Jerod Harris/Getty Images Entertainment

Finally, The Walt Disney Company (NYSE:DIS) is trying to move in the right direction. I wrote in July that the company could struggle to meet the expectations it set for subscribers and profitability. After a shocking miss on DTC profitability, the board should be applauded for swiftly bringing back Bob Iger to right the ship.

Unfortunately, and as this article will discuss, there is little Iger can do over the next year or two to turnaround the company. Making matters worse, Iger is the primary cause of Disney’s profitability struggles, so it’s unclear to me for now how he can turn the company around.

Why is Disney’s Stock Struggling?

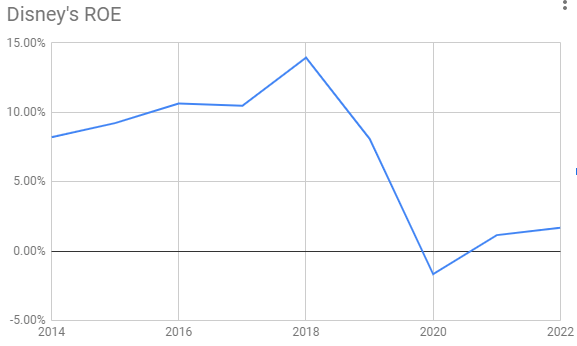

Disney’s ROE declined sharply over the past 9 years (Created by authors using Seeking Alpha’s financials page)

Disney’s return on equity has simply collapsed since 2018 and is lower than it was in 2014, for two main reasons: 1) The acquisition of 21st Century Fox increased shareholders’ equity substantially. 2) The pivot to streaming has been a drag on net income.

It is worth noting that operating income from the company’s legacy networks operating income grew during the period at a compounded annual rate of 2.5% from $6.8 billion in 2014 to $8.5 billion in 2022. Iger recently said that traditional TV is heading towards a precipice, so the decline in cable is yet to be a major factor on return on equity. If Iger is right, it will be a major drag on profitability for the next 5-10 years.

An improvement in the long-term performance of the stock will require a significant improvement in return on equity.

While I believe there will be an improvement in return on equity under Iger, it is unlikely that Disney can generate ROE above 22%, the current average for S&P 500 companies. It might even struggle to get to the historical average S&P 500 return on equity of 10.5%.

2 Reasons Why Iger Won’t Be a Quick Fix

I’ve alluded to the first reason earlier which is that cable is going into secular decline. Linear networks are the company’s biggest profit generator, bigger than parks. Iger will have to find a way to make up for the coming decline in profits over the next decade or so if Disney is to achieve the historical average S&P 500 ROE. Just to illustrate the size of the challenge, the operating income of Disney’s linear networks in 2022 was 30%. Netflix (NFLX), the most mature streaming business, has operating income in the mid-teens, half that of Disney’s legacy networks. So Iger has to build $60 billion streaming business (double the 2022 revenue of legacy networks), if he is to offset the decline in linear networks. That’s triple the current DTC revenue. It is fair to say that won’t happen in the next two years. Not to mention that he will have to make a decision on how to proceed with ESPN.

The second reason is that Iger will find it difficult have to justify the price paid for 21st Century Fox. I am highly critical of this deal and think it deserves a place next to the Direct TV-AT&T merger in being one of the worst high-profile deals ever. Iger spent $71 billion to essentially buy non-core assets and left shareholders with a $4 billion in DTC losses just in 2022. Incredibly, the stock is actually down since the merger was announced in 2017. Disney could have launched Disney+ as a children’s streaming service with only its regular theatrical releases and no multibillion dollars of exclusive streaming content and still be successful, that has always been Disney’s advantage. Here is Charlie Munger highlighting that in 1996:

Well I think it helps to do the arithmetic. Suppose you have a billion children of low middle-income 20 years from now. And suppose you could make $10 per year per child after taxes from your position, it gets into very large numbers. And I don’t know about your children and grandchildren but mine wanna see Disney

Streaming enables Disney to reach those 1 billion children and hundreds of millions of adults with the content the company is really good at making (Pixar, Marvel, Star Wars). Instead of focusing on selling its unique assets at a premium price, Iