HeliRy

Last week, United Maritime Corporation (NASDAQ:USEA) or “United” completed its spin-off from Seanergy Maritime Holdings Corporation (SHIP) or “Seanergy” to “pursue a diversified business model and greater exposure to different shipping segments“.

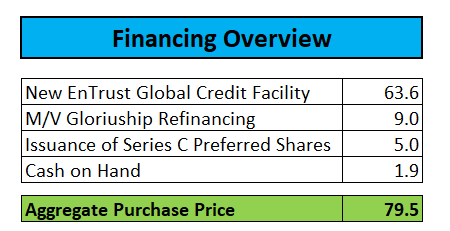

The company wasted no time expanding its fleet and on Monday announced the “accretive” purchase of four second-hand vessels for an aggregate purchase price of $79.5 million:

- two Aframax crude tankers built in 2006 and

- two LR2 product tankers built in 2008

Indeed, charter rates have been decent for both Aframax crude and product tankers in recent months so these vessels should start generating meaningful cash flow for the company very soon.

That said, the LR2 product tankers will likely be due for their 15-year special survey next year while the crude carriers will also require drydocking for their intermediate 17.5-year survey.

In contrast to peers Imperial Petroleum (IMPP, IMPPP) and OceanPal (OP), the company actually managed to significantly expand its fleet without diluting common shareholders:

Cash on hand used to fund the acquisition is expected to include $5.0 million of proceeds received from United’s former parent, Seanergy Maritime Holdings Corp., which has agreed to purchase an additional 5,000 of United’s Series C Preferred Shares.

United has obtained a commitment letter from the existing lender of the M/V Gloriuship, for the financing of 80% of the acquisition price of the four-tanker fleet. The $63.6 million facility will have a term of 18 months, will bear interest at a fixed rate of 7.90% per annum, and will amortize through 3 quarterly instalments averaging $4.0 million, followed by a $51.6 million balloon payable at maturity. The repayments will commence nine months following drawdown of the loan.

United has also received a commitment letter from the same lender for the refinancing of the loan secured by the Gloriuship with current outstanding of $4.95 million, through a new $14 million loan facility.

The new facility will have a term of 18 months, will bear interest at a fixed rate of 7.90% per annum, reduced from 10.5% currently, and will amortize through 3 quarterly instalments of $1.0 million each, followed by a $11.0 million balloon payable at maturity.

In sum, the tanker quartet will be financed as follows:

Company Press Release, SEC-Filings

Given the rather short term of the new credit facilities provided by EnTrust Global, the company will have to arrange refinancing or raise new capital in the not-too-distant future.

In addition, the issuance of additional dilution-protected 6.5% Series C Convertible Preferred Shares will provide former parent Seanergy a decent opportunity to grab back up to 29.9% of the company on the cheap should dilution cause the price of the common shares to crater like witnessed at peers Imperial Petroleum and OceanPal.

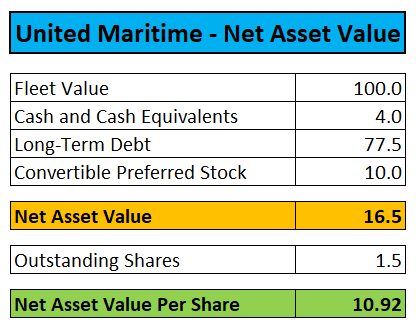

While the transaction has no direct impact on net asset value (“NAV”), debt service obligations have increased quite meaningfully, particularly when considering the quarterly instalments kicking in next year.

Company Press Release, SEC-Filings, Compass Maritime

At Monday’s close, United’s common shares traded at a rather moderate 35% discount to estimated NAV, way ahead of former parent Seanergy and closest tanker peers Imperial Petroleum and Performance Shipping (PSHG).

Bottom Line:

At current share price levels, the United Maritime spin-off represents an approximately $0.06 one-time dividend for Seanergy shareholders.

Given United’s stated intent to grow its fleet and the requirement to refinance the new EnTrust Global credit facilities by the end of next year, I firmly expect the company to raise new equity sooner rather than later.

Considering the elevated valuation relative to the company’s closest peers and likelihood of substantial dilution going forward, investors should avoid the shares or consider selling existing positions.

That said, with just 1.5 million common shares currently outstanding, I would strongly advise against taking a short position at this point as the stock might be taken for another ride by the momentum crowd at any time, quite similar to last week.

Be the first to comment