THEPALMER/E+ via Getty Images

Company Overview

Founded in 1932, ULH was previously known as Universal Truckload Services, Inc. before a name change in April 2016. Now known as Universal Logistics Holdings, Inc. (NASDAQ:ULH), the company is headquartered in Warren, Michigan, and employs over 9000 people in the Road & Rail industry. After many decades of success, ULH decided to IPO in February of 2005, and today ULH has a market cap of $937 million and revenue of over $2 billion over the last 12 months.

As a logistics and transport company in the United States, Mexico, Canada, and Colombia, ULH provides a variety of transport and logistics services. The company specializes in truckload, including dry van, flatbed, heavy hauls, and refrigerated operations; freight forwarding, customs brokerage, and final mile service. ULH transports all kinds of stuff, including automotive parts, machinery, building materials, paper, food, consumer goods, furniture, steel, and other metals. Among its clients are automotive, steel, oil and gas, alternative energy, manufacturing companies, and transportation companies who aggregate loads from different shippers.

ULH also offers value-added services like material handling, consolidation, sequencing, subassembly, cross-dock, kitting, repacking, warehousing, and returnable containers; and intermodal support services that cover short-to-medium distances between the port or railhead and the customer, as well as drayage.

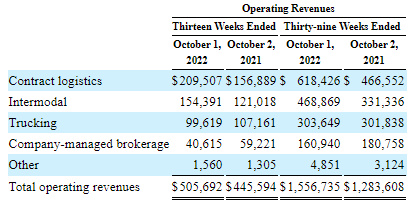

ULH breaks down its business into four operating segments: contract logistics, intermodal, trucking, and company-managed brokerage. The contract logistics segment provides inbound transportation services to major retailers and original equipment manufacturers (OEMs) on a contractual basis, usually one year or longer. The Intermodal segment uses a mix of owner-operators, company equipment, and third-party capacity providers to transport goods over a short distance. The Trucking segment includes individual freight shipments arranged by ULH agents who utilize owner-operators, company equipment, and broker carriers. The final segment is the Company-Managed Brokerage segment which provides pick-up and delivery of individual freight shipments organized by ULH-managed operations using broker carriers. The tables below show each segment’s performance from the most recent quarter.

ULH data from 10Q (10/27/2022) ULH data from 10Q (10/27/2022)

Growth Opportunities

ULH’s management has identified several opportunities for growth that they will be focusing on. The first element of the company’s growth strategy is to make strategic acquisitions. The transportation and logistics industry is fragmented and comprises hundreds of small and medium-sized players. As a result, there are two types of competitors in ULH’s industry: competitors specializing in a specific service/industry or regional competitors with a limited geographic coverage serving multiple industries. ULH will pursue strategic acquisitions of both types of competitors to expand its geographic network and diversify its customer base.

Another favorable growth trend for ULH is manufacturers outsourcing logistic functions to focus on their core business. In addition, as global supply chains have increasingly become more complex, companies across many industries are looking to outsource much of their logistic functions to cost-effective third-party partners with experience navigating these complex supply chains. ULH offers a host of transportation and logistics services to potential and existing clients to let them focus on what they do best, while ULH focuses on managing their logistics.

A final area of growth to focus on is ULH’s further penetration into its customers in the North American auto industry. Of the industries that use outsourced logistic services the most, the automotive industry is one of the largest. The automotive industry is critical to ULH’s success making up 31% of 2021 revenues. Some of the company’s key customers in this industry include General Motors, Stellantis, and Ford. ULH intends to build on these relationships by taking over more outsourced logistics services, including sub-assembly and sequencing. There is a high value in these particular services because they link directly to production lines and require specialized technology and strict quality control. If ULH can capitalize on these specialized services, it will grow the business and become more challenging to replace ULH’s services.

Risks

Before investing in ULH, it’s essential to consider some of the risks associated with the company. One particular risk that stands out is that ULH has a concentrated customer base, with 38% of its revenues made up of its ten largest clients. If ULH were to lose one of these clients, either of poor performance or something happening to the client’s business outside ULH’s control, then ULH would lose a meaningful percentage of its revenue. In addition, the industry in which ULH competes is fragmented and full of potential substitutes for the company’s services. Many of ULH’s customers regularly bid out their logistic needs and accept bids from multiple logistic providers, occasionally resulting in ULH losing business or cutting its pricing.

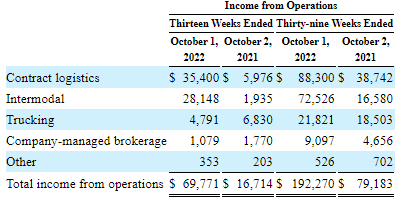

Additional risks include price fluctuations for diesel fuel. One of the most critical operating expenses for ULH is diesel fuel. The company doesn’t hedge against the risk of diesel fuel prices increasing except occasionally charging its clients a diesel fuel surcharge when prices rise. However, ULH cannot guarantee that it will always be able to assess its clients for a diesel fuel surcharge. As the cost of diesel increases, so will ULH’s operating expenses, and if ULH cannot pass this added expense on to its customers via surcharge, then ULH’s profitability will be hit hard. Unfortunately for ULH, diesel prices have steadily increased throughout 2022, peaking in June at $5.75 per gallon.

Data by Statista

A final risk that stands out right now is the difficulty attracting drivers. Driverless trucks may be the way of the future, but for now, trucks don’t move without qualified drivers. Competition for truck drivers has been fierce recently, with the American Trucking Association estimating that the industry is short roughly 78,000 drivers. If ULH cannot find enough drivers for their trucks, they risk increasing compensation packages, increasing recruiting efforts, or leaving the trucks to sit idle. All these options negatively affect profitability. Another hidden risk of not having enough drivers is the pressure to lower the qualification standards for drivers, increasing the risk of an accident. Settlements for truck driver accidents are sky-high, with some settlements upwards of $1 billion. There are plenty of headwinds for ULH, and the stock price will suffer if it cannot navigate these risks.

Valuation

To find ULH’s intrinsic value, we will run a comparative and discounted cash flow (“DCF”) analysis. We’ll begin with the comparative analysis and use the last five years’ worth of P/E ratios to develop a bull, bear, and median case scenario. As a bonus, we’ll also look at the sector median P/E, which is 16.21. Finally, we’ll multiply these ratios by the average analyst estimate of 2023 earnings, which is $5.50.

| Scenario | P/E | 2023 Earnings Estimate | Intrinsic Value Estimate | % Change from Current price |

| Bear Case | 6.36 – Current P/E | $5.50 | $34.98 | -1.77% |

| Median | 7.60 – 5-year median P/E | $5.50 | $41.8 | 17.38% |

| Bull Case | 14.15 – 2019 P/E | $5.50 | $77.82 | 118.53% |

| Sector Median Valuation | 16.21 | $5.50 | $89.15 | 150.35% |

On a comparative analysis, ULH has a more significant upside than downside. Investors would realize an excellent 150.35% return if next year’s earnings estimate materializes, and the market was to apply the sector median multiple to said earnings. However, if next year’s earnings materialize and the market continues to trade ULH’s stock at its current multiple, investors would stand to lose 1.77% on their investments. This indicates that ULH has a minimal downside from here; however, sometimes a comparative analysis can be misleading, which is why it’s essential to use multiple different valuation techniques when estimating the intrinsic value of a stock.

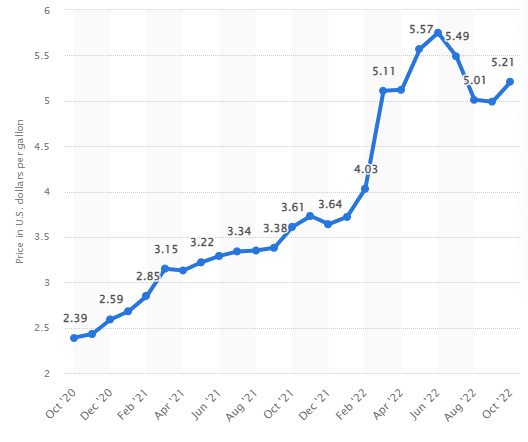

Turning to the discounted cash flow analysis, we will begin by taking the average of the last five years of free cash flows, which is $48.2 million. Then we will apply a modest 7% growth rate for the next ten years, followed by a 2.5% growth rate into perpetuity to figure out the terminal value. We will then use a discount rate of 10%. With these inputs, the DCF analysis gives us an intrinsic value of $35.19, representing a downside of just -1.19% from ULH’s current share price. Therefore, ULH doesn’t appear to have any margin of safety according to the DCF

Summary

There’s plenty to like about ULH. It operates in a fragmented industry with many small competitors, which makes the sector ripe for consolidation. If ULH can capitalize on this and make intelligent strategic acquisitions, then it can grow its geographic footprint and diversify the industries that it serves. ULH could even be an acquisition target themselves. ULH also benefits from an industry trend where its existing and potential customers are looking to outsource their increasingly complex trucking and logistic functions to third-party logistic partners like ULH. The company has put together an impressive track record. It doubled its revenues over the past decade while maintaining an average ROE of 29.23% without a year under 15%. Companies that perform at such a high level often outperform the market.

Still, ULH does not come without its risks. Diesel prices have steadily climbed over the past couple of years while competition for truck drivers remains tense. While ULH looks to grow its relationship with some of its top automotive clients, the reality is they operate in a competitive industry, and losing just one of its top clients will significantly hurt its profitability. Additionally, from a valuation perspective, the estimates remain mixed. Investors could realize a nice gain if the bull cases from the comparative analysis were to come to fruition; however, the DCF analysis results do not indicate a proper margin of safety for ULH. This is a well-run business, but because it operates in such a competitive industry and without a margin of safety, I will rate ULH as a sell. Please let me know your thoughts in the comments section below.

Thank you for reading!

Be the first to comment