Christopher Furlong/Getty Images News

When looking at the financial headlines in the last few weeks and months, there seem to be two buzzwords which are rather dominant – “inflation” and “recession”. With the S&P 500 (SPY) declining about 23% from previous highs and being officially in a bear market, it is not surprising to read a lot about a potential recession. And with inflation rates being in the high single-digits in many countries around the world, it is also not surprising that inflation is dominating financial news.

And although the stock price of Unilever (NYSE:UL) was constantly declining during the last few months, Unilever might be one of the suitable picks for this environment as the company should be able to withstand these two major challenges – inflation and recession – quite well. In the following article, I will argue why I think Unilever might be a good pick and a “sleep well stock” like I argued in my last article.

Unilever Can Withstand the Inflation

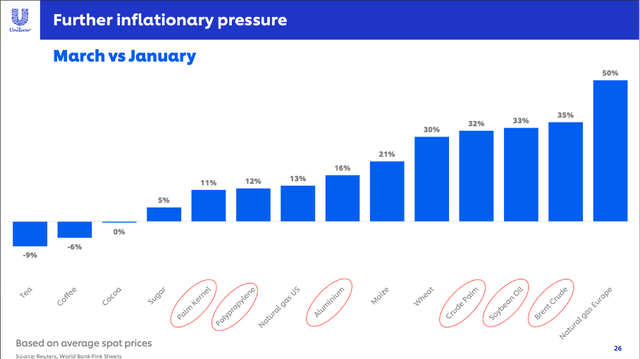

When looking at the last quarterly or the last fiscal results, we can see why Unilever is able to withstand the inflation quite well and might be able to perform well during an inflationary environment. Before we get carried away, we also must acknowledge that Unilever is dealing with increasing prices for raw materials which is leading to rising expenses. I already mentioned the inflationary pressure in my last article and during the last few months, the situation got even worse. While prices for tea or coffee declined, most other raw materials prices increased at least in the double digits during the last few months.

Unilever Q1/22 Trading Statement

We can speculate if inflation might have reached its peak and level off again in the coming quarters, but we never know. The Federal Reserve is raising rates again and while the 75 bps increase last week was the highest rate hike since 1994, it is not enough to get inflation under control. And the European Central Bank is also discussing about rising rates – but discussing that possibility probably won’t be enough.

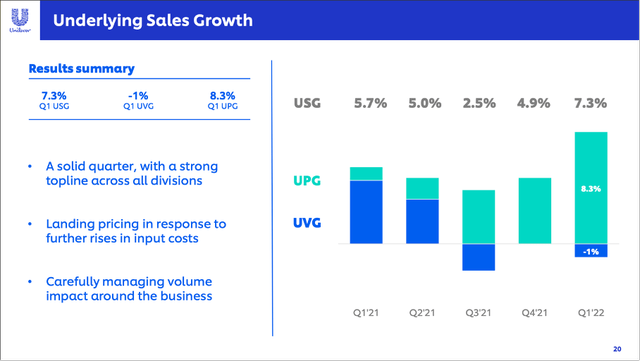

However, when looking at the last quarterly results, we can see that Unilever is able to pass these price increases on to the consumer. Revenue increased from €12,328 million in the same quarter last year to €13,782 million in this quarter – resulting in 11.8% year-over-year growth. And underlying sales growth was 7.3% in this quarter with sales volume declining 1.0% but prices increasing 8.3% YoY.

Unilever Q1/22 Trading Statement

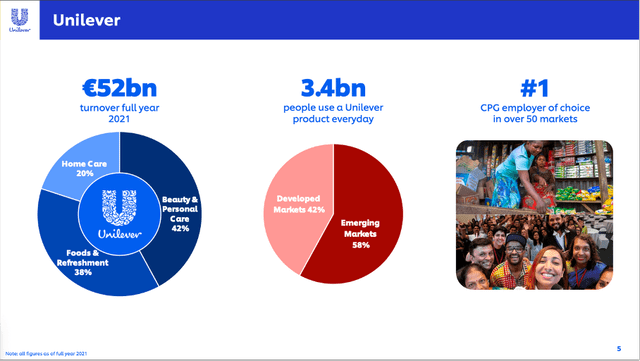

We can also look at the results for fiscal 2021. And of course, inflation was not as extreme in 2021 as it is in 2022, but we can see that Unilever was able to perform quite well and could not just increase its top line by raising prices. When looking at the full year results for fiscal 2021, revenue increased from €50,724 million in fiscal 2020 to €52,444 million in fiscal 2021 – 3.4% year-over-year growth. Operating profit increased from €8,303 million in fiscal 2020 to €8,702 million in fiscal 2021 – 4.8% year-over-year growth. And finally, diluted earnings per share increased 9.4% from €2.12 in fiscal 2020 to €2.32 in fiscal 2021.

