Pavliha/iStock via Getty Images

Introduction

Union Pacific (NYSE:UNP) shares are down more than 30% from their all-time high as a result of weakening economic growth, challenges related to railroad operations, labor talks, a hawkish Fed, and ongoing (related) supply chain problems. Not only is the company my second-largest dividend growth investment, but it’s also a bellwether of the US/global economy, given its dominant position in every supply chain imaginable. Hence, in this article, we’re going to dive into the company’s earnings, using the bigger economic picture and all-important variables that will help us to understand whether we’re dealing with a company in trouble or a buying opportunity.

Spoiler alert, I’m buying more as the company is starting to offer tremendous value, especially for people looking to make bigger investments in the industry.

So, let’s get to it!

Some Context

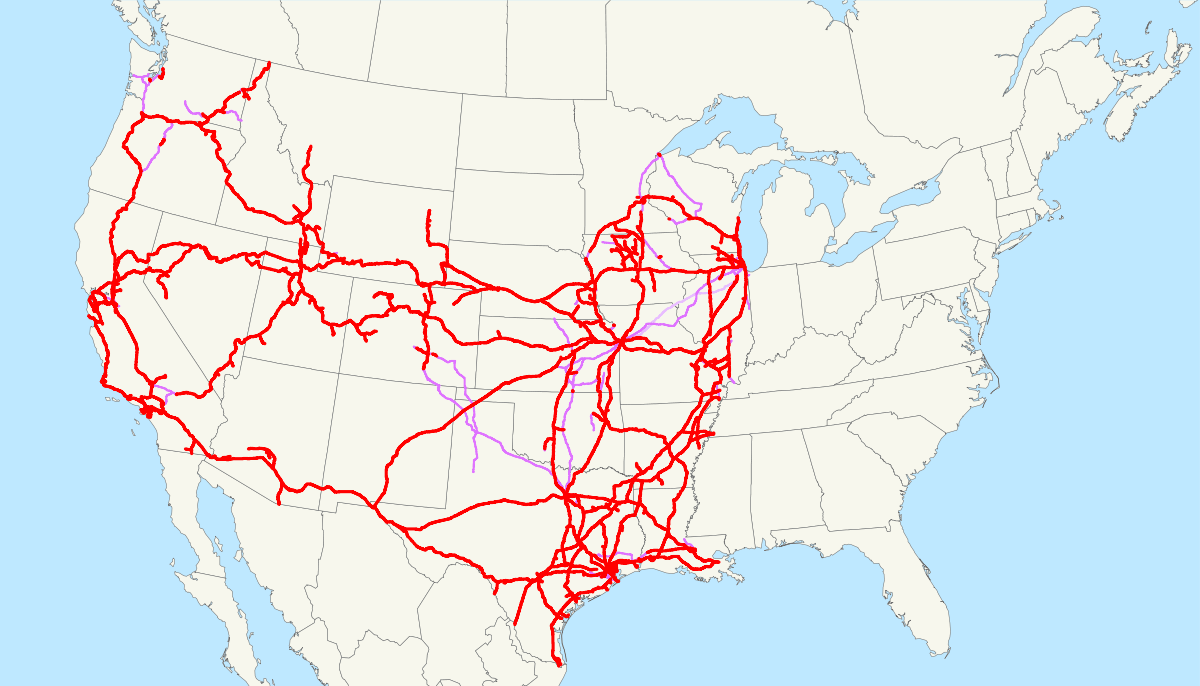

Before we dive into the company’s earnings, I believe it is extremely important to zoom out and look at the bigger picture. After all, we’re dealing with the largest stock-listed railroad in North America, responsible for almost all major rail traffic in the Western part of the United States – together with its Buffett-owned peer BNSF.

Union Pacific

Starting with the biggest issue, economic growth is slowing. The high growth rate we enjoyed last year (as a result of the post-pandemic recovery) is gone. Now, we’re stuck with an ugly mix of persistently high inflation, a hawkish Fed, consumer weakness, supply issues, and related problems.

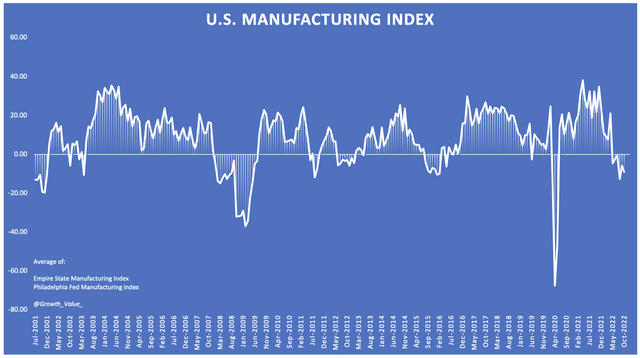

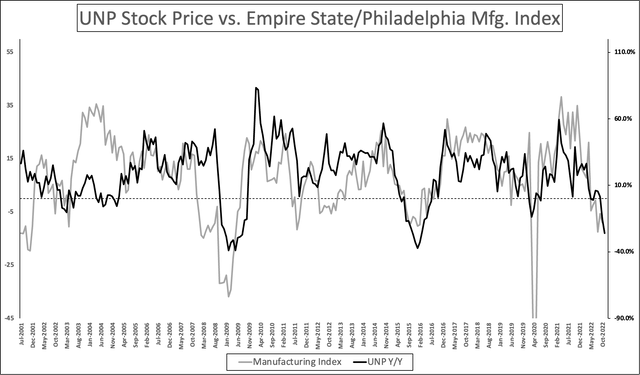

Before I started writing this article, I updated my manufacturing index, which consists of New York and Philadelphia Fed numbers. What we’re looking at is contraction, after almost two years of very high expectations.

Author

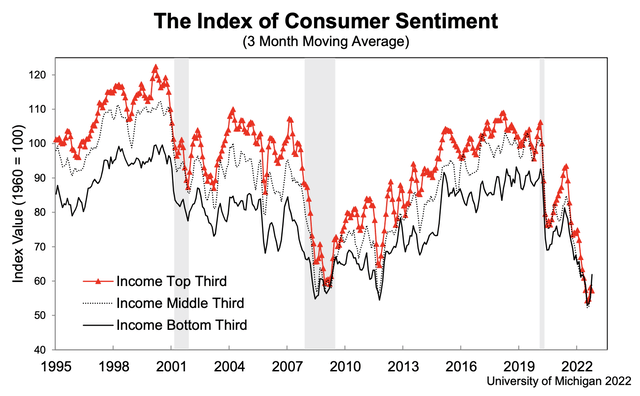

While manufacturing is connected to pretty much every other industry, problems are now everywhere. For example, this is what consumer sentiment looks like:

University of Michigan

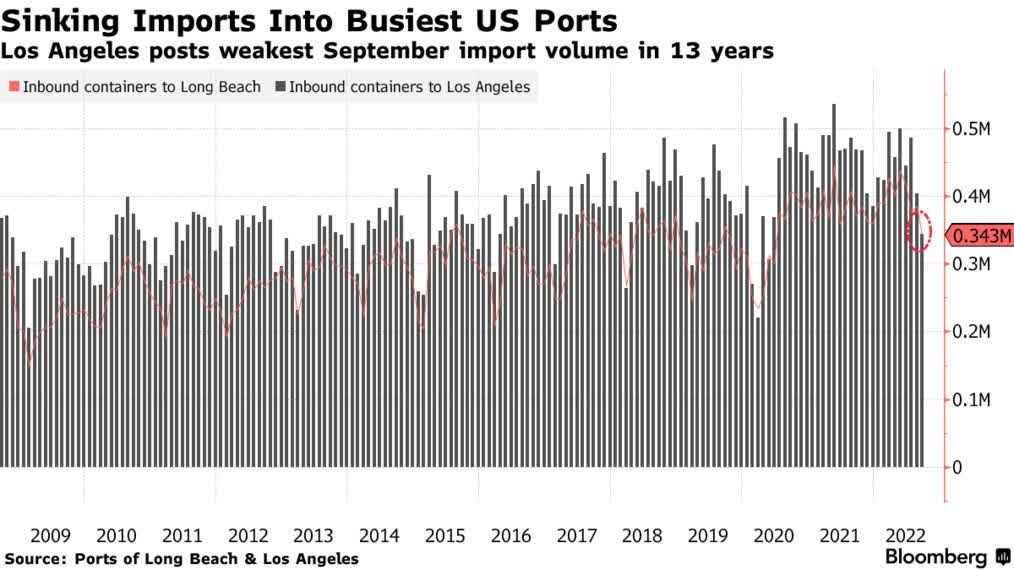

What this means is that overall transportation demand is lower. In this article, we will discuss this in greater detail using Union Pacific’s own numbers. In a situation where consumer demand drops, railroad traffic is impacted. One way railroads are hurt is by lower imports. As a lot of (cheaper) consumer goods are imported, we now see that the busiest US ports are witnessing a steep decline in container imports:

Bloomberg

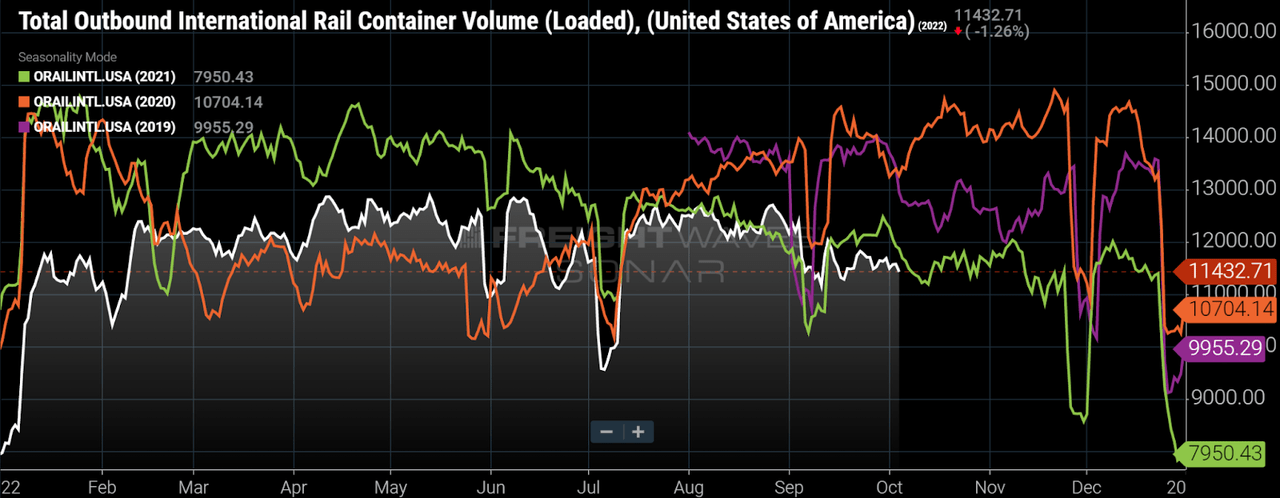

Unfortunately, outbound volumes aren’t much better as outbound rail container volumes are now below anything we’ve seen in the prior three years.

FreightWaves

On top of that, railroads are dealing with operating issues. In the third quarter, railroads worked on a last-minute tentative labor agreement with labor unions as railroads were dealing with the risk of strikes in light of unsatisfied workers.

The pandemic caused a steep decline in shipments, which caused railroads to lay off workers. It didn’t just happen in the railroad industry, but pretty much everywhere.

Railroads were already focused on efficiencies by implementing Precision Railroading (“PSR”).

Under PSR, freight trains operate on fixed schedules, much like passenger trains, instead of being dispatched whenever a sufficient number of loaded cars are available. In the past, container trains and general merchandise trains operated separately; under PSR they are combined as needed. Inventories of freight cars and locomotives are reduced and fewer workers are employed for a given level of traffic.

During the pandemic, this wasn’t an issue. It became a problem when the demand came back. Global container shipments exploded when countries reopened their economies, overwhelming railroads, and international ports.

Now, railroads are accelerating hiring efforts, going into a steep slowing cycle. That’s not perfect, but it’s a chance to rebuild trust with customers.

