JPY Price Analysis & News

- Low Yield FX Outperforms

- USD/JPY Makes Clean Trendline Break, Bears Vulnerable

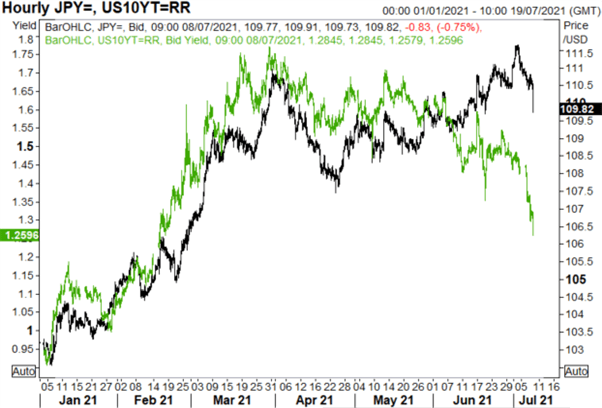

Safe haven currencies beginning to pick up the pace as the slide in US yields persists, prompting a re-think on the consensus short low yielding FX trade. A rather sizeable move in the US 10yr, which now yields 1.26%, down from 1.52% at the beginning of last week and thus eyes the 200DMA at 1.2371 and thus limiting downside for both the CHF and JPY.

CHF & JPY Outperform as US Yields Plunge

Source: Refinitiv

Taking a look at CFTC positioning data, speculators currently hold a large short position in the currency and while some unwinding of positions has likely played its part, there could be some more pain ahead for JPY bears. A clean technical breakthrough the rising trendline that has been in place since the beginning of the year looks to have exacerbated the move lower in USD/JPY overnight, the 50DMA (109.77) holding for now. However, should this level, this opens the doors towards 109.00-10. On the topside, resistance resides at 110.50.

USDJPY vs US 10Y Yield

Source: Refinitiv

USD/JPY Chart: Daily Time Frame

Source: Refinitiv

Be the first to comment