Morsa Images

Dear readers/Followers,

I haven’t been subtle about my stance on Unum (NYSE:UNM) for the past 2 years. During some months, I was the sole contributor covering the business and maintaining a “BUY” stance due to what I viewed as over-considered LTC block considerations – a common yet somewhat opaque risk to most, and apparently, this also included the market.

The company has made an amazing sort of recovery from the $1x share price levels we saw not that long ago and now trades at above $40/share before even I thought it possible.

Unum – Updating on the company

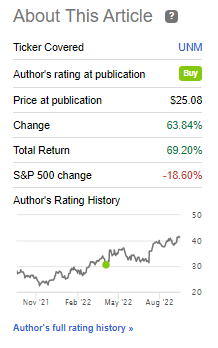

Take a look at what this company has done since one of my more positive pieces was published back in August. And I assure you, this is not where I purchased the lion’s share of my investment.

Unum Article (Seeking Alpha)

Unum is a very good example of what COVID-19 did with quality companies due to one risk consideration or another. Risk considerations are all well and good, but the market has a tendency towards overreaction both in the positive and negative direction. I used strong language to describe what was happening at the time.

So what, on God’s green earth, is happening to the share price?

As I see it, there are a few factors at play here. First of all, the company, while communicating improvements, is still declining in terms of earnings for the year. Any real improvement would of course see comparable earnings growth, and it seems the company as of yet struggles with this.

Furthermore, at the same time that the company communicates good results due to less COVID-19 mortality and impact, the world closed down a bit more, with hotel trips and conferences being canceled – a contrary signal. This surely played some role as well – and some of this risk was also mentioned in the earnings call.

(Source: Seeking Alpha Article, Unum)

The Unum investment for me has now, finally, reached its absolute end. What I mean by this is that the company has fulfilled the expectations I had for it based on its metrics, and I’ve rotated all but a few shares into other investments.

This decision is not based on doubts about Unum as a quality business. Quite the opposite. Unum is a great business. It’s a leader in benefits and a myriad of other segments.

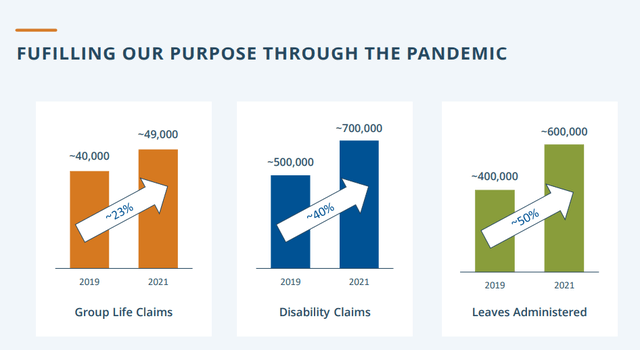

The company is a well-diversified insurance player with a diversification that leaves nothing to be desired. It has proven strong capital generation directly in opposition to the development of the share price and has shown its resiliency through the entire pandemic. Many investors expected Unum to falter and even fail, but despite administering near-record leaves, disability claims and group life claims…

The company has come out even stronger on the other side. I tip my hat to management for combining strong execution, pivoting on digital, leveraging its already-present capabilities to deliver growth and even further expected growth going forward, and for skillfully managing the LTC block risk.

If you’re new to Unum, you might wonder just what this odd “LTC Block risk” I’m talking about is, exactly.

Let me recap for a moment.

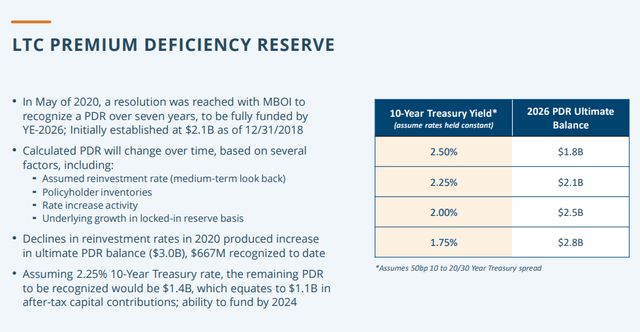

The company had a gloomy cloud in the form of the legacy LTC (Long-term care block), which was constantly weighing down and providing discounts to the share price. A “block” is essentially a group of policies where the insurance company has obligations, in exchange for payments. The company stopped issuing these LTC policies as early as 2012, but it nonetheless is obliged to continue managing the block of already-issued policies, unless they can successfully transfer them (i.e., sell the risk).

Take note of this, because this is a lot of how insurance works!

This block generated $600M in earnings per year, and cover around 1M lives, and the challenge Unum faced was how much money to put into this fund. Unum already put money in to handle future potential liabilities here but decided already in 2014, that these were inadequate, and back in 2016, the ratio of interest-adjusted loss exceeded 90% for two quarters in a row – which called Unum’s original statement into question, where they said they would revisit the assumptions if losses exceeded this for a prolonged period of time.

It dropped back down for 3 quarters – only to rise sharply in 2017, and again in 2018, at which point Unum decided to revisit the LTC reserve, and ultimately decided to raise it by $750M (more than a year’s worth of policy income). That’s also when the share price fell by 17%. This story has been part of how Unum has been trading for some time.

Many players expressed confidence in Unum’s ability to handle this pressure, including Credit Suisse (CS) back in 2020, but the fact was this block is still faced with a reserve shortfall during the past few years.

The risk here was unexpected LTC developments and even lower interest rates could place pressure on Unum. This is far less the case today, and it also comes with the fact that the company has plenty of cash on hand to handle eventual shortfalls here.

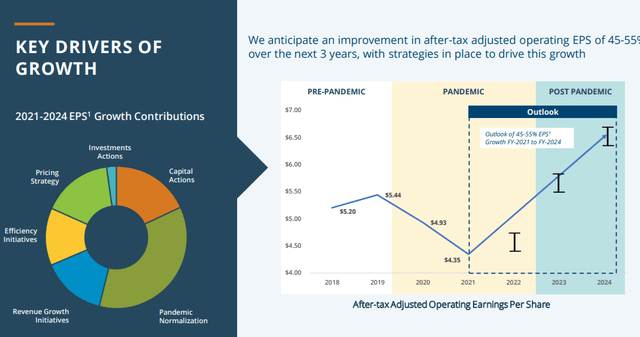

But we’re mostly past this. Instead, we’re talking about Unum’s growth drivers as they pertain to the 2024E target.

I don’t really have an issue with these growth targets either. I think, given the company’s pandemic exposure and normalization impact, that these are fairly realistically considered. However, I believe this normalization will be, as EPS has implied, rather front-loaded, and that the company’s valuation already reflects this from a normalized discounted perspective.

In layman’s terms, the company is already mostly priced for this recovery

Unum does not work or operate in a vacuum. It operates in a market full of quality insurance companies, each doing their best to do exactly what Unum seeks to do. Drive premium growth, gain market share, drive efficiencies, all those lovely things that give us investors that lovely dividend combined with safety that we so look forward to.

My decisions regarding Unum are made on the cold, calculating basis that other companies are in a better position, with better price, and better yield to drive those returns and that yield than Unum is.

Would you believe me when I said that Unum, at one point when I bought, offered a yield of no less than 9%?

Check the dividend and the last 2-3 years.

If you’re looking at Unum today, or arguing for why someone should “BUY” Unum here, it’s my firm view as a value investor, that you’re so “late to the party” that people have left, cleaners have already been there, and people have been posting on social media about the great party we had for about 4 weeks while you’re in your party clothes wondering where everybody is.

It’s just not there anymore.

Oh, I won’t argue that there’s an upside to Unum – let me show you.

Unum’s valuation

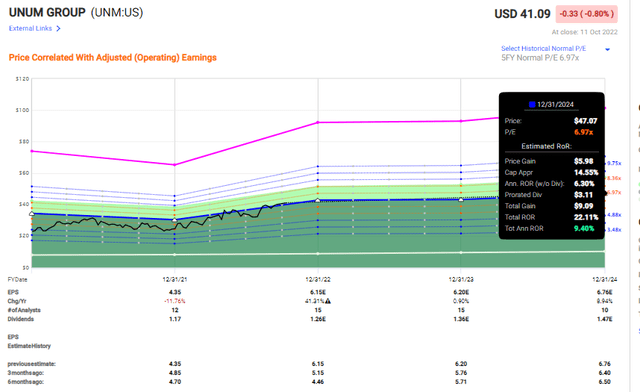

Some contributors argue that there’s an upside to Unum. I would agree with that assessment 100%. Based on the company’s EPS growth rates, its historical valuation ranges, and its fundamentals, there’s an upside to Unum.

But that upside, it’s not exactly great. Not even double digits from a company that used to offer triple-digit upside to investors. You can view a company from many different perspectives or vantages. This one is up 45% in one year, while the market is down around 20%. A lot of future upsides is already baked into the current valuation.

Estimates are very clear on the analyst side as well. Unum trades at PTs in a range from $34 on the low side to $50/share on the high side. Out of 13 analysts, only one is currently at a “BUY” stance, with 12 either at “HOLD” or “Underperform”. The company has been overvalued or at less than 5% upside for over 7 months at this point, as seen in valuation targets.

From such a perspective, there really isn’t that much to like about Unum here. It’s a fully valued (as I see it), 3.3%-yielding insurance business in a world where insurance businesses are often at significant discounts while sporting a yield often more than twice the size of Unum, without even slightly compromising on investment safety. In fact, investment safety in these is not seldom higher than in Unum, seen in fundamentals.

Based on this relatively simple thesis, I consider Unum to be a “HOLD” with a relatively unappealing current share price/valuation – and I would consider the company not buyable here.

Thesis

My view on Unum is currently as follows:

- Unum is a theoretically appealing insurance company, but it no longer has a significant upside in terms of valuation.

- However, this upside is now more based on earnings growth than on reversal – and ideally, I want both when I invest.

- Unum is now a “HOLD” with a PT of $35/share, and I would still consider other investments significantly above Unum at this valuation and upside.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment