mevans

Looking for a picks n’ shovels high yield play on Energy?

You may want to take a look at USA Compression Partners (NYSE:USAC), one of the biggest compression service providers in the US.

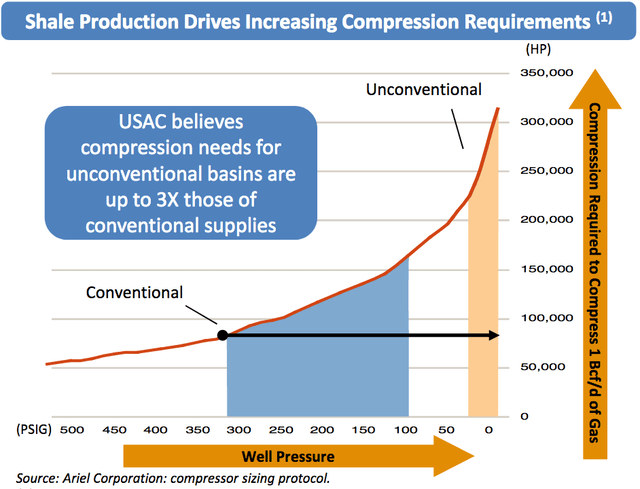

Natural Gas producers need compression to get their product out of the ground, especially in unconventional shale basin environments. In fact, USAC’s management estimates that it takes 3X the amount of compression to extract it from shale:

Company Profile:

USAC is a limited partnership that provides natural gas compression services in terms of total compression fleet horsepower. The company offers compression services to oil companies and independent producers, processors, gatherers, and transporters of natural gas and crude oil, as well as operates stations. It primarily focuses on providing natural gas compression services to infrastructure applications, including centralized natural gas gathering systems and processing facilities. The company is headquartered in Austin, Texas. (USAC site)

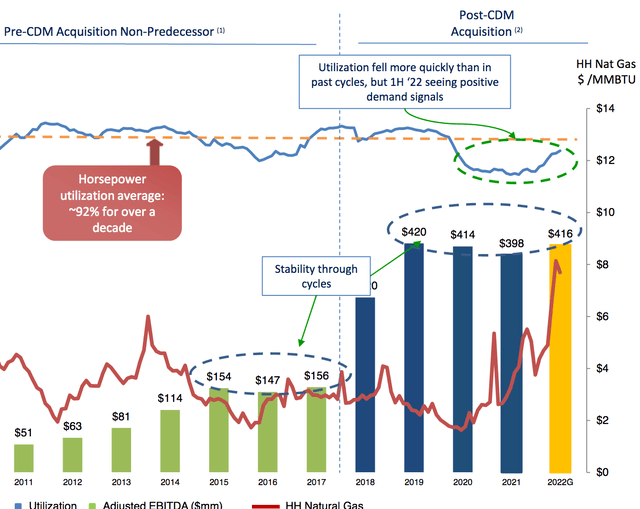

USAC was founded in 1998. It has been through natural gas boom and bust cycles before, but the utilization of its horsepower fleet has been steady, averaging over 92% since 2012. Even in the Energy pullback of 2015-2017, USAC’s EBITDA was stable, running between $147 to $157M annually.

EBITDA’s lowest point was $398M, in pandemic-pressured 2021, but management sees it running at $416M for full year 2022.

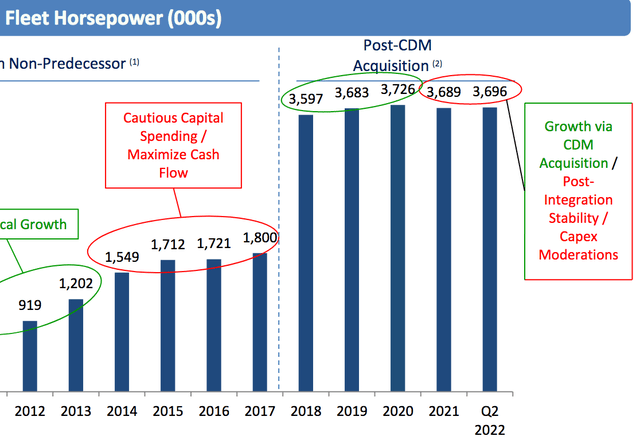

USAC underwent a big transformation in Q2 2018, acquiring CDM.

