Roman Tiraspolsky

Purpose & Introduction

While Urban Outfitters, Inc. (NASDAQ:URBN) continued to see revenues increase in Q3, tightening margins and elevated inventory will keep the stock from soaring; I forecast a share price of $29 over an 18-month frame, up $2 from my previous “Hold” rating. The company remains supported by several brands, with two key brand segments making up the majority of sales; Anthropologie Group, a women’s casual apparel, and beauty and wellness line, and Urban Outfitters, a youth brand line. This report showcases a neutral outlook for the company after Q3 results, but acknowledges positive developments are occurring.

Q3 Results & FY2022 Guidance

URBN reported earnings in Q3 of $0.40 per share, a staggering $0.50 drop from the prior year period of $0.90 per share. Gross margin fell 410 basis points, almost exclusively due to higher markdowns at all three brands. Inventory soared 31% from the prior year period, to $743MM, forecasting a worrying trend on sell through. This jump is concerning, because it was headlined by lower growth brands – the company forecasts potential decline in YoY comparisons for the Urban Outfitters brand due to inventory mismanagement. Inventory was higher vs. Q2 as well, which was $697MM. On the earnings call, management did have some positive trends highlighted to offset the gross margin declines and softening demand. Executives mentioned that supply chain costs have dropped significantly over the last six months, and that speed-to-market capabilities are almost back to FY ’20 levels. Also highlighted was Nuuly, the apparel rental business, offered by URBN. Active subscribers grew by 37%, surpassing the 100,000 sub milestone in early October and the company now has in excess of 120,000 active subs. Revenue from this segment, while still immaterial at $35MM, almost tripled since last year, and gives URBN a unique sales channel from other mid-cap competitors. This segment has seen impressive results in a short period of time. The company forecasted opening 10 new stores next quarter, while also closing 11 stores.

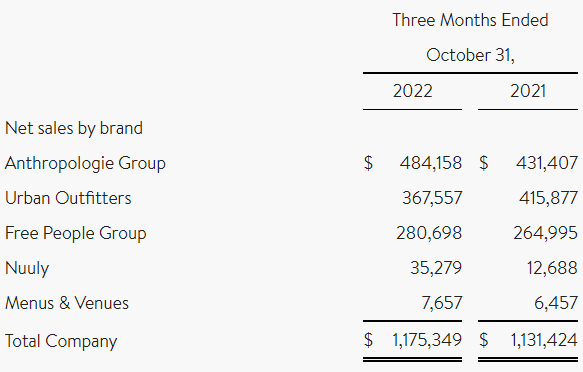

The company provided a sales breakdown from their five separate brand segments in the Q3 release. While it was encouraging to see sales growth prevalent across the Anthropologie Group and Free People Group, the flagship brand lagged considerably. The Urban Outfitters brand saw sales fall 9%, with the two aforementioned brands posting bumps that helped revenues hit an all-time high in Q3 at $1.18Bn. While positive, executives cautioned on the call that continued discounting will occur, especially in the Urban Outfitters and Free People Group brands, as there simply remains too much excess inventory. Coupled with softening sales demand in early November, a Hold rating still feels appropriate when considering to buy the stock.

URBN Q3

The company reiterated their intention to hit their previously targeted $225MM CAPEX spend for the year. After hours, the stock ticked up a couple percentage points, but overall, these quarterly results didn’t make much noise. Most analysts expected a tough quarter and the stock has continued its slide in 2022 like a lot of its mid-cap apparel peers. With a difficult macro environment for discretionary spending, URBN will likely tread water in the $25-$30 range, but I am more impressed now compared with 6 months ago, as two of their three key brands continue to grow, and their unique sales channel business has gained over 120,000 subscribers.

Model Shows Stock is Fully Valued

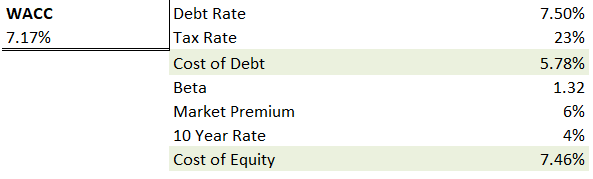

I don’t foresee much intangible strength from URBN, and the model doesn’t show a ton of upside either. Given their Q3 performance, I anticipate the cost of debt rising above 7% should they attempt to leverage in this environment.

Author WACC

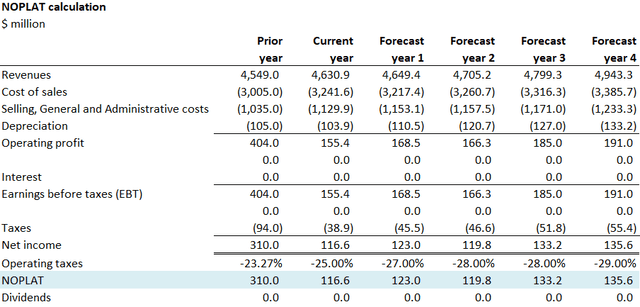

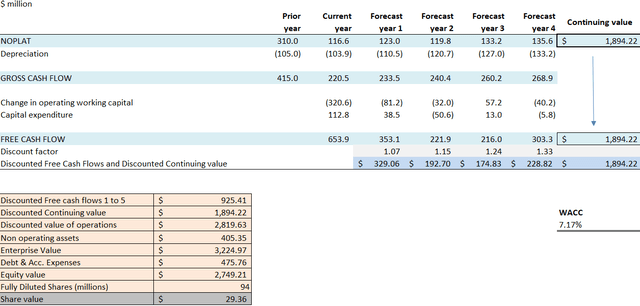

I forecast the continuing value of ~$1.8B, given a 1.8% revenue increase this year and blended revenue growth of ~2% for four years, as inflation continues to hit consumer discretionary spending. I hold other cost ratios equal from the previous model, while cutting gross margin guidance based on Q3 results. The model shows that a $29 share price (see below) can be supported with fundamentals and a 2023 EV/EBITDA model forecast of ~11.6.

Author NOPLAT Forecast Author EV Forecast

Conclusion

URBN announced decent Q3 earnings results, as the highlights were offset by high inventory and falling margins. Traction in multiple business lines provide some momentum for the stock. While revenue has steadily grown, I anticipate the share price to remain in its current range without more new positive news. I don’t think URBN is worth a buy right now, and if you currently own the stock, its likely best to just hold for the time being.

Be the first to comment