hobo_018/E+ via Getty Images

Investment Thesis

Unity Software (NYSE:U) is the world’s leading platform for creating and operating interactive, real-time 3D content. It is mostly known for its Unity gaming engine, and boasted 94 of the top 100 game development studios as customers in 2020. Its platform can be used across the globe to build and operate games by developers of any size, from individual creators to large publishers.

It may already be a leader within the gaming world, but Unity is using its existing real-time 3D technologies to branch into non-gaming industries, which could provide even more growth levers for this company over the coming decade. Combine this with a powerful business model that balances recurring revenue (from Create Solutions) and usage-based revenue (from Operate Solutions), and I believed Unity was set up for success.

Sadly, this has not been the case so far in 2022 – in fact, it’s been pretty abysmal, with shares of Unity down almost 80% year-to-date, falling an eye watering 85% from their 52-week highs. This is in-part due to the incredibly high valuations we saw in the 2021 stock market, and many companies have pulled back by at least 30% over the past year; yet this is only half of the story for Unity.

The company has seen substantial issues with its Operate Solutions in 2022 (as outlined in a previous article), which saw growth grind to a halt as Unity scrambled to repair the issues. The recent acquisition of ironSource (IS) should help to turn this side of the business around, but it is a substantial acquisition, and substantial acquisitions always carry a high degree of risk.

There is a lot of negativity surrounding Unity stock at the minute, and this is quite frankly deserved. Investors will be looking to the company’s Q3’22 results for some good news, which are expected to be released on 17th November, but what should they be watching? Let’s take a look.

Q3 Earnings Expectations

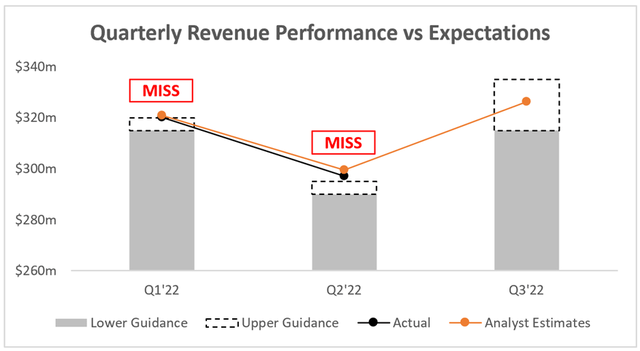

It’s been a difficult 2022 for Unity, and quarterly results have only compounded the pain thus far. In both Q1 and Q2, Unity’s revenue came in below analysts’ expectations & the guidance has often disappointed.

Looking ahead to Q3, analysts’ consensus estimate of $326m falls squarely in the middle of management’s $315-$335m guidance range. In my eyes, Unity’s revenue results will rely solely on how successfully the company has been able to fix the issues within Operate Solutions – but more on that later.

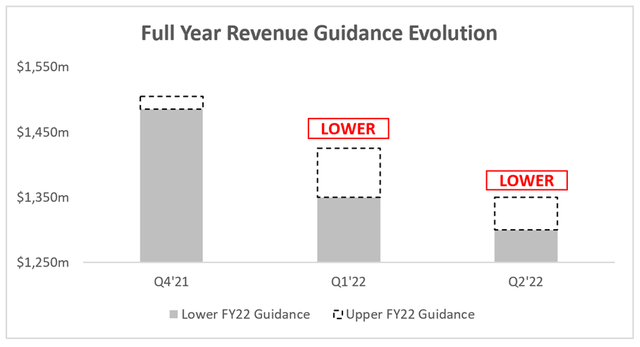

In terms of full year revenue guidance, it’s been another sad story. Unity’s initial revenue guidance offered up in Q4’21 was $1,485-$1,505m, indicating YoY growth of ~35% at the midpoint. Compare this to the guidance offered up in Q2’22 of $1,300-$1,350m, indicating revenue growth of just ~19% at the midpoint.

Analysts are now expecting Unity to achieve revenue of ~$1,320m in 2022 according to Seeking Alpha, also representing ~19% YoY growth. This certainly explain why Unity’s shares have been tanking this year; it was priced as a premium growth stock, and investors certainly aren’t willing to pay such a high valuation for a business that is growing revenues by less than 20% annually.

The headline revenue figure is going to be crucial for investors in Q3, and I for one would be extremely disappointed to see the FY22 revenue guidance fall even further. So, let’s take a further look at what needs to go right within Unity for this business to turnaround.

All Eyes On Operate

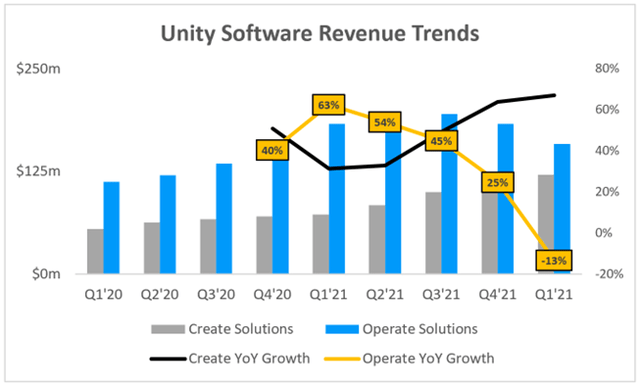

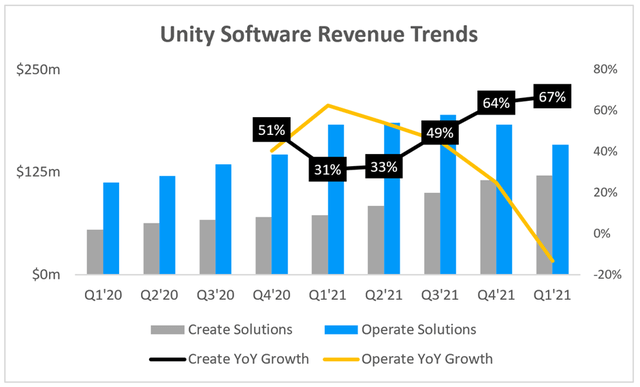

Operate Solutions is without a doubt the number one business area that investors need to be watching in Unity’s Q3’22 results. The graph below highlights just how aggressive the slowdown in revenue has been within Operate Solutions – and, given that it made up ~64% of Unity’s revenue back in 2021, it’s clear just how much of an impact this slowdown has had on the overall business.

The first & most obvious indication that the issues within Operate are fixed will be an improved revenue figure, and hopefully a levelling off of the trend that we are currently seeing. Perhaps my expectations are too low, but I just want to see that Operate Solutions revenue trending up QoQ rather than down.

At a minimum, this would give me more confidence in Unity’s short-term prospects & demonstrate that they have managed to at least partially resolve the issue. This would also go some way to repair my faith in management, as CEO John Riccitiello indicated on the Q2 earnings call that the issues in Operate had essentially been resolved:

We have fixed the data challenges that we discussed last quarter and are launching new features. We’re seeing improvements in our products with lead indicators, such as Audience Pinpointer accuracy showing our innovations are effective.

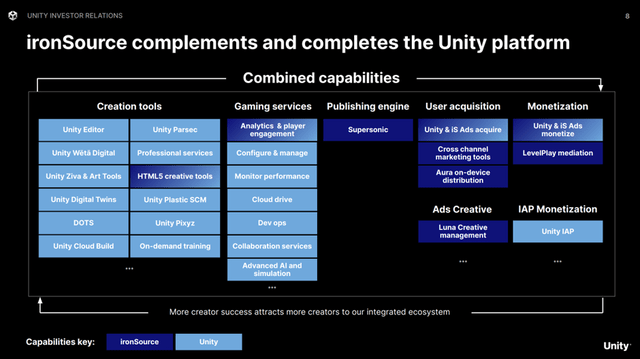

In the long term, however, Unity’s success within its Operate Solutions will be heavily reliant on the success of its upcoming ironSource acquisition. IronSource specialises in supporting developers of mobile gaming apps with the launch, monetization, and scaling of their products; basically it was a competitor to Unity’s Operate Solutions, and so I think this deal makes a lot of sense for Unity. I’m not a big fan of acquisitions of this magnitude, but at least I can understand (and agree with) the rationale behind this one.

