Rawpixel

Down almost 70% from the high as investors turned on growth stocks, AppLovin (NASDAQ:APP) seems to represent an interesting opportunity to investors. Its mix of growth (92% revenue growth in 2021) and profitability (FCF was 13% of revenue in 2021) makes it stand out from other growth stocks who have found little love this year. However, the merger of Unity Software Inc. (U) and ironSource (IS) could change the outlook for AppLovin.

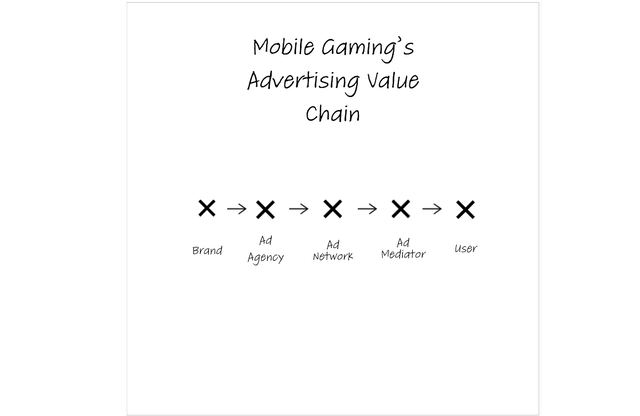

The value chain for mobile gaming’s advertising

AppLovin is an ad mediator (created by user for illustrative purposes)

Brands and ad agencies are concerned with getting their ads to reach the user. For that they go to an ad network (like Unity) which collects all the supply from apps in order to match it with the advertising demand. Because there are multiple ad networks, developers would need to download the SDK for each one and try to manually manage their advertising side of their business in order to get the highest possible CPM for the ads they publish. Doing so would take time away from their core competency of creating games that users love. Instead, the game developers use ad mediation to help them get the best CPMs possible. AppLovin is currently the leader in the space.

Now obviously this is a very basic illustrative picture and the value chain from the “Ad Network” to “User” is a lot more comprehensive than that. There is currently enormous competition between different platforms to expand their offering across the value chain. AppLovin looked to be winning until the Unity/ironSource merger was announced.

The Flywheel Race

Mobile advertising platforms like AppLovin and ironSource are in this competition simply because it will offer the winners a flywheel effect.

Mobile advertising platforms rely mainly on contextual targeted ads; users who play game A tend to like game B, so place ad for game B to users who are playing game A but didn’t download game B.

The more of the value chain a mobile advertising business has, the more contextual data it will be able to collect. Note that this kind of data proved to be hugely important as the majority of these companies were left largely unaffected by Apple’s (AAPL) privacy changes which played a role in crushing the stock of Snap Inc. (SNAP) recently for example. All the data they needed was available within the game-playing phase of the user’s interaction with the Apple device.

The better the data, the more relevant the ads, the more likely users are to download the game, which increases CPMs, which in turn makes developers more likely to stick with using the platform they are on.

With AppLovin having the bigger ad network and ad mediation platforms, it looked to be set to have that flywheel effect, but the Unity/ironSource merger is a game-changer.

The Mother of All Flywheels

With Unity merging with ironSource, AppLovin will find it difficult to offer a compelling value proposition to a lot of customers. Not only will the combined company offer the ad network/ad mediation part of the value chain (Unity never had that ad mediation portion), it will become a one-stop shop for creating games. When half the mobile-gaming market is using Unity, that’s trouble.

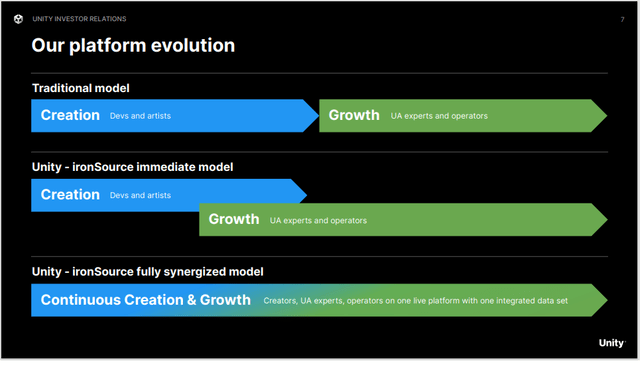

Unity’s vision for becoming a one-stop-shop for game developers (Unity Software)

One example of the size of the challenge facing AppLovin is the potential revenue synergy the merger could create for Unity; ironSource had 397 customers contributing more than $100k in revenue, Unity had more than 1000 such customers. If you are a game developer that works with Unity on creating all aspects of the game as well as the operations side such as managing in-game purchasing for example or pre-launch testing, and now all of a sudden Unity is telling you they can handle all the pain points of mobile advertising for you, why would you stick around with AppLovin?

Unity CEO John Riccitiello summed it up in the company’s presentation on the merger:

We are going after the biggest prize; a unified creation and growth platform that leads to both better and more commercially successful content and games for our customers, that will bring in more innovation and success for creators of real-time 3d content.

So the more developers use Unity to create mobile games, the more likely they use ironSource’s solutions, the more contextual data the combined company have, and the better it gets at handling advertising for developers, which drives them to use Unity to create their games, and that flywheel keeps turning.

No Where to Run

In my opinion, further consolidation in the industry is inevitable. The problem for AppLovin as an acquisition target is it has a relatively large market cap of almost $14 billion.

Epic Games, Unity’s competitor, was valued at $32 billion in a recent round. Even if it did want to buy the business the dilution will be too great to go through with it. Another company that’s in a similar situation is The Trade Desk (TTD). There is no reason to believe the company is considering such a move, but even if it did the dilution would be too great. Other companies like Alphabet Inc. (GOOG) (GOOGL) are relatively a small player in the field with AdMob and maybe would like to grow its presence (there is no indication of that), but regulators may not let Alphabet make acquisitions to grow their ad business.

Conclusion

The merger of Unity and ironSource could signal the end of Applovin’s dominance of the ad mediation space. The company could find it difficult to add customers post-merger, given Unity’s flywheel advantage by that time. Some relief for AppLovin is that it caters to all app developers and not just gaming, and that the merger has seen some backlash from game developers, which may drive more away from Unity, at least in the short-term. For those two factors AppLovin is a hold for now rather than a sell.

Be the first to comment