Gwengoat/E+ via Getty Images

Introduction

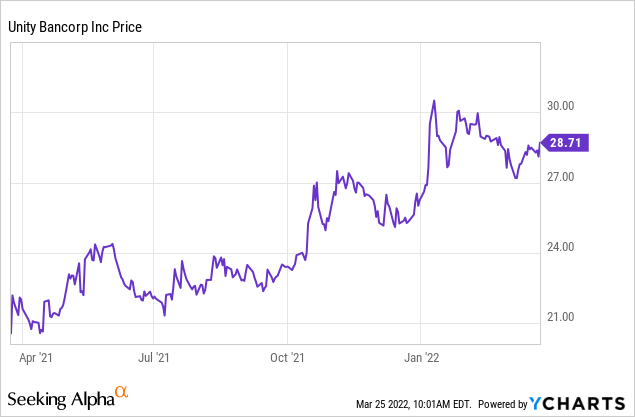

Unity Bancorp Inc. (NASDAQ:UNTY) is the holding company of a local New Jersey based bank with its main office in Clinton, New Jersey and sixteen additional branches in the state. The bank is currently trading at just 8 times its 2021 earnings, so I wanted to have a look under the hood to see why the market wasn’t rewarding this financial institution with a higher valuation. The very low dividend yield of 1.40% likely contributes to the low valuation.

An exceptionally strong result in 2021 thanks to a lack of loan loss provisions

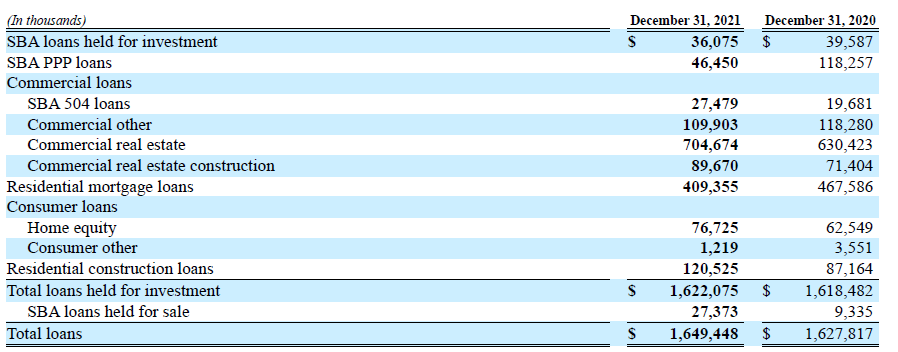

Unity Bancorp’s balance sheet expanded by a few percent in 2021, mainly due to the retention of earnings as the equity ratio (equity versus total assets) increased from 8.88% to 10.11%. This makes the bank safer, but it could also be an indication of running an inefficient balance sheet as the total amount of assets on the balance sheet increased by just $75M, fueled by a $32M increase of the equity component.

