ThomasVogel/E+ via Getty Images

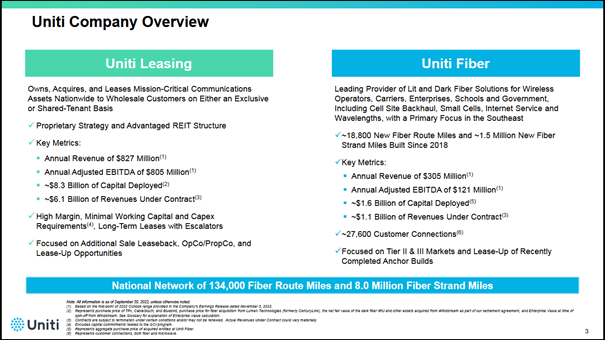

Uniti Group Inc. (NASDAQ:UNIT) is an owner of telecom cable assets which it rents out to companies and institutions. Its largest tenant by far is Windstream, the telecom company from which it was split-off in 2015. Next to this “legacy” business, Uniti has a substantial non-Windstream business which it acquired over the years since 2015.

In this article, we have a look at how successful Uniti’s new business is in terms of profitability. Next topic is an estimate of Uniti’s free cash flows in the coming years. We hope to answer the question when Uniti is in the position to raise the dividend. In the last section, we revisit the lease dispute with Windstream and look at what impact this may have on Uniti’s credit risk.

Uniti’s non-Windstream income

Uniti Fiber is the business unit that generates most of Uniti’s non-Windstream income. Some further non-Windstream income is generated by Uniti Leasing.

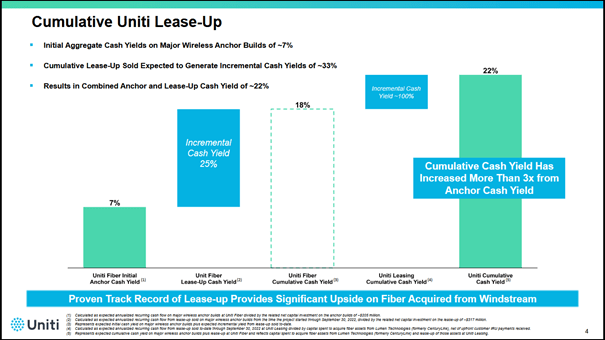

In Uniti’s presentations, the company claims that Uniti Fiber is very successful and generates large incremental yields.

Company presentation

Even without the Lumen business, of which we don’t know the takeover price, Uniti claims the fiber business now generates a cash yield of 18%. Adding the former Lumen business, that number even increases to 22%. The initial yield was only 7% from anchor tenants, and then over the years new tenants increased that yield three-fold. That sounds impressive.

What Uniti doesn’t tell us, however, is whether “cash yield” is an interesting number to look at. It is basically nothing other than turnover, generated by the new investments. It doesn’t tell us anything about the recurring costs to generate this new business.

To get an idea of how these costs impact the bottom line, we can relate Uniti’s cash yield with Uniti’s non-Windstream Ebitda numbers.

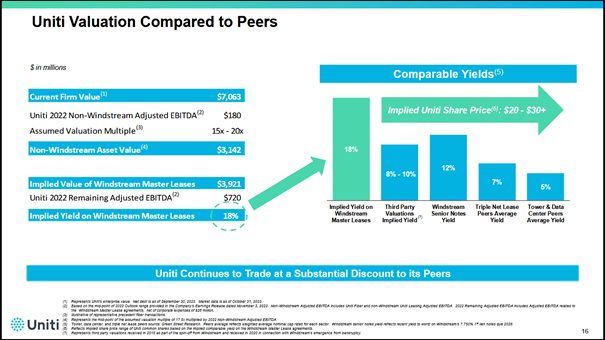

Uniti company presentation

The above slide shows that Uniti generates $180 million of non-Windstream income (EBITDA).

Now we want to know how this $180 million relates to Uniti’s non-Windstream investments over the years. In the small print on the first slide, we read that Uniti spent $205 million on anchor builds and $317 million on lease-up investments. The below slide…

Uniti company presentation

tells us that Uniti paid another $1.6 billion for various takeovers. A final investment we have to add is the purchase of certain third party contracts from Windstream, which were acquired under the settlement agreement, at a price of $245 million. Adding it all up, we get:

|

Investment |

Amount |

|

Takeovers |

$1,600 |

|

Anchor builds |

$205 |

|

Lease-up |

$317 |

|

Windstream settlement IRU contracts |

$245 |

|

Total* |

$2,367 |

*The total does not include the $400 million 2020 purchase of certain Windstream assets, as Uniti is still in the early stage of monetizing these.

Now we are in the position to relate the $180 million Ebitda to the $2.37 billion investment, which is 7.6%. Although the 22% is not related to the entire non-Windstream investment, it is clear that a more realistic picture of Uniti’s non-Windstream income is the not-very-impressive 7.6% earnings before depreciation.

Since these are actively managed assets, like lit services that require high tech instruments, we should not ignore the costs of depreciation. If you assume only one percentage point of depreciation, the total return on investment drops to 6.6%.

We can conclude that Uniti’s non-Windstream business is profitable but still doesn’t exceed Uniti’s funding costs, which are currently above 8%. Uniti still has a long way to go.

More dividend?

“We want more” is one of the topics that keeps the Uniti stock investor busy. Unfortunately, Uniti currently does not generate sufficient free cashflow to increase the dividend. The most important reason is the high capital investments under the Windstream settlement agreement (GCI program).