CDM was the compression services arm of Energy Transfer Partners LP, and Energy Transfer Equities, which merged into Energy Transfer LP, (ET). CMD was valued at ~ $1.8B. That deal doubled USAC’s total fleet horsepower to ~3600:

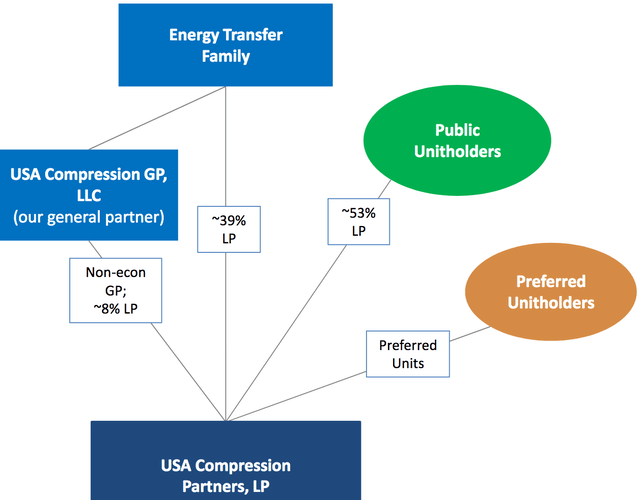

The Energy Transfer family owns 47% of USAC, with public unitholders holding ~53%. There are also non-public preferred unitholders.

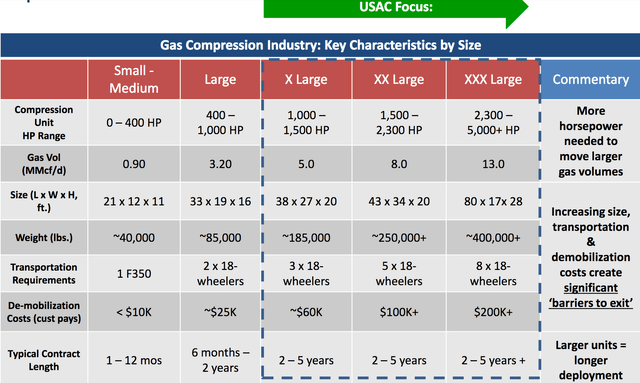

When it comes to compression horsepower, size matters. These are extra large to XXX-large units, often used in multiple numbers by large power providers, and other large operators. They’re contracted on longer terms than the smaller units, and are often renewed. A key point is that USAC’s customers foot the bill for returning units under contract, which, in the case of large units, is very expensive.

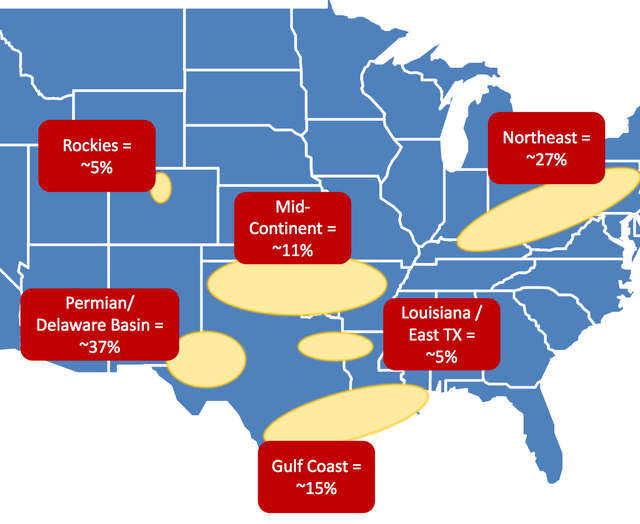

USAC’s equipment is utilized most heavily in the prolific Permian/Delaware Basin, and in the increasingly active Marcellus Basin in the Northeast:

Natural Gas Tailwinds:

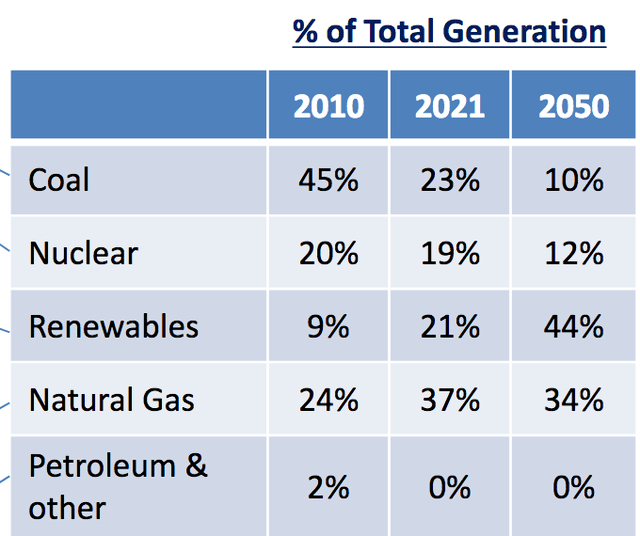

This table shows you how Natural Gas has overtaken Coal as the #1 fuel used in the US for electricity generation, rising from 24% to 37% during 2010 to 2021. While Renewables have made big inroads, Natural Gas is still expected to represent ~40% of power generation additions through 2050.

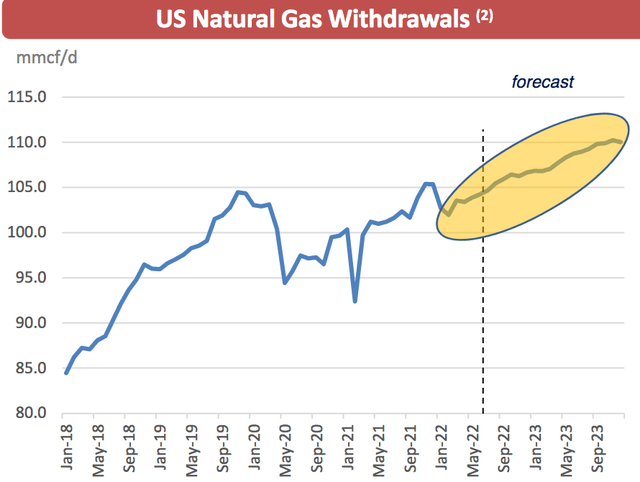

Due to increases in exports and industrial use, attractive demand signals have led producers to increase activity, leading to increased natural gas production – the forecast looks good for continued increases throughout Q1-3 2023:

Earnings:

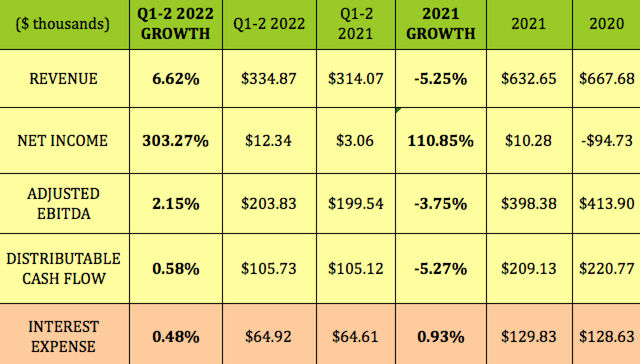

Growth has improved in 2022, with Revenue rising 6.6%, and Net Income up by 3X. Adjusted EBITDA also returned to modest growth, after declining a bit in 2021, while Distributable Cash Flow, DCF was stable in Q1-2 ’22. Management has kept a lid on interest expense over the last 6 quarters:

Guidance:

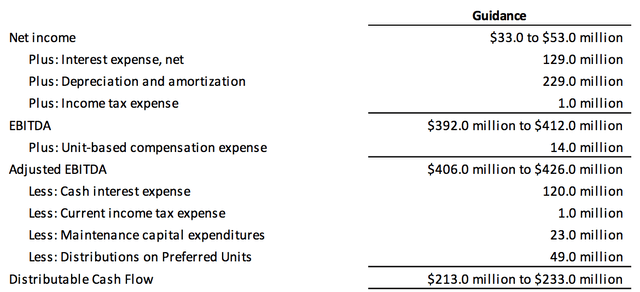

Management is targeting Adjusted EBITDA of $406M – $426M for full year 2022 – the $416M guidance midpoint would be 4.5% above 2021’s EBITDA total.

DCF guidance calls for a midpoint of $223M, which would be 6.7% growth vs. $209M generated in 2021.

Distributions:

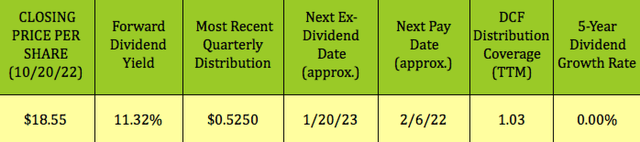

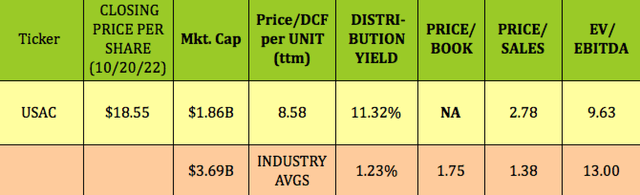

At its 10/20/22 $18.55 closing price, USAC yielded a very attractive 11.32%. It should go ex-dividend next on ~1/20/23. Like most Energy-related companies, USAC pays in a Feb/May/Aug./Nov. schedule. Management has kept the quarterly distribution at $.525 since Q2 2015, hence the 0% 5-year dividend growth rate.

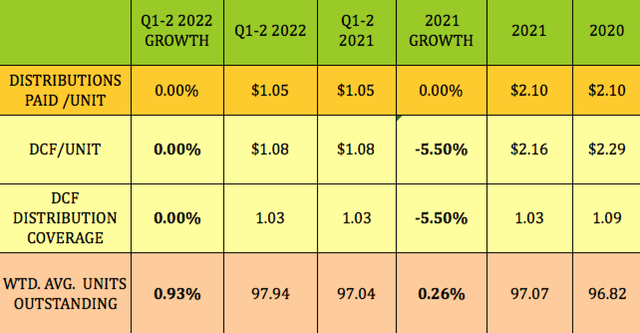

DCF/Distribution coverage averaged 1.03X in Q1-2 ’22, the same as in Q1-2 ’21, and in full year 2021, when it declined from 1.09X in 2020:

Taxes:

USAC issues a K-1 at tax time.

Profitability & Leverage:

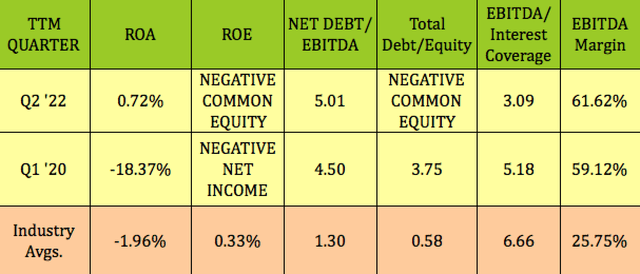

Comparing USAC’s Q2 ’22 metrics shows an improvement in ROA and EBITDA Margin, while Net Debt/EBITDA leverage has moved up to 5X from 4.5X, much lower than the 1.3X Gas & Oil Services industry average. EBITDA/Interest coverage has declined from 5X to 3X, which is lower than the 6.66X industry average.

