JJFarquitectos/iStock Editorial via Getty Images

Good companies don’t always make good investments. Investing is about the future, not the past, and often times good companies with strong brands aren’t enough to make the stock appealing.

Unilever (NYSE:UL) is a good example of a company with a number of the strongest brands in the consumer industry that has not been a good investment for a number of years.

I don’t believe Unilever is a good investment because management has consistently failed to show they can grow the company’s mature brands, and the stock price isn’t cheap using a number of metrics.

Unilever sells some of the strongest brands there are in the U.S. and abroad, and the company operates in 3 core segments; Beauty and personal care, home care, and food and refreshments. Unilever boasts such iconic brands as Ben and Jerry’s, Dove, Comfort, Hellman’s, and Seventh Generation.

Unilever has a number of strong brands, but these brands are mostly mature ones, and management hasn’t been able to generate any significant earnings growth for some time.

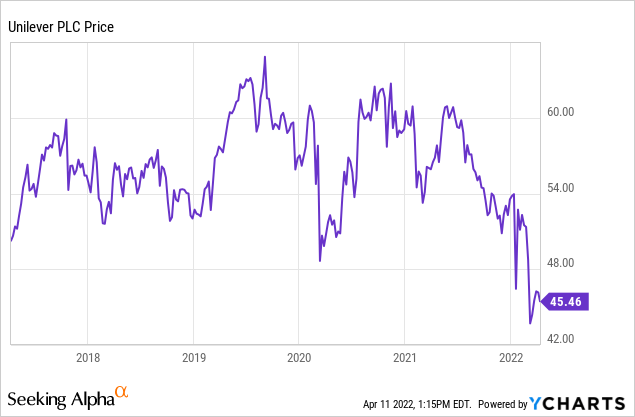

Unilever’s stock has gone nowhere over the last 5 years.

5 years ago, Unilever was trading at $50 a share, and today the stock trades at nearly $45 dollars a share.

Unilever’s revenues over the last 12 years tell the story of company with strong and stable earnings, but almost no earnings growth.

| Unilever Annual Revenue(Millions of US $) | |

|---|---|

| 2021 | $62,047 |

| 2020 | $57,942 |

| 2019 | $58,218 |

| 2018 | $60,210 |

| 2017 | $60,714 |

| 2016 | $58,332 |

| 2015 | $59,155 |

| 2014 | $64,386 |

| 2013 | $66,145 |

| 2012 | $66,008 |

| 2011 | $64,719 |

| 2010 | $58,776 |

| 2009 | $55,537 |

Unilever’s revenues reached a short-term peak in 2013, and the company has only been able to grow revenues at 3% over the last 10 years. The stock has risen over the last 9 years as earnings per share has gone up primarily because margins have increased as the company has gotten rid of lower margin brands and the company has bought back a significant amount of shares, but revenue growth has been stagnant for some time. Unilever has bought back nearly 10% of the company’s shares since just 2017, and the current payout ratio for the 4% dividend is just over 65%. Unilever’s average 5 year dividend growth is 7%, but this dividend growth is obviously being financed in part by debt since earnings and revenue growth have not been anemic for some time.

Unilever’s returns have all been below industry average of recent too. The company’s return on assets is 8.2%, below the industry average of 11.2%. The company’s return on capital deployed rate is 16.8%, also below the industry average of 20.9%.

Unilever’s core problem is that the company’s most important brands are mature ones that are seeing little to no volume, market share, or revenue growth. Unilever has seen no sales growth in the US over the last 5 years, and the company’s sales growth in Europe has consistently been in the mid-single digits, with European sales growth coming in at 4.5% in 2021.

The company’s recent earnings report again showed the problems that management has been having for multiple years now. Even though the company recently reported the best sales growth the company has seen in 9 years on a year-to-year basis, that growth was just 4.5%, and even that number is misleading. Unilever raised prices by 2.9% in 2021, but the company only saw sales volume increase by 1.6%, and sales growth came in below 5%. Earnings per share grew at 5.5%, but that number was also obviously impacted by the significant share buyback program that company is continuing.

Unilever logo (Unilever)

Unilever’s beauty and personal care division saw sales growth of 3.8%, but 3% was from pricing. The company’s home care division saw 3.9% sales growth, but 3.1% of that growth was from pricing. The food and refreshment division grew at 5.6%, with pricing making up 2.7% of that sales growth. The only impressive organic growth that Unilever showed over the last year was in the food and refreshment division, with Ben & Jerry’s and Magnum making up most of that growth. This division was the only division that showed organic growth of over 1% excluding price increases.

Unilever is not a cheap stock either. The stock trades at 16x forward earnings estimates, 6x forward book value, and 2x forward sales. Industry averages are 3x forward book value and just 1.3x forward sales estimates. Well, Unilever is trading below historical valuation numbers for this stock, the company earnings and revenue growth has essentially stalled over the last 5 years, but the company still trades at a growth multiple. Unilever’s core businesses are recession resistant, and the company has many strong brands, but the shares of this leading consumer giant are still pricing in growth that the company has not recently been able to deliver on.

The failed recent takeover of GSK also shows management does not have a viable plan to return the company to sustainable growth. In an embarrassing episode for Unilever, the company was forced to recently withdraw management’s bid for the consumer health company GlaxoSmithKline, as the price became too expensive for Unilever to continue the company’s attempts to make this acquisition. Given how embarrassing the recent failed acquisition attempt was, Unilever isn’t likely to try significant new acquisitions any time soon.

Unilever has some of the best and most iconic brands in the world, but the company’s earnings growth is stagnant, and management has no clear plan for how to return the company to a path of sustainable growth. The company has not substantively grown revenues in over 10 years, and the share buyback and cost cutting are what has enabled the company to grow earnings over the last decade, with even that earnings growth being minimal. The reality is that growing mature brands in competitive markets isn’t easy, and Unilever isn’t delivering the top or bottom-line growth to support the premium valuation this stock trades at.

Be the first to comment