Zerbor

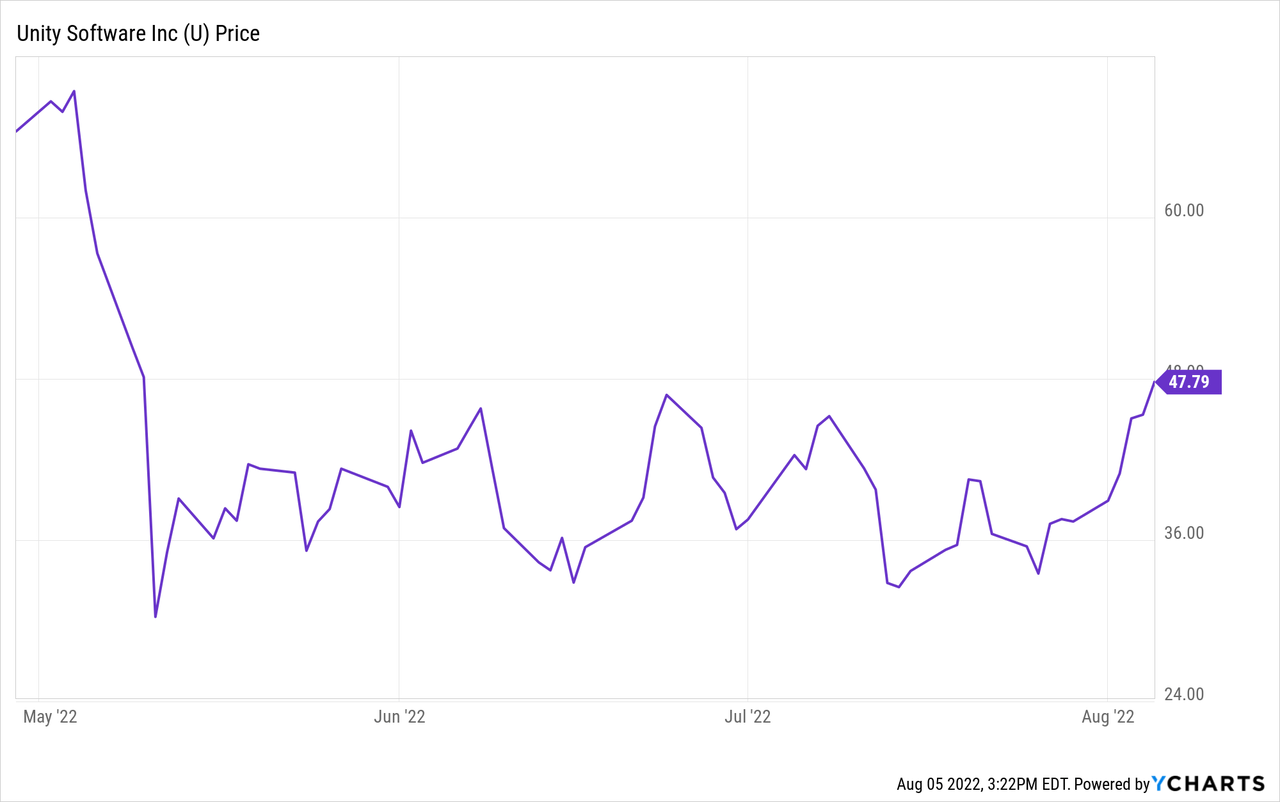

Unity Software (NYSE:U) is continuing its trend of being a bumpy ride for long-term investors. Having fallen drastically since becoming a publicly traded company, the pain has continued all the way up to last quarter’s Q1 2022 earnings report. At the time, I wrote that a good buying opportunity had finally emerged at around $30 per share. Since then, Unity’s stock price has been ping ponging up and down in large swings, bounded by the prices of ~$30 and ~$50, despite nearly all news about the company, perhaps besides their recent merger announcement, being negative.

In this article, I explain why I believe Unity Software is setup for a strong negative reaction to their Q2 2022 earnings report. I highlight a series of company and industry news that paints a very scary picture for Unity Software’s stock going into Q2 2022 earnings. Finally, I end with my long-term views on the company’s outlook, including a slightly revised entry price for the cautious investor.

The Flashing Warning Signs

1. Layoffs

After the massive post Q1 2022 earnings correction, a first piece of tangible company news came about a month later: Unity was undergoing layoffs.

