuations

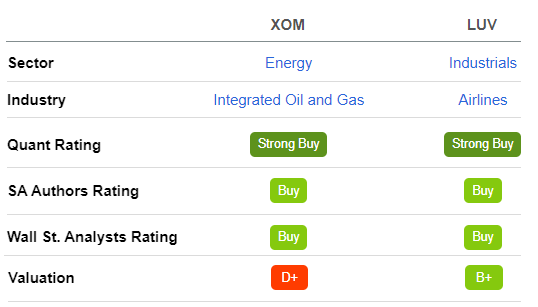

On the other hand, as shown in the table below, both XOM and LUV are rated as strong buys by SA’s Quant ratings, with the airline company having a valuation score of B+. Thus, after a 20% downside during the last month, it could climb back to the $39 level with just a 10% upside.

Stock ratings and valuations (www.seekingalpha.com)

As to my rationale for still investing in XOM despite its high valuations (above D+ score) and recession fears, investors will note that this time the economic environment is different from 2008-2009 or March 2020. Thus, generally speaking, demand is still high, and the problem is more on the supply side, with the price of commodities surging during the last year. Additionally, there are also issues both in terms of the availability of components as well as their escalating costs, which are adversely impacting the topline and bottom line of equipment manufacturers. Furthermore, with the supply of oil remaining tight due to the war in Ukraine, the post-Covid pick-up in travel remaining unabated and China starting to ease lockdowns, oil prices are not likely to sink in the medium term.

Thus, after a 13.5% downside during the last month, it could climb back to the $94-95 level with just a 10% upside.

Profitability as a Shield Against a Worst-Case Scenario

Now, in the worst-case scenario when oil prices slide, it is going to reduce the cost of doing business for most service-oriented companies like airlines and transportation.

For this purpose, airlines that faced a demand problem as soon as different countries throughout the world closed their borders to prevent the spread of Covid in 2020 are now faced with high energy bills in addition to insufficient pilots to cope with the surge in passenger numbers. Problems have been exacerbated by high wage inflation with trade unions also participating in negotiations with employers.

Now, with the fuel bill estimated to constitute around 24% of airlines’ operating expenses at a price of $101.2 per barrel of Brent, LUV’s operating margin which has suffered considerably due to the Covid lows could benefit significantly in case the price of oil falls by an estimated $35 to $50 during a recession. Additionally, in contrast to other carriers, LUV has a hedging policy which is expected to save the company about $1.2 billion this year.

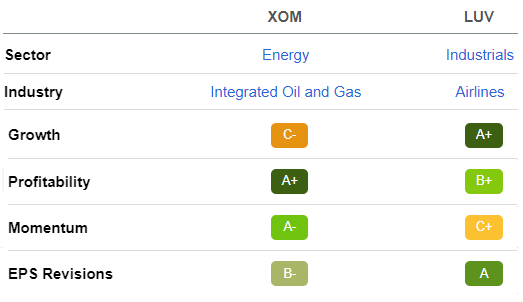

To help LUV in its journey to achieve more sustained margins, there is the fact that there is pent-up demand with more people willing to travel, be it for recreational or business purposes. This should lead to more ticket sales resulting in more revenues on which to spread the fixed costs which means more profits. For this purpose, its profitability score of B+ shows its superiority compared to peers.

Comparison of growth and profitability metrics (www.seekingalpha.com)

XOM is even better with its profitability grade of A+, and this brings some comfort to income seekers that the company has the means to sustain payments of its dividend yield of 3.85%.

Concluding with the Investment Rationale

Now, in addition to the trading dimension which can be viewed as risky by some investors with a longer-term perspective, the XOM-LUV pair also makes sense as a buy-and-hold permitting for regular income while waiting for an upside to materialize. This upside should be driven by LUV’s higher growth potential (as per the A+ score in the above table) while profiting from XOM’s dividends. For this purpose, XOM’s total returns, which is the price performance of 45.22% (as shown in the return table above) plus the dividend yields added together equal 53.6%.

Finally, analysis of historical performance shows that the XOM-LUV pair generates better returns for traders with timing being a key factor here. Furthermore, those looking to hedge their XOM gains can also use the market dynamics around the energy supply chain theme which results in inversely correlated stock prices. This said, with XOM’s superior profitability metric and consistent dividends combined with LUV’s high growth potential, long-term investors can also use the pair as a buy-and-hold, as volatility due to high inflation adversely impacts markets in the short term.

Be the first to comment