tsvibrav/iStock via Getty Images

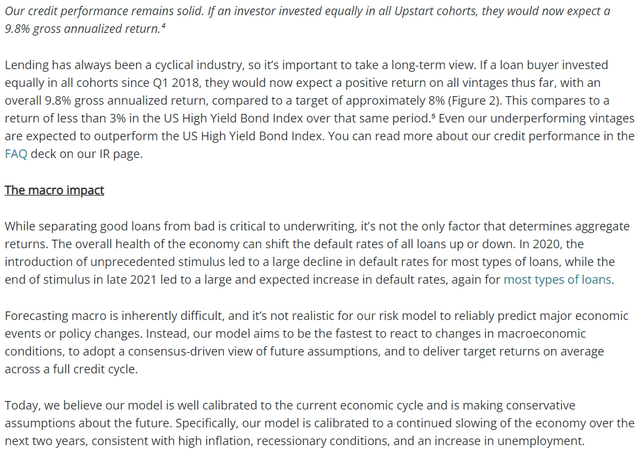

Brief Overview of Upstart’s Q2 Results

As we have previously discussed, Upstart’s (NASDAQ:UPST) business is inherently volatile due to its dependence on lending partners, i.e., institutional investors and bank & credit union partners. In challenging macroeconomic environments, lenders tend to homogeneously cut back on new loan originations (especially for higher-risk borrowers). And Upstart’s transaction-based revenue model means its business is exposed to severe volume contractions during downturns in debt markets. This phenomenon was on full display in Upstart’s Q2 report.

Upstart Q2 Earnings Presentation Upstart Q2 Earnings Presentation

While the disappointing sales and net income figures of $228M and -$29M were in-line with pre-announced Q2 results, the report still managed to shock investors (including me) on many levels.

For starters, Upstart’s Q3 revenue guidance of $170M was worse than my bear case projections of $200M, and this tells us that lending activity on Upstart’s platform is contracting faster than expected. During the early days of the COVID-19 pandemic, Upstart went through a ~70% contraction in lending volumes, and looking at Q3 guidance, we could very well end up with a similar (or worse) contraction this time around.

Upstart Q2 Earnings Presentation

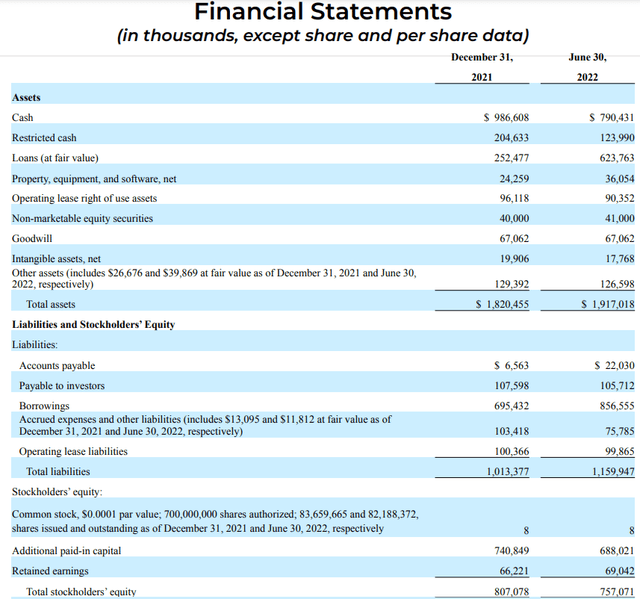

With that said, a significant jump in contribution margins is set to offset some of the pain on the bottom line. According to Upstart’s management, the company is benefiting from higher take rates and low fixed costs. The fact that Upstart is operating near breakeven free cash flow during such a vicious volume contraction is thoroughly impressive. Something that’s not impressive is the increasing amount of loans held on Upstart’s balance sheet.

In Q2, Upstart recorded a $30M impact on revenue due to losses on sale of loans. After an adverse market reaction to non-R&D loans showing up on Upstart’s balance sheet, management promised quick disposal of these loans. However, Upstart’s non-R&D loan balance went down by just $13M in Q2 and still stands at $140M. Overall, Upstart’s loans held on the balance sheet increased in Q2, and my fears of this figure reaching $1B by the end of 2022 could come true.