With all of this in mind, let’s look at Union Pacific’s results.

UNP 3Q22 Wasn’t Great

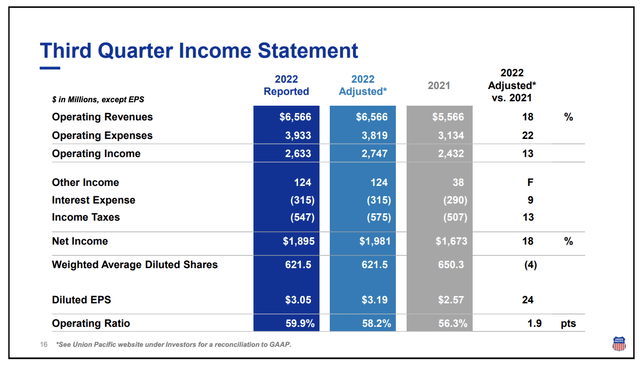

The Nebraska-headquartered railroad generated $6.57 billion in third-quarter revenue. That’s $160 million higher than expected and 18.0% higher compared to the prior-year quarter.

Adjusted EPS came in at $3.19. That’s $0.13 higher than expected.

The official statement from the company can be seen below:

We made positive strides in the third quarter to increase network fluidity and better meet customer demand,” said Lance Fritz, Union Pacific chairman, president, and chief executive officer. “Inflationary pressures and operational inefficiencies continued to challenge us. We reported strong revenue and operating income growth in the quarter through increased fuel surcharge revenue, volume gains, and solid core pricing. As we close out 2022, we will maintain strong price discipline while improving efficiency and service to capitalize on the available demand.

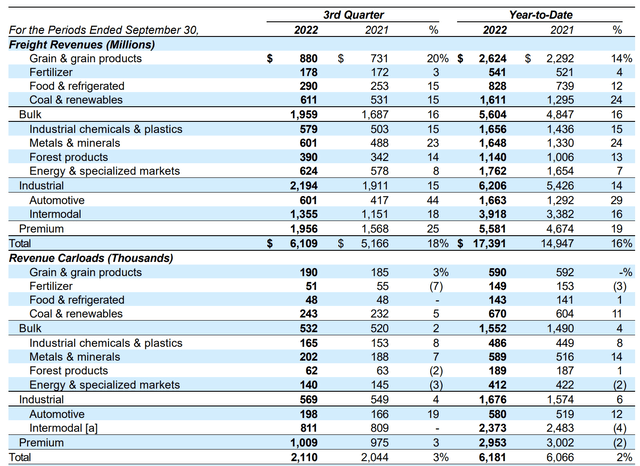

These results were provided by a 3% surge in total carloads to 2.1 million carloads. Bulk shipments soared 2% as a result of strong grain shipments and higher coal shipments, which were partially offset by lower fertilizer volumes.

Union Pacific

Industrial shipments were up 4% thanks to strong industrial chemicals and metals and minerals. These shipments were partially offset by lower forest products and energy & specialized markets.

Premium shipments were up 3% as 19% growth in automotive shipments met flat intermodal shipments (trailers and containers).

Higher pricing results in total revenue growth of 18% as I just mentioned with growth in every single segment. The strongest segment was automotive, which benefited from easing supply chain issues, allowing producers to turn backlog into finished cars.

Moreover, coal, fertilizer, and grains were strong. I expect that to continue as the war and changing landscape of high export demand for energy and agriculture have put the United States in a terrific spot to (partially) satisfy the needs of overseas countries.

Intermodal benefited from increased inland shipments, which shows that trucks have not become an issue due to low freight rates. However, the company sees softening domestic intermodal demand, which confirms what we discussed in the first part of this article: weakening economic growth and soft consumer demand.

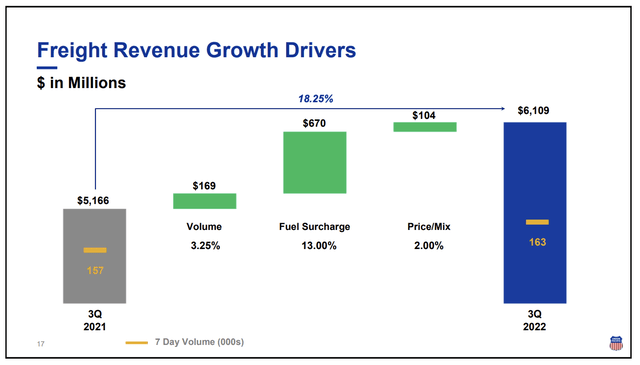

The overview below shows that volume and pricing accounted for roughly 5.25% of year-on-year revenue growth. Fuel surcharges contributed 13.0% or $670 million as a result of – you guessed it – high fuel prices.

Union Pacific

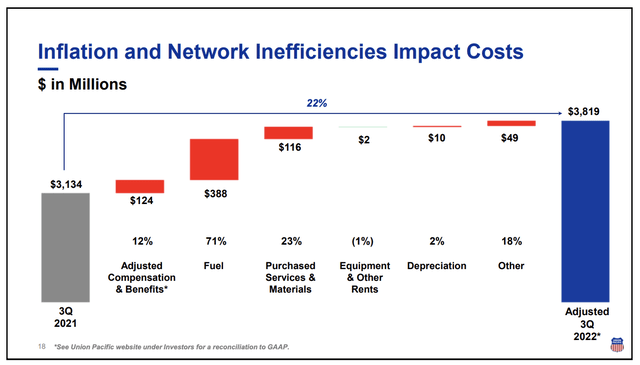

At this point, you probably know where I’m going with this. In an environment where fuel surcharges are close to $700 million, operating expenses will be an issue. And that’s correct.

Expenses rose by 22%, outperforming revenue growth by 400 basis points. While compensation costs underperformed, fuel expenses rose by 71%, adding $388 million to the fuel bill in 3Q22. Purchased services and materials added 23%.

Union Pacific

The result can be seen below. Operating income rose by 13%, which means the operating ratio rose to 59.9%. This is quite high, and one of the reasons why UNP shares aren’t doing so well this year, to put it mildly.

For people who are new to railroads, the operating ratio measures how much it costs as a percentage of total revenues to run the railroad. The lower the operating ratio, the better.

Union Pacific

Non-adjusted EPS came in at $3.05. EPS benefited from share repurchases. The number of shares outstanding was 4% lower. More on that in this article.

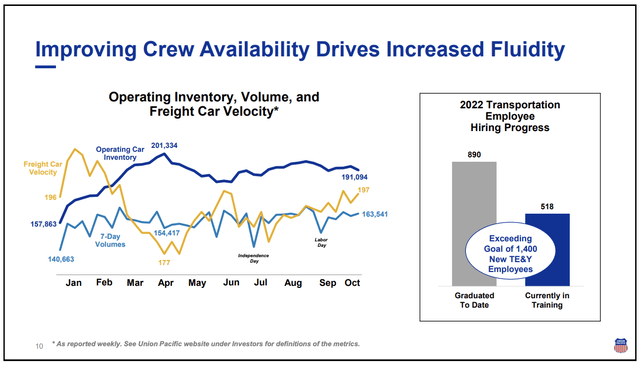

With that said, the company exceeded its hiring goals for 2022, which is great news. Unfortunately, the cost per employee came in higher than expected, rising 8%, driven by wage inflation.

The company currently has 518 new train, engine, and yard employees in training. 890 have graduated to date. This helped the company to improve freight car velocity.

Union Pacific

Unfortunately, velocity was still down. 3Q22 velocity came in at 191 daily miles per car. That’s down from 195 daily car miles in the prior-year quarter. Intermodal trip plan compliance (% of boxes on time) fell by 4 points to 62%. The total number of cars that were on time fell to 58%. That’s down from 60% in 3Q21, but up from 56% in 2Q22.

Still, these numbers are bad. I expect these numbers to improve gradually if countries around the globe refrain from using new lockdowns to fight whatever is left of the pandemic.

According to Union Pacific:

Entering the fourth quarter, as we continue to improve train speed and other measures, locomotive productivity will continue to strengthen as well. Third quarter workforce productivity was flat as both the labor force and car miles increased. Train length improved 1% compared to third quarter 2021 as the team utilized longer trains to handle increasing volumes.

The company will have to find a balance between higher crew numbers, elevated operating inventory, and falling economic demand, which will erase some of its freight demand at a time when it is boosting equipment and labor.

In other words, the company needs to balance the surge in volumes compared to the pandemic lows, while increasingly incorporating economic weakness.

The Outlook Isn’t Great Either

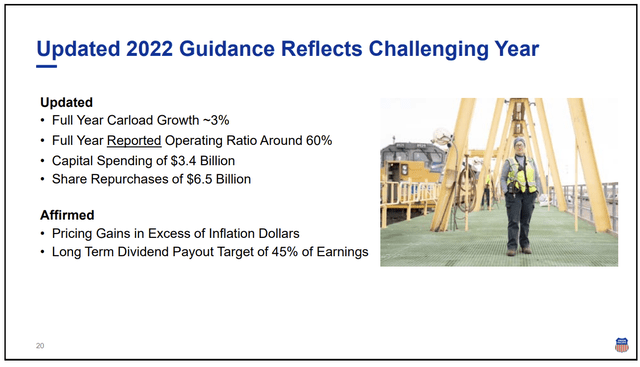

The company sees full-year carload growth of roughly 3%. In the second quarter, the company expected between 4% and 5% in carload growth as volumes were expected to rebound in the second half. That is still happening, just at a slower pace.

UNP expects to end up with a full-year operating ratio “around” 60%. That’s up from “around” 58%. This 200 basis points increase is a big deal. Going into this year, the company expected a 55.5% operating ratio.

While the company is not yet ready to share its 2023 outlook, we can expect that UNP will aim to end next year with a 55.5% operating ratio.

Union Pacific

Capital spending estimates are up $100 million to $3.4 billion.

The company is now expected to repurchase shares worth $6.5 billion. Prior estimates were that buybacks would be in line with 2021 levels. 2021 saw buybacks worth $7.3 billion. In other words, the company is reducing that number to deal with a more challenging environment, which is a logical step.

Why I’m Not Worried

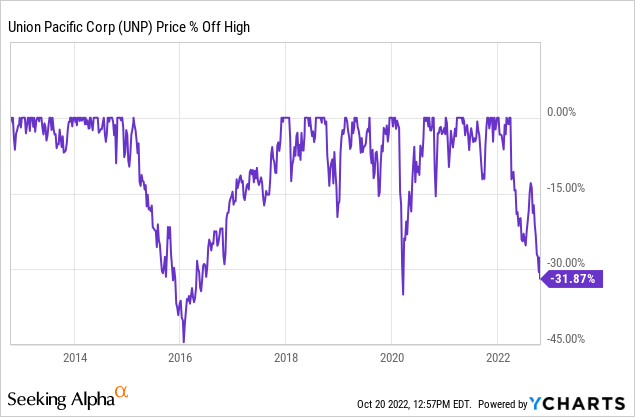

Union Pacific shares are down almost 6% while I am writing this. The company behind the “Building America” slogan is now roughly 32% below its all-time high. That’s 10 points better than the performance of 2015 when the company was hit by a manufacturing recession and an implosion of commodity prices and demand.

Right now, UNP shares are inches away from my average entry price. That would be bad news if I were a trader. Yet, as a long-term investor, I’m quite excited to be buying UNP with a high yield again.

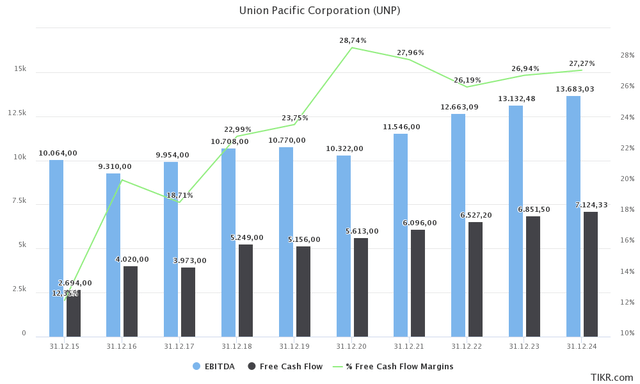

This year, the company is still expected to maintain a free cash flow margin of more than 26.0%, generating $6.5 billion in free cash flow. That would imply a 5.5% free cash flow yield, using the company’s $117.2 billion market cap. Next year, that number could be 5.9%.

TIKR.com

Even if these estimates come down further, the company will be able to sustain and grow its current dividend yield of 2.7% – as well as its planned buybacks.

The company’s balance sheet also remains solid. The net leverage ratio is not expected to rise above 2.60x.

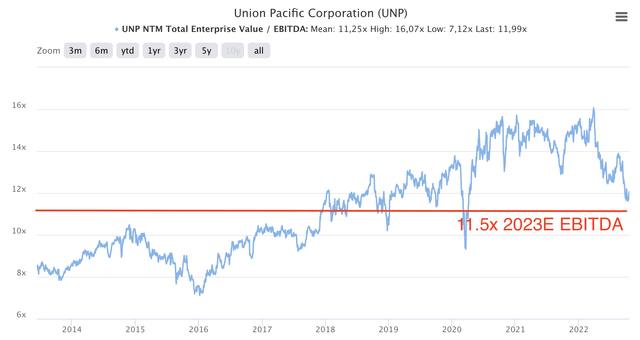

Moreover, the company is now trading at an enterprise value of $150.2 billion, using its $117.2 billion market cap and $33.0 billion in 2023E net debt. That’s 11.5x 2023E EBITDA.

That valuation is now more attractive than anything we have seen after 2018 – excluding the 2020 sell-off.

TIKR.com (+ Author Notes)

When adding the year-on-year performance of the UNP stock price to the manufacturing chart I showed in the first part of this article, we see that a lot of weakness has been priced in.

Author

In other words, I’m really starting to like the risk/reward at these levels.

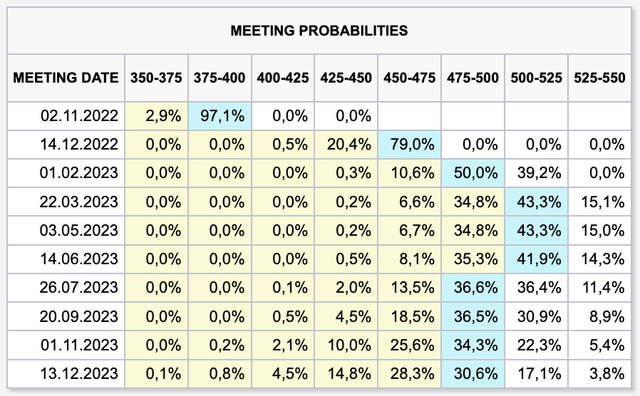

The biggest downside risk is a continuation of the ongoing hiking cycle. The Fed is now expected to hike rates past 5.0%, keeping it at these levels until inflation eases. That could put tremendous stress on financial stability, and eventually force the Fed to end QT and lower rates again.

CME Group (Expected Fed Funds Rate)

Yet, despite these issues, I remain bullish based on the risk/reward through the eyes of a long-term investor with significant exposure in this railroad.

Takeaway

There’s no denying that the 3Q22 earnings release was a big disappointment. While both revenue and EPS estimates were beaten, the company lowered full-year guidance as it witnesses a slowing economy, rising labor costs, and higher expenses related to improving network efficiencies.

The company is now entering an economic downturn while still dealing with supply issues caused by the pandemic – and PSR.

However, as a long-term investor, I am not worried. The stock price decline means that a lot has been priced in. The dividend yield has crossed 2.7%, and the EV/EBITDA valuation is at a 5-year low.

I also believe that UNP will be able to deal with supply chain issues. It has hit its hiring target and could soon get some “help” from slower customer demand when it comes to dealing with the backlog in other areas.

My strategy is to continue buying. I recently added to its peer Norfolk Southern (NSC), and I will continue to add quite aggressively to UNP in the weeks and months ahead.

(Dis)agree? Let me know in the comments!

Be the first to comment