narvikk/E+ via Getty Images

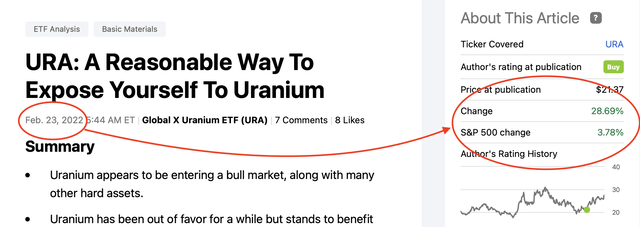

Welcome to the forbidden zone. Few come here, and almost nobody talks about it. And who writes about it? Fewer still. In fact, the last article published by on Seeking Alpha regarding the Global X Uranium ETF (NYSEARCA:URA) was written over a month ago, despite the fact that it is up.

Last URA article (Seeking Alpha with red markings by Zvi Bar)

I believe this total lack of activity is an indicator that this bullish move in uranium is still way off the radar and likely to continue for a while. I believe we are hardly through the early stage of this new cycle, and that this ETF continues to be a reasonable way to allocate into the asset class.

I am sure there are reasons others do not write about uranium. After all, it is not that popular, and clicks are so important. Performance of the underlying equity is also important, and arguably paramount, but article performance is not really correlated to that.

Uranium’s recent strength comes from many factors, including broad outperformance by all energy commodities this year. This cycle of price appears to be affecting a great many real goods and/or hard assets. This price cycle is inflationary, but other forces are also likely at play. For uranium and nuclear power, there is also a cycle of tolerance that appeared to hit new lows last decade.

Now, I believe the tide has turned and that URA is entering a melt up that could continue for quite a while. It also appears that the ETF may have recently broken out and is likely to test the highs URA made in late 2021.

Japan’s Fukushima nuclear disaster back in 2011 appeared to be a nail in the coffin, and maybe it was, but not the final nail. That nation still relies upon nuclear power, and now appears to be considering increasing the usage. After Fukushima, Germany also announced the intention to phase out nuclear power, and has shut down a substantial portion of its existing and previously operational nuclear power plants. Germany remains reluctant to prolong the use of nuclear power, but that could change over time. That may take an election to change, but the price of energy may become the key issue during Germany’s next one.

Another thing that recently happened was that a sizable nuclear power plant was literally attacked by an army, and the world saw that plant on fire. That actually occurred between this article and the one I wrote in February. Similarly, Chernobyl is being tossed about like a game of hot potato. These events may desensitize us all to the baked in sense of risk most have towards nuclear power. After all, could your local power plant survive an attack?

URA appears the most reasonable way to invest in uranium companies due to its broad exposure and volume. URA provides access to uranium miners and producers of nuclear components. URA has a fee of 0.69%, which is high for a core index fund, but reasonable for a smaller tactical position like this. and especially if it can continue to substantially outperform.

URA provides domestic investors with access to uranium producers that are not on the domestic markets, which includes a great many of them. Kazakhstan is the largest annual producer, with Canada and Australia coming in at two and three. There are also many South Korean and Japanese companies within URA, where a significant portion of those equities are not readily available on the domestic exchanges.

Conclusion

It appears that uranium prices hit a bottom a few years ago and languished there in the second half of the last decade. Uranium has been moving up on a slow trajectory for the last couple of years, and this trend could easily increase for several more years. Few are looking at uranium now, but it appears likely that a growing number of investors will be allocating into uranium over time. URA appears to be a reasonable way to obtain diversified exposure to the industry.

Uranium continues to be a volatile commodity that many retail and institutional investors see as untouchable, but I already have exposed my portfolio to the stuff and the effects seem rather positive. URA is melting up on the back of a uranium price breakout that is likely to continue for quarters to years. The URA ETF appears destined for the $30s within 2022, and possibly this quarter.

Be the first to comment