Urogen Pharma Ltd. (URGN) is now a commercial biotechnology company that designs and develops therapies for urological pathologies. It was founded in 2004, and while technically incorporated in Israel, URGN’s corporate offices are located in Princeton, New Jersey. The company had 173 employees as of 2/17/2020, of which 127 were in the United States and 46 work out of Israel.

URGN’s primary technology is called RTGel, which is a drug delivery system. RTGel allows a medicine (URGN’s two flagship products use mitimycin) to be delivered in a liquid form that then turns into a gel once inside a patient (at the patient’s body temperature). This allows respective patient populations to avoid surgeries in two cancer treatments. The purpose of this article is to demonstrate that URGN’s valuation is a fraction of potential forward-looking revenues using third-party data points. Investors otherwise interested in the competitive clinical advantages of URGN’s science, because they are considerable, are encouraged to learn more on the company website.

Primary Products

URGN’s first product, UGN-101 (tradename Jelmyto), was approved by the FDA on April 15, 2020. The FDA designated UGN-101 as an orphan drug and “fast-tracked” approval as a “breakthrough” because it fills a complete unmet need for 6,000-7,000 patients/year to treat low-grade upper tract urothelial carcinoma (“UTUC”). (Source: URGN Investor Presentation) UTUC are rare cancers that happen in the linings of the kidneys or uterus. The use of UGN-101 will be the first non-surgical way to treat such cancers. Incidentally, pre-UGN-101 treatment for UTUC most of the time results in the loss of the kidney. In URGN’s Phase III study, 59% of patients treated showed complete responses to UGN-101. The durability of the complete responses was 84% after an entire year. (Source: April 15, 2020 Press Release)

The day after the FDA formally approved UGN-101, URGN set the price of UGN-101 at $21,376 per dose (Source: April 16, 2020 conference call at exactly 16 minutes 0 seconds). UGN-101’s label reflects 6 doses (and 11 maintenance doses). To be crystal clear, the company will only promote for the 6-dose regimen. Per the CEO, a patient should only need 6 doses. Because the durability of response was so high, there are not many patients to test (because it works so well). Hence, it will be up to the individual physician to treat in excess of 6 doses. (Source: April 16, 2020 conference call at 25 minutes and 55 seconds.)

URGN did not provide guidance on its anticipated gross to net revenues (one of the most important data points to forecast revenues). The company CEO specifically comments on anticipated gross to net on the Q4 2019 conference call, starting at 27 minutes and 50 seconds into the call. To summarize what URGN’s CEO said, because UGN-101 fills an unmet need (and therefore, there are no competing therapies), UTUC is otherwise the most expensive cancer to treat on a per patient basis and the only non-surgical treatment available, URGN does not expect to be discounting with payors. URGN’s CEO then went on to say gross to net will reflect traditional distribution and administrative fees and the like. It is the author’s conclusion to anticipate gross to nets will be the highest seen in the industry. Hence, for modelling revenue forecasts, it appears quite reasonable, if not overly conservative, to assume gross to nets will be in the 85% range. We will model 80% as worst case, 85% as base case and 90% as best case. Lastly, it is important to note that in URGN’s 10-K on page 7, the company notes the patents issued protecting UGN-101, UGN-102 and UGN-201 in the United States expire between 2024 and 2032 (patents pending protect the therapies until 2035). It therefore appears these therapies won’t have competition for more than 10 years.

The following is how to calculate a range of potential revenues of UGN-101 via assumptions on number of doses (the label is 6 doses) at $21,376/dose with various ranges on gross to net adjustments (listen to URGN’s CEO discuss gross to net guidance on URGN’s Q4 2019 earnings conference call, beginning 27 minutes and 50 seconds):

Investors are again encouraged to listen to URGN’s CEO during the company’s presentation at Cowen on 3/3/2020 discuss how 70% of physicians who treat UTUC said they will use UGN-101 (1 minute and 40 seconds into the presentation) and how identifying the appropriate patients is a big hurdle but noted 75% are essentially “low-hanging fruit” from an identification perspective. The author concludes the CEO appears confident 70% of the physicians who treat UTUC will easily identify 75% of the annual patients (very roughly 70% of 75%, or 55% of the patient population). The author’s analysis therefore concludes URGN could “blow out” consensus revenues of $55 million (per Seeking Alpha) in 2021 and $121 million in FY2022. The author would point out that H.C. Wainwright identified peak potential revenues from UGN-101 at $667 million (right between our best and peak possible noted above). You will note H.C. Wainwright has a $53 price target per the same link dated 4/13/2020.

With an enterprise valuation of approximately $300 million, our analysis concludes the market grossly underestimates how quickly URGN will begin to generate material revenues and operating profits from UGN-101 (aka Jelmyto). While UTUC is a rare condition affecting 6,000-7,000 patients per year, it appears a therapy desperately needed. Per a recent article in The Pharma Letter, “This is the first approval specifically for patients with low-grade UTUC and provides an option for some patients who may otherwise require a nephroureterectomy,” said Dr Richard Pazdur, director of the FDA’s Oncology Center of Excellence and acting director of the Office of Oncologic Diseases in the FDA’s Center for Drug Evaluation and Research. “Due to substantial treatment challenges associated with the complex anatomy of the upper urinary tract, many patients need to be treated with radical surgery – usually complete removal of the affected kidney, ureter and bladder cuff. Jelmyto (or UGN-101) gives patients, for the first time, an alternative treatment option for low-grade UTUC,” he noted. (Source: The Pharma Letter)

URGN will launch UGN-101 on June 1, 2020 and expects a C and J code (for reimbursement) in place by the end of the year. Later in this article we will provide an analysis of the company’s commercial infrastructure and financial position. Most importantly, we will note URGN’s CFO guided investors to expect $110-116 million in FY2020 cash operating expenses that includes the entire commercial staff for the entire year. This means cash operating expenses for SG&A won’t rise dramatically in 2021 because the commercial infrastructure is in place for the entire of FY2020 (absent new R&D initiatives). Furthermore, URGN has also built out an inventory of UGN-101 that was previously charged to R&D expense that will otherwise lower COGS at launch (it did not disclose the value of the pre-built inventory). With just under $200 million cash in the bank, no debt and, assuming modest increases, perhaps $130-140 million in cash operating expenses in FY2021 (again, perhaps excluding new R&D programs), it appears quite reasonable URGN will break even at some point in FY2021 and generate material profits thereafter as revenues ramp. This is the primary reason our analysis concludes the company’s enterprise valuation should be markedly higher (discussed below). This is especially the case using peer valuation analysis.

As noted, URGN has approximately 127 employees in the United States. On the Q4 2019 earnings conference call (beginning at 5 minutes 15 seconds) the CEO noted the company’s commercial infrastructure is fully staffed, including:

- 48 sales reps

- 7 regional managers

- 7 clinical nurse educators

- 7 field reimbursement specialists

- 7 medical science liasons (MSLs)

On the same conference call, investors can forward to 22 minutes and 30 seconds to listen to the CFO affirm URGN’s commercial infrastructure is in place for all of FY2020 (to confirm no material incremental commercial headcount in 2021 for modelling purposes).

UGN-101 non-US opportunities are material, but the company has acknowledged all resources have been allocated to the US FDA approval. Hence, the UGN-101 launch overseas appears years away. We will not model any non-US revenues for UGN-101.

URGN’s second product, UGN-102, is designed to treat low-grade non-muscle invasive bladder cancer (“NMIBC”). Like UGN-101, UGN-102 is designed to be the first non-surgical treatment of NMIBCs (the company notes the last medicine to be approved for NMIBCs was 15 years ago). On an April 3, 2020 press release, URGN disclosed interim results from its Phase IIb trial of UGN-102. At 6 doses, UGN-102 showed complete response rates of 65% with durabilities (remaining free of disease) of 85% at 9 months. URGN plans to start a Phase III trial for UGN-102 in 2H2020.

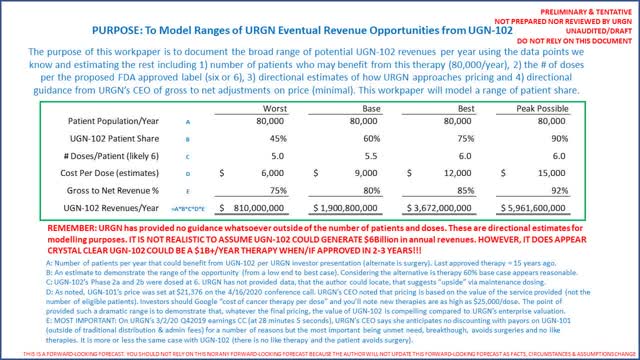

URGN estimates approximately 80,000 suffer from NMIBC, for which UGN-102 would be appropriate. While it has not provided guidance on pricing for UGN-102 (nor gross to net), investors should listen to the CEO’s confidence when asked about pricing for UGN-102 on the company’s April 16, 2020 conference call, beginning at 47 minutes and 25 seconds into the call. The CEO shies away from guidance, but in the author’s opinion, suggests gross to nets will be directionally consistent with UGN-101 because there is no current therapy available for these 80,000 patients/year. It is important to note that it is 2-3 years before UGN-102 will be launched commercially (following completion of a Phase III trial expected to start 2H2020 and submission of an NDA). That being said, URGN’s Phase IIB data makes it clear the technology works and heals 65% of patients treated of an awful cancer.

To summarize URGN’s UGN-102 revenue opportunity:

Again, and only to be crystal clear, URGN has provided no formal guidance on UGN-102’s revenue forecast. However, the range above demonstrates that the opportunity is significant (even in a worst-case scenario). Investors, when assessing patient share potential, need to remember the alternative is surgery (in both UGN-101 and UGN-102). Again, investors should simply Google “cost of new cancer therapies” and you’ll see ranges for courses of treatments from $50,000 to $160,000. The author studied Trastuzumab from Genentech (Roche (OTCQX:RHHBY)), and the cost will be $9,800/dose with an average 10-dose treatment. (Source: Wikipedia)

Regarding the cost to market UGN-102, investors should listen to URGN’s April 16, 2020 conference call the day after UGN-101 was approved (beginning at 34 minutes and 10 seconds), where the CEO note minor incremental costs to market UGN-102 when/if approved. The CEO noted virtually all employees working on UGN-101 will work on UGN-102. The call points are identical. The CEO said the company would perhaps increase its sales force size by about 20-30%. Should UGN-102 revenues get close to our models, the company’s profits could be substantial.

URGN’s License Agreements with Third Parties

URGN has an agreement with Allergan (AGN) where AGN has worldwide rights to use URGN’s RTGel technology with AGN’s Botox in the treatment of overactive bladders. AGN is expected to complete the Phase II trial in May 2020. It will likely take AGN a few months to compile, analyze and publish the Phase II data. Investors should assume AGN will disclose the results of the Phase II trial by the end of the year (URGN has no control over the trial) and hopefully start a Phase 3 trial in FY2021. Should AGN move forward with ots Phase 3 trial, URGN will receive a $20 million milestone payment. Investors should read URGN’s FY2019 Form 10-K to learn more (page 13), but to summarize, if AGN is successful, URGN could receive additional milestones (up to $200 million) and royalties in the “low single digits” on future sales.

While a $20 million milestone payment from AGN is respectable, it is the author’s conclusion that AGN’s interest in the RTGel technology is what is important. It validates the use of the technology in future drug development for other therapies.

URGN entered into an agreement with Janssen Research in April 2019 to “co-develop a product of interest.” The company also licensed a molecule from Agenus (AGEN) for development of a next-generation product (UGN-302). These agreements and efforts are noted here to affirm URGN’s pipeline is active after UGN-101 and UGN-102.

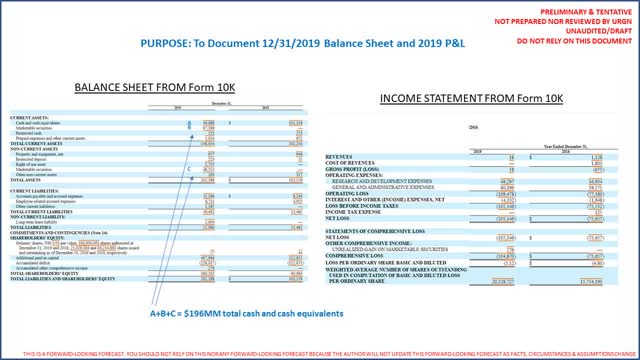

Financial Position, Forecast and Low Risk of Dilution

URGN ended 2019 with $196 million cash and marketable securities and no debt. (Source: URGN FY2019 10-K) Investors should note URGN has $48 million in marketable securities as non-current assets, as they are US treasuries with maturities of 1-4 years (but still in substance cash). On URGN’s Q4 2019 earnings conference call (beginning at 22 minutes and 30 seconds), the company’s CFO guides investors to expect total FY2020 operating expenses (R&D and SG&A) to be between $145 and $155 million, of which $32-36 million will be stock compensation (non-cash) and $2.5 million will be depreciation and amortization. Hence, simple subtraction notes FY2020 cash operating expenses will be between $110 million and $116 million. URGN has no debt, so there is no interest expense nor debt service. Lastly, the company has “pre-built” UGN-101 inventory and charged the expenses to R&D while UGN-101 was being approved (this is a common practice in the life science industry). URGN did not note the value of such inventory. The point is there will be some period of time where the company will record virtually no COGS while it sells the inventory on hand. The following is a copy and paste of URGN’s 12/31/2019 balance sheet and FY2019 P&L to verify cash and equivalents for yourself and see that 2019 operating expenses suggest an estimate of $145-155 million for FY2020 appear directionally reasonable:

