imaginima

Unity (NYSE:U) has been an active acquirer over the past 18 months, adding to the capabilities of their game engine and providing developers with access to collaboration tools. These have generally been small acquisitions, with less than 0.5% of Unity’s revenue coming from acquisitions completed over the last 12 months, as of Q3 2021. In comparison, ironSource (IS) appears to be a defensive acquisition that is focused on monetization and will add significantly to Unity’s revenue. The negative market reaction may be in response to the acquisition or could be due to Unity lowering guidance. Layoffs combined with previously announced monetization issues potentially indicate ongoing problems.

Weta Digital

Unity acquired Weta Digital’s tools, pipeline, technology, and engineering talent to expand the capabilities of their platform and increase traction amongst artists. This acquisition aims to democratize access to sophisticated visual effects tools, enabling more real-time 3D applications.

Weta’s tools can be used to perform advanced facial capture and manipulation, anatomical modeling, advanced simulation and deformation of objects and hair and fur modeling. These tools can be used across film, gaming, automotive, architecture and ecommerce and have been used in films like Avatar, Lord of the Rings, and Wonder Woman. Weta also has a library of thousands of digital assets that will continue to grow over time. Assets include fully formed characters, skins, trees, houses and vehicles. These assets will be offered as a content library where creators can import objects into Unity’s editor. Weta has 275 engineers that are responsible for architecting, building, and maintaining Weta’s tools and core pipeline. Over 500 person-years of engineering time have been invested in developing these tools, potentially making the capabilities difficult to replicate.

Bringing artists onto the Unity platform is fundamental to the company’s vision, as artists typically make up 70-80% of gaming teams and 60-70% of film teams. Unity believes that the Weta acquisition is an important step towards a 100x increase in users, as they are targeting the millions of potential creators in the prosumer market rather than just the thousands of professional artists. The largest opportunities for Weta are within games, film, animation and advertising.

Unity acquired Weta Digital for 1.625 billion USD in a combination of cash and stock and estimates that the acquisition expanded their TAM by over 10 billion USD. The Weta acquisition closed at the end of 2021 and Unity has stated that the integration is progressing as planned. This is a process though and productizing Weta’s tools will take an estimated two years. Weta Digital’s VFX teams will continue to exist as a standalone entity known as WetaFX, and are expected to become Unity’s largest customer in the Media and Entertainment space.

Ziva Dynamics

Ziva provides software for the creation of lifelike characters that fundamentally changes the character creation process while providing greater control, speed, and capabilities to artists of all levels. Emerging artists, award-winning studios, and global brands are all leveraging Ziva’s technology to make characters for movies, TV, retail experiences, and interactive environments. Unity plan to make realistic character creation, accessible and scalable for all artists, regardless of skill level.

Interactive Data Visualization

Interactive Data Visualization provides the SpeedTree Environment Creation Suite. SpeedTree is a leading vegetation modeling and environment creation product, which enables creators to rapidly develop realistic environments, often a critical pain point. SpeedTree software is currently the leading foliage solution for the games industry and is also used in architecture, games, visual effects, and real-time simulations.

Interactive Data Visualization is a long-time partner of Unity and the acquisition will enable deeper integration of SpeedTree into the Unity ecosystem, enhancing artist’s authoring workflows and environment creation capabilities. SpeedTree’s tools and expansive library of ready-to-use content will remain engine agnostic though. Along with the Weta and Ziva acquisitions, SpeedTree enhances Unity’s capabilities for artists.

Metaverse Technologies

Metaverse Technologies are the providers of Pixyz, a 3D data preparation, and optimization software. Unity’s acquisition will allow creators to more easily and quickly import 3D data and optimize models for real-time development.

OTO

OTO provides an AI-driven acoustic intelligence platform that can be leveraged to build and foster safer gaming environments. OTO’s acoustic intonation engine operates 100x faster than speech recognition, is language independent, and is able to detect a wider and more accurate range of disruptive behavior. This enables developers to swiftly identify and act upon possible toxic behavior. OTO will be integrated into Unity’s industry-leading Vivox platform.

Toxic behavior can lead to poor player experiences and lost revenue for game creators. Nearly half of the players say that they at least sometimes experience toxic behavior while playing multiplayer video games and 67% of players were likely to stop playing a multiplayer video game if another player were exhibiting toxic behavior.

Parsec

Parsec is a remote desktop and streaming company that enables distributed work and collaboration, and has become a go-to solution for hybrid work models among gaming companies. Game development is rich in detail and interactive and hence creators need low latency, ultra-high-definition desktop streaming, which Parsec’s platform supports. Parsec also focuses on simplicity and access, enabling use to spread virally within and between organizations.

Parsec was heavily used within Unity prior to the acquisition, which contributed to the acquisition decision. Parsec also has strong relationships with gaming companies like EA, Ubisoft, Square Enix, and many of the industry verticals where Unity sells solutions, including media and entertainment, architecture and design. This provides potentially significant opportunities for cross-selling.

Parsec’s subscription business was growing over 170% year-over-year at the time of acquisition, with subscription growth driven by a net dollar expansion rate of nearly 200%. While these figures are impressive, it is likely that growth was accelerated by the pandemic.

SyncSketch

SyncSketch enables secure, cloud-based collaboration, rapid review and feedback between remote creators. It is like video conferencing software but designed specifically for remote collaboration on 3D content. This is another solution targeted at the hybrid work models brought about by the pandemic, although it is unclear whether there are synergies between Parsec and SyncSketch.

ironSource

Unity announced a merger agreement with ironSource on 13th July 2022. ironSource provides a platform that enables mobile content creators to turn their apps into scalable businesses. Customers use the platform for a number of business-critical functions, including user growth, monetization, analytics, creative management and publishing. The merger will create an end-to-end platform to build, run, manage, grow and monetize 3D applications.

Sonic

The Sonic solution suite supports developers by providing solutions for app discovery, user growth, content monetization, analytics and publishing. Connecting user growth and monetization through analytics creates a virtuous cycle, one of Unity’s primary reasons for merging with ironSource.

Aura

The Aura solution suite allows telecom operators to create new engagement touchpoints that deliver relevant content for their users across the entire lifecycle of the device. These touchpoints are also a unique distribution channel for developers to promote their apps as a native part of the device experience.

The stated strategic intent behind the deal is that by tightly integrating the creation and growth of games, creators will be able to leverage data on audience feedback to improve content from the beginning of the creation process. ironSource also has best-in-class mediation and publishing platforms and the merger may be in part due to Unity having trouble with mediation. ironSource’s mediation platform will leverage the combined strength of the two companies’ ad networks to deliver increased user reach and data scale, and provide an increased return on spend to advertisers.

Unity expects the combined company to deliver a 1 billion USD adjusted EBITDA run rate by the end of 2024, with 300 million USD in annual EBITDA synergies. ironSource estimated that their total addressable market was 17 billion USD in 2020, with the potential to grow to 41 billion USD by 2025. There is likely substantial overlap between Unity and ironSource’s TAMs though and so it is unclear what the TAM of the combined company will be.

The all-stock transaction values ironSource at approximately 4.4 billion USD, with Unity shareholders owning 73.5% of the combined company. In addition to the merger, Unity’s board has authorized a share buyback program of up to 2.5 billion USD to reduce dilution caused by the transaction. This is a somewhat unusual move as the net effect is similar to a cash acquisition. Unity’s management may feel they can opportunistically repurchase shares at a depressed price in the coming months or ironSource could have wanted to maintain upside exposure to a rebound in Unity’s stock. Silver Lake and Sequoia have committed to investing a total of 1 billion USD in Unity in the form of convertible notes. The convertible notes are due in 2027 and bear an interest rate of 2% per annum. The conversion price is 48.89 USD per share.

Digital Advertising

There have been doubts about Unity’s Operate business over the past 12 months due to Apple’s privacy initiatives. While Unity has been confident about their ability to manage these changes and had been performing quite well until the most recent quarter, their recent stumble has likely increased concerns.

Unity pinned poor performance in the last quarter on challenges in monetization due primarily to internal issues, which they believe are temporary and will be resolved by the end of the year. The estimated impact of these issues is approximately 110 million USD in 2022 with no carryover impact to 2023.

One of the problems was a fault in Unity’s platform that reduced the accuracy of their Audience Pinpointer tool. Pinpointer is a user acquisition product that allows game developers to acquire players based on a target return on spend. This is an expensive issue as the Pinpointer tool has experienced significant growth post IDFA changes.

Unity also lost the value of a portion of their data after ingesting bad data from a large customer. Unity’s data only retains value over a relatively short period and hence the issue will naturally correct over time, although Unity is assisting this process. Unity must rebuild data and train models before performance improves and revenue begins to recover as customers scale-up spending again. These problems have also meant that the introduction of other revenue-driving features like mediation, header bidding and new releases for Audience Pinpointer will be delayed.

Despite these issues, Unity Monetization should be relatively well positioned for a privacy-focused future. The majority of games are built with the Unity engine and analytics, providing Unity with proprietary data. Unity has deep insights into gameplay, what players like to play, when and how they play games, and in gaming, this data is the most relevant for advertising.

Layoffs

Unity recently laid off approximately 300 employees (4% of their workforce), stating that this was done to match resourcing levels against company priorities. The layoffs were reportedly concentrated in Unity’s AI and engineering divisions. There have also been suggestions that Unity has frozen hiring, although this is something they deny and is not apparent in hiring data. The layoffs could be the result of acquisitions causing a duplication of headcount in some areas. They may also indicate that Unity’s growth is not living up to management’s expectations.

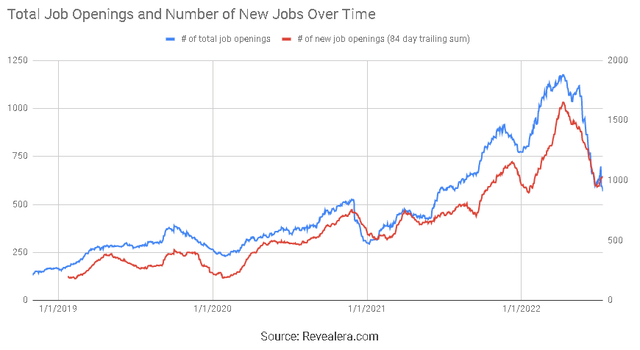

Figure 1: Unity Hiring Data (source: Revealera.com)

Conclusion

Most of Unity’s acquisitions have been relatively small and aimed at adding specific capabilities to the platform. The ironSource acquisition is large and focused on improving Unity’s monetization. The market reacted poorly to the announcement, but it is not clear whether this is because the deal is viewed as defensive or because Unity lowered their full year guidance. The deal isn’t particularly expensive from a valuation perspective but it possibly indicates that both Unity and ironSource are currently operating in a difficult environment. For long-term investors, the immediate performance of mobile gaming should be viewed as less important than the proliferation of game engines across use cases and Unity’s ability to develop a leading engine.

Be the first to comment