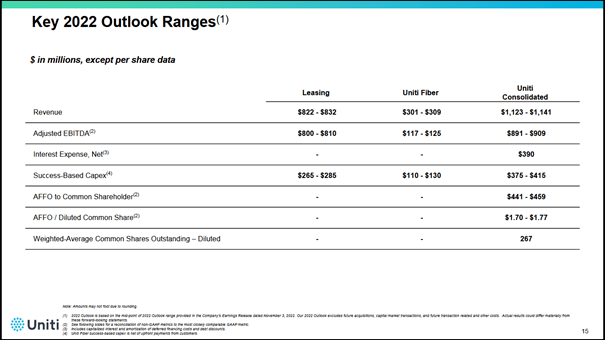

Uniti company presentation

As the above slide shows, Uniti has cash outflows, interest and capital investments of $785 million over 2022. That leaves only $115 million available for dividend payments, which is 49 cents per share per annum (over 237 million shares). That is less than the currently paid 60 cents per annum.

Uniti’s free cash flow position, and thus dividend capacity, will get better only when the GCI requirements come down as of 2025. From then on, the dividend may increase in the area of 20 cents per annum in 2025 and another 20-30 cents in 2027. What will happen to the dividend in 2030, after the Windstream lease renewal, is anybody’s guess.

The Windstream dispute

In November 2021 Windstream started a public dispute with Uniti about the likely lease renewal rent as per 2030. Windstream claims the rent will come down from $700 million in 2029 to under $200 million in 2030. Uniti, on the other hand, claims that the rent will very likely not come down substantially, if at all.

We now know that this dispute is the consequence of an inconsistent lease contract from 2015 which was not adjusted during the renegotiations in 2020.

Windstream claims that the 2030 calculation should be consistent with the 2015 calculation. That position is correct, since the contract explicitly prescribes that the renewal calculation in 2030 should be consistent with the 2015 calculation.

However, there is a problem, as the 2015 lease annuity calculation is not done correctly. It turns out the parties made an error such that the calculation is not consistent with IRS guidelines (Internal Revenue Service). And, you guessed it, the contract states explicitly that the calculation should be consistent with IRS guidelines. A long story short, that means the contract is inconsistent.

The dispute in more detail

If you want to know in more detail what the dispute is about, you should make yourself comfortable with the Excel formula PMT. This formula generates an annuity amount based on certain input variables. The parties agreed to calculate the lease rent based on the below formula:

Fair Market Rental Formula

Fair Market Rental = PMT(rate, nper, PV, [fv], [type])

rate = Fair Lease Rate

nper = Renewal Term

PV = Fair Market Value – Residual Value

fv = 0

type = 1 (lease payment due at beginning of period)”

The above formula does not use the input variable fv, which is the future value of the lease asset, but instead only uses the input variable PV. PV then basically reflects two capital flows, the initial transfer of the lease assets, “Fair Market Value,” reduced by the transfer in opposite direction of the assets at the end of the lease contract, the “Residual Value.”

In principle, this is a correct approach as long as you remember that these two cashflows are fifteen years apart. The Fair Market Value, of the initial lease assets, is transferred at the signing of the contract and the Residual Value is transferred 15 years later, at the end of the contract. If you want to subtract these amounts from each other under PV, Present Value, you should make sure that the future cashflow ‘Residual Value’ represents an amount in present terms. Making a cashflow present is standard economic practice and is done by discounting the future amount over the fifteen year period (X/(1 +rate)^15). Uniti’s claim that the residual value should be discounted therefore is true.

Back in 2015, the parties[1] made a material error and forgot to apply this discounting to the residual value. They may have realized this, but came up with the wrong solution. In order to “repair” the error, the parties dreamed up some fake transaction terms, most likely the interest rate, such that the outcome of the formula fitted with a, in their view, reasonable rent level.

Windstream shows us proof of this process, as it disclosed the 2015 transaction terms:

Value of the assets: $7.45 billion

Interest rate: 10.35%

(Residual Value: 2.465 billion)

Annual rent: $650 million

These transaction terms make no sense, as 10.35% interest over $7.45 billion is far more than $650 million. This would imply that Windstream had to pay negative principal redemptions on the lease. That would suggest that the parties anticipated that the assets would go UP in value over the fifteen year period, not down. Since these were primarily depreciating copper cables, this is not realistic.

What next?

Unfortunately, the parties still have not resolved their dispute. Uniti still pretends that it has the upper hand in the dispute and does not admit that the contract is ambiguous. It openly states that it doesn’t see a reason to resolve the issue.

We don’t know how this will end, as Uniti is wasting precious time by not doing anything. If this goes to court, we cannot predict how and how quickly the issue will be resolved. If Windstream prevails, the rent will likely come down with $500 million per annum. It is very likely that then certain bond covenants will be breached and Uniti may have to file for Chapter 11 restructuring.

Irrespective of the outcome, this dispute already negatively affects Uniti’s position in the capital markets. Its share price is very low and its bonds are trading at relatively high yields. Uniti’s management should act quickly, and its current inaction only adds to the poor decisions made in the past.

Conclusion

Since 2015 Uniti has invested over two billion in non-Windstream related assets. These investments have started to generate substantially more income over the years, although still below Uniti’s cost of capital.

Uniti has very limited room to increase the dividend in the next two years and may only start increasing the dividend as of 2025. Larger increases are likely as of 2027.

The lease dispute with Windstream has still not been resolved. It is now clear that both parties made material errors in arranging the contract. Uniti’s inaction in resolving the dispute harms the company and results in elevated insolvency risk.

[1] This is an over $7 billion contract that was arranged by JPMorgan, Bank of America, Stephens Inc., Ernst & Young and Uniti and Windstream management.

Be the first to comment