Australian Dollar, AUD/USD, Chinese Trade Balance, Technical Analysis – Market Alert

- Australian Dollar seeing bearish technical pressures after Chinese trade figures

- Numbers likely being distorted by low base effect, imports unexpectedly surged

- Data suggests global economy continuing to recover as AUD/USD eyes US CPI

Recommended by Daniel Dubrovsky

How to Trade AUD/USD

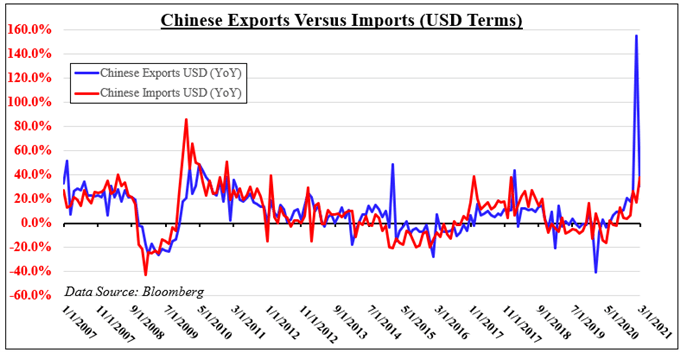

The Australian Dollar traded relatively flat after China released its latest trade figures for March, focusing on what may be more prominent event risk ahead. In USD terms, exports gained 30.6% y/y versus 38.0% anticipated. Imports climbed 38.1% y/y, beating the 24.4% consensus. The surge in imports compared to exports meant that China’s trade surplus unexpectedly shrunk to USD13.8 billion versus 52 billion anticipated.

It should be noted that recent data from China is being distorted due to a low base when comparing to data at the onset of last year’s coronavirus outbreak. Nevertheless, strong imports could be a sign of healthy local demand amid strong lending as the economy slowly transitions into a more consumption-based powerhouse over time. Moreover, the data can have profound implications for the world economy.

These figures continue to underpin the healthy recovery occurring in the planet’s second-largest economy from the coronavirus. Moreover, it is a sign that global growth could very well be on the road to outperform this year. Recently, the International Monetary Fund (IMF) revised its trajectory for global growth, upgrading the pace to 6% from 5.5% previously estimated.

That is something that the growth-sensitive AUD could welcome given that China is Australia’s largest trading partner. However, the downside here is that faster growth could mean more aggressive monetary tightening measures from the PBOC to cool overheating woes. This was underpinned recently by stronger-than-expected Chinese wholesale inflation figures as the government tackles what it perceives as a frothy stock market.

Ahead, the Aussie will be eyeing US headline and core CPI data. The Fed has made it clear that it expects a transitory increase in inflation, but unexpectedly stronger readings could risk unnerving markets and push longer-term Treasury yields higher. Beyond that, the AUD/USD will also be awaiting Chinese first-quarter GDP readings where the nation is expected to witness record-breaking figures.

Check out the DailyFX Economic Calendar for the latest updates on some of these events

Discover what kind of forex trader you are

Chinese Exports and Imports (In USD Terms)

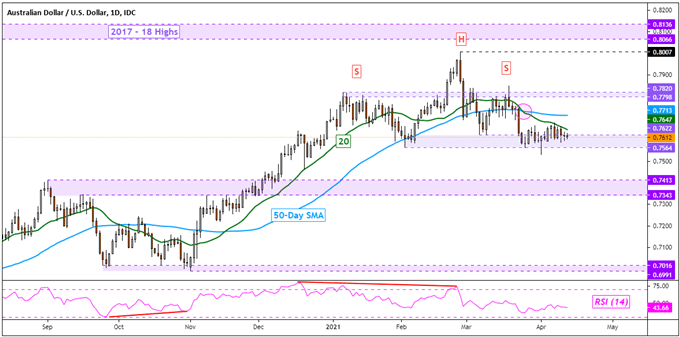

Australian Dollar Technical Analysis

AUD/USD continues to consolidate above what appears to be the neckline of a bearish Head and Shoulders chart pattern. This makes the 0.7564 – 0.7622 zone critical support. A breakout lower could open the door to extending losses. A bearish crossover between the 20-day and 50-day Simple Moving Averages seems to suggest that this could be the path of least resistance. Otherwise, a bounce here places the focus on the 0.7820 – 0.7798 inflection zone.

| Change in | Longs | Shorts | OI |

| Daily | 1% | 5% | 3% |

| Weekly | 5% | -1% | 2% |

AUD/USD Daily Chart

Chart Created Using TradingView

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Be the first to comment