Khanchit Khirisutchalual

A Quick Take On Upland Software

Upland Software, Inc. (NASDAQ:UPLD) reported its Q2 2022 financial results on August 3, 2022, beating expected revenue estimates.

The company provides cloud-based work management software to organizations worldwide.

While UPLD may indeed pick up a few bargains in the M&A bin as the economy slows down, I don’t see them as a meaningful catalyst to the stock.

I’m on Hold for UPLD until management can organically grow revenue while producing GAAP earnings.

Upland Software Overview

Austin, Texas-based Upland was founded in 2010 to develop a suite of work management tools for primarily small and midsize businesses.

The firm is headed by Chairman and CEO Jack McDonald, who was previously Chairman and CEO of Perficient.

The company’s primary offerings include software covering these functional areas:

-

Business Operations

-

HR & Legal

-

Sales and Marketing

-

Contact Center

-

IT

-

Product Management

The firm acquires customers through its inside sales, direct sales and marketing teams as well as through partner referrals.

Upland Software’s Market & Competition

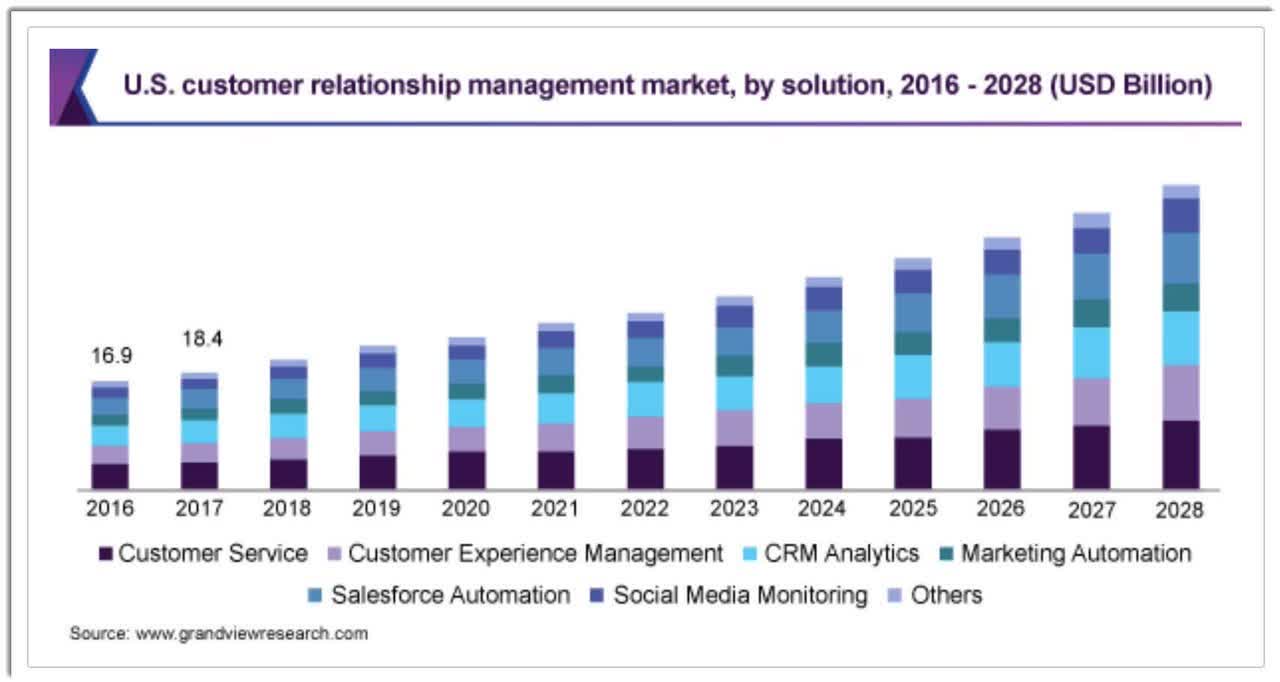

According to a 2021 market research report by Grand View Research, the global market for customer relationship management was an estimated $43.7 billion in 2020 and is expected to reach $98 billion by 2028.

This represents a forecast CAGR of 10.6% from 2021 to 2028.

The main drivers for this expected growth are a growing demand for integrated software suites to automate engagement with customers and prospective clients.

Also, below is a historical and projected future growth trajectory for the CRM industry in the U.S., from 2016 to 2028 by solution type:

U.S. CRM Software Market (Grand View Research)

Major competitive or other industry participants include:

-

Salesforce

-

Zoho

-

Microsoft

-

SAP

-

Oracle

-

Adobe Systems

-

Zendesk

-

ServiceNow

-

BMC

-

Ivanti

-

Atlassian

-

HubSpot

-

Sage

-

Others

Upland Software’s Recent Financial Performance

-

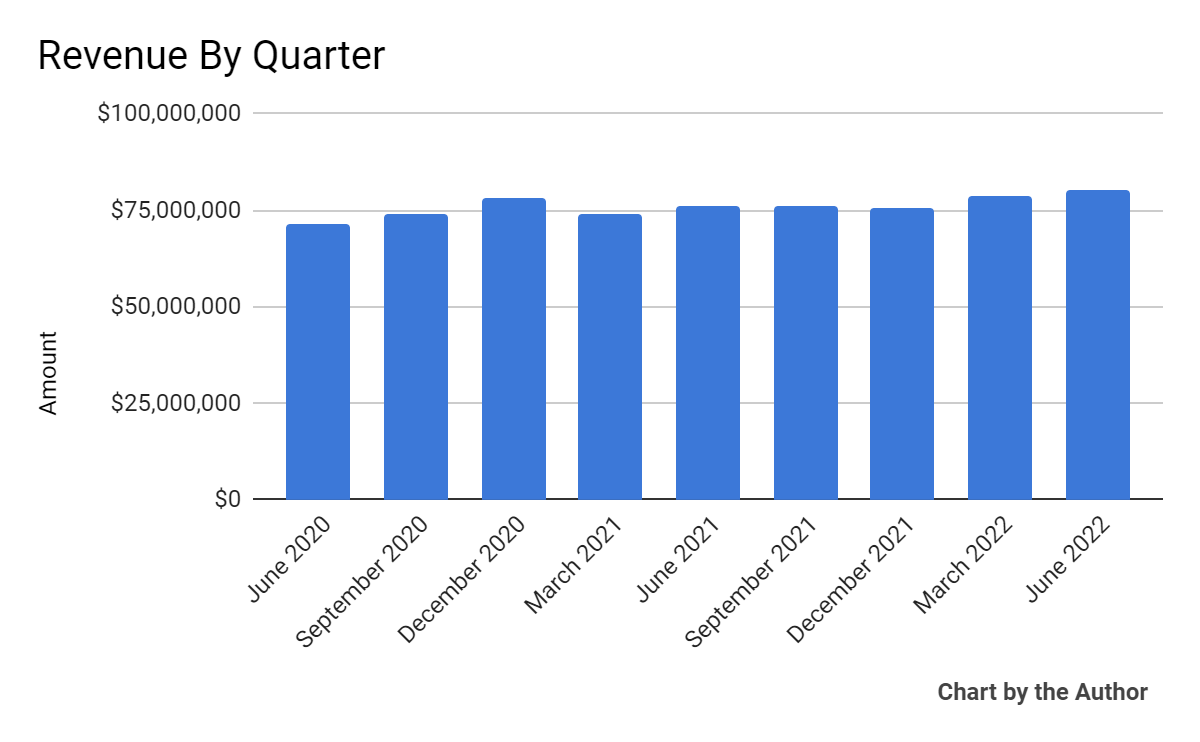

Total revenue by quarter has grown at a relatively low rate over the past several quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

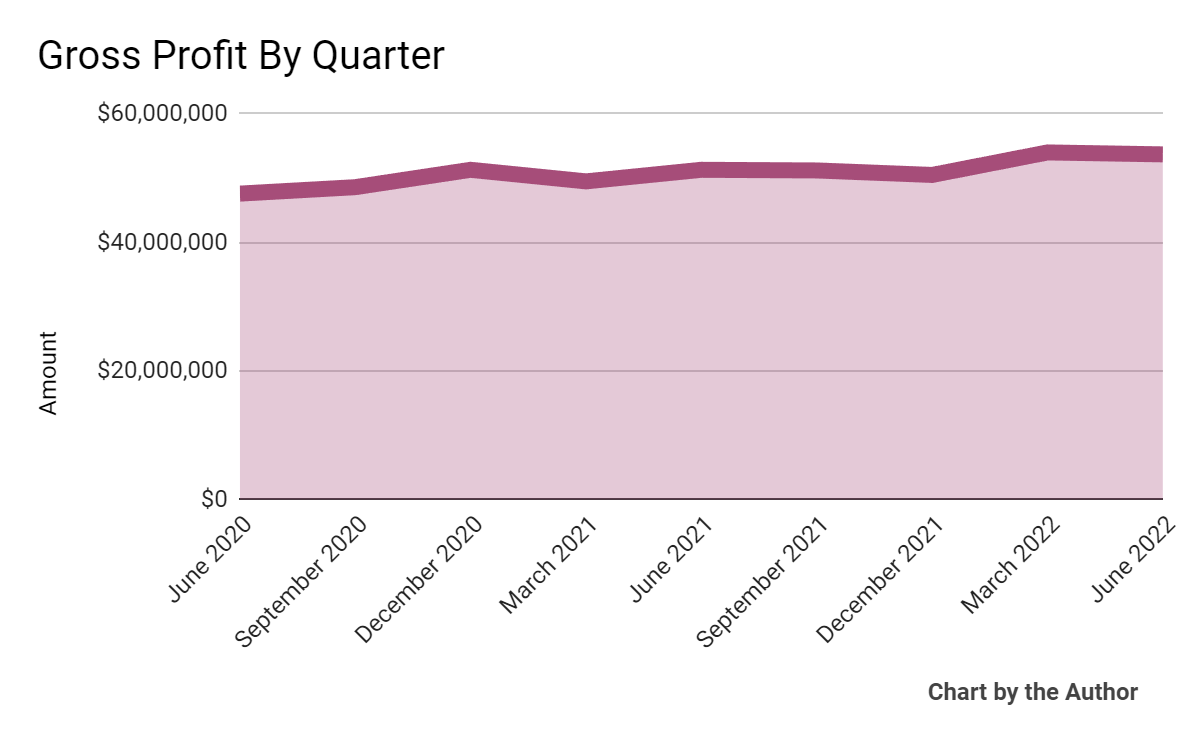

Gross profit by quarter has largely plateaued as well:

9 Quarter Gross Profit (Seeking Alpha)

-

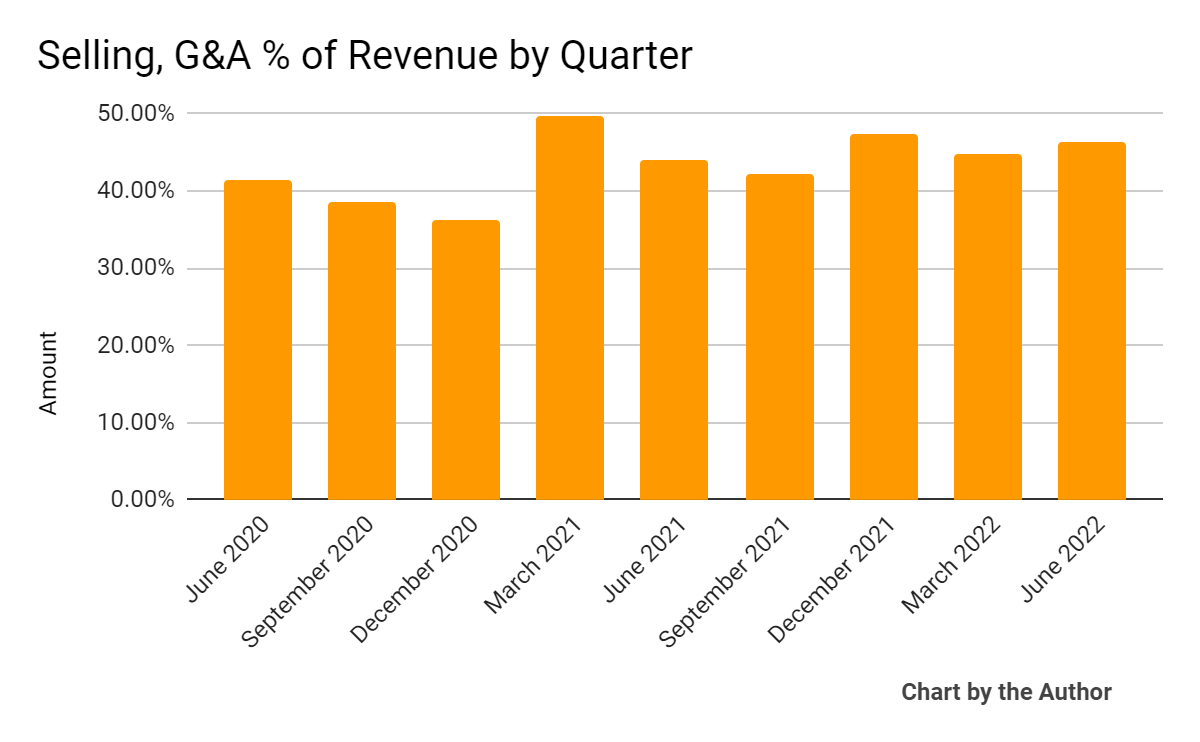

Selling, G&A expenses as a percentage of total revenue by quarter have varied within a relatively narrow range:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

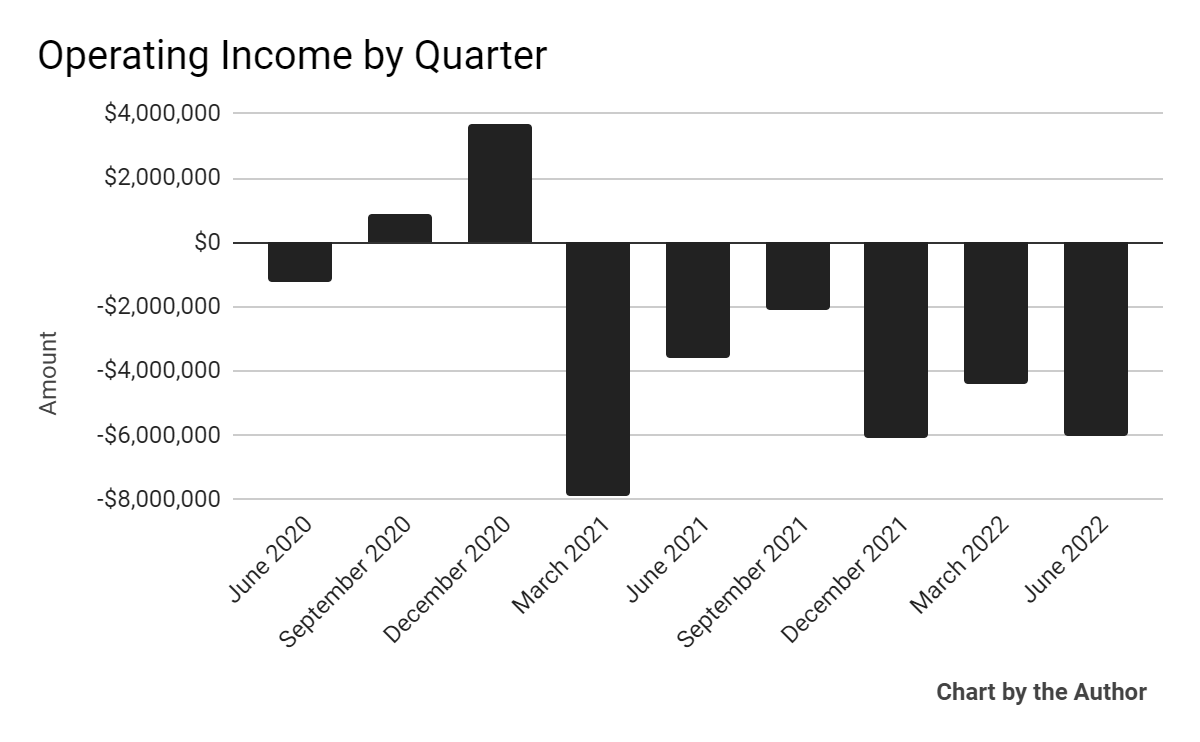

Operating income by quarter has been negative in each of the last six quarters:

9 Quarter Operating Income (Seeking Alpha)

-

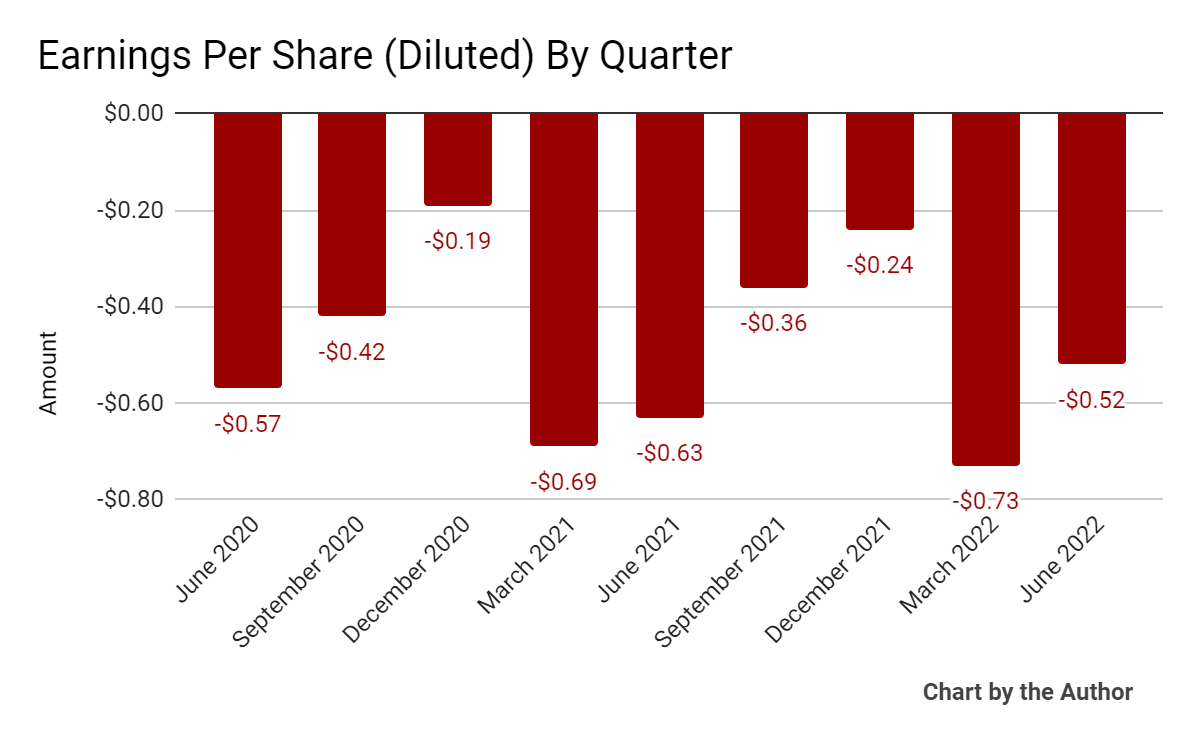

Earnings per share (Diluted) have remained negative, as the chart shows below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

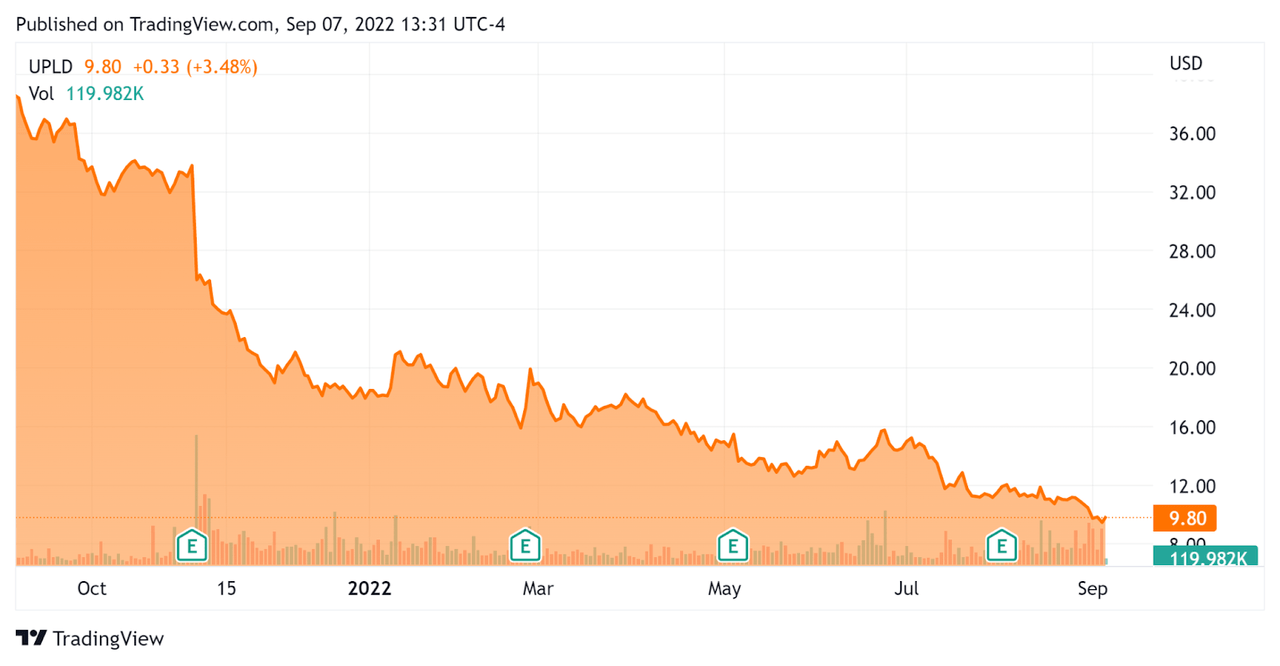

In the past 12 months, UPLD’s stock price has fallen 74.7% vs. the U.S. S&P 500 index’ drop of around 12.6%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Upland

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.25 |

|

Revenue Growth Rate |

2.7% |

|

Net Income Margin |

-18.6% |

|

GAAP EBITDA % |

13.9% |

|

Market Capitalization |

$311,270,000 |

|

Enterprise Value |

$699,920,000 |

|

Operating Cash Flow |

$40,690,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.85 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Freshworks Inc. (FRSH); shown below is a comparison of their primary valuation metrics:

|

Metric |

Freshworks |

Upland Software |

Variance |

|

Enterprise Value / Sales |

6.15 |

2.25 |

-63.4% |

|

Revenue Growth Rate |

42.2% |

2.7% |

-93.7% |

|

Net Income Margin |

-68.7% |

-18.6% |

73.0% |

|

Operating Cash Flow |

-$2,670,000 |

$40,690,000 |

1624.0% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

UPLD’s most recent GAAP Rule of 40 calculation was 16.6% as of Q2 2022, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

2.7% |

|

GAAP EBITDA % |

13.9% |

|

Total |

16.6% |

(Source – Seeking Alpha)

Commentary On Upland Software

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted beating its expected revenue and adjusted EBITDA midpoint guidance.

Also, the firm exceeded its plan on operating and free cash flow despite facing foreign exchange headwinds due to a stronger US dollar.

The company continued to integrate its two Q1 2022 acquisitions and will continue to be ‘active in the market for additional acquisitions.’

Just after the close of the quarter, management announced a $115 million PIPE (Private Investment in Public Equity) investment from private equity firm HGGC.

The purpose of the investment, which has a share conversion price of $17.50, is ostensibly to capitalize UPLD for further acquisitions that management expects to provide attractive valuations as a result of the current macroeconomic slowdown.

Notably, UPLD has been acquiring firms for specific technologies over the past several years but its stock has still suffered substantially in the past 15 months, dropping from a high of $50.00 down to its current level of around $10.00.

As to its financial results for the quarter just ended, total revenue rose 5% year-over-year, while recurring revenue grew 4%.

Management did not disclose the company’s net dollar retention rate, which for a subscription software company is important for investor visibility into product/market fit and the firm’s sales & marketing efficiency.

Operating expenses were in line with expectations, while GAAP operating loss was $6 million and the firm generated $0.52 in earnings loss. UPLD hasn’t produced positive earnings in the past 9 quarters.

For the balance sheet, the firm finished the quarter with $138.3 million in cash and equivalents while producing free cash flow of $13.9 million.

Looking ahead, management said it is “targeting $30 million to $40 million of free cash flow for the full year 2022.”

This positive free cash flow plus its recent HGGC investment, existing cash and undrawn revolving line of credit give the company plenty of resources to pursue its acquisition efforts.

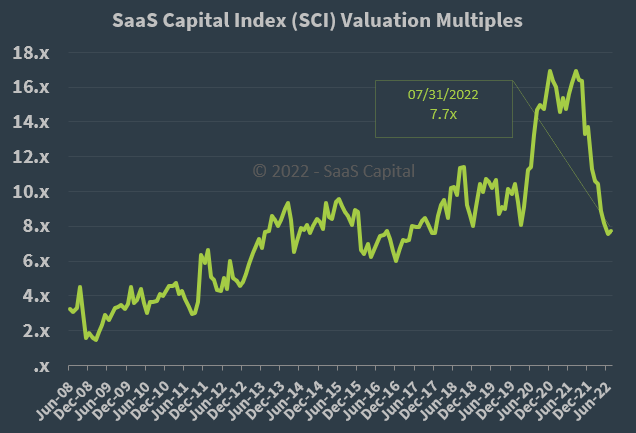

Regarding valuation, the market is valuing UPLD at an EV/Sales multiple of around 2.25x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.7x at July 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, UPLD is currently valued by the market at a significant discount to the broader SaaS Capital Index, at least as of July 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which will slow sales cycles and reduce its revenue growth trajectory.

I see UPLD as one of those companies that is in perpetual acquisition mode, with the latest acquisition being the shiny new thing that management can point to as a reason for its future growth prospects.

But, looking at the firm’s performance over the last few years where it should have seen far better revenue growth, I’m left disappointed.

While UPLD may indeed pick up a few bargains in the M&A bin as the economy slows down, I don’t see them as a meaningful catalyst to the stock.

I’m on Hold for UPLD until management can organically grow revenue while producing GAAP earnings.

Be the first to comment