shaunl

Thesis

Leading railroad Union Pacific Corporation (NYSE:UNP) is scheduled to report its Q2 earnings on July 21. It has been battered since its March highs, losing about 27% to its recent lows this week. However, given its long-term uptrend and robust profitability, we believe some long-term investors could have used the recent dips to add to their portfolios.

Notwithstanding, investors need to consider that UNP could be reporting slower growth in its revenue and profitability moving ahead as macros headwinds continue to pile up. Consequently, our valuation model suggests that UNP could underperform even at the current levels.

Our price action analysis suggests that UNP has been trying to consolidate. However, it remains mired in a medium-term bearish bias; therefore, we believe it is not conducive for aggressive dip buying yet. Hence, we urge investors to wait for more constructive price action before pulling their buy triggers.

Accordingly, we rate UNP as a Hold for now.

Union Pacific – The Disappointment May Not End In Q2

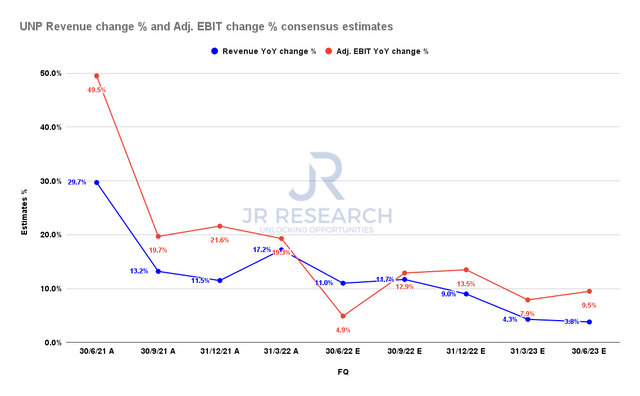

Union Pacific revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

CFO Jennifer Hamann revised the company’s guidance at a June conference. She emphasized that UNP doesn’t expect to achieve its 45% operating margin range in FY22, given the intensifying macro headwinds.

The revised consensus estimates (generally bullish) indicate that Union Pacific could post a FY22 adjusted EBIT margin of 42.9%, slightly ahead of FY21’s 42.8%. Furthermore, Union Pacific’s revenue and adjusted EBIT growth cadence are projected to moderate through Q2’23, exacerbated by the recessionary headwinds.

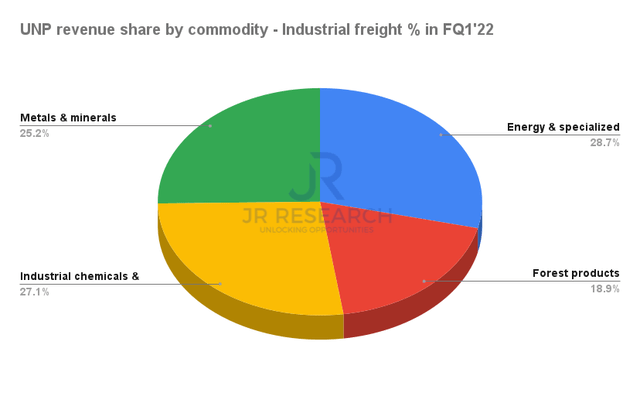

UNP revenue share by commodity – Industrial freight % in FQ1’22 (Company filings)

Given the company’s exposure to the various commodity markets, as seen above, we believe the moderation in estimates is credible. Moreover, UNP also cautioned in its 10-Q, accentuating the headwinds. It added (edited):

We are affected by general economic conditions. Prolonged, severe adverse domestic and global economic conditions or disruptions of financial and credit markets, including inflation, may affect the producers and consumers of the commodities we carry and may have a material adverse effect on our access to liquidity, results of operations, and financial condition. (Union Pacific FQ1’22 10-Q)

Susquehanna also articulated in an early July note, accentuating these concerns. It added (edited): “There is also a growing risk of underlying demand softening before rail capacity meets the challenge, as the Fed’s inflation fight cools rate-sensitive rail markets, such as housing, construction, and autos.”

Still, Profitability Should Remain Robust

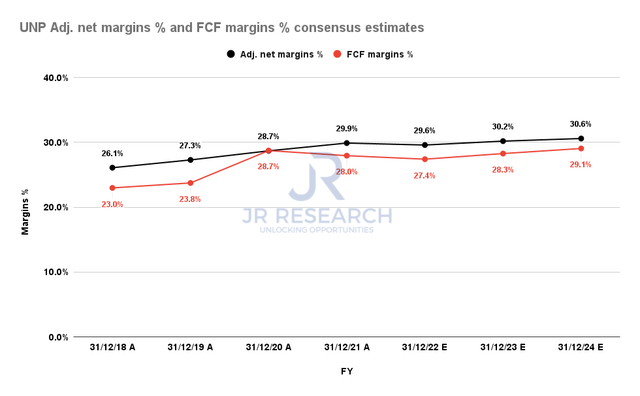

Union Pacific adjusted net margins % and FCF margins % consensus estimates (S&P Cap IQ)

Notwithstanding, Union Pacific’s adjusted net margins and free cash flow (FCF) profitability are projected to stay robust, despite the revenue headwinds.

Therefore, the company’s excellent operating model could still lend tremendous support to its valuation, demonstrated clearly in its long-term uptrend.

UNP – Solid Long-Term Uptrend

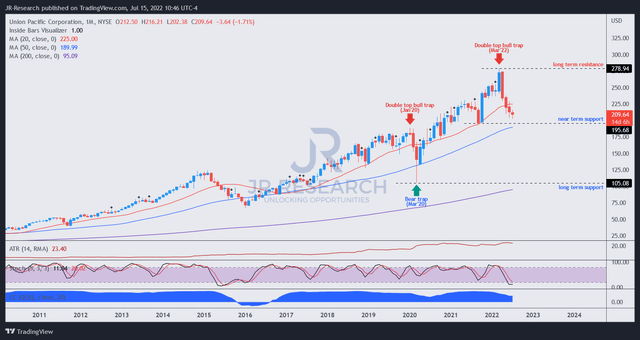

UNP price chart (monthly) (TradingView)

For a fundamentally-strong stock like UNP, we can glean its long-term uptrend clearly on its monthly chart. Therefore, long-term investors could hardly have gone wrong buying UNP on significant dips over the years.

Notably, UNP looks oversold on its long-term charts, having fallen steeply from its double top bull trap (significant rejection of buying momentum) in March 2022. Therefore, a short-term consolidation is likely as it could appeal to long-term dip buyers to add exposure.

However, in our medium-term charts, we noted that UNP is still entrenched in a bearish bias, and we have not observed constructive price action yet. Therefore, we believe investors should be patient and wait for a re-test of its near-term support ($195) first.

UNP – Valuation Suggests Caution

| Stock | UNP |

| Assumed entry price | $195 |

| Hurdle rate [CAGR] | 5% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 5.5% |

| Assumed TTM FCF margin in CQ4’26 | 28.3% |

| Implied TTM revenue by CQ4’26 | $29.59B |

UNP reverse cash flow valuation model. Data source: S&P Cap IQ, author

We used its near-term support as our entry level, with a hurdle rate of 5% (market-underperform). Our hurdle rate is also markedly lower than UNP’s 5Y total return CAGR of 15.8%.

We used a FCF yield of 5.5%, which we think appropriately models the current market dynamics. Notably, the marker rejected further buying upside in March, even as UNP traded at a FY24 FCF yield of 4.34%. UNP last traded at a FY24 FCF yield of 5.76%, which could also form its near-term bottom. As a result, we believe the market will likely ask for higher yields to compensate for potential underperformance.

Moreover, our TTM revenue target of $29.59 by CQ4’26 seems achievable based on the current consensus estimates. However, that’s predicated on a market-underperform hurdle rate of 5%. As a result, even though we think UNP is more well-balanced now, we believe investors should continue to be patient.

Is UNP Stock A Buy, Sell, Or Hold?

We rate UNP as a Hold for now.

Management needs to assure investors that it doesn’t expect these headwinds to be extended, impacting its profitability growth cadence through FY24.

Our valuation model suggests that UNP’s surge from its COVID bottom was too much and too fast. Therefore, we believe UNP needs to fall further to help investors improve their potential for outperformance when adding exposure.

Our price action analysis indicates that UNP is at a likely bottom. However, we encourage investors to first wait for a re-test of its near-term support ($195).

Be the first to comment