Debt & Liquidity:

USAC standalone has historically had very little bad debt write-offs; in fact, over the last 17 years, USAC has written off only ~$3.4 million in bad debts-Equates to 0.07% of total billings.

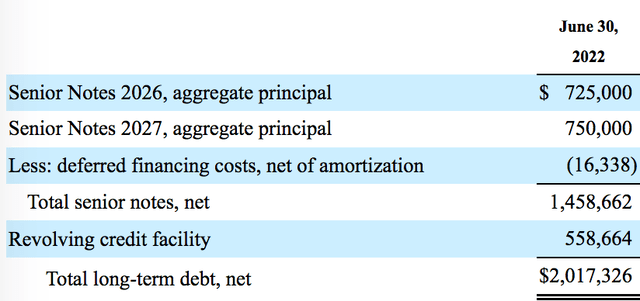

As of June 30, 2022, USAC had outstanding borrowings under the Credit Agreement of $558.7M, $1B of borrowing base availability and, subject to compliance with the applicable financial covenants, available borrowing capacity of $360.9M. The Credit Agreement will mature on December 31, 2025.

USAC also has $725M in 2026 Senior Notes, and $750M in 2027 Senior Notes.

Valuations:

Although there is positive preferred unit equity, common equity is currently negative, hence there’s no Price/Book for USAC. While its yield dwarfs the industry average, its P/Sales and P/DCF look higher than other compression providers. Its EV/EBITDA is below the broad industry average.

Performance:

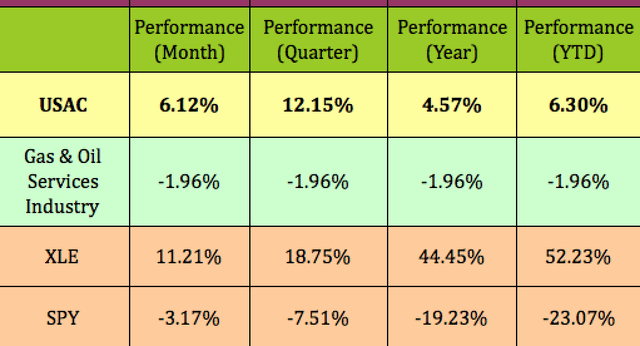

Although USAC has lagged broad Energy sector performance, it has outperformed the Gas & Oil Services industry and the S&P 500 over the past month, quarter, year, and so far in 2022.

Analysts’ Price Targets:

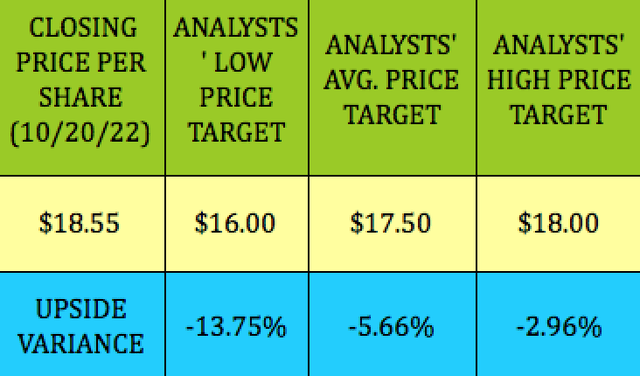

That outperformance has pushed USAC past analysts’ low, high and average price targets.

Parting Thoughts:

This is one for your watchlist. Wait for the next market hissy fit – you just may be able to snag USAC at a better price.

If you’re interested in other high yield vehicles, we cover them every Friday and Sunday in our articles.

All tables by Hidden Dividend Stocks Plus, except where noted.

Be the first to comment