William Barton/iStock Editorial via Getty Images

Investment Thesis

Unibail-Rodamco-Westfield (OTCPK:UNBLF), which I will refer to as URW here after, is emerging as a speculative buy as I estimate that even though its Adjusted Recurring Earnings per Share (AREPS) run-rate will likely decline to about 6 EUR/share once US operations are significantly reduced, only to improve to 7 EUR/share as redevelopment projects and normalized operational performance kick in, the shares will command a higher cash flow multiple once the balance sheet is in order. Hence I think a 12.5 multiple on my 7 EUR/share medium term AREPS target could boost the shares some 25-30% higher in the next 3-4 years. However this upside potential hinges on the US disposals being made within a 20-25% discount of appraisal value and interest rates remaining in check, both of which are somewhat uncertain.

Company Overview

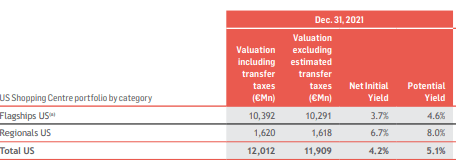

URW operates in four main segments with a total portfolio value of 54.5B EUR, namely retail properties (86% of total), offices (6% of total), convention & exhibition centers (5% of total) and services (2% of total). The US shopping center portfolio is valued at circa 12B EUR as of December 31 2021 and represents around 22% of total portfolio value.

Operational Overview

URW saw continued operational improvement in H2 2021, with vacancy improving by 1.9% to 7%, and tenant sales running at 93% of 2019 levels. However with a market capitalization of 9.5B EUR against a net debt of about 22B EUR at the end of Q1 2022 (My estimate for IFRS net debt as of Q1 2022. Proportionate net debt, accounting for ownership shares in joint ventures, is even higher at circa 24B EUR) the company remains laser focused on debt reduction. Hence despite the strong cash flow forecast in terms of Adjusted Recurring Earnings per Share (AREPS) of about 8.2-8.4 EUR/share for 2022 investors are cautious as they wait to see the nature and form of the much anticipated US portfolio downsizing to occur in 2022 and 2023.

Market-implied Net Initial Yield Valuation

To calculate the market-implied net initial yield I will use the EPRA Net Disposal Value (NDV) which I estimate stood at 112.5 EUR at the end of Q1 2022:

Market-implied net initial yield = Valuation net initial yield / Division factor where:

Division factor = Price/NDV Ratio * ( 1 – Loan-to-value ratio) + Loan-to-value ratio

Substituting with my estimates for Q1 2022, namely:

1. EPRA NDV = 112.5 EUR

2. Loan-to-value = 42%

3. Valuation net initial yield = 4.2%

4. Closing price at the time of writing = 68.58 EUR

You get a Price/NDV Ratio of 68.58 /112.5 = 0.61, a division factor of 0.774 (0.61 * (1-0.42) + 0.42 ) and a market implied net initial yield of roughly 5.43%. For comparison, I estimate largest peer Klepierre (OTCPK:KLPEF) currently trades around a market implied yield of circa 5.66% while smaller peer Wereldhave (OTCPK:WRDEF) is at 6.64%.

Valuation based on current cash flows

I think current cash flow valuation is not very suitable for URW since its capital structure is very debt-heavy. Nevertheless, at just 8.3 times the 8.2 – 8.4 EUR/share management outlook for AREPS, URW among the cheapest retail REITs. Largest peer Klepierre trades at about 10.3 times its cash flow outlook. Curiously, you have some smaller peers such as Wereldhave Belgium trading at 12.65 times their cash flow outlook. However the difference is largely explained by a diametrically different capital structure, i.e. Wereldhave Belgium has a market capitalization of about 522M EUR against net debt of circa 240M EUR.

Disposal Scenarios

Following the latest sale of a development parcel in Los Angeles I estimate the remaining US portfolio is currently worth around 11.85B EUR after transfer taxes:

URW 2021 Registration Document

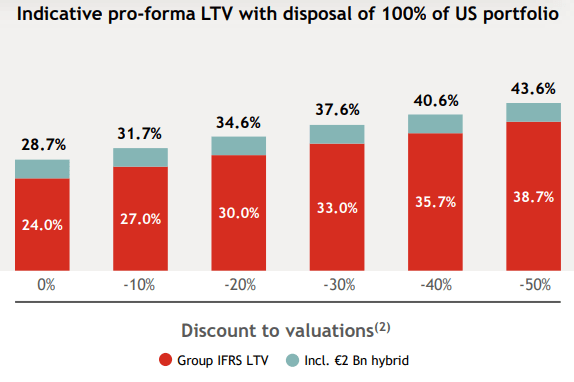

As you can see from the investor day presentation, even a 50% discount to appraisal values will not stop URW from reaching its 40% loan-to-value target:

URW 2022 Investor Day Presentation

Combining the above scenario analysis, a 2% cost of debt, a 8.3 EUR/share average management outlook for AREPS (Adjusted Recurring Earnings Per Share) and my estimate of 3.6 EUR/share impact from US disposals on AREPS (11.91B EUR multiplied by the 4.2% net initial yield, divided by 139 013 166 shares), offset by interest rate savings between 1.71 to 0.86 EUR/share, brings us to the following impact on AREPS under the 6 scenarios for valuation discount:

| Percentage Discount | Negative impact on AREPS from lost earnings | Positive impact on AREPS from reduced interest expense | Net impact |

| 0% | 3.6 | 1.71 | 1.89 |

| 10% | 3.6 | 1.54 | 2.06 |

| 20% | 3.6 | 1.37 | 2.23 |

| 30% | 3.6 | 1.2 | 2.4 |

| 40% | 3.6 | 1.03 | 2.57 |

| 50% | 3.6 | 0.86 | 2.74 |

As you can see from the table above, the larger the discount on US valuations, the smaller the interest rates savings will be, and hence the net impact from the disposals on AREPS grows in line with the discount.

To sum up, the current 8.3 EUR/share outlook could be adjusted to 6.41 EUR/share in a 0% discount scenario, or 5.56 EUR/share in a 50% discount scenario. Based on my market-implied net initial yield estimation above, the market is currently pricing in a roughly 23% discount, with the most likely net impact on AREPS from a potential US disposal of about 2.23 EUR/share, bringing AREPS to 6.07 EUR/share.

While the above scenarios are purely theoretical and do not account for rental growth, redevelopments, higher cost of US funding (as of December 31 2021 cost of debt was 1.5% for EUR and SEK denominated debt, and 3.9% for USD and GBP denominated debt respectively) and new revenue lines, I think the outlined scenarios are a good mental experiment about the optionality surrounding a potential sale of US operations.

Growth Opportunities

The above calculations are somewhat conservative in that they do not account for the growth opportunities outlined at the 2022 Investor day. What I think will actually happen is that some of the capital released from the US operations will fund the identified growth opportunities in Europe. As stated in the 2022 Investor Day press release:

By 2024, URW will deliver €2 Bn of its committed pipeline which will generate €125 Mn in stabilized NRI. In addition, URW will unlock further development opportunities embedded in its assets during the plan horizon, with a potential €1 Bn in projects to add to its controlled pipeline, with limited predevelopment expenses.

Source: URW 2022 Investor Day Press Release

If we assume these 3B EUR of projects are developed over the medium term at a yield on cost of 6.25% against a cost of debt of 2%, we can estimate a boost to AREPS of about 0.92 EUR/share.

The Bottom Line

I think the current AREPS run-rate of about 8.3 EUR/share will likely take a hit in the next 1-2 years once the US footprint is dramatically reduced. Hence I estimate the AREPS run-rate should bottom at about 6 EUR/share, and gradually improve to 7 EUR/share once redevelopment opportunities are finalized and operational performance returns to 2019 levels:

URW expects tenant sales to return to pre-COVID levels in 2022, occupancy and variable income in the course of 2023, and retail NRI on a run rate basis in 2023, with full effect in 2024. In 2024, the Group forecasts Retail NRI of €1.56 Bn and EBITDA of circa €1.9 Bn for its streamlined European portfolio.

Source: URW 2022 Investor Day Press Release

Furthermore, current inflation rates could support higher AREPS figures should they continue over the medium term. Likewise advertising revenues should limit the downside impact on current cash flows.

Investor Takeaway

While I think a lot of things could go wrong for URW, my base case is that AREPS should stabilize at about 7 EUR/share over the medium term, and as long as investors perceive the new capital structure as sufficiently robust the shares should rerate higher to account for the higher asset quality of the underlying portfolio. Personally, I will continue to monitor the shares and may initiate a position on weakness.

Thank you for reading.

Be the first to comment