ChiccoDodiFC/iStock via Getty Images

Fall from the heavens for the Upstart

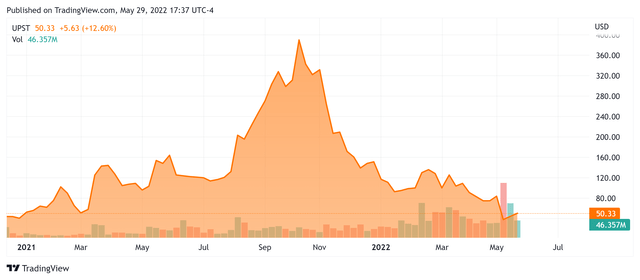

Listed in an IPO at $20 in December ’20, Upstart Holdings, Inc. (NASDAQ:UPST) registered a meteoric rise in 2021 on the back of revenue growth coupled with growing recognition of the utility of Machine Learning (ML) algorithms (a subset of Artificial Intelligence) in lending. The share rose to a peak at $390 in October ’21, a 19-bagger in less than a year since the IPO!

The descent from the heavens was equally sharp; as the market assimilated higher inflation and the Federal Reserve began a belated monetary belt-tightening, by the time of the 1Q ’22 earnings call, Upstart had already fallen by 80% (to $77) from its $390 peak, along with other fintech/growth stocks.

Broker downgrades post the 1Q ’22 earnings call

The market reaction to the 1Q ’22 earnings call was savage. The day after the earnings call, Upstart halved from $77 to close at $33.

UPST Price Since Listing (Seeking Alpha)

Even though Upstart matched/surpassed street estimates for Q1 ’22, the shares saw a dramatic decline in price targets by virtually all sell-side analysts. The average Wall St. price target was cut from $174 at the end of April ’22 (before the call) to $50 currently.

This article refutes the wholesale downgrade by Wall St. analysts as grave misdiagnoses. Before explaining the errors, it will prove useful to state them explicitly. Analyst concerns, cited below, may be grouped into three main factors (my italics):

1. Use of own balance sheet for loans is a volte-face and escalates credit risk

Stephens analyst Vincent Caintic pointed out that Upstart has originated loans on its balance sheets that it hasn’t been able to transfer to its funding partners, causing him to downgrade the stock to Underweight from Equal-Weight and slash his price target to $28 from $124. “This breaks the thesis for us of a marketplace lender, which is supposed to originate on the behalf of funding partners,” the analyst wrote in a note to clients.

Piper Sandler’s Arvind Ramnani downgraded the stock, lowering his rating and dramatically reducing his price target to $44 from $230. Upstart faces a “perfect storm of headwinds,” he wrote. Despite a growing network of bank partners and investors, Upstart has increased its loan exposure from $261M in Q4 to $604M in Q1, primarily for auto lending and new segments of personal lending,” he wrote. “While Upstart continues to have a fee-based revenue model, the larger loan balance does increase its risk exposure.

2. Upstart’s AI model will lose predictive power with rising rates

Citi analyst Peter Christiansen downgraded Upstart to Neutral and chopped the price target to $50 from $180, as the company’s artificial intelligence appears to take “time to adjust to deteriorating macro” conditions, the analyst wrote. “Key questions now are (I) will consumer credit worsen vs. pre-COVID, (II) will funding sources temper their appetite, and (III) did Upstart (UPST) cut its outlook enough?” He also noted that the use of its balance sheet to park some loans “raises an eyebrow.”

3. Declining growth through rising interest rates

Bank of America’s Nat Schindler wrote, in cutting his rating on Upstart’s stock to neutral from buy and reducing his price objective to $41 from $255:

Although Upstart’s business model has shown strong growth in a benign credit environment, yield demands from credit investors have risen rapidly as interest rates and default rates have risen, suggesting problems ahead. The negative view is that at some point soon credit investors will likely force Upstart to charge consumers a rate so high that they will balk, decimating loan originations… we fear the economic uncertainty could limit upside potential.”

Let’s start with a short summary of Upstart to fully comprehend why the dramatic downgrade – due to the three factors above – is misguided.

Dragging FICO into the 21st Century

In 2017, after a rigorous review of UPST’s model, the relevant regulatory authority, the Consumer Financial Protection Bureau (CFPB) allowed Upstart to use their multi-variable ML (Machine Learning) model in the marketplace.

One of CFPB’s oversight responsibilities is to ensure there is no bias, explicit or latent, in the granting of credit. As Upstart’s model necessitated far more information (converted into +1,000 variables derived from the application form) than the legacy FICO-based methodology, the CFPB was fastidious in monitoring Upstart’s loan data. Hence the CFPB’s first assessment of UPST’s loan data was pivotal.

In August 2019, the CFPB stated about Upstart’s machine learning model compared to the traditional model:

The results provided from the access-to-credit comparisons show that the tested model approves 27% more applicants than the traditional model, and yields 16% lower average APRs for approved loans.

This reported expansion of credit access reflected in the results provided occurs across all tested race, ethnicity, and sex segments resulting in the tested model increasing acceptance rates by 23-29% and decreasing average APRs by 15-17%.

In many consumer segments, the results provided show that the tested model significantly expands access to credit compared to the traditional model. In particular, under the tested model, the results provided reflect that near prime” consumers with FICO scores from 620 to 660 are approved approximately twice as frequently.

The CFPB’s assessment was a landmark for Upstart. Actual data from the data-trained algorithms of its ML-based model proved that, not only did it extend credit (often at lower rates) to borrowers excluded from the traditional FICO-based model, but the inclusion of potentially discriminatory detail of the borrower actually helped to extend credit to minority groups, not restrict it.

Hence Upstart’s confidence in its future is backed by facts; the company now has 57 lending partners (banks and credit union partners that provide the credit for Upstart’s borrower referrals), up from 10 when Upstart listed. In addition of those 57 lending partners, after having thoroughly tested the model, 11 have relinquished their FICO minimum credit score policy, allowing Upstart’s model to replace an industry standard that prevailed for decades.

The policy of loans as principal has been revised

Days after the violent market reaction to Upstart’s first quarter conference call, the CFO participated in a Barclays Fintech Forum. Below is my own transcript of this key issue: Min 13 of Interview:

Barclay’s Analyst

And Sanjay. In your most recent quarter, you carried more loans on the balance sheet. Then you have historically. Can you talk a little bit about the drivers, the increase in some of the dynamics at play there?

Upstart CFO, Sanjay Datta Answer (my italics)

In the majority of our time are our platform is borrower-constrained and we’re working hard to find more borrowers at good unit economics and that’s our growth model.

There are these periods of time, these sort of macro shocks, where funding changes rapidly, and it becomes the constraint on the platform. In those periods of time, we essentially have a decision where we can either choose to, step in with our balance sheet and support the volume until the equilibrium clearing price is set, and we get back in when it’s recalibrated. Or We could have just not originated a bunch of loans.

In Q1 we did take the decision a step in with our balance sheet and support volume when funding became volatile…You know, it was a relatively modest mount; we did $4.5 billion in originations in Q1 and I think this amounted to maybe $150 million.

But you know, look in retrospect, we were a little bit caught off guard with the visceral reaction by the market to this, and I think in retrospect and certainly in the future, I think the decision’s just going to accept the volume volatility, and not weigh into the platform with our balance sheet as a stabilising mechanism.

Note that a number of Wall St Analysts downgraded Upstart for this very policy. Well, the CFO has categorically stated that Upstart will no longer employ its own balance sheet as principal, (save loans needed to train its ML model, currently about $450m of the $604m). However not a single Wall St Analyst has acknowledged Upstart’s revised policy and amended his/her price target.

The Upstart AI-Model is working superbly

Rather than duplicate content on Seeking Alpha, I urge readers to read a great article by Christopher Hoeger, a fellow SA Contributor, Upstart: It’s Time For Some Accountability. It details the superior performance of Upstart’s model when compared to the traditional FICO-based methodology.

In summary, Upstart’s model:

- has far lower default rates for prime or near-prime borrowers; and

- permits access to ‘risky’ borrowers that traditional banks would not touch. (For example, U.S. Bank only provides personal loans for customers with a FICO score above 660). Not only does Upstart appraise/approve loans to them, but the model dissects creditworthiness at such a granular/individual level, that Upstart’s default rates in these riskier strata are often lower than prime borrowers from conventional FICO models used by major banks.

Will Upstart’s AI model lose predictive power with rising rates?

Granted, UPST’S model was trained over the last decade, where interest rates were flat or declining. But the model does not employ blunt macro factors such as rates, but delves on a micro/individual level, using the specific individual’s circumstances.

A simple analogy might be where a traditional FICO-based model has one column called “interest rates” in its matrix (where each row represents the borrower’s details and each column is a factor to determine the borrower’s ultimate FICO score); Upstart’s ML-model dissects the “interest rates” column into a multitude of sub-factors (e.g., employment rates in the borrower’s industry, tenure of borrower in current employment, sensitivity of borrower’s industry to economic cycles, sensitivity of borrower’s industry to the U.S. dollar, government intervention in the borrower’s industry, duration of unemployment of borrower between jobs…).

These micro factors are far more accurate in analyzing the individual’s creditworthiness than crude macro-economic factors such as interest rates. Naturally, the model accommodates for the prospect of rising costs of living (including food inflation, higher interest rates on his credit card or mortgage) when the appraisal of his/her creditworthiness is computed. Importantly, this variability (in living expenses) existed in the data used to train the UPST ML model.

UPST is confident that this micro approach is far more effective than the traditional FICO macro model that’s been the industry standard since 1989. Remember the borrower’s rate is fixed when the loan is granted, and does not vary with rising rates.

A related criticism is that Upstart’s lending partners lost faith in the model, hence their reluctance to award credit during in Q1, leading to $200m of loans on the company’s balance sheet. However, this criticism does not take account of the turbulence faced in the quarter. Credit markets overall stalled as they digested the Fed’s acknowledgement of the need for rapid monetary tightening.

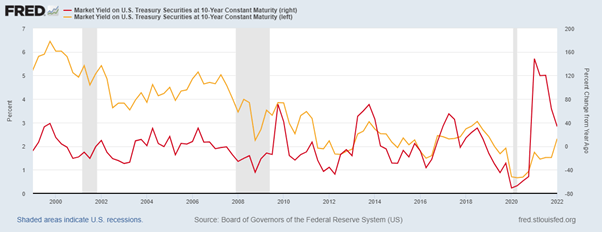

The graph below puts the jump in the 2-yr Treasury Yield (the base rate for personal loans) in historical context; the red line represents the QOQ change in %. As rates rose from a very low base, the percentage jump in Q1 was massive, leading to a pause in overall credit markets. Once credit markets have absorbed the step-jump, they will return to normalcy, albeit at higher rates.

2yr Try yield in context (FRED)

Has growth gone or just moderated?

This leads to the third reason for Upstart’s dramatic downgrade, and is partially valid. Lending is an inherently cyclical industry that, by definition, will be influenced by the higher cost of credit.

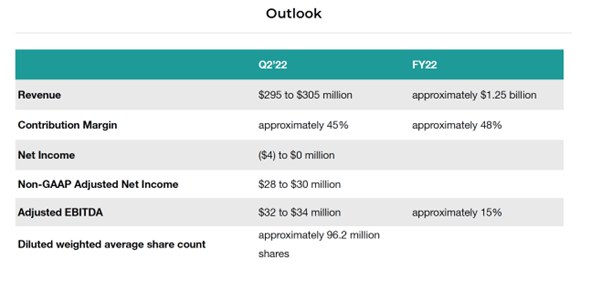

Upstart is cognizant of this; hence, the Q1 conference call included a reduction in their outlook. Upstart now forecasts growing revenue to around $1.25B for the FY 2022, which represents a 48% YoY revenue growth rate.

(Note. As outlined in this SA article, Upstart: The 3 Risk Factors Investors Ignored, Upstart had raised its revenue guidance in February this year during its 4q ’21 quarterly conference call, where revenue growth of 70% to $1.4B for 2022 was expected.)

In addition, Upstart reduced its estimate for profit margins; in 1q 22, the adjusted Ebitda margin was 20% of revenue, whilst for the year 2022 the revised forecast is 15%.

Revised EBITDA margin for 2022 (seekingalpha.com/article/4509554-upstart-holdings-inc-2022-q1-results-earnings-call-presentation)

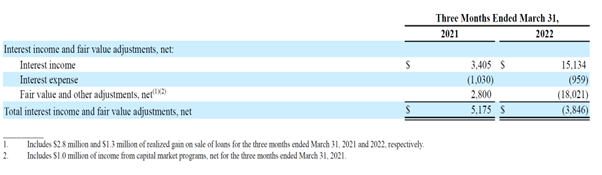

This suggests a dramatic fall in profitability for the company. But the devil’s in the detail. As Upstart has about $400m of loans on-balance-sheet needed to train its ML-algorithms, these needed to be repriced in the face of rising rates.

Included in the adjusted EBITDA-margin is the net interest income. From the 10Q filed for Q1, it’s seen that margins were affected by this fair value adjustment, moving from a positive $2.8bn in Q1 ’21 to a negative $18bn in Q1 ’22.

Repricing of loans on-balance-sheet (seekingalpha.com/filing/6429060)

Hence the dramatic reduction in profitability forecast is tainted by this fair value adjustment. This represents a transient hit to profit margins as rates continue to rise (probably into mid-2023), but not a permanent reduction in Upstart’s profitability.

Valuation of Upstart under rising rates

As stated, Lending is a cyclical industry and faces the headwind of rising rates. Nonetheless, Upstart has earned its reputation as a leading force in the use of AI to transform the lending industry. Even if overall lending moderates, Upstart will continue to gain market share; it expects revenue growth of 45% in 2022, a year of uncertainty marked by aggressive monetary tightening. Unlike many fintech startups, Upstart is currently profitable.

The central question: what would an investor pay for an established fintech with a growing roster of lending partners, new growth vectors (auto-loans) that’s likely to grow revenue at 45%, and profits at 35%?

(Remember, the profit trajectory is tainted only temporarily, as the adjustment from repricing loans ebbs as interest rates stabilize.)

Using current consensus for 12-month forward EPS of $2.20 (EPS for 2022: $1.84; EPS for 2023: $2.56 ), Upstart is valued on a FPE ($48.5/$2.20) of 22X. A company with a sustainable growth rate of a minimum of 35% should trade at a PEG ratio (FPE to growth rate) at a minimum of 1X, offering a 35X P/E ratio. That gives the company a valuation of $77/share, or 59% upside today.

Upstart should maintain that P/E for the intermediate future, or at least until it reaches a significant size and growth is constrained by overall lending. Given the enormous untapped potential ($112bn personal loan market, $751bn auto-loan market), Upstart’s growth rate – cemented by the superior performance of their ML-based model – should prevail for at least the next 5 years. Hence, the P/E ratio of 35X should prevail also, offering a share price that grows in tandem, at 35% per annum for the next 5 years.

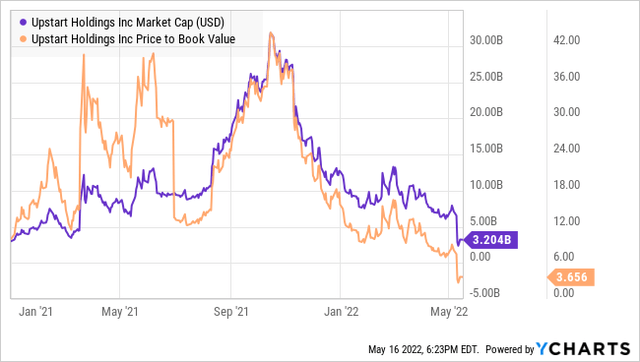

Upstart Market Cap since IPO (Ycharts)

It’s worth noting that Upstart is cheaper now, on a Price/Book Value than when it IPO’ed. The dramatic and unwarranted slide, precipitated by an overreaction by Wall Street analysts, offers an outstanding opportunity for a secular growth story of the new age. Strong Buy.

Be the first to comment