Upstart Q2 Earnings Presentation

Here’s what I said in July:

While I am pleased with the sale of loans from Upstart’s balance sheet (reduction in balance sheet risk), I am a little surprised with the implied loss on sale of ~$30-40M. If Upstart got rid of all the loans on its balance sheet, I would say this one-time loss would be forgivable, but I fear that more R&D loans will continue to show up on Upstart’s balance sheet, and this will create an overhang on Upstart’s financial results for multiple quarters. The ongoing volume compression could worsen, and Upstart’s cash flows could come under severe pressure.

Source: Upstart Stock: An Opportunity Of A Lifetime Or A Tragic Mistake?

Looking at Upstart’s loan purchase and sell activity, I think that the company continued to use its balance sheet as a bridge in Q2 in contrast to what the management said after the Q1 results. Also, Upstart failed to get rid of the non-R&D loans during Q2 as promised.

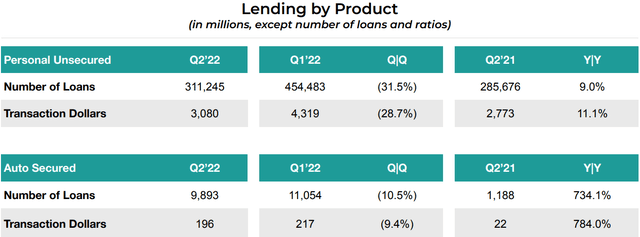

Furthermore, Upstart’s management basically acknowledged the ongoing marketplace funding constraints as a failure of its business model by announcing a permanent shift in (or adoption of a newer) business model towards committed (stable) funding. On paper, committed funding would reduce the volatility in Upstart’s revenue across debt cycles. However, this shift is likely to take a good bit of time, and during this evolutionary process, Upstart is going to use its balance sheet as a bridge for facilitating loans on its lending marketplace. Once again, Upstart’s management team has flipped its stance in a matter of weeks. In a nutshell, Upstart’s management is still behaving naively and flip-flopping between business models from quarter to quarter.

In the past month, we have discussed Upstart twice and highlighted the cyclicality aspect of its business in detail:

- Upstart Stock: An Opportunity Of A Lifetime Or A Tragic Mistake?

- Upstart Q2 Earnings Preview: Short-Sellers Should Brace For Impact

Frankly speaking, I am not entirely surprised with management’s decision to evolve Upstart’s business model to inculcate stable funding. Well, if I were running Upstart, I would want stable funding too (especially during a downturn in debt markets).

Here’s what Upstart’s CEO, Dave Girouard said about this transition:

Update on Upstart’s Credit Performance and Funding Model – Upstart Blog Update on Upstart’s Credit Performance and Funding Model – Upstart Blog

Upstart’s positioning as a two-sided marketplace is falling apart as it ventures into lending using its balance sheet. The addition of committed capital (stable funding), i.e., institutional investors willing to invest through debt cycles, could help the company eliminate balance sheet risk and regain its status as a marketplace (lose the tag of a lending institution). While this business model evolution sounds perfect for Upstart, it is easier said than done.

Considering current market conditions, I don’t see institutional investors lining up to partner with Upstart to provide committed capital to support its lending activity, and so, the likelihood of this move bearing fruit in the near term is extremely low. Moreover, Upstart’s recent credit performance makes me skeptical of the long-term prospects of this new business model pitched by Upstart’s management.

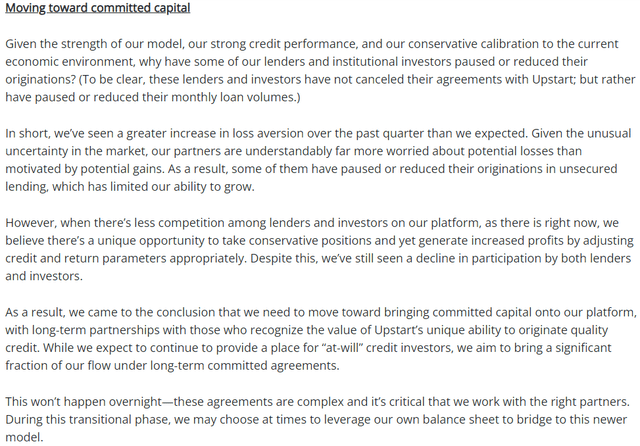

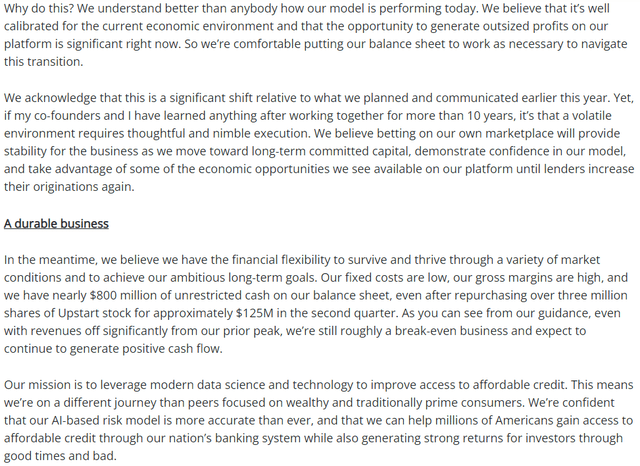

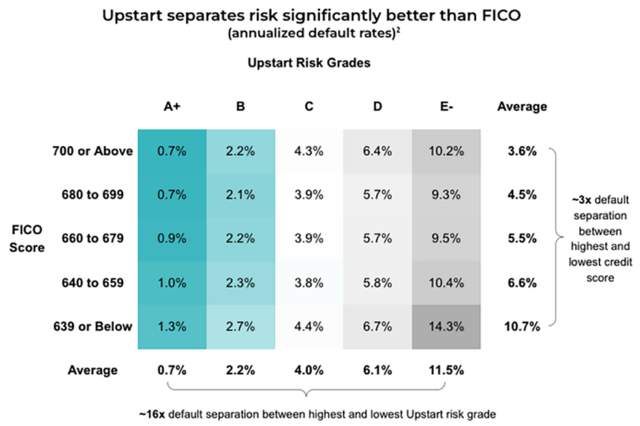

By way of background, loans on Upstart are commonly funded in two different ways: for lower-risk borrowers, our bank and credit union partners typically originate loans according to their own credit policy, and hold those loans on their balance sheet. For higher-risk borrowers, the loans are commonly originated by bank partners and then sold later to institutional investors.

Source: Update on Upstart’s Credit Performance and Funding Model – Upstart Blog

While funding constraints are hurting Upstart’s marketplace on all fronts, data shows that Personal (unsecured) loans for higher-risk borrowers [funded by institutional investors] are facing the major brunt of the ongoing contraction.

Upstart Q2 Earnings Presentation Upstart Q2 Earnings Presentation

Clearly, institutional loan buyers on Upstart’s platform are rapidly cutting back their activity on Upstart’s marketplace (much faster than Upstart’s growing origination partner-base of banks & credit unions). While I understand that deteriorating macroeconomic factors are playing a big part here, Upstart’s credit performance data is extremely concerning.

Management Says AI Model Is Accurate, Credit Performance Data Suggests Otherwise

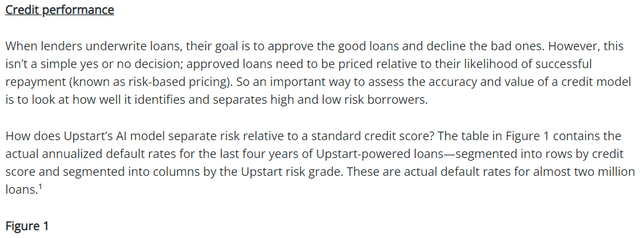

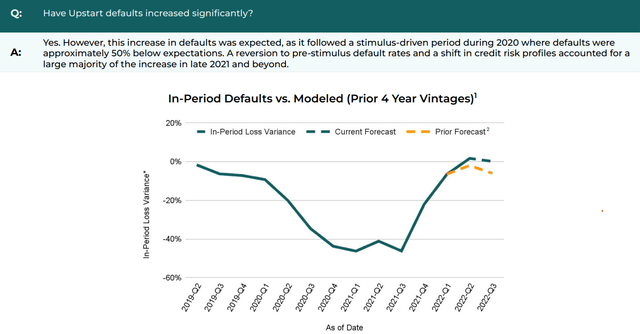

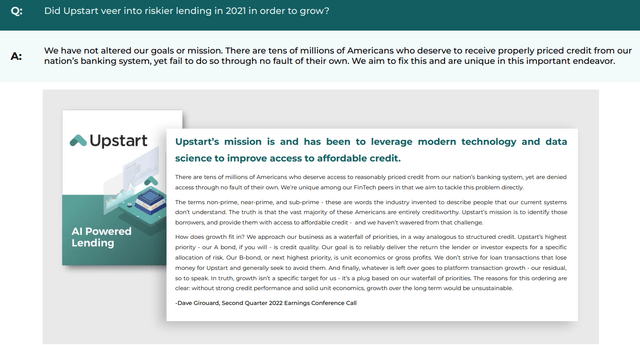

In an attempt to dispel concerns around the effectiveness of Upstart’s AI models and to justify a change of business model, its management recently released an Update on Upstart’s Credit Performance and Funding Model – Upstart Blog and a Q&A deck. Please carefully read the text shared below:

Update on Upstart’s Credit Performance and Funding Model – Upstart Blog Update on Upstart’s Credit Performance and Funding Model – Upstart Blog Update on Upstart’s Credit Performance and Funding Model – Upstart Blog Update on Upstart’s Credit Performance and Funding Model – Upstart Blog Update on Upstart’s Credit Performance and Funding Model – Upstart Blog

As you can see above, Upstart’s recent vintages are showing significant underperformance relative to their target gross returns. For Q3 and Q4 of 2021, the vintages are underperforming by more than 400 basis points. Upstart’s management is asking investors to take a long-term view and average their returns on different vintages; however, the underperformance of vintages from 2021 is not something any investor could just gloss over.

While I completely understand that withdrawal of fiscal stimulus is causing a jump in default rates back up to pre-stimulus default rates (as indicated by the company). However, with the unemployment rate (~3.5%) still near record lows, Upstart’s vintages should not be underperforming by ~400 basis points.

When I look at the gross annualized return data with the default rates chart shared by Upstart, I think something is not right here. If Upstart’s AI model is accurate and default rates are only back up to pre-stimulus default rates, then gross annualized returns on Upstart’s vintages should be in-line with pre-stimulus gross annualized returns.

The only reasonable explanation for this underperformance that I can think of is that Upstart’s vintages from 2021 had a greater mix of riskier borrowers, and inflation is hurting these borrowers’ payback capacity much worse than prime borrowers. The delinquency rates in these vintages must have shot up drastically (not reflected in default rates just yet), and thus Upstart is expecting a much lower gross annualized return on these loans.

As debt markets tighten up and Upstart’s volumes contract (higher-risk loans go away [pause] first), I expect to see a recovery in Upstart’s gross annualized return performance. And this is something I will be keeping an eye on over the next couple of quarters. Hopefully, Upstart’s management will continue to break down their credit performance for us in the future.

Why Even Bother Investing In Upstart?

Upstart’s volume contraction is set to accelerate in Q3, and its cash flows could come under severe pressure if this trend continues in Q4 and beyond. Also, Upstart now carries balance sheet risk, and while it searches for committed funding, it is similar to a lending institution. Other fintech companies like LendingClub (LC) and SoFi (SOFI) have turned into banks to reduce the cost of capital for their lending operations and, quite frankly, have a far superior business model than Upstart for the current market conditions. Honestly, if Upstart wants to use its balance sheet to carry out lending activities, it is better off becoming a bank. And this is where Upstart will be headed if management fails to secure committed capital (stable funding) from partners.

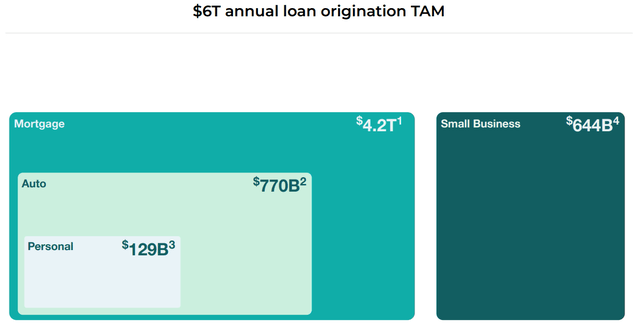

As a long-term investor, I really want Upstart to succeed in its marketplace vision because that is the only way Upstart achieves massive scale and truly disrupts the credit industry. Upstart’s mission to enable affordable credit to all borrowers (based on true risk) differentiates the company from other fintechs and lenders that tend to focus solely on prime borrowers.

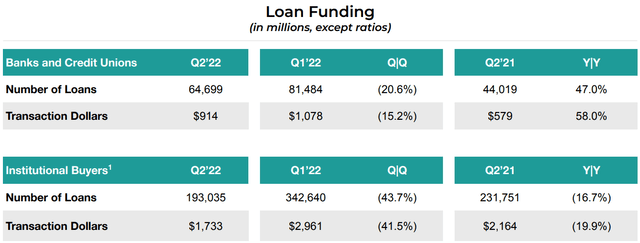

While Upstart’s revenues have peaked for this debt cycle, its addressable market opportunity is humongous, and it will continue to grow as the AI lender expands into adjacent markets in the upcoming years. The trajectory of this expansion will likely be a lot slower considering the ongoing shift in Upstart’s business model, but I still think Upstart has the potential to become a massive business over the long term.

Upstart Q2 Earnings Presentation

Currently, Upstart is experiencing a vicious contraction in lending activity on its platform amid funding constraints. However, the business is still operating near breakeven free cash flows, and a balance sheet cash position of $800M provides ample liquidity to get through to the other end of this downturn in debt markets.

Upstart Q2 Earnings Presentation

Lastly, Upstart is a heavily-shorted stock with ~35% of its outstanding float currently sold short. In Q2, Upstart bought back 3.3M shares for ~$125M, and it still has another $275M left on its buyback authorization. Since the current price is much lower than where Upstart bought back shares in Q2, I think the management will (and must) continue to execute an aggressive buyback program. As I laid out in my previous note, Upstart’s stock is a coiled spring, and an unfreezing in debt markets could trigger a significant rally in this counter. With that said, this may not happen in the near term, and investors may need to stay patient over the next few quarters.

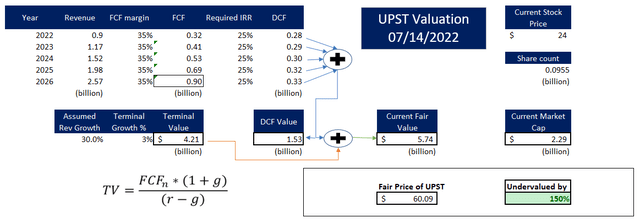

The Risk Is High, But So Is The Reward

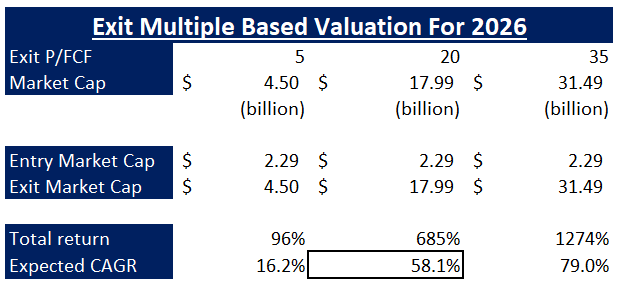

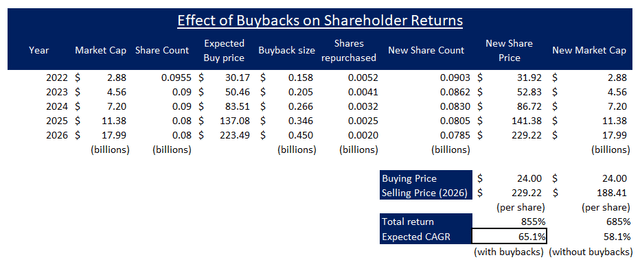

For the purpose of brevity, I will just share the assumptions and results from my recent valuation exercise in this note. A detailed description of my valuation model for Upstart is available here.

Assumptions:

| 2022E revenue (ultra-conservative estimate) | $900M |

| Forward 4.5-Yr Revenue Growth Rate (%) | 30% |

| Terminal Growth Rate (%) | 3% |

| Optimized FCF Margin (%) | 35% |

| Discount Rate / Required IRR (%) | 15% |

| Exit Multiple [P/FCF] | 15-25x |

Results:

TQI Valuation Model (Author) TQI Valuation Model (Author) TQI Valuation Model (Author)

In a nutshell, Upstart is a high-risk, high-reward bet. Currently, the stock is trading well below its fair value, and investors buying here could generate massive returns over the next few years. However, the company is in a transition, and the new business model put forward by Upstart’s management may fail to materialize. As a long-term investor with a strong alignment with Upstart’s mission, I am willing to take this risky bet, but I will continue to manage my risk proactively until the business model transition is complete.

Positioning Is Everything

Upstart’s stock has been a train wreck since Fed’s pivot in November 2021, and Q3 guidance points towards a violent volume contraction that the market has probably been pricing into the stock for quite some time. Debt markets are cyclical, and this downturn will also end at some point. And that means Upstart will see a rebound in lending activity once the debt market unfreezes. However, in the meantime, Upstart’s stock could get cheaper, a lot cheaper. After all, the market is re-pricing Upstart as a lender, and lenders tend to trade at 1-1.5x book value, which would put Upstart’s market cap at $0.8-1.2B. With Upstart currently trading at $2.4B ($28 per share), the stock could lose another 50-70% if the market chooses to price Upstart like traditional lenders. Well, the $10-15 analyst targets don’t seem so puzzling anymore.

While these bearish targets make sense in the near term, Upstart is not going to be a lending institution in the long run. Even if Upstart’s management fails to evolve its business model by adding committed capital to its marketplace, the company will still grow its marketplace volumes organically by adding more bank partners, credit unions, institutional investors, and auto dealerships to its marketplace. The idea that Upstart will be permanently valued like a highly-leveraged lender is just absurd, that’s not what it is!

However, do investors need to sit through another 50-70% decline (if that were to materialize)? The simple answer is no. As you may know, I have been using hedging strategies to protect my wealth and reduce my cost basis in Upstart. While my hedge in Upstart expired last Friday, I am going to set up a new one as soon as my position settles.

Here’s a brief overview: In mid-May, I owned a significant position in Upstart with a cost basis of $78 (after my last purchase at $35 per share in early May). Post a quick rally, Upstart’s stock was trading at around $48, and I couldn’t see the stock holding up in the face of upcoming losses on the sale of loans and a lending volume contraction. And so, I implemented an options-based hedging strategy as below – For every 100 shares of Upstart, I bought 1 at-the-money put (SP of $48) [limiting my downside], sold 1 out-of-the-money call (SP of $55) [limiting my upside], and sold 2 out-of-the-money puts (SP of $25).

Of these, my $55 calls and $25 puts expired worthless. And I exercised my $48 puts to sell my Upstart shares.

In the next week, I will be repurchasing my original position in Upstart at around the current price of $28 (hopefully lower). I am not redeploying all of my capital into Upstart because the Q3 guidance is worse than my bear case projections, and while I agree with the idea of getting stable funding, I want to see some solid execution from Upstart’s management before weighting Upstart so heavily in my portfolio. Also, I will be hedging my Upstart shares by buying an ATM put at $30 and selling 2x OTM puts at $15.

With the excess cash, I intend to increase my long position in Opendoor (OPEN), Roku (ROKU), and Hims & Hers (HIMS).

Final Thoughts

After a strong rally going into Q2 earnings, Upstart’s stock squeezed up to $37.50; however, we have seen a sharp retracement in the stock over the last three trading sessions. On Upstart’s earnings day [8th August], I issued a buy rating on the stock at $29 per share, and while the stock is now trading below this level, I want to congratulate those who took profits on the post-ER rally.

As we know, Upstart’s financial numbers are heading in the wrong direction, and the company is undergoing a business model transition. With turmoil in debt markets unlikely to end in the near term, the stock could remain volatile over the coming months. Upstart has hit turbulence, the seat belt sign is on, and all trading bets are off.

From a long-term perspective, I continue to remain bullish on Upstart. The business is still operating at breakeven FCF with robust unit economics. With ~$800M in cash, Upstart’s liquidity position is strong enough to get through this downturn in the debt markets. Once debt markets normalize, Upstart could emerge as a big beneficiary since its credit underwriting will have been war tested (i.e., proven). Personally, I have been proactively managing risk in Upstart through option-based hedging strategies; and I will continue to do so for the next couple of quarters.

Thanks for reading, and happy investing. Please share your thoughts, questions, or concerns in the comments section below.

Key Takeaway: I rate Upstart a strong buy at $28 for long-term investors.

Housekeeping Note: I’ll soon launch a Marketplace service on Seeking Alpha focused on generating long-term outperformance through financial engineering. For a short period post-launch, “The Quantamental Investor” will be offered at a heavily discounted legacy price. Stay tuned for more updates!

Be the first to comment