Unity Software has laid off about 4% of its workforce, becoming the latest company to announce job cuts amid growing concerns about the state of the economy.

The maker of tools for creating videogames and other applications had 5,864 employees as of March 31, according to a regulatory filing, suggesting that more than 225 jobs may have been eliminated.

Source: Wall Street Journal

For a very nice writeup and analysis of this, see Kotaku’s commentary surrounding these layoffs. Suffice to say, my feelings about the layoffs align closely with the Kotaku commentary, and are very negative. I agree that it is a tough pill to swallow to “see the CEO’s pay rise 160% to $22 million” followed shortly by company-wide layoffs. I will end this section with one final thought: forgetting about any potential for 40% or 50% YoY growth at this point, how exactly would Unity be expected to grow at the CEO’s projected 30% YoY revenue growth for the foreseeable future while simultaneously downsizing and laying off employees? Tech companies are not like other companies with plants and lots of equipment and assembly lines. For a tech company, the output of tech comes from tech employees. And, for the record, merging with ironSource is not growth of Unity, it is a merger.

2. Macro Warning Signs

Interleaved amongst almost all the red flags surrounding Unity Software at this moment are the greater macro warnings signs. I believe Meta Platforms (META) gives a perfect snapshot of what I am talking about here. This is what Mark Zuckerberg, who in my opinion always has his finger on the pulse of what is going on, said in July about the current environment in digital ads:

…we seem to have entered an economic downturn that will have a broad impact on the digital advertising business. It’s always hard to predict how deep or how long these cycles will be, but I’d say that the situation seems worse than it did a quarter ago.

Source: Mark Zuckerberg / CNBC

This comes alongside his claim of one of the “worst downturns that we’ve seen in recent history,” and alongside similar looking layoffs. Regardless of where you fall in the ongoing debates about whether we are in or are entering a recession, or whether the current inflation rates are transitory or not, it appears that some digital advertisers are already starting to really feel the heat from lowered digital advertisement spending from advertisers.

Perhaps these digital advertising woes could be sector specific. But even just recently, a new report came out showing a decline in video game sales this quarter. So we effectively have both a bad macro and a bad micro environment for Unity since it relies primarily on video game creation and sales and digital advertising.

3. The ironSource Merger

The ironSource merger has to be the single most impactful piece of news for Unity Software since Q1 earnings. It also was several major pieces of news bundled into one. I am actually only going to highlight here the worsening sales outlook for the year that was included inside the announcement. I am not going to highlight the fact that Unity is paying a whopping 74% premium for ironSource. I am not going to highlight how this appears to me to be, for better or for worse, a massive step away from Unity’s core competency of being a game engine developer. I will simply opine that if you are long Unity, you have a lot of homework to do at this point, especially when the deal is completely finished. As someone who only likes to spend time analyzing companies that I find personally interesting to analyze and keep up with, this merger is a major step towards me no longer following this stock or at least only following at a much higher level. ironSource, on the surface, does not seem like a company I would have any interest in personally following.

So, instead of focusing this article on any of the above, or the fact that ironSource allegedly made software that was bad enough that even the built-in Windows virus protection software flagged it as malware, I simply want to highlight from this merger that Unity Software went ahead and gave yet another disappointing look towards the future by downgrading its sales outlook to between $1.3B and $1.35B from between $1.35B and $1.42B announced earlier. This is, admittedly, a somewhat small ~4.5% step, but it is another small step in the wrong direction, after previous large steps in the wrong direction, and to me reads as another nail in the coffin for what looks like a horrible upcoming Q2 2022 earnings report.

4. Part Two of Known Revenue Pain

Speaking of previous large steps in the wrong direction, my final major point to highlight here is to remind everyone of what we should all know is coming. Here is an excerpt straight from the Q1 earnings transcript that I think should help everyone gauge the upcoming Q2 results versus what the company just told us a few months ago. I think the full excerpt is worth rereading:

Moving on to guidance. Our original guidance for the full year of 36% year-on-year growth at the top of the range, considered fairly even growth in each of the four quarters. As John mentioned earlier, the challenges we are having now with Monetization represents a substantial short term headwind to our revenue growth. We quantify this headwind at $110 million with roughly 60% impacting the second quarter, 30% third quarter and 10% the fourth quarter. The recovery substantially re-phases our year from being fairly even quarterly year-over-year growth to a year that is both front loaded and back loaded.

For the second quarter, we expect revenue of $290 to $295 million, representing growth of 6% to 8% from last year’s second quarter, which was our strongest quarter last year with 48% year-over-year growth.

Source: 1Q22 Earnings Transcript

Anyone long Unity probably does not need a reminder of this, but when this story broke, it cratered Unity’s stock 35% into the ~$30 range, where it had previously traded right around where it sits at today’s price (Aug. 5) of ~$48. Going into Q2 earnings, investors are going to get a tangible, in-your-face reminder of why they had decided Unity was only worth $30 just a single quarter ago.

Conclusion and Outlook

One quarter ago, investors decided that a single event leading to a major one-time impact on revenue justified a massive selloff of Unity Software, plunging it from the ~$50 range to the ~$30 range. I personally found $30 to be an attractive entry price, after waiting patiently since the sky high IPO and post IPO Unity mania, and wrote an extended reasoning behind $30 being a good valuation for a cautious investor. Investors are now staring at a $48 price tag, reminiscent of the pre Q1 earnings valuation. I want to give two final forward-looking outlooks: one more short term and one more long term.

Short Term

I wrote this article to give my more short-term outlook. In the more short term, let’s say one day to around three months to a year after earnings, I just can’t possibly imagine anything other than a major pullback. I think we could even possibly be looking at a repeat on the order of the 35% 1Q22 pullback. It would be much easier for me to play it safe and simply react to the earnings transcript, than to try and make a concrete prediction about the future, which is notoriously difficult to do. But, I feel so strongly, and feel the evidence is simply so overwhelming at this point, that I feel compelled to go ahead and try to make the short-term call. If you are an investor who is interested in short-term trades, I think this moment represents a good short-term exit point. To reiterate, we are going into a quarter that we already know is affected significantly by the bad data bug, which led to a mass investor revolt one quarter ago. Since then, there have been major macro, and even micro, warning signs flashing red. Unity has been seeing layoffs. And finally, the company has already just announced further reductions to their financial outlook for the year. Despite all this news, the stock is up about 60% since its 1Q22 post earnings lows. I believe the upcoming earnings call will snap investors back to reality again, erasing much of Unity’s regained stock price momentum.

Long Term

Despite all of the negatives surrounding Unity Software and its stock, I still believe the company should have a very bright future ahead of it in the much longer term. For someone who has been long Unity, I believe there has been only one major event which has had a major material impact on owning the company, which is of course the ironSource merger. Instead of being a 100% owner of Unity, which you may have believed in whole heartedly, your money is now going towards ownership of 73.5% of a combined Unity and ironSource. To me, this is a massive change. Anyone interested in being long Unity, including myself, has a massive amount of homework to do. This change is so massive, that, as I mentioned, I may pull back from analyzing Unity or even stop entirely. I can see both the potential positives and negatives of this merger, and so will simply leave it by saying that, for those of us who were interested in Unity for Unity, we all have a lot of homework to do. But, I do believe that Unity’s future is still bright in the very long term.

A Right-Now Price

Finally, I want to leave with a thought on another very cautious entry price for Unity. If not the ironSource merger, I would still feel similarly to my prior analysis, which left me at a buy price around $30. Perhaps with the macro climate, I could argue for a slight discount from $30, but let’s just stick with $30. Now the main uncertainty I believe for nearly all investors in Unity will be the value of the ironSource Merger.

First, what price would be so low as to not even have to think about this? Assuming the merger happened tomorrow, a good valuation of the combined company would basically be 0.735 * x + 0.265 * y where x is what you consider to be a good valuation of Unity and y is what you consider to be a good valuation of ironSource. So, for me, a price of 0.735 * 30 + 0.265 * 0 = $22.05 would be me paying a price that I like for Unity, and then essentially getting ironSource for free. Given this, if Unity goes to $22, I will enter a large position. But, I do not believe this will happen. The value of ironSource is obviously well above $0 and I don’t think Unity would go far below $30 on its own at this point. So, the question is, what should the value of y be? Currently, I simply don’t know. Which is why my current right now price would have to be around or a bit above $22 until I feel good about pricing the merger. If you feel you have your own values for x and y that you feel good about then you can make a similar decision. And, I have a feeling you will do well starting a very long term position at your price you come up with. But, for me, investing should feel like a very sure thing, which is why, after I missed the opportunity for my $30 entry price after the last earnings call, I won’t be pulling the trigger on Unity any time soon.

Be the first to comment