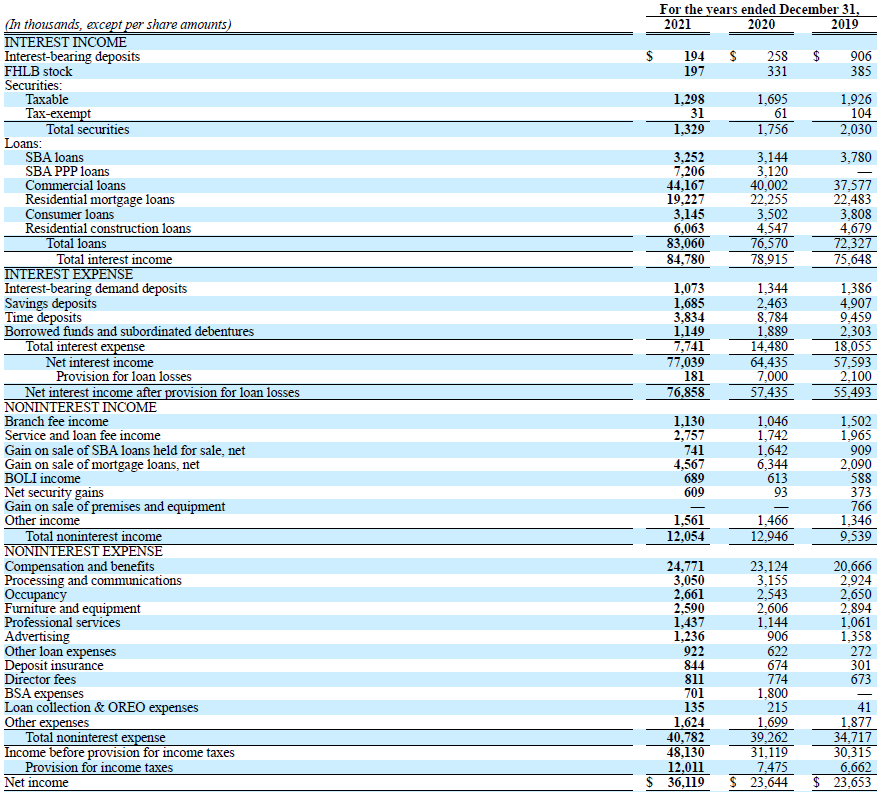

The bank once again saw its interest income increase while the interest expenses decreased and with a net interest income of $77M in FY 2021, the NII has increased by almost 35% compared to FY 2019 when the net interest income was just over $57.5M.

UNTY Investor Relations

The bank also recorded a net non-interest expense of approximately $28.7M resulting in a pre-tax and pre loan loss provision income of almost $48.5M. The loan loss provision was rather low in 2021 with just $181,000 added to the total provisions (much lower than the $7M in FY 2020 and the $2.1M in FY 2019) which ultimately resulted in a pre-tax income of $48.1M and a net income of $36.1M for an EPS of $3.47 based on an average share count of 10.4 million shares throughout the year. The net share count as of the end of 2021 decreased by just under 1% as the bank repurchased 199,000 of its own shares for a total of $4.2M (indicating it paid an average of $21/share) which more than offset the 134,000 shares that were issued due to option exercises. The share count will continue to fluctuate as more options will be exercised and as of February 28, Unity Bancorp had 10.46 million shares outstanding.

The loan book mainly consists of CRE and residential real estate

When looking at a bank from an investment perspective, it’s always important to have a look at what the bank has actually invested in. While banks always are some sort of a “black box” and you don’t really know exactly what the loan portfolio consists of, the breakdown of categories is usually helpful.

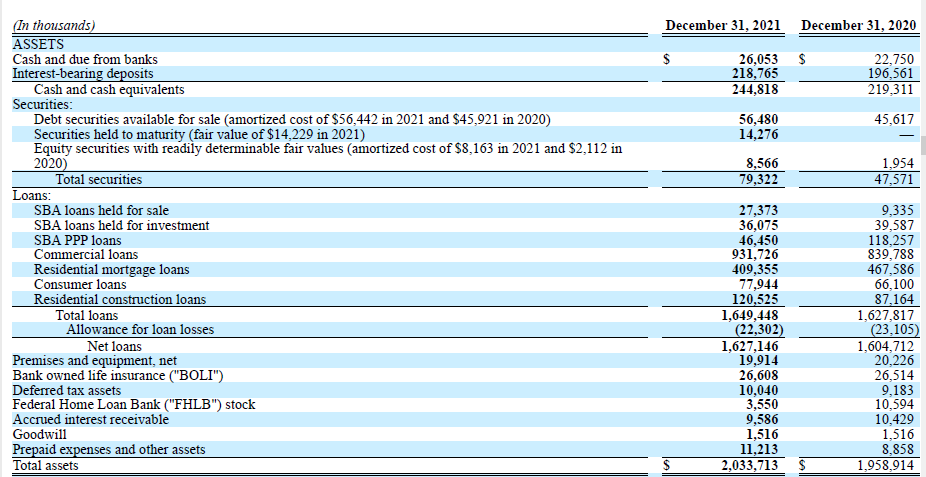

As mentioned before, Unity Bancorp’s balance sheet contains just over $2B in total assets, of which about $245M is held in cash and deposits and an additional $79M consists of securities. So about $325M or 16% of the balance sheet is held in liquid and very liquid assets. I’m mainly interested in the total loan book of $1.65B.

UNTY Investor Relations

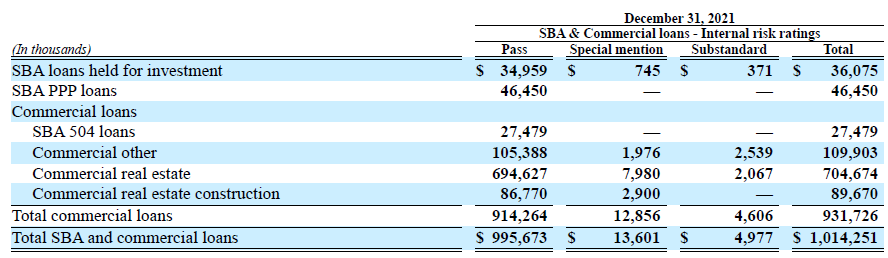

When looking at the balance sheet, I was a bit worried when I saw the largest position representing over 55% of the loan book was classified as commercial loans. However, as the image below shows, Unity Bancorp included commercial real estate loans in the “commercial loans” segment so they aren’t just business loans. As you can see below, in excess of $800M of the commercial loans are real estate related and the “business loans” are less than $110M of the total loan book.

UNTY Investor Relations

The asset quality appears to be very decent as of the $932M in non-SBA loans only $12.9M are classified with a “special mention” and just $4.6M are ranked “substandard.”

UNTY Investor Relations

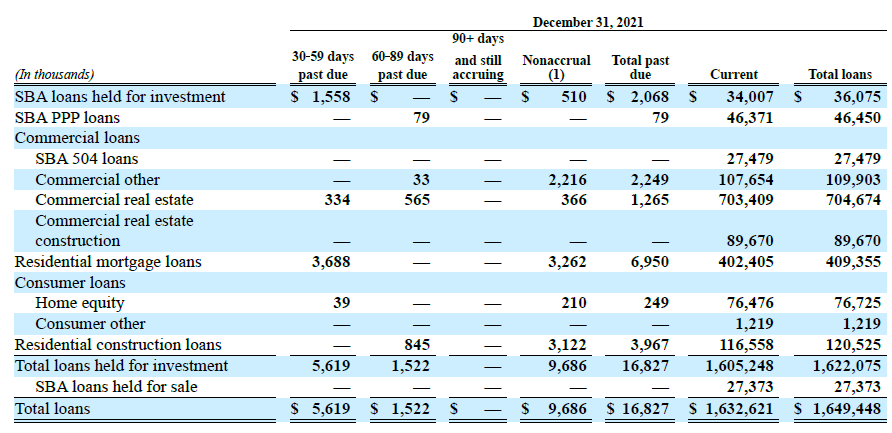

And it’s not because a loan has a “special mention” situation that it the bank risks losing everything as it tends to keep close tabs on those loans and the collateral. As of the end of 2021, there were a total of $16.8M in loans past due, which is approximately 1% of the loan book. Of those $16.8M, only $9.7M was put on a nonaccrual basis while just over $7M of the loan book was past due but still accruing.

UNTY Investor Relations

With a total loan loss allowance of $22.3M, Unity Bancorp should be able to cover all loan losses even if it cannot recover a single dollar from the loans that are currently past due (and that is very unlikely).

Investment thesis

That being said, we should expect the bank’s loan loss provisions to increase again from this year on as the recorded provision of less than $0.2M in FY 2021 obviously was a one-time event related to the much higher loss provision in 2020. But even if the loan loss provisions increase to for instance $3.5M per year, the net income will decrease by just under $3M or around $0.25 per share per year, keeping all other things equal. That means that even when loan loss provisions normalize, Unity Bancorp should still be able to generate an EPS of in excess of $3/share.

And as the balance sheet (and equity ratio) look pretty healthy and as the interest rates start to increase, it’s quite likely we will see the net interest income increase as well. Unity Bancorp pays a dividend of just $0.10 per quarter per share which means that on an annual basis, the bank is able to retain $2.5-3 per share in earnings which are rapidly boosting the book value per share which stood at $19.80 as of the end of 2021, up from just $16.6 a year earlier.

While the multiple of 1.4 times the book value is quite high and the current dividend yield of 1.4% is unappealing, Unity Bancorp is rapidly backfilling the premium to its book value and I expect the book value and tangible book value to exceed $25/share before the end of next year thanks to the very low payout ratio for the dividend.

I currently have no position in Unity Bancorp but I’m adding it to my watch list.

Be the first to comment