Anton Skripachev/iStock Editorial via Getty Images

I recently wrote a positive article on United Fire Group Inc. (NASDAQ:UFCS), noting how it had strung together a few good quarters of underwriting results, and continued underwriting momentum could re-rate the stock significantly higher.

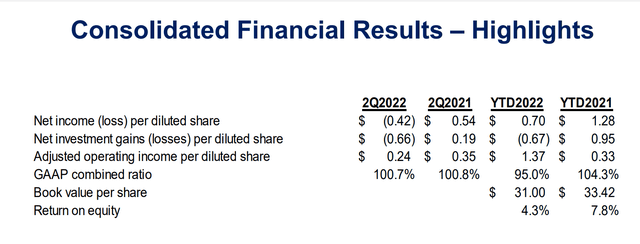

Unfortunately, the recently announced Q2/2022 results were not what I had hoped for. After two straight quarters of sub 90% Combined Ratio, the Combined Ratio climbed back above 100% in Q2. Furthermore, investment losses led to a net loss for the quarter. With YTD ROE now only 4.3%, I believe the re-rate potential has been pushed out, pending more fundamental improvements.

Quarter Was Soft But Not A Disaster

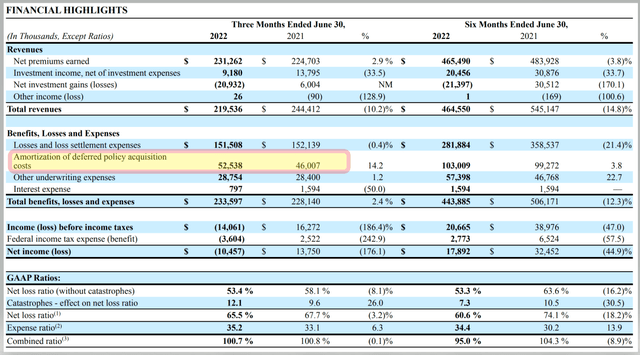

For the recently announced quarter, UFCS reported a net loss of $0.42 per share, vs. net income of $0.54 in the year-ago period, and $1.12 in Q1/2022 (Figure 1).

Figure 1 – UFCS Consolidated financial results (UFCS Q2/2022 earnings presentation)

If we look at the quarterly results in detail, it was definitely a step in the wrong direction, but not the total disaster as indicated by the 1-day stock reaction of -21.6%.

Poor Results Driven By Investment Losses

When I wrote my previous article, I highlighted a key investment risk being the YTD performance of equity and fixed income markets, and how many insurance companies were likely to report large losses:

However, given the recent market volatility and rise in bond yields, it would not be surprising for United Fire and other insurers to show large mark-to-market losses in the upcoming quarters. This could translate into weak headline earnings, and if the investments are sold to fund insurance payouts, realized losses.

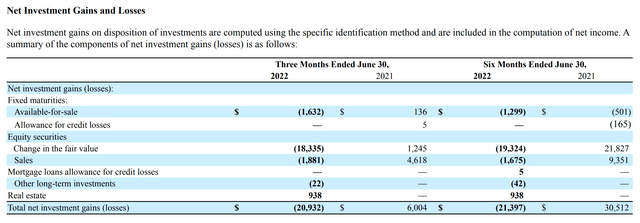

Unfortunately, this paragraph turned out to be prescient, as UFCS reported net investment losses of $20.9 million or $0.66 per share, vs. net investment gains $6.0 million or $0.19 in Q2/2021.

Digging into the details, the majority of the headline investment losses were incurred from the equity securities portfolio, which saw $20.2 million in losses in Q2 (Figure 2). At the end of Q1, the equity portfolio had carrying value of $194.2 million, so the equity portfolio experienced losses of 10.4% in Q2. For reference, the S&P 500 declined 15.7% in Q2, so UFCS outperformed the market.

Figure 2 – Investment gains and losses (UFCS Q2/2022 10Q report)

This outperformance is to be expected, as insurance companies tend to invest in more defensive securities. For example, UFCS’s equity portfolio has a 9.4% weighting to utilities, almost triple the weighting in the S&P 500.

