Pekic/E+ via Getty Images

Upstart Holdings, Inc. (NASDAQ:UPST) will be reporting its Q3 results after market close tomorrow, 8 November. With interest rates on the rise, investors will be watching how reduced and strained consumer budgets will impact Upstart’s revenue. But in addition to tracking its headline financials, investors may also want to monitor its loan originations volume, conversion rate, its segment financials, and its management’s outlook for the quarter ahead. These items will better highlight how adversely the lending platform has been hit by rising interest rates and should influence where Upstart’s shares head next. Let’s take a closer look at it all.

Key Operating Metrics

Let me start by saying that Upstart’s management has done a terrific job at growing their business at a rapid rate over the recent years. Its Q1 FY22 revenue, for instance, was up 260% from Q1 FY20. This exceptional pace of growth is rarely achieved by fluke and it’s rather a by-product of smart decision making. So, full points to management for growing the business so far. But with interest rates on a meteoric rise, the first order of business should be to ascertain how Upstart has been affected financially and operationally.

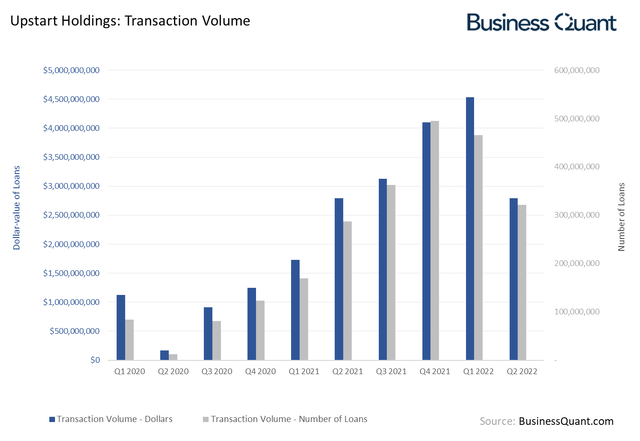

We can start by monitoring Upstart’s transaction volume in terms of total number of loans disbursed as well as their total dollar value. As consumer budgets get strained due to inflationary pressures in a recessionary environment, loan originations are bound to take a hit industry-wide. So, while a decline in Upstart’s transaction volume is near-certain event, like it dipped in Q2, what remains unknown at the point of this writing is the extent of its decline. Therefore, this transaction volume metric will provide us with insights about how Upstart is faring in this challenging macroeconomic environment.

Investing forums are currently rife with doomsday scenarios for Upstart Holdings. This is also evident in its price action, with its shares plummeting 94% over the last 1 year alone. This selloff is due to the fact that Upstart is faced with a two-fold risk – weak demand from consumers and the company being funding constrained to originate Upstart-powered loans.

So, it’s important for investors to track the company’s transaction volume in its Q3 earnings report. I think it’s needless to say but any kind of growth in its transaction volume, be it in the form of number of loans disbursed or their total dollar-value, will inspire confidence amongst investors and can trigger a massive rally in its shares.

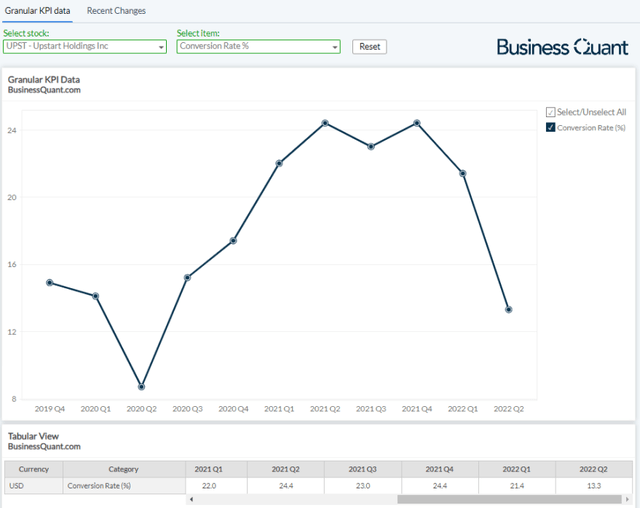

Having said that, the transaction volume alone isn’t enough to reveal the entire picture. We’ve to also look at Upstart’s conversion rate to gauge consumer demand and to also get a sense of its competitiveness in the rapidly-evolving online lending industry. For the uninitiated, Upstart defines its conversion rate as the number of loans disbursed, divided by the total number of enquiries received in a quarter.

If Upstart is actually offering attractive cost savings to its customers, then its customers are more likely to sign up with the company and boost its conversion rate along the way. On the other hand, if the company’s offers aren’t as good as its competitors, then these potential customers are likely to sign up elsewhere which, inevitably, will drag Upstart’s conversion rate lower. But I think weak consumer demand, due to rapid interest rate hikes and rampant inflation, will weigh down on the company’s conversion rate. Upstart actually outlined this very risk factor in its last 10Q filing:

“As the U.S. Federal Reserve raises interest rates, the average interest rates charged to borrowers for Upstart-powered loans also increase, which results in decreases to our Conversion Rate.”

Having said that, let’s now shift attention to financial expectations from Upstart Holdings’ upcoming Q3 results.

Revenue Bifurcation

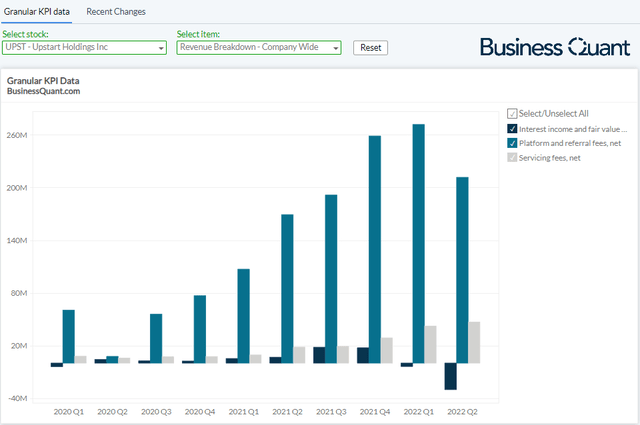

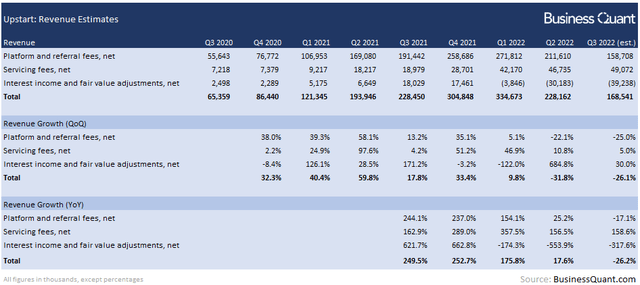

It’s worth noting that Upstart Holdings has three streams of revenue, namely interest income, servicing fees, and platform and referral fees. Its net interest income has usually been a small revenue driver, accounting for just under 6% of its total revenue during Q4 2021. However, the reported figures turned negative on a net basis in subsequent quarters due to rampant rate hikes. Essentially, its cost of funds became higher than the interest income as the company wasn’t able to transfer rate hikes to its customers fast enough.

The Fed has hiked interest rates twice since Upstart reported its Q2 results, at the same quantum as before, meaning things will continue to deteriorate for Upstart’s interest income on a net basis. So, I estimate the figure will worsen by 30% sequentially and approximately amount to a loss of $39 million in Q3.

Next, Upstart charges a Servicing Fee from its partner banks that are holding Upstart-powered loans, for processing and reconciling repayments, while also providing support to end consumers throughout their loan tenures. This business vertical accounted for roughly 18% of the company’s total sales last quarter and has been a growth driver for the company, growing in excess of 150% year over year and growing nearly 11% sequentially.

However, with transaction volume expected to remain under pressure during Q3, Upstart’s Servicing Fee is naturally going to take a hit as well. I’m expecting the segment’s revenue growth rate to moderate in Q3 to just 5%, with the actual revenue figure amounting to roughly $49 million.

Lastly, Upstart charges fees from its partner banks as it generates transaction volume for them and classifies these collections under its Platform and Referral Services segment. This can be a fixed unit fee, variable unit fee, or both, depending on the company’s individual contracts with its partner banks. This has been the primary revenue contributor for the company since its inception, amounting to almost 82% of its total revenue last quarter.

But again, with transaction volume expected to be down in Q3, this segment will take a hit as well. I expect Upstart’s platform and referral fees revenue to be down 25% sequentially, with the figure coming in around $158 million. This brings us to a company-wide revenue total of $168.5 million, which is coincidentally within the Street’s estimates that are spanning from $157.95 million and $175.3 million at the time of this writing.

But having said that, we must also pay close attention to Upstart management’s revenue outlook for Q4. There have been several 75-basis point interest rate hikes this year and the management would now have ample data points to reliably extrapolate the impact of continued rate hikes on its revenue during Q4.

Final Thoughts

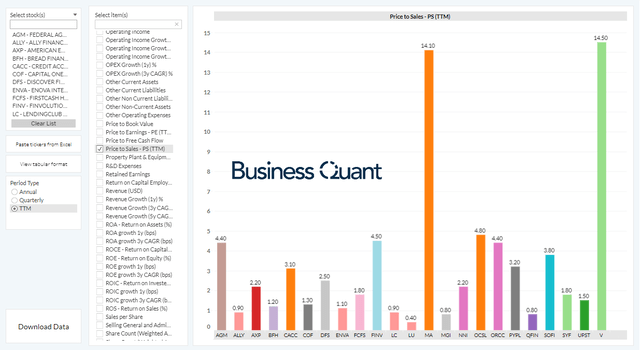

Upstart’s shares are trading at just 1.5-times its trailing twelve-month sales. This figure is quite low when compared with many of the other names in the credit services industry, as evident in the chart below. So, it’s understandable why many investors feel the stock is undervalued at current levels.

Having said that, Upstart’s prospects continue to be weighed down by interest rate risk. Since we don’t yet know whether the Fed has one, two or three interest rate hikes in store, we cannot reliably forecast how adversely Upstart’s financials will be impacted over the course of 2023. These odds make Upstart an extremely risky stock to own and I’ll reiterate my previous call, that risk-averse investors may want to avoid Upstart stock for the time being, at least.

But as far as Q3 is concerned, investors may want to keep close tabs on its conversion rate, transaction volume, bifurcated revenue and its management’s outlook for Q4. These items will have a major bearing on where the company and its stock head next. Good Luck!

Be the first to comment