Jarretera/iStock Editorial via Getty Images

Investment thesis

United Parcel Services (NYSE:UPS) is focusing on shifting its revenue mix from large customers like Amazon (AMZN) to SMBs and other eCommerce players, where there are better growth opportunities and attractive yields. UPS is also improving its international business through expansions and network improvements, which should improve its long-term growth prospects. On the operating margin front, the company is making use of various technological and automation initiatives for cost-cutting, which should help the company improve its margins. So, UPS’ long-term growth prospects look good. However, there are some short to medium-term headwinds in the form of challenging macros, tough comparisons and Amazon volumes declining. The valuation is also in line with historical levels. So, it is not a bargain at the current levels. Hence, I have a neutral rating on the company.

Last Quarter Earnings and UPS Key Metrics

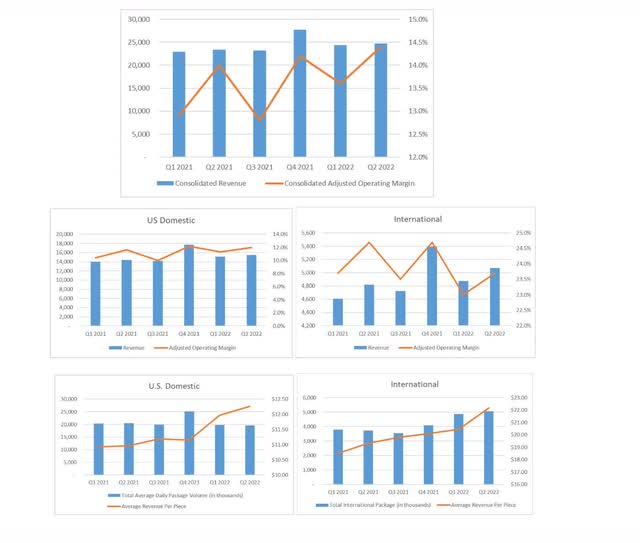

The company reported consolidated revenue of $24.8 billion (vs. the consensus estimate of $24.62 billion), which was up ~5.8% y/y helped by an increase in revenue per piece. Volumes for the quarter declined more than expected due to a combination of the worsening economy and the actions taken by the company to limit shipments for large customers like Amazon. Adjusted EPS of $3.29 (was better than the consensus estimate of $3.16) and grew ~7.5% y/y.

The domestic business grew by ~7.3% y/y, driven by an ~11.9% y/y increase in revenue per piece. The increase in yield was due to an increase in fuel surcharge and revenue quality improvement. The average daily volume declined by ~4% y/y to 19,685, as B2C volume declined by 8.2% y/y, which was partially offset by an increase in B2B volume of ~2.3% y/y. SMB made up ~29.2% of total U.S. volume, which is an increase of ~200 bps y/y. B2B represented ~43% of the domestic volume (up from ~40% in Q2 2021).

The international segment’s revenue increased by ~5.3% y/y thanks to a rise of ~14.8% y/y in revenue per piece, which was partially offset by a decline of ~9.2% y/y in total average daily volume due to war situations in eastern Europe and lockdowns in China.

The consolidated adjusted operating margin was at ~14.4%, which is a ~40 bps y/y increase. The domestic segment’s margin increased by 40 bps y/y to ~12% and the international business saw a decline in adjusted operating margin by 100 bps y/y to ~23.7%.

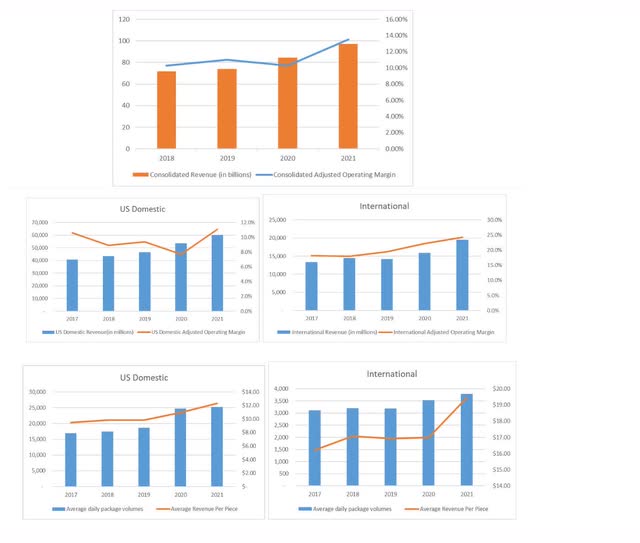

UPS Key Metrics – Quarterly (Company Data, GS Analytics Research) UPS Key Metrics – Annual (Company Data, GS Analytics Research)

Growth prospects

The US domestic package business is the largest revenue contributor for the company accounting for ~62% of the total consolidated revenue last year. This segment’s volumes are expected to take a hit in the short term due to headwinds like the slowing economy, tough comparisons from the last two years which were really strong due to government stimulus and consumer preference towards online purchases, and contractual agreements that the company has negotiated with its large customers like Amazon to lower the shipments.

The company is strategically reducing volumes and revenue from Amazon through contractual agreements and is projecting Amazon revenue to be less than 11% of total revenue by the end of 2022. The company intends to shift volumes to a more attractive SMB market, and I believe this is a good move as yields from the SMB clients is better. SMB volumes are expected to grow at a low double-digit CAGR, with B2C SMB volumes growing faster than B2B SMB volumes. Nearly half of the overall SMB market growth is expected to come from platform and marketplace merchants. There is an opportunity to ship ~67 million packages per day in the SMB market by 2025 vs. ~57 million packages per day at present.

SMB customers generally have a more sticky nature as they want an integrated experience. UPS has a good position in the market to provide integrated solutions through its Digital Access Program platform by executing every step of the shipment process in an integrated fashion. I expect this platform to be a significant growth booster for acquiring SMB customers, and it has already helped to grow customer accounts by 1 million. The company is on track to achieve its $2 billion revenue goal for FY22 from this platform and more than $1 billion of revenue has already been achieved by the company in the first half of 2022 from it. In addition, UPS has improved processing times in different areas to provide swifter services to attract more customers. The new pricing platform, Deal Manager, is simplifying and expediting the pricing process, which ultimately helps customers ship sooner by 3 days. With these customer-friendly offerings and improvement measures, the company should be able to gain continued traction in the SMB market.

While the company’s strategic shift towards SMB clients in the domestic business is no doubt interesting and a long-term positive, there are a couple of near-term risks as well which investors should be aware of. SMBs are likely to get more impacted by a prolonged slowdown or recession compared to their well-capitalized larger peers. Also, FedEx (FDX) already has a significant presence among SMBs and non-Amazon eCommerce players. So, gaining market share in this segment might not be that easy and one should closely watch the company’s execution and progress.

Apart from its domestic business, its international business is anticipated to grow at a high single to low double-digit CAGR with targeted expansion initiatives. Looking at the success in the US market, UPS is also exploring opportunities in international business to expand the Digital Access Program by leveraging existing relationships. UPS is also focusing on network improvement for international business. It has recently launched new daily flights from Osaka-Shenzhen, which connect multiple countries within Asia. This measure should improve the transit time in intra-Asia. In addition, in Q2 2022, the company announced a new joint venture with InterGlobe Enterprise in India called MOVIN, to offer express and premium service coverage across India with a portfolio of B2B domestic services including day-definite and time-definite solutions. So, international business is also expected to post good long-term growth helped by these initiatives.

Operating margin outlook

UPS is taking various technological and network improvement initiatives to drive productivity and save costs. One of the technological initiatives, the Next Generation Profit program, is an integrated cross-function program that reduces overhead expenses and drives revenue quality efforts in U.S. operations. The company is replacing manual processes with technology that leverages AI, which optimizes pricing for each customer by adjusting pricing in a more dynamic manner based on real-time data to maximize overall profitability. This tool has the capability to link revenue quality and costs to serve at the package and customer level, and it is improving UPS’s profit per piece. This initiative is estimated to improve profitability by over $1 billion through 2023.

The company is also enhancing its network efficiencies. On July 11, the company launched total service plans across the US network, which is a key initiative that should lower costs and provide predictability for customers. It will minimize driver wait times and help execute on-time dispatch across the network, thus reducing idle time across the network. The management has estimated that roughly 10 minutes of improvement within the integrated network saves $257 million annually. In addition, the company is making investments in the Smart Package Smart Facility initiative, which will help eliminate all preload scans that are done manually and will assist in reducing misloadings of packages. The management is estimating that these initiatives, combined with total service plans, should save $300 million in the second half of 2022. UPS is also leveraging its automation capabilities and these are benefiting the company by reducing the time and cost of handling the packages. So, all these technological advancements and network improvements should help it drive better profitability.

Conclusion

UPS is currently trading at 16.2x FY22 EPS which is only a slight discount to its 5-year average forward P/E of 16.94x and a premium vs FDX’s 10.14x FY22 P/E multiple. So, I don’t think the stock is cheap. While the company has good long-term prospects with a focus on growth markets like SMBs and its operating margin should also benefit from the technological and automation initiatives, its valuations are not that attractive and there are short-term headwinds from tough macros and AMZN volumes tapering off. Hence, I have a neutral rating on the stock.

Be the first to comment