Wolterk

When asked what kind of investor I am I always say GARP. In case you are unfamiliar this term, it’s the acronym for Growth At A Reasonable Price. But what does it mean exactly? As far as I know there is no GARP ETF nor any Index such an ETF could be based on. My own sense of what GARP means has always been intuitive. My preference for “GARP” stocks may well stem from the fact that my first awareness of the market came during the great post-war bull market of the 1950s which began when all stocks were much cheaper than they are at the present. It was reinforced by being an active investor through the inflationary 1970s when high inflation drove P/E ratios to the single digits.

For the past two decades I have looked for quality stocks at prices somewhere between the current valuations and those of the 1950s and 1970s. I also require at least a moderate amount of growth – thus “growth at a reasonable price.” My use of quotation marks reflects the fact that the portfolio (see this recent article) put together in this fashion, while serving my personal goals, is idiosyncratic and not shaped to fit a well-defined category. GARP has no such rigorous definition.

Index ETFs like the Vanguard Growth Index ETF (VUG) and Value Index ETF (VTV) are constructed using clearcut and rigorous definitions put together by the University of Chicago’s CRSP methodology. As I mentioned in my previous article on Growth, there are six factors defining Growth and 5 Factors defining Value. The Growth factors are: future long-term growth, future short-term growth, three-year historical earnings growth, three-year historical sales growth, investment/assets ratio, return on assets. The Value factors are: price to book ratio, future price to earnings ratio (3 years), historical price to earnings ratio (3 years), dividend yield, and price to sales. What stands out in comparing the two is that Growth is all about the future. It never mentions price. Value takes a short term view of earnings and is firmly tethered to the ground by price and valuation.

Could a combination of the above potentially provide a formal definition for GARP? The question arose in my most recent article when I realized that UnitedHealth (NYSE:UNH) did not appear to fit comfortably in the Value category despite the fact that it was ranked #3 by market cap in the Value Index ETF. Then I noticed that Apple (AAPL), the #1 stock in the Growth Index ETF, had many important metrics which were surprisingly similar to those of UNH. Should UNH be moved from Value to Growth? Should AAPL be moved from Growth to Value? Don’t hold your breath waiting for that. Or was the similarity in important metrics of the two companies the key to putting together a more rigorous definition of the elusive category of GARP which seems to exist somewhere in the middle between the two formal categories of Growth and Value.

This article is thus about two subjects. One is the quest for a more rigorous and formal definition for the GARP category. The other is an analysis of UnitedHealth, which I came to see as a wonderful company with characteristics which might epitomize the GARP category.

UnitedHealth And Apple Are Like Twins Separated At Birth

In the course of writing the above linked article I stumbled on an intriguing fact. If you covered the names of these two well known companies and disguised the absolute scale, the 10-year numbers for revenue growth would be virtually identical. What I found stunning was that the CRSP methodology which defines Growth and Value put them in opposite indexes. Moving down to P/E ratios I saw that their numbers were almost identical.

Apple is the number one stock in the Growth Index and all the funds and ETFs based on it. Its market cap is $2.25 trillion. It’s about five times the $485 billion market cap of UnitedHealth. Adjusted for that size difference the steady increase in revenue numbers is very similar. Here’s the comparison in numbers:

- Apple’s revenues were up 245% over 9 years plus a quarter. Its average annualized increase over that period was 10.2 %.

- UnitedHealth’s revenues were up 269% over the same period. Its average annualized increase over that period was 11.3%. The revenue growth of UNH thus actually exceeded that of AAPL.

- The rate of increase for both companies accelerated over the past five years.

- The P/E ratio for both companies as I write this rounds to 23.

- Other metrics track less closely mainly because the two companies are in different industries. It’s like twins who diverged a bit in the less fundamental ways their lives took different forks in the road. Apple has amazing returns on equity and throws off a huge amount of cash which it regularly invests in buybacks. It has reduced its share count by around 40% over the past 9.25 years.

- UnitedHealth also generates cash at an outstanding rate but is able to plow a good bit of it into organic growth. It has reduced its share count by just 8% over the past 9.25 years. Its yield, however, is about twice that of Apple.

- Both companies grow overall at a moderate but very stable and persistent rate.

Both Apple and UnitedHealth have growth which is well above the market average but seems borderline for the rigorous CRSP Growth Category. One major difference that stands out is the matter of share repurchases. Much of Apple’s growth in earnings and cash flow per share was generated by the reduction of shares outstanding. This is unusual for a Growth leader. Most mega-cap growth companies generate their EPS and cash flow numbers through operating results. All other mega-cap growth companies which have made it to the top ten of the S&P 500 continue to have a growth rate of at least 20% to 30% largely if not entirely from operations.

It goes back to those CRSP criteria. Merely growing a lot faster than the market isn’t enough to rigorously define Growth. Companies in the Growth Index fit the profile of companies which are measured by future growth not manufactured by balance sheet manipulation. With true Growth there is also no consideration of price. Most companies classified as Value are measured primarily by Valuation with a single nod in the direction of very short term 3-year future growth. Considering the above factors you could easily make the case that UNH has a better claim to being in the Growth Index than Apple.

How did Apple and UnitedHealth end up in different indexes anyway? There’s no simple explanation. The CRSP methodology actually has a system for sliding a company in phases from one index to the other. Maybe that will eventually happen in the case of Apple. For me, whatever the Growth and Value indexes do in the future, the sensible present reality is that both companies might fit best in a separate GARP category for companies which combine characteristics of Growth and Value. It’s stocks like these which interest me the most because they have strong business models and generate good returns with minimal risk. They tend to do well in tough market environments and have very few major losers.

The Peter Lynch Model For Growth At A Reasonable Price

It’s no secret that in his 13 years running Fidelity Magellan Fund (1977-1990) Peter Lynch strongly preferred Fast Growers, as he named them. He built his 29.2% annualized returns on 10 or 20 baggers of which the most famous was the 30 bagger (3000% return) with L’Eggs, which was brought to his attention by his wife who had bought their stockings. By the time he retired in 1990, however, the world of rapid growth was changing, and it became harder to buy truly obscure growth companies. Falling interest rates had also begun to inflate prices and his famous rule of never buying a stock with a P/E higher than its growth rate had begun to be out of date.

In his legendary book One Up On Wall Street Lynch described a category he called “Stalwarts,” large and successful businesses that grow nicely, but not enough to be considered growth stocks. His number for moderate growth was 8-12% annualized revenue growth. This is probably a good starting point for defining GARP stocks. The basic premise is that Stalwarts do not produce spectacular results in normal times but provide protection in market meltdowns like 2000-2003 and 2007-2009. Owning Stalwarts is not the way to get rich, but it helps you to stay rich. They protect your capital in bear markets and help Keep up with inflation.

At that 8-12% annualized growth rate Lynch’s Stalwarts will more than double your money over a decade. For Apple and UnitedHealth, with their more than 10% annualized revenue increase, they should double top line growth in around 7 years. Lynch warned, however, that stocks like this should be bought carefully when the P/E provided good value. He added that they should be sold if they ran up quickly. The criteria for “Stalwarts” summarize the majority of factors from both Growth and Value indexes, thus their informal designation as the Growth-At-A-Reasonable-Price category.

One of Lynch’s favorite tools was the PEG (price-to-earnings-growth) ratio which puts companies with different growth rates on a level playing field. Here’s the formula (linked here): PEG equals P/E ratio divided by growth rate. At the time he wrote, he felt that a ratio over 1 suggested overvaluation. It’s helpful to remember that for Lynch his sense of proper valuation goes back to 1990 and may be out of date in the current market. A further Lynch innovation involved including dividend yields in the denominator, thus producing this definition: PEG equals price to earnings ratio/growth rate plus dividend yield. This approach produces a very interesting result when adding the dividend yields of Apple (.65%) and UnitedHealth (1.31%). The PEG rations are pretty close as Apple’s manufactured per share earnings growth due to buybacks does enough to slightly more than offset UnitedHealth’s higher dividend yield. Here are the numbers:

- Apple’s EPS growth for the past 9.25 years has been 15.8%. Adding in its current dividend yield of .65% produces a denominator number of 16.5.

- UnitedHealth’s EPS growth for the past 9.25 years has been an annualized 14.4%. Adding in its current dividend rate of 1.31% produces a denominator of 15.7%.

- Note that on the earnings line both companies are somewhat growthier than Lynch’s numbers.

- For Apple the PEG ratio including dividends is 1.4.

- For UnitedHealth the PEG ratio including dividends is 1.47.

Given the neutral number of 1 used by Peter Lynch, the PEG ratios of both Apple and United health seem high. There are two explanations for this. One is that Lynch took over Fidelity Magellan in 1977, the approximate mid-point of the inflationary 1970s when P/E ratios were extremely low with the market as a whole having a P/E in single digits. In recent years, and particularly since 2010, markets have run to the opposite extreme as low interest rates helped push P/E ratios up to extreme numbers in the other direction. Recent market P/Es by some measures have been as high as 30. In fact, the long term backward-looking average, which I remember looking at in Value Line in the 1970s when it was 13.7%, has been pulled up steadily over the past several decades until now it is 2 points higher at roughly 16.7%. That does a good deal to inflate the number for a rule of thumb like the PEG rate.

It’s hard to estimate the right long term market P/E as we are now much closer to extreme highs than extreme lows. The answer is probably somewhere in the middle, perhaps around or just under the midpoint, perhaps around 15. To get there with present earnings the market as a whole would have to fall about 25%. In any case, the handy number used by Lynch feels out of date at the present moment. Only time will tell us how abnormal current P/E ratios turn out to have been and how long they will remain so.

What Peter Lynch provided was a framework for a new category, the one which he called “Stalwarts” and which we call GARP. Its major characteristics as laid out by Lynch were as follows:

- Large and well established companies with strong fundamentals.

- Stable revenue growth at a rate of 8-12%.

- EPS and Free Cash Flow per share growing at a rate slightly higher than the market as a whole. Both numbers might also exceed revenue growth with strong cost controls and, increasingly in recent years, share buybacks.

- A modest PEG ratio, established by Lynch as a number under 1 but in the current environment perhaps somewhat higher.

- A business that holds up well in recessions.

- Low debt.

- A rising dividend yield and a stable and moderate payout ratio.

- Strong and persistent return on equity and return on assets.

That’s what Peter Lynch Stalwarts are in more or less quantifiable terms and which we can use to define GARP stocks. Though not perhaps as specific as those used for the CRSP Growth Index, these criteria amount to a defined Category. This leads to an important question. With those words “Reasonable Price” in its acronym, can GARP stocks be overpriced?

Both As Individual Stocks And As A Category, GARP Stocks May At Times Be Overpriced

When using the above criteria to identify a GARP stock one should not assume that it is cheap. Although the words “Reasonable Price” are part of the acronym, they are not necessarily descriptive of a particular stock in the category. A GARP stock may well be overpriced, and at times many stocks or sectors in the Category may be overpriced. Like all other stocks, be they Growth or Value, GARP stocks may become overvalued on strictly individual grounds, or as part of an overvalued market Sector, or simply because the market as a whole is overvalued.

Peter Lynch, who had a modestly positive view of GARP stocks, felt that “Stalwarts” bought at a good price should probably be sold if they went up by 50% over a brief period of time. In context of the Fidelity Magellan fund this advice made sense. The tax consequences would be minimal for investors while Lynch was always looking for a Fast Growth opportunity. You and I are in a different position. My portfolio consists entirely of GARP stocks bought at what turned out to be very good prices. If I sold, my tax bill would be very large. Unless something goes wrong with a business I rarely sell winners and much prefer to sell the occasional tranche that is in the red. The few times I sold winners on a basis of price I have come to regret it as I mentioned in the linked article.

Presently most stocks in most categories, including Growth, Value, and GARP, still seem overpriced to on the basis of any long term average value criterion. I’m not selling, but I bought only two new GARP stocks this year in my own portfolio, McKesson Corp (MCK) and Markel (MKL). I have written on both. Coincidentally, one or both of the two Buffett Berkshire Hathaway (BRK.A)(BRK.B) investment managers, Todd Combs and Ted Wechsler, did too without any communication between us, including the Berkshire 13F filing and my articles. The fact that only two GARP stocks have been seen as viable so far in 2022 suggests that factors on the above list involving PEG ratio and dividend yield include a price element which cannot be ignored either for the category or for its individual stocks.

Basing the numbers once again on his 1970s experience Lynch thought that the highest price you could pay for a run-of-the-mill stock was a P/E of 20 minus the inflation rate. Right now that means not buying an ordinary stock at more than 11 or 12 times earnings. Only McKesson of many GARP stocks I explored met that tough criterion at the time I bought it. Markel qualified because of consistent somewhat higher growth. Again choosing a number somewhere in the middle between different eras I might dock the Peter Lynch formula of 20 P/E by 5 at the present time.

So the short answer is this: don’t buy a company with the characteristics of a GARP stock but at an excessive price.

Drilling Down On UnitedHealth

UnitedHealth provides my own health insurance. It was more or less imposed on me when the Illinois State University Retirement System dumped CIGNA and chose UnitedHealth in a package which made it absorb Medicare and serve as the second payer as effectively Medicare-plus coverage. I naturally had misgivings and wondered what kind of reduction in service might result. My wife, who is also on Medicare combined with my state insurance coverage, was even more displeased because she has frequent athletic injuries. We were both pleasantly surprised. My wife, the harder sell, volunteered the view that they had been very good in covering her athletic injury treatments. The takeaway is that UnitedHealth appears to treat is customers pretty well. This is likely a factor in its ability to lock in chunks of customers through negotiation with entities like the Illinois SURS system.

Unfortunately, UNH is not cheap. The 23 P/E just seems like too much. The rising 1.31% dividend helps but just isn’t enough. The fact that stocks like McDonald’s (MCD) and Coca-Cola (KO) which have higher P/Es of 25.5 or so should not be persuasive. Companies like that fall in the Peter Lynch Category of Slow Growers with declining revenues and dividends paid by issuing debt should be dismissed as duds. I couldn’t agree more strongly. Being cheaper than both in P/E turns doesn’t cut any ice with me when it comes to accepting a UnitedHealth P/E of 23. Its growth, which is stable and excellent, just isn’t enough to justify that sort of price.

The numbers for absolute revenue growth and EPS growth, keep UNH in the gray area at the margins of growth and value, and just aren’t enough to warrant a 23 P/E. The Seeking Alpha Factor Grades for Profitability (A+), Momentum (A+), and Revisions (B+) are excellent. The Growth grade (C-) seems a bit low when set against the Revenue, EPS, and Free Cash Flow numbers as presented above. It’s Valuation that’s the hold-up, and the Seeking Alpha Factor below nails it:

Valuation: D

P/E Non-GAAP (‘FWD’) 23.76

P/E GAAP (‘TTM’) 28.21

Price/Book (‘TTM’) 6.65

EV/Sales (‘TTM’) 1.68

EV/EBITDA (‘TTM’) 18.98

UnitedHealth is ranked #3 out 9 in the Managed Health Care Industry, #168 out of 1147 in the Health Care Sector, and #895 of 4622 Overall. A quick look at its competitors in the Managed Health Care Industry revealed that the number one stock, Humana (HUM), is about 15% cheaper in terms of P/E but had slightly lower growth. The number two stock, Centene (CNC) is high growth niche company dealing with the uninsured and underinsured and belonging in the Growth category.

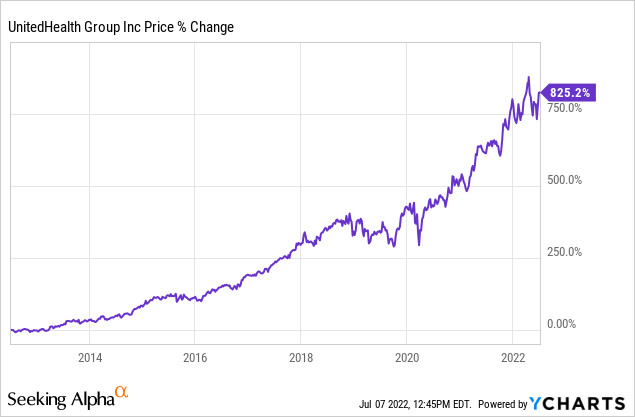

The 10-year chart below shows the recent acceleration to the upside which made the momentum grade for UNH an A+ but at the same time moved it down to a D for Value.

UNH is up more than 8 times over a decade in which its Total Revenues were up 270% and its Basic Earnings were up 350%. Quick arithmetic tells me that its 825% gain in price versus its 350% increase in earnings means that almost 60% of its gain was an increase in valuation. It undoubtedly deserved an upgrade in valuation. After all, it kept up with Apple on most operational metrics. But did it deserve that large a Valuation increase? It looks from the chart that UNH was last reasonably priced in 2020 and might require a substantial give back to be that cheap again. That doesn’t mean it isn’t a great company, mind you. Their statistical resemblance, I can’t resist adding, has roughly the same implications for Apple. Great companies, great GARP characteristics, significantly overpriced.

Conclusion

This article started with two questions, (1) whether GARP stocks are a definable category and (2) whether UnitedHealth epitomizes a wonderful company and model for the GARP category. Citing some elements by which Peter Lynch defined “Stalwarts,” I suggest a working definition of Growth At A Reasonable Price (GARP) stocks using 8 factors, some quantitative and some qualitative. The 8 factors combine some but not all of the elements used by CRSP to define Growth and Value for indexes and ETFs.

UnitedHealth is indeed a wonderful company and has all the characteristics we usually have in mind when we use the term GARP. The important question comes up when we ask if all GARP stocks are selling at a reasonable price. The answer is no. The “Reasonable Price” language for the category is part of the formal definition of the group and should not be taken to mean that all the stocks in the category or the category itself are currently selling at a cheap or reasonable price.

Many factors including some specific to the company, some coming from the sector, and some having to do with the market as a whole have an impact on the valuation of GARP stocks. In its business characteristics and metrics, UnitedHealth is an almost perfect GARP stock. Unfortunately, along with the market and its industry it is currently overpriced. It would be a very good buy if its P/E ratio dropped by around 25%.

Be the first to comment