Nordic Currency Outlook:

- A hawkish turn by the Federal Reserve has traders selling a trio of less-watched European currencies versus the US Dollar: USD/CHF, USD/NOK, and USD/SEK.

- Both USD/CHF and USD/SEK rates appear poised for most upside in the near-term, while surging energy prices may be offering a different route for USD/NOK.

- According to the IG Client Sentiment Index, USD/CHF has a mixed bias.

Non-Major USD-crosses Turning Bullish

The US Dollar has been gathering pace over the past several days as US Treasury yields ratchet higher following the September Fed meeting. With the Federal Reserve poised to begin its stimulus slowdown over the coming months, the US Dollar has been acting in a manner similar to price action in 2014, when the taper tantrum rattled markets.

Like in 2014, elevated US Treasury yields helped lift the US Dollar versus most of its European currency counterparts. Short-term technical readings suggest that more gains may be in store for USD/CHF and USD/SEK rates, although USD/NOK rates may not climb at all if the surge in energy prices continues in the near-term.

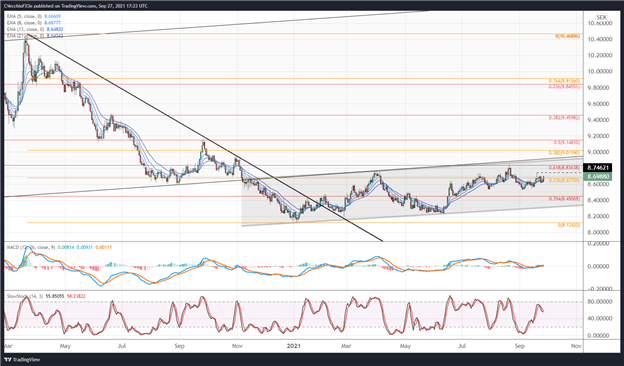

USD/NOK RATE TECHNICAL ANALYSIS: WEEKLY CHART (June 2020 to September 2021) (CHART 1)

USD/NOK rates remain in the broader confines of the descending channel in place for the past year, having just briefly touched a fresh monthly low earlier today as oil prices continue to surge.

Bearish momentum has been gathering pace in USD/NOK. The pair is fully below its daily 5-, 8-, 13-, and 21-EMA envelope, which is in bearish sequential order. Daily MACD is now declining below its signal line, while daily Slow Stochastics have started to drop into oversold territory.

By moving below the prior September low at 8.5615, USD/NOK rates me be predisposed to further weakness towards the 23.6% Fibonacci retracement of the 52-week high/low range at 8.4954.

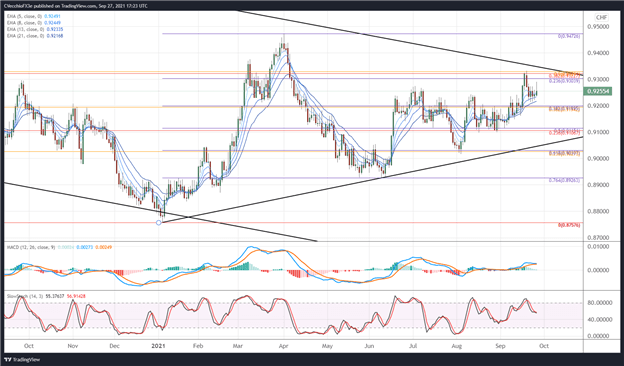

USD/SEK RATE TECHNICAL ANALYSIS: WEEKLY CHART (March 2020 to September 2021) (CHART 2)

USD/SEK rates are starting to turn higher, in part because of the growing divergence in the near-term path between the Sveriges Riksbank and the Federal Reserve. In breaking above the 23.6% Fibonacci retracement of the 2020 high/2021 low range at 8.6776, USD/SEK rates may be poised to rally to and through their September high at 8.7462.

Bullish momentum is gathering pace, now fully above its daily EMA envelope (which isn’t in bullish sequential order just yet). Daily MACD has issued a bullish crossover through its signal line, while daily Slow Stochastics have started to turn higher while above their median line.

USD/CHF RATE TECHNICAL ANALYSIS: DAILY CHART (September 2020 to September 2021) (CHART 3)

USD/CHF rates are gathering bullish momentum after being rejected by a trifecta of Fibonacci retracements earlier in the month between 0.9304 and 0.9329: the 38.2% retracement of the 2019 high/2021 low range; the 50% retracement of the 2020 high/2021 low range; and the 23.6% retracement of the 2021 low/high range.

USD/CHF rates are above their daily EMA envelope, which is in bullish sequential order. Daily MACD continues to point higher while above its signal line, and daily Slow Stochastics’ descent from overbought territory appears to be ending. Another run towards the monthly high at 0.9333 could materialize in the coming days.

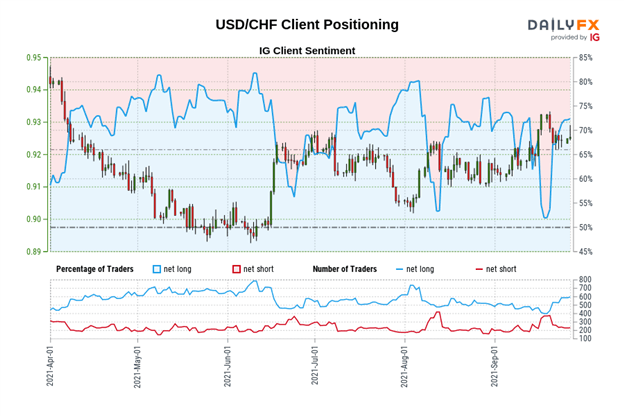

IG Client Sentiment Index: USD/CHF Rate Forecast (September 27, 2021) (Chart 4)

USD/CHF: Retail trader data shows 69.60% of traders are net-long with the ratio of traders long to short at 2.29 to 1. The number of traders net-long is 1.52% higher than yesterday and 47.55% higher from last week, while the number of traders net-short is 15.35% higher than yesterday and 38.98% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CHF prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USD/CHF trading bias.

— Written by Christopher Vecchio, CFA, Senior Currency Strategist

Be the first to comment