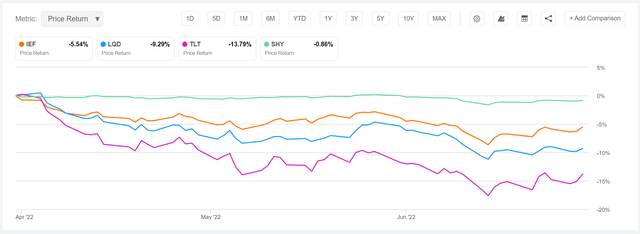

Furthermore, Net Unrealized Losses in the fixed income portfolio increased to $70.3 million from $20.2 million in the first quarter, a delta of $50.1 million. This is on a portfolio of $1.65 billion at the end of Q1, or a 3% loss. For context, the several fixed income ETFs such as the SHY, IEF, TLT, and LQD fell 0.9% to 13.8% in Q2 respectively (Figure 3), so United Fire’s fixed income losses were not out of line.

Figure 3 – Select fixed income ETF returns in Q2 (Seeking Alpha)

Note for insurance companies, fixed income securities are generally classified as “Available For Sale” and their gains and losses are realized in “Accumulated Other Comprehensive Income”, not the “Income Statement”.

Underwriting Took A Step Back To Breakeven

After two straight quarters of sub-90% Combined Ratio, UFCS’s underwriting results took a step back, reporting GAAP Combined Ratio of 100.7%. Recall, the Combined Ratio tells you how profitable the insurance business is, and 100% is breakeven, so UFCS’s Q2 underwriting results were roughly breakeven.

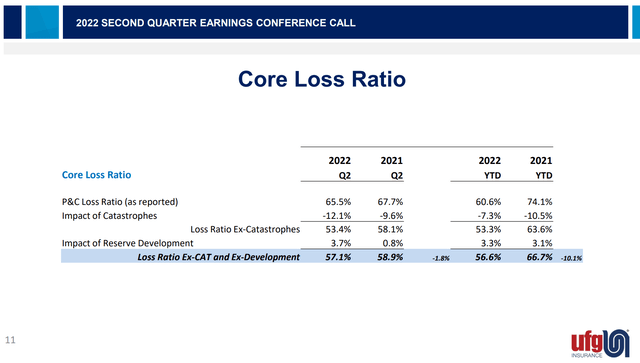

Encouragingly, UFCS’s P&C Loss Ratio improved 2.2% YoY to 65.5%. This improvement came despite above average catastrophe losses of 12.1% vs. 9.6% in Q2/2021 (management mentioned on the conference call that cat losses average 11% in second quarters). Adjusting for cat losses and positive reserve developments, UFCS’s core loss ratio showed a 1.8% improvement YoY in Q2. Year to date, core losses showed a 10.1% improvement (Figure 4).

Figure 4 – Core Loss ratio improved (UFCS Q2/2022 earnings presentation)

Although the Loss Ratio improved, UFCS’s Expense Ratio (measure of operational efficiency) deteriorated by 2.1% YoY to 35.2% (Figure 5). Looking through the details, the Expense Ratio was negatively impacted by Amortization of deferred policy acquisition costs, which increased by $6.5 million YoY. From the quarterly disclosures, it is unclear why this line item increased by 14.2% YoY. I have sent the company a question regarding this item and will report back when they reply.

Figure 5 – Expense ratio driven by amortization of PAC (UFCS Q2/2022 10Q report)

Net Premiums Earned Start To Grow

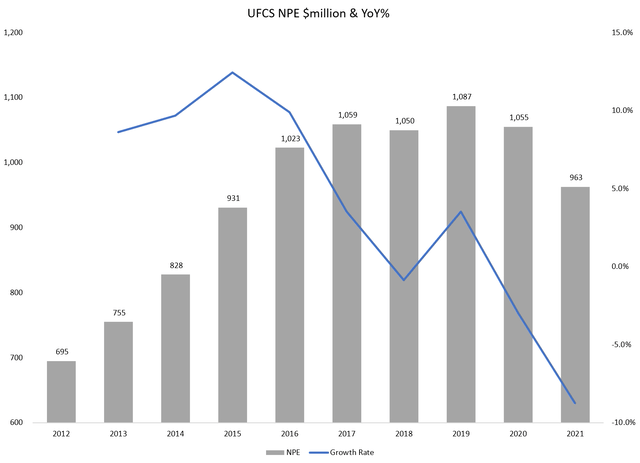

Another important point to note in the quarter is that after more than 2 years of declines, the insurance business returned to growth in the quarter, with Net Premiums Earned increasing 2.9% YoY to $231.3 million. NPE peaked for UFCS in 2019, and had declined since (Figure 6).

Recall, one of the main conclusions from my prior article was that UFCS had grown too quickly in the latter half of the prior decade and did not have a firm grasp of policy pricing, particularly in the Commercial Auto line of business. It will be important for investors to monitor UFCS in the coming quarters, to make sure the company isn’t growing at the expense of profitability like it did in years past.

Figure 6 – UFCS NPE growth (Author created with data from UFCS 10K reports)

Inflation Under Control For Now

Another key risk I identified in my prior article was the impact of high inflation:

Insurers take on insurance policies in today’s dollars and pay out claims at a future date. If inflation is very high (for example the material and labor costs to fix a car) and the insurer did not take that into consideration when setting the policy rate, then actual loss ratios could be higher than expected.

On this point, management continues to believe they are taking adequate pricing action that more than offsets inflation. YTD, renewal premiums are up 8.1%, with 5.1% coming from rate increases and 3% coming from exposure changes. Commercial auto rate increases averaged 7.1% while commercial property averaged 9.2% rate increases.

New CEO To Take The Helm In August

UFCS also announced on July 7th that Randy Ramlo, the current CEO, will retire and Kevin Leidwinger will take his place on August 22nd. This was widely expected, as Mr. Ramlo announced his intention to retire earlier.

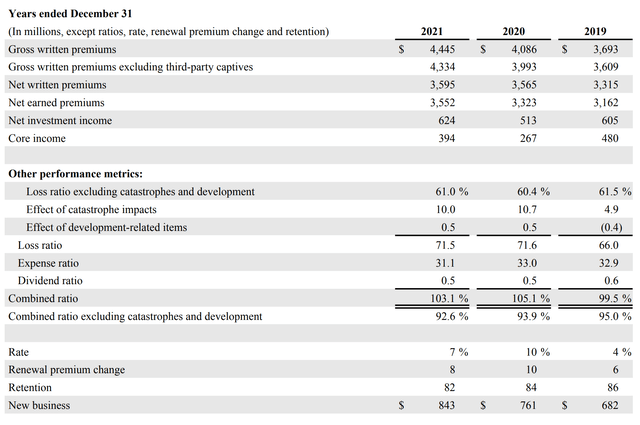

Mr. Leidwinger has more than 30 years of experience in the insurance industry, most recently as President and Chief Operating Officer of CNA Commercial Lines.

While not totally comparable, CNA Commercial Lines operations for the past 3 years are included below in Figure 7. In terms of size, CNA Commercial Lines is approximately 4x the size of UFCS. Underwriting performance has not been particularly robust, with combined ratios of 103.1% and 105.1% in 2021 and 2020 respectively. These figures appear to have been impacted by cat losses of 10.0% and 10.7%. However, combined ratios for CNA Commercial Lines were 101.1%, 102.7%, and 104.1% in 2018, 2017, and 2016 respectively as well.

Figure 7 – CNA Commercial Lines financial summary (CNA 2021 Annual Report)

It is too far early to judge Mr. Leidwinger’s performance solely on CNA Commercial Lines’ combined ratio. Perhaps the business was run to maximize insurance float (monies to be invested), and hence a moderate underwriting loss was acceptable. In any event, Investors should closely monitor the coming quarters to see how the new CEO will be implementing his vision and strategy for UFCS.

Valuation Back In The Penalty Box

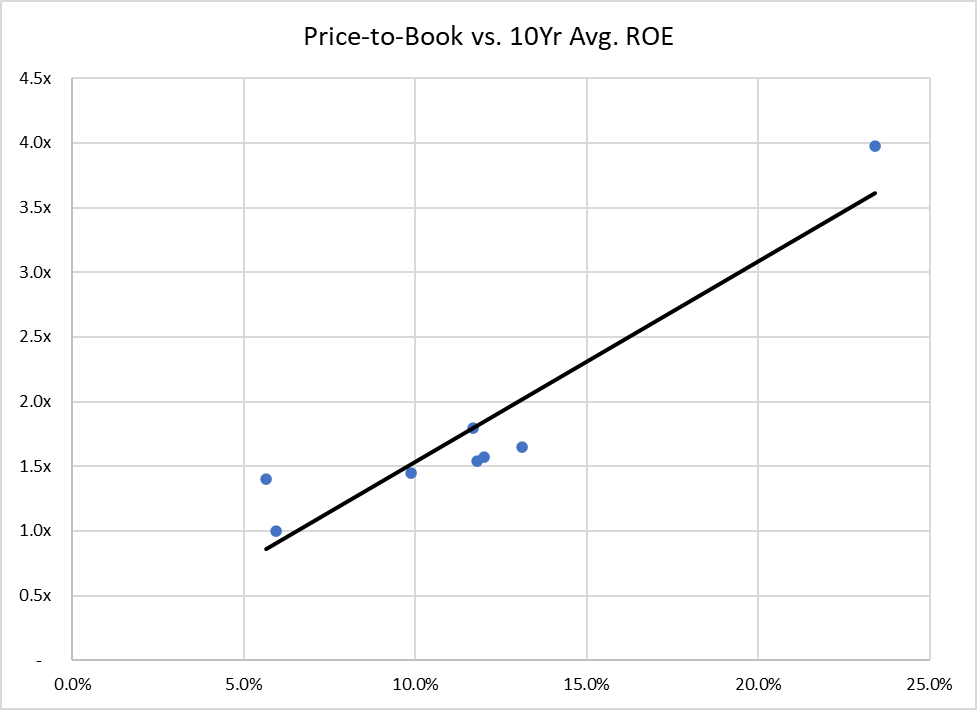

The weak financial performance in Q2 combined with unrealized fixed income losses led to a decrease in book value per share to $31.00, from $33.27 last quarter. YTD ROE declined to 4.3%.

Previously, I had shown the following chart, which suggests UFCS could re-rate higher to 1.5x P/B if it were able to sustain a 10%+ ROE. However, as UFCS’s ROE has declined to 4.3% YTD, I believe this re-rate will have to take longer. I now value UFCS at 0.9x P/B on current book value of $31.00, which gives fair value of $28.00.

Figure 8 – P/B to ROE valuation (Author created with data from tikr.com)

Stock Price Over-Reacted But Recovery Will Take Time

UFCS’s stock price certainly over-reacted to the weak quarter, dropping by 21.6% on August 4th on the back of the earnings release. As level-headed investors pored through the earnings release, the stock rebounded by 10.0% on August 5th to $27.81.

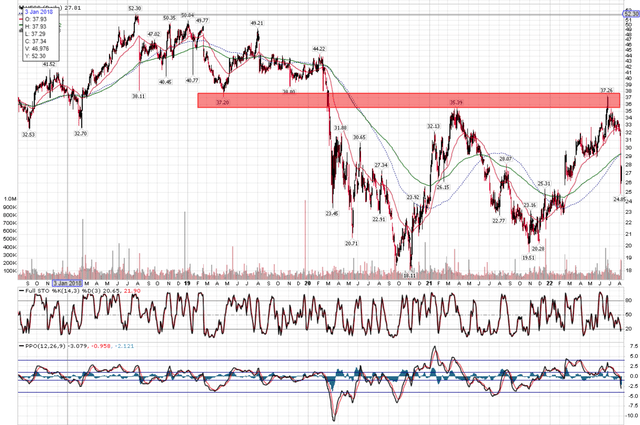

I had previously identified the $35 to 37 area as key resistance zone, and recommended cautious investors acquire shares above this resistance zone, which should coincide with further operational results confirming the turnaround story. This remains the main technical recommendation.

Figure 9 – $35 to 37 remains resistance (Author created with price chart from stockcharts.com)

The poor quarterly results was a strong negative thrust that will need quite a bit of time and positive fundamentals to overcome.

Moving To A Hold Pending Further Underwriting Improvements

While UFCS’s Q2 earnings was disappointing, it wasn’t the total disaster that the negative stock reaction would imply. Core loss ratios improved YoY and premiums earned returned to growth after 2 years of declines. However, it was disappointing to see combined ratios climb back above 100%, after 2 straight quarters of sub 90%. With YTD ROE now only 4.3%, the re-rate potential has been pushed out pending more underwriting improvements. I am changing my recommendation to a HOLD.

Be the first to comment