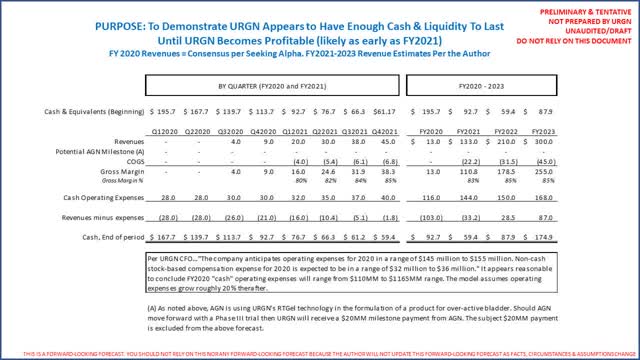

For modelling purposes, we will assume it takes 3 years for URGN to get to “worst” case revenues noted above from January 1, 2021 (a reminder, reimbursement is expected by 12/31/2020). As noted, URGN’s CFO guided to $110-116 million in FY2020 cash operating expenses that, more importantly, includes the full commercial team for the entire year… so that 2021 and 2022 estimates are in the ballpark, but nonetheless, significantly less than likely revenues. (Source: URGN March 2, 2020 Q4 2019 earnings call, beginning at 22 minutes and 30 seconds.) The following is therefore a summary of a directional FY2020 to FY2023 operating forecast:

Readers should first remember the above analysis excludes a likely $20 million milestone from AGN that should be received in 1H2021 when/if AGN moves forward with a Phase III trial as discussed above.

The above analysis uses consensus FY2020 revenues and assumes it takes 3 years to get to our “worst-case” URGN revenue forecast of $300 million (yes, our actual worst case reflects $310 million). The analysis uses FY2020 expense guidance, then increases expenses modestly. It is not perfect, because first it will likely take the company 60-90 days to collect sales (but it should be able to borrow against sales immediately). The point being, with $196 million cash at the start of 2020, and using revenues modeled above coupled with URGN’s directional guidance, our analysis concludes the company has more than enough liquidity to last until it breaks even. Should URGN get a 50% share of this small market where AGEN has represented it has 70% physician awareness, it appears URGN could be profitable much sooner than most think.

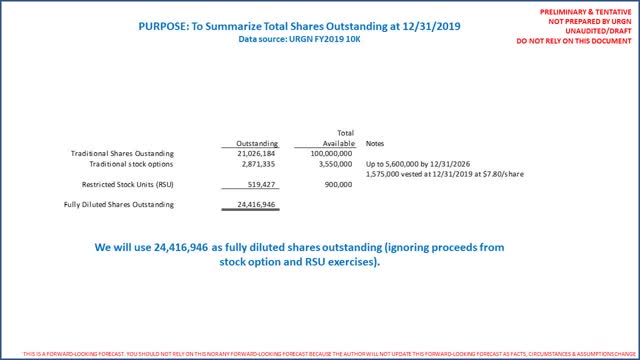

Company Valuation

Our analysis concludes URGN is undervalued versus peers. At 12/31/2019, there were 21,026,184 shares outstanding. There is an effective shelf-registration effective allowing the company to raise up to $100 million (no amounts drawn to March 2, 2020). Up to 5.6 million shares are reserved for URGN’s employee stock option plan through FY2026, of which 2,871,335 were outstanding at an average price of $32/share. There is a traditional “Inducement Plan” for senior personnel for which 900,000 shares are reserved. Finally, there is a restricted stock unit (“RSU”) plan for certain personnel that allows up to 900,000 shares to be issued. There were 519,427 RSU shares outstanding as of 12/31/2019. The following summarizes fully diluted shares outstanding:

It should be noted that on November 20, 2019, URGN’s CEO purchased 7,470 of the company’s common shares for $28/share in an open market purchase (not a stock option exercise). The total purchase price was $209,160. (Source: SimplyWallSt) This is in addition to her 1/3/2019 grant of 277,432 options to purchase the company’s ordinary shares, at an exercise price of $47.57, as well as 317,065 RSUs, with a combined fair value of $24.1 million. (Source: URGN FY2019 Form 10-K, page 102). Obviously, an open market purchase of URGN stock by the company’s CEO is a bullish data point.

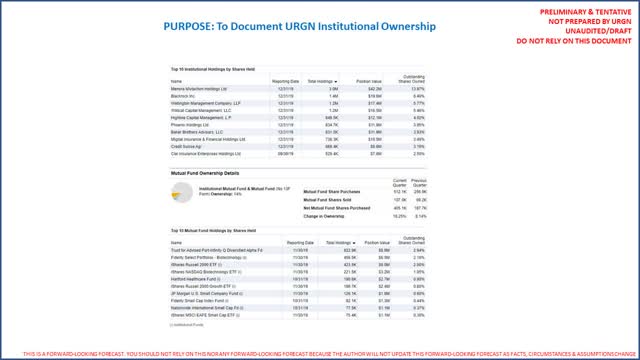

The following is a summary of the top 10 institutional investors in URGN (Source: Fidelity Investments; however, the author is unable to provide a link to Fidelity. Link to CNN providing same data here):

Normally our life science-related analysis excludes ownership reviews. This is provided so investors will note URGN’s largest holder is an Israeli holding company (publicly traded). Our analysis concludes this is Menora Mivtachim’s first material life sciences investment. Investors should consider what that may mean in terms of a long-term commitment to the company (will the majority owner request a sale of URGN sooner rather than later?).

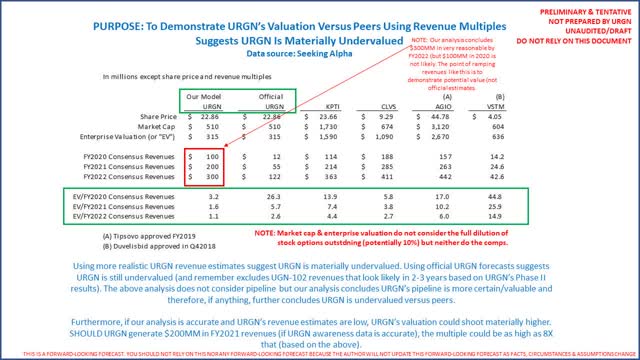

Most important, our analysis concludes URGN is materially undervalued when compared to peers, especially if consensus revenues are understated. The following is how the company’s valuation compares to peers:

Investors need to consider UGN-101 revenues per patient are north of $100,000 (6 doses at $21,376 each, or $120,000+). There are up to 7,000 patients/year who could benefit. Official estimates of $55 million for FY2021 suggest less than 500 patients (at $120,000+/patient) of 7,000 when the CEO tells us 75% are “low-hanging fruit.” Our analysis concludes this is materially understated. Listen to the 3 most recent investor presentations for yourself. This is probably why the CEO bought so many shares in the open market.

Finally, while our analysis concludes that URGN appears materially undervalued versus peers, investors should also consider the fact that it appears an ideal time for a sale of the company. This is because UGN-101 was just approved. URGN is now in the process of securing reimbursement for UGN-101 and will launch virtually 6/1/2020. However, one would conclude it is best to fully launch once reimbursement is fully in place. From a commercial launch perspective, the next few months would be an ideal time to transition the company to a new owner. From a clinical perspective, URGN just completed its Phase II trial that provided compelling clinical value propositions. It is the company’s plan to start a Phase 3 trial later in 2020 as it finalizes trial design. Again, it is an ideal time to transition UGN-102 to a new owner so the new owner can control Phase III design (i.e., global versus just US). The author has no direct evidence a sale of URGN is being considered.

For all of the reasons noted above, our analysis concludes the company offers opportunities for compelling valuation gains. Should UGN-101 show better-than-expected sales in the second half of the year, it should raise longer-term revenue estimates. With peak potential UGN-101 revenues between $600 and $700 million and peak potential UGN-102 revenues (with strong clinical data to date) as high as $2 billion when launched in 2-3 years, URGN is trading at a fraction of peak potential revenues. Per E&Y’s FY2019 Biotech Firepower report (page 23), valuations in buyouts for oncology-related concerns can be as high as 5X peak potential revenues. Using a multiple of 5X URGN potential peak revenues, the company’s eventual valuation could be north of $10 billion. URGN’s Investor Presentation identifies peak potential revenues of $1 billion+ (we have demonstrated revenues could be much higher).

Disclosure: I am/we are long URGN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We own considerable URGN shares.

Be the first to comment