Canadian Dollar Talking Points

USD/CAD snaps the recent series of higher highs and lows after struggling to test the August high (1.2949), and the exchange rate may consolidate ahead of the Federal Reserve interest rate decision as market participants brace for a potential shift in monetary policy.

USD/CAD Struggles to Test August High Ahead of FOMC Rate Decision

USD/CAD appears to be unfazed by the federal election in Canada as Prime Minister Justin Trudeau secures his third term, but the pullback from the fresh monthly high (1.2896) may end up being short lived if the Federal Open Market Committee (FOMC) delivers an exit strategy.

Plans to start normalizing monetary policy should prop up USD/CAD as the Bank of Canada (BoC) insists that the Canadian economy “continues to require extraordinary monetary policy support,” and fresh forecasts from Fed officials may generate a more bullish fate for the US Dollar if the Summary of Economic Projections (SEP) show a steeper path for the federal funds rate.

In turn, USD/CAD may continue to trade to fresh yearly highs in the second half of 2021 as an inverse head-and-shoulders formation seems to be unfolding, but a further appreciation in the exchange rate may fuel the recent flip in retail sentiment like the behavior seen earlier during the previous month.

The IG Client Sentiment report shows 47.19% of traders are currently net-long USD/CAD, with the ratio of traders short to long standing at 1.12 to 1.

The number of traders net-long is 2.89% lower than yesterday and 29.16% lower from last week, while the number of traders net-short is 12.70% higher than yesterday and 45.23% higher from last week. The decline in net-long interest comes as USD/CAD pulls back from a fresh monthly high (1.2896), while the rise in net-short position had fueled the flip in retail sentiment as 61.17% of traders were net-long the pair last week.

With that said, the break above the January high (1.2881) may continue to reflect a change in the broader trend as an inverse head-and-shoulders pattern takes shape, and the exchange rate may stage further attempts to test the August high (1.2949) if the FOMC changes the course for monetary policy.

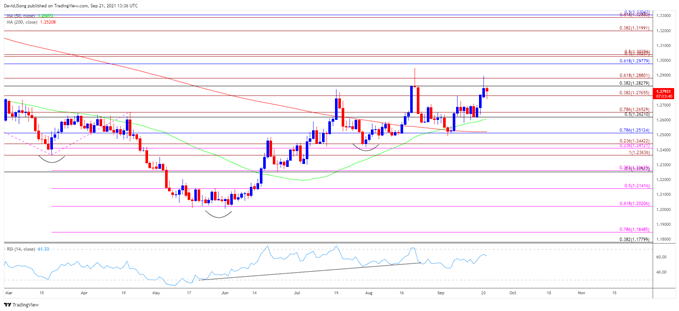

USD/CAD Rate Daily Chart

Source: Trading View

- The break above the January high (1.2881) indicates a shift in the broader trend as an inverse head-and-shoulders formation takes shape, with the 50-Day SMA (1.2607) now reflecting a positive slope as USD/CAD pushed to a fresh yearly high (1.2949) in August.

- In turn, the pullback from the fresh monthly high (1.2896) may end up being short lived, but lack of momentum to hold above the Fibonacci overlap around 1.2830 (38.2% retracement) to 1.2880 (61.8% expansion) may generate a larger pullback in USD/CAD as it snaps the recent series of higher highs and lows.

- A close below the 1.2770 (38.2% expansion) area may push USD/CAD back towards the overlap around 1.2620 (50% retracement) to 1.2650 (78.6% expansion), with a move below the 50-Day SMA (1.2607) opening up the 1.2510 (78.6% retracement) region.

- Need a close above the overlap around 1.2830 (38.2% retracement) to 1.2880 (61.8% expansion) to bring the August high (1.2949) back on the radar, with the next region on interest coming in around 1.2980 (61.8% retracement) to 1.3040 (50% expansion).

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment