Luis Alvarez/DigitalVision via Getty Images

Health is the greatest possession. Contentment is the greatest treasure. Confidence is the greatest friend.“― Lao Tzu

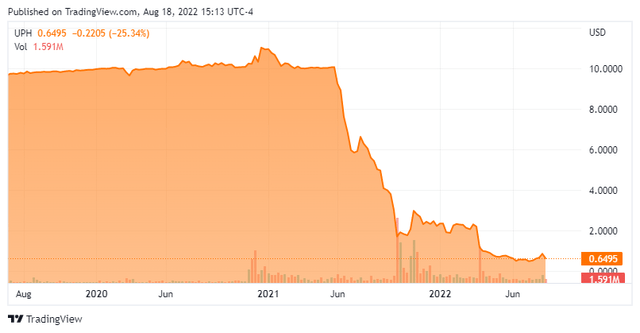

The SPAC craze that ran approximately from the second half of 2020 through the summer of 2021, saw more companies brought public at stretched valuations than any era since the Internet Boom of the late 90s. Almost every stock that was brought public via this method has destroyed substantial shareholder value to date. On the bright side, the implosion of this bubble has put hundreds of names into the Busted IPO category, giving me plenty of companies to analyze.

Today’s “disaster du jour” from SPACland is a concern named UpHealth, Inc. (NYSE:UPH). UpHealth was the result of a business combination between UpHealth Holdings and Cloudbreak Health in telemedicine market via the blank-check firm GigCapital2 in 2021. As can be seen below, the entity has destroyed much shareholder value since coming public. However, the company is producing impressive revenue growth. Brighter times on the horizon? An analysis follows below.

Company Overview:

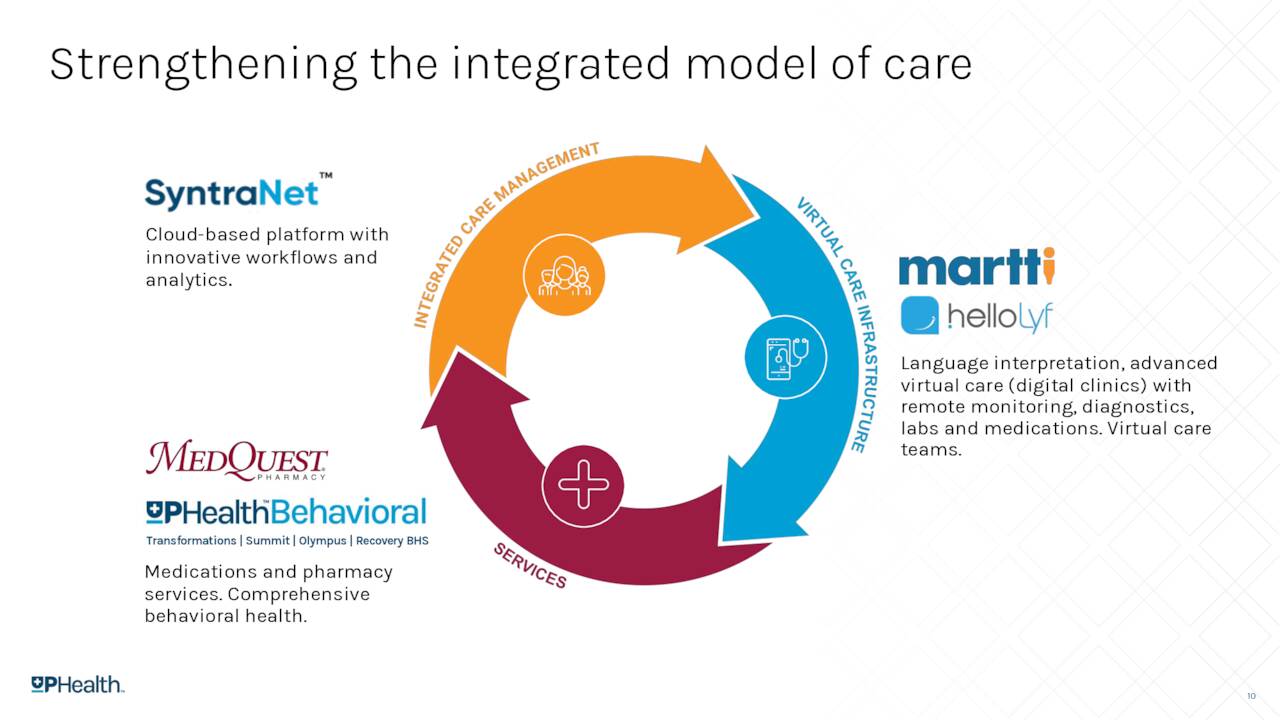

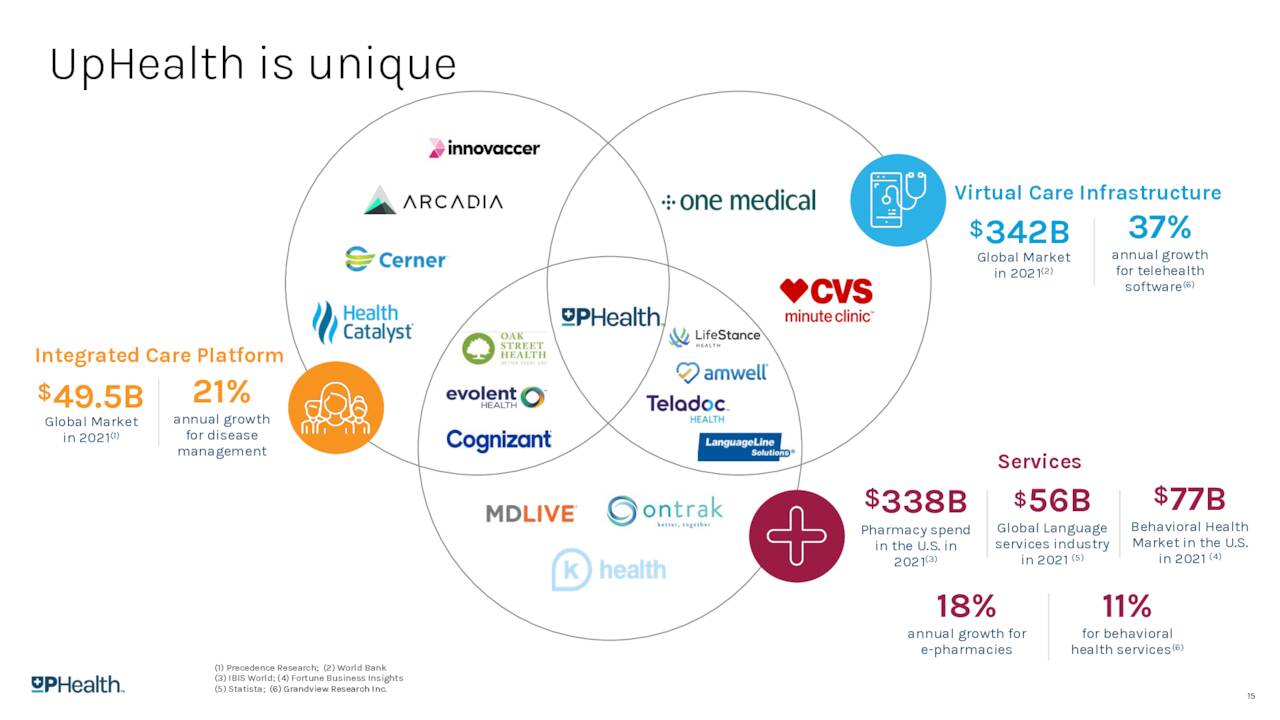

UpHealth is located in beautiful Delray Beach, FL. About three miles from my loft here as the crow flies. The company o provides a patient-centric digital health technologies and tech-enabled services to manage health and integrate care in the areas of integrated care management, virtual care infrastructure, and services. The small cap concern provides the following capabilities/platforms to its customers.

May Company Presentation

Syntranet Core Platform:

An integrated care management platform.

Martti:

Consists of virtual care teams that offer digital clinics, remote monitoring diagnostics, labs and medications.

Cloudbreak:

A provider of unified telemedicine solutions and digital health tools.

HelloLyf from Glocal:

A platform that delivers primary care and specialty consultations.

MedQuest Pharmacy:

A full-service retail and compounding licensed pharmacy that dispenses prescribed medications shipped directly to patients.

May Company Presentation

The company’s platform and capabilities are aimed at modernizing care delivery and health management. The stock currently trades for just over 60 cents a share and sports an approximate market capitalization of $100 million.

Second Quarter Results:

The company posted its second quarter numbers this Monday. The company had a GAAP net loss of 9 cents a share as revenues rose 37% on a year-over-year basis to $37.3 million. Both top and bottom line numbers missed the analyst consensus slightly. On a pro forma basis, sales were up 11% from 2Q2021, which wouldn’t count the merger with Cloudbreak Health. Gross margins rose to 51% from 43% in the first quarter of this year. This is how the company broke out is revenue segments in its earnings press release.

- Integrated Care Management generated $10.4 million of revenue (13% of total revenue) with a gross margin of 82%.

- Virtual Care Infrastructure generated $32.4 million of revenue (41% of total revenue) with a gross margin of 48%.

- Services generated $36.8 million of revenue (46% of total revenue) with a gross margin of 37%.

Telehealth use rose to a record 10.6 million minutes of consultations in Q2, compared to 9.4 million minutes in the previous quarter. During the quarter, UpHealth closed 46 new Martti™ contracts, with over 90 implementations in healthcare facilities within the United States.

Analyst Commentary & Balance Sheet:

So far in 2022, Northland Securities ($4.50 price target) and Benchmark ($4.00 price target, down from $5 previously) have reissued Buy ratings on the stock while Lake Street ($1.00 price target) has a hold rating on UpHealth. The last analyst rating came out on May 13th.

Just over two percent of the outstanding shares are currently held short. There has been no insider activity in the shares so far in 2022. After posting net losses of $28 million in the first two quarters of 2022 (a 27% improvement over the same period in 2021), the company had $44.1 million in cash and marketable securities on its balance sheet.

Subsequent to its earnings release, the company announced the sale of $67.5 million in aggregate principal amount of a new series of variable rate convertible senior secured notes due December 15, 2025. $45 million of the proceeds went to paying off 6.25% convertible senior notes due 2026. The company paid a steep price for this refinancing. These new senior secured obligations will accrue interest at a rate equal to the daily secured overnight financing rate (“SOFR”) plus 9.0% per annum, with a minimum rate of 10.5% per annum, payable quarterly in arrears. In addition, they can be converted into equity at $1.75 per share.

Verdict:

The current analyst consensus has the company losing some 30 cents a share in FY2022 as revenues rise some 55% to just north of $190 million. Sales growth is projected to show to approximately 30% in FY2023 as losses narrow to 13 cents a share.

May Company Presentation

The company is targeting some huge and growing markets. The company has missed earnings expectations two of the past three quarters and just named a new CEO this May. That said, UpHealth does seem to marching towards profitability with adjusted GAAP adjusted EBITDA of $2.6 million in the first six months of the year.

To be truthful I am “on the fence” on whether to take a small “watch item” position in this name given its revenue growth and price to sales valuation. The recent financing terms seem a bit onerous and will increase annual interest costs significantly. There also has been no insider buying in 2022 despite the fall in the shares. Therefore, I am passing on any investment recommendation on UpHealth, until we get a quarter or two where the company meets or surpasses expectations.

Objection, evasion, joyous distrust, and love of irony are signs of health; everything absolute belongs to pathology.”― Friedrich Nietzsche

Be the first to comment