Black_Kira

How is Upstart (NASDAQ:NASDAQ:UPST) faring in the current macroeconomic environment and how are its models coping with the changes the global macroeconomic environment? I look deeper into the company and its second quarter to determine the answers to these questions.

Investment thesis

I have written an earlier article on Upstart, explaining more about the business model and current challenges faced by Upstart. Here are some of the investment case for the company:

- The main advantage Upstart has is its superior Artificial Intelligence (AI) model, which brings value add to both its consumers as well as its banking partners. This competitive advantage continues to improve as there are evidences that the model is improving in accuracy over time.

- While the company has recently taken up loans on its balance sheet, this is done in a responsive way to adjust to the changing business conditions. The main business model remains to be capital light as the company acts as an intermediary between consumers and its banking partners, which the management has continued to reiterate.

- Despite the challenging environment, Upstart continues to expand its total addressable market (TAM) into the huge auto loan origination market, demonstrating a large market opportunity.

- As a result of improved scale and increased use of automation in its processes, the company’s margins and unit economics have seen improvements and will likely continue in that trend.

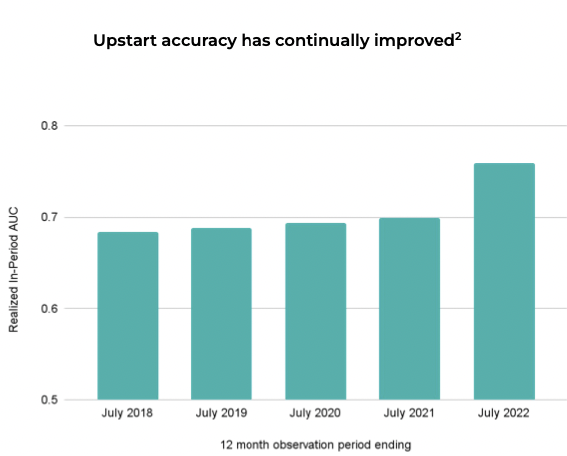

AI-powered models continue to improve accuracy and risk separation

It was encouraging to see management disclose more credit performance metrics as well as data on how the Upstart models have changed over time. As evident from the chart below, Upstart’s models have actually improved over time and especially so over the one year period from July 2021 to July 2022. To explain briefly, the term Area Under the Curve is used by management to determine how is the model able to separate high and low risk loans and it does so by determining what is the portion of loans that can be approved based on a specified maximum loss level. As such, the AUC metric implies that with AUC figures of 0, this implies that the model’s predictions are 100% wrong. With regards to the Upstart model, we can see a significant improvement in the model in the past 1 year.

Accuracy of the Upstart model (Upstart Credit Performance slides)

While management has continuously stated that the company has been improving the models, making adjustments to the model according to changes in the environment and seeing improving accuracy, this disclosure of the AUC metrics since 2018 provides a good gauge as to how much progress the company made in improving the accuracy of the model in the past one year. As such, I am of the view that based on the data, the model’s accuracy is fundamentally improving, contrary to the noise heard in the market saying otherwise.

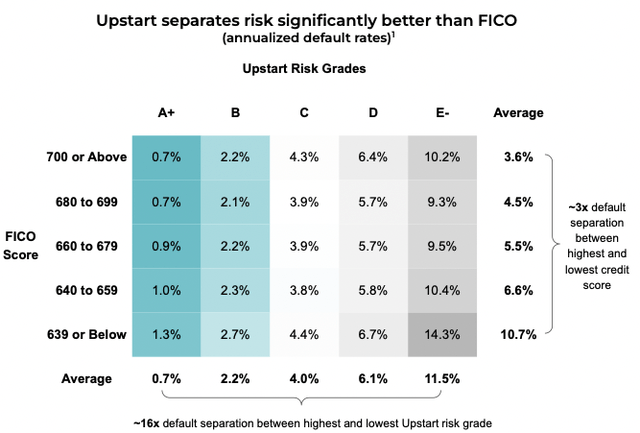

In addition, Upstart continues to see 5 times better risk separation than the traditional FICO scores, which highlights the continued advantage Upstart has over it despite the near term challenges it is facing.

Better risk separation than FICO (Upstart credit performance slides)

As such, I think that the Upstart’s risk models powered by artificial intelligence is working as designed and in fact, continue to see improved performance in terms of higher accuracy and better risk separation. We continue to see the company adjusting and calibrating its models to the changing environment, which helps further enhance and strengthen the reliability and accuracy of the model in changing times. Furthermore, I think that management has incorporated prudence into the models by adjusting the models to factor in a recession in the next 18 to 24 months. I think this prudence in the model will go a long way to ensure better credit performance and improved model performance over the long run.

Funding remains a constraint

As expected, the constraint in funding has been the main drag for revenues for the company in the current quarter. As the management did not expect investors to so abruptly reduce their pace of originations or stop entirely, this sudden change in risk appetite as its partners react proactively in fear of a rapid slowdown in the economy is hurting the company in terms of slowing growth.

As a result, there is a need for Upstart to plug in the gap here to improve the funding limitations. Although initially the company had communicated that it was not going to be a bank or use its own balance sheet for funding, I think that we need to be flexible in viewing this. On one hand, management sees the using of balance sheet as a key way to plug the gap in funding as they are able to leverage on the huge information asymmetry in their business and take advantage of that when its partners are acting less rationally, bringing about better than expected returns on its assets while improving the stability of the platform. On the other hand, management has reiterated their stance on not being a bank and that this shift is somewhat temporary during what it seems like a transition period as the cycle changes.

Furthermore, it is good that management is working to improve the capital structure and bring more stable funding into the platform in the long run. This will entail bringing in partners who have a longer term horizon and with a mindset to invest across cycles. While this is in the initial phases, I think that it is great that management is learning from this current cycle to proactively prevent this in the subsequent cycle.

It is worthy to note that the company’s loans balance in 2Q22 was $624 million, of which $484 million were their research and development loans used for their relatively newer auto segment. Only $140 million were for the personal loans business and this was $10 million less than the prior quarter. I thought it was also encouraging that management was selling down a significant portion of these loans in the personal loans segment, although this was done after the second quarter results.

To end off, while I think that the market has been wrongly focused on the fact that the company is taking on loans on its balance sheet when the management previously stated otherwise, investors who are able to look past that and acknowledge that every business needs to be flexible to changing macroeconomic environments and responsive to different operating challenges in order for the long term viability of the business will see this current negative sentiment about Upstart a real valuable opportunity.

New segments positioned for growth

In its second quarter, Upstart managed to increase the number of dealerships utilizing the Upstart auto retail software to 640. In addition, Upstart’s auto retail software was named the “fastest growing digital retail software for auto dealerships” by Automotive Market Data. Two new OEMS, Volkswagen (OTCPK:VWAGY) and Subaru, also announced support for the software, on top of many other brands and OEMs that are already in the platform. The retail loan originations from auto was reported to be $10 million in the quarter and although small, it is the first steps to scaling up the program. There are many synergies the company is able to reap when rolling out auto loans and one example is that of merging the machine learning model that was used for its personal loans process for the automation of verification of income. Of course, there are without a doubt issues the company will need to address in the coming months to have a more automated auto loan product and to continuously improve on its auto loans AI model. Furthermore, the company’s small business loans also brought in $1 million in principal when the company launched the product at the end of June.

As Upstart rolls out on its new products, it can continue to leverage on what it has learnt in the personal loans segment to adjust and fine-tune the eventual model used for auto loans and small business loans. While these new businesses may contribute incrementally to the business today, these will be the future growth drivers of tomorrow for Upstart as it leverage on its AI and machine learning models to disrupt different segments of credit.

Valuation

There is a need to adjust my DCF model for Upstart as the macroeconomic environment has changed since the last time I wrote on the company. Due to the lowered guidance for the year and the funding constraint that I think could be a limiting factor for the business in the near term, there is a need to lower the forecasts for 2022 and 2023 to be more aligned to the current business conditions. Furthermore, I increased my assumptions for WACC to 15% and maintain my terminal growth rate at 1.5% respectively.

As such, my target price for Upstart is $45.30, implying 65% upside potential from the stock’s current levels. While the outlook for Upstart appears to be challenging, the main driver or catalyst for the stock, in my view, would be evidence of improved funding, which remains to be uncertain in the near term. In the longer run, I think that the company remains on track to gaining market share in its respective segment and remains attractive as a company with pure play exposure into an AI-powered model that is expanding across credit segments. As such, I would think that the stock will be more attractive to investors with a longer time horizon.

Risks

Macroeconomic environment

As with all issuers of credit, Upstart is also vulnerable in a weak macroeconomic environment. If the global macroeconomic environment worsens, this will reduce demand for Upstart’s loans and thus, loan volume growth will be affected in this scenario. Given that the company is vulnerable to credit cycles very much likes other peers, this is a risk in the near term as the global backdrop does seem volatile and uncertain.

Competitive pressures

While Upstart’s AI models do currently have an advantage over peers, this could be eroded if a competitor were to build a better, more accurate and more superior AI model. While I think that this is unlikely given the company’s continued push for innovation and improvement in the model, there are many startups and traditional financial players that are attempting to fine-tune and improve on their model and as such, this could be a risk if any one of these competitors are successful.

Concentration risk

As the company’s business is currently primarily focused on the unsecured personal loans segment, there is in fact a concentration risk in this segment. While I have mentioned above that the company is expanding into the auto loans segment, this remains to be an early stage development as the company rolls out and ramps up on its auto loans segment. For the near term at least, unsecured personal loans will form the bulk of its revenues as the auto loans business scales up.

Execution risk

Along the same lines, as Upstart rolls out and ramps up on auto loans and its other new segments, there is the risk of execution slippage or the risk of poor execution. Although the company has done well in the unsecured personal loans segment, there is no guarantee of success in other segments it wishes to expand into.

Conclusion

Ultimately, the decision to invest in Upstart would depend on the comfort level in management taking a flexible and responsive approach to using balance sheet to alleviate the shortfall in funding in the near term. For investors who are comfortable with management using this temporary approach as a strategy for the long term benefit of the company, Upstart is certainly an attractive investment. Given that there are clear evidences of the superior and improved accuracy of the AI model in the past year, as well as the more efficient risk separation compared to traditional FICO scores, the company’s model remains relevant in a changing world. Furthermore, the company is expanding rapidly into other segments like auto loans which could reaccelerate growth as these segments pick up steam. When the dust settles, we will see the true value of Upstart platform and the AI-driven model as well as management would have been cycle tested and a more resilient company than before. My target price for Upstart is $45.30, implying 65% upside potential from current levels.

Be the first to comment