And Unilever will be able to increase prices further in the quarters to come. Due to the economic moat around the business (which is based on a portfolio of several great and well-known brand names), Unilever should be able to increase prices further without losing customers. In my first article about Unilever, I describe the economic moat in more detail:

The reason brands are so powerful and lead to a wide economic moat for a company is quite simple: Brands usually deliver a constant experience for its customers and this consistent experience for the customers drives loyalty of these customers and the companies shouldn’t give the customer any reason for switching to another company and another product. Unilever is generating a competitive advantage as it is reducing search costs for the customer. By recognizing a brand, I know I can trust the product and be sure I will get a similar quality as in the past.

And it is rather difficult for competitors, to reproduce the assets and brand names Unilever has as it would cost a lot of money to establish similar brands as Unilever. And the pricing power of Unilever and its ability to raise prices a little bit every single year is proof, that competitors can’t copy Unilever’s brands and products so easily.

And Unilever could also profit from an inflationary environment for another reason. When looking at the company’s balance sheet on December 31, 2021 (Unilever is reporting its balance sheet only twice a year) the company had €7,252 million in short-term financial liabilities and €22,881 million in long-term financial liabilities. And when comparing €30,113 million in total debt to the total equity of €19,746 million this is resulting in a debt-equity ratio of 1.53. When comparing the total debt to the operating income of €9,636 million, it would take a little more than 3 years to repay the outstanding debt, which is acceptable. But Unilever can increase its operating profit and free cash flow in such an environment quite easily (at least when it can keep its expenses under control) and the debt (which is the same) can be repaid easier.

Unilever also has a high exposure to Asia. When looking at the three geographic regions Unilever is reporting in, Europe is taking the third spot, America (North- and South America) is taking the second spot and Asia/AMET/RUB is taking the first spot. In fiscal 2021, €23.4 billion in revenue were generated there (46% of total revenue). China is accounting for about 6% of total revenue and India is account for about 11% of total revenue.

And this is not only interesting as China does not have the same inflationary problems as many western countries right now, but the emerging markets are also offering the opportunity to grow by increasing volumes and not just the price (as reaction to the high inflation rates).

Unilever Can Withstand the Recession

Aside from high inflation, there is another risk most businesses are facing right now: The high probability that the United States will be in a recession at some point during the next few quarters. However, we can see Unilever as a rather recession-proof business as the company is mostly selling essential, every-day products. And people will continue to purchase these products even during economic downturns as it is rather impossible to give up on consuming these products (as they are essential).

Customers might be able to switch to the product of a competitor, which might be cheaper. But we should not forget the strong brand name (and the positive experience customers are associating with the product) and that might make switching more difficult. And as we are talking about products that cost only a few dollars (or euros) or sometimes even less, it might not be incentive enough to save a few cents by switching to the product of a competitor. When people must save money during a recession, they will start cutting down expenses somewhere else.

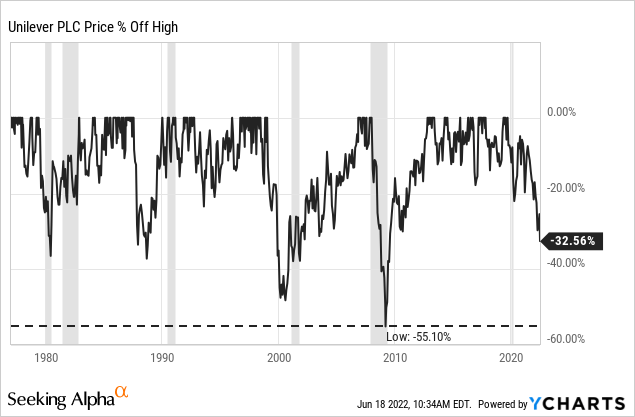

The stock is also a rather good investment for a recession as the drawdowns were not so extreme. In the last 45 years, the steepest drawdown for the stock was during the Great Financial Crisis when Unilever declined 55%. However, during many other recessions (and bear markets), Unilever did not decline so steep.

I don’t know if this is actually a pattern, but we can see that Unilever’s stock often started declining already before the recession and would have been a good investment when bought slightly ahead of the recession. And right now, Unilever also declined 33% again and we could be before a recession. So, one could argue that Unilever might be a good investment already as the stock declined quite steep and a recession once again seems to be on the horizon. And Unilever is also a good company (from a fundamental point of view) to pick for a recession.

Dividend

Unilever is not only a recession-proof and inflation-proof business, but the stock is also getting more and more interesting for its dividend. Right now, the company is paying a quarterly dividend of €0.4268, which is resulting in an annual dividend of €1.7072 and a dividend yield of 4.1%. Unilever has not only a high dividend yield, but it also increased the dividend annually at least since 1995.

When comparing the annual dividend Unilever is paying to the earnings per share of fiscal 2021 (€2.32) we get a payout ratio of 74%. And while this is a rather high payout ratio, we should not question if the dividend is sustainable. Unilever does not need a lot of cash to reinvest in the business (capital expenditures are rather moderate) and the business can therefore pay out a larger part of its earnings.

Intrinsic Value Calculation

Our goal is to determine if Unilever is a good investment. Knowing that Unilever might be able to withstand an inflationary environment as well as a recession is great, but for it to be also a great investment the stock must also be fairly valued.

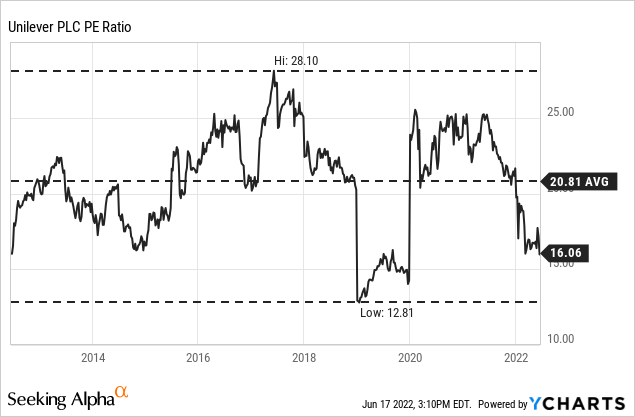

When looking at the price-earnings ratio, Unilever seems to be trading for a reasonable valuation multiple. Right now, Unilever is trading for 16 times earnings and the stock is trading clearly below the 10-year average P/E ratio of 20.81. When looking at the last 10 years, this is one of the cheaper P/E ratios and when excluding 2019, we are at the lower end of P/E ratios.

Aside from using the price-earnings ratio to determine if Unilever is a good buy right now, we can also use a discount cash flow calculation to determine an intrinsic value for Unilever. When using the free cash flow of the last four quarters (€6,632 million) and assume that Unilever will be able to grow 5% annually from now till perpetuity, we get an intrinsic value of €50.84 (assuming a 10% discount rate).

Technical Picture

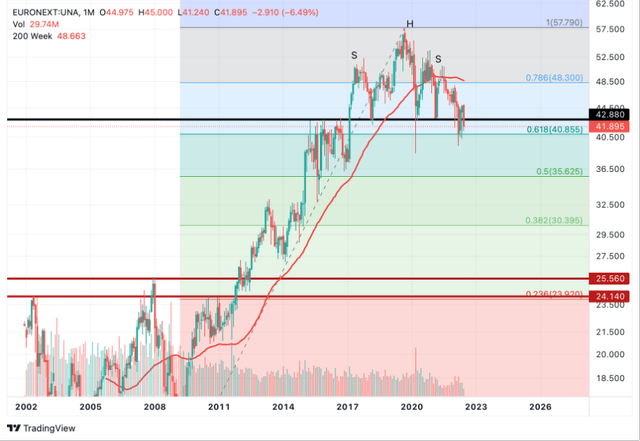

So far, the picture presented is one of a great business and solid investment. However, there is one reason to be worried right now and also make us question if we should buy the stock at this point in time. In my last article, I already warned that Unilever could form a topping pattern (head-and-shoulder pattern) with the risk of a steeper decline for Unilever.

We have an extremely strong support level around €42 and right now it seems like Unilever is fighting to hold that support level. While I would not say that the fight is already lost as Unilever is not trading clearly below the support level, the stock is dipping below the support level again and again. And at this point I would be very cautious if Unilever is able to hold that support level. And if the stock should not be able to hold the support level, the stock might decline much lower and reach levels around €25 where we find the next strong support level.

Conclusion

From a fundamental point of view, Unilever is a buy as we can expect solid growth rates from Unilever in the years to come due to the wide economic moat. In my last article I called Unilever a “sleep well stock” and it is certainly a boring stock, but one with a solid performance. However, the technical picture should make us rather cautious right now as there is a high risk of the stock dropping much lower.

Be the first to comment