Unity x ironSource Presentation

The acquisition is expected to close in Q4’22, so don’t expect to see any impact of this in Unity’s Q3 results – although it will be worth monitoring the press release and earnings call transcript to see if management offer any breadcrumbs as to the integration plans & the impact thus far to Unity.

So with this acquisition coming later down the road, my focus for Q3 results will be squarely on whether or not Operate Solutions has truly managed to turn a corner & return back to the growth that investors have come to expect from a company like Unity.

Can Create Solutions Continue To Impress?

Despite shares absolutely plummeting, it hasn’t been all bad news for Unity this year. Whilst Operate Solutions has been woeful, Create Solutions has actually accelerated compared to 2021. This is particularly exciting since Create Solutions often works as an onboarding ramp for Operate Solutions, so growing Create Solutions’ revenue today could lead to increased Operate Solutions revenue tomorrow – especially if Unity improve their Operate offerings courtesy of ironSource.

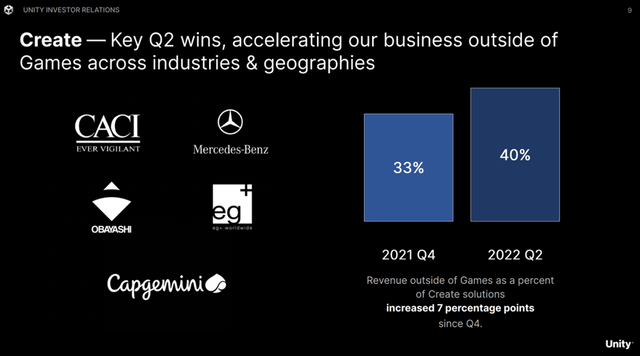

A big part of my thesis for investing in Unity is the company’s ability to move outside of its core gaming business & into different verticals – and the successful execution of this in particular has been driving Create revenues in 2022.

The push outside of gaming has certainly been helped by Unity’s relatively recent acquisition of Weta Digital, a visual effect company used widely within the movie industry. Yet the big success has been through the acceleration of Unity’s Digital Twins business, which refers essentially to 3D digital copies of existing real-world items, places, or landscapes. All this success led to an ever-increasing proportion of Create revenue coming from outside of Unity’s core gaming vertical.

Unity Q2’22 Investor Presentation

Whilst I don’t necessarily expect Create Solutions to continue its YoY growth rates above 60%, I certainly would not complain if it did! The Operate Solutions might be a nightmare right now, but at least Create has been a dream & is doing exactly what I hoped it would when I laid out my investment thesis for Unity.

When it comes to the Q3’22 results, I will be hoping to see that Unity has continued its momentum within Create Solutions & continues to see more customers outside of gaming utilise its solutions. There is no telling just how much future growth potential there is in these industries, but I’m excited to be investing in a company at the forefront.

Bottom Line

As I mentioned at the start, this has been an awful year for Unity – but I’m starting to believe that things can only get better from here. The company has seen momentum within Create Solutions throughout the year, but that has been overshadowed by extreme disappointment in Operate & an acquisition saga.

If Unity can turn a corner in Operate Solutions this quarter, then I believe the market might start to change its mind about this beaten down business. If management is to be believed, then that it what we will see in these Q3 results, and with Create Solutions performing well thus far, it could be a sharp turn of fortunes for Unity.

I am sticking with my ‘Hold’ rating for now, but if Q3 results end up being a turning point for this company, then I may well start adding to my existing position once again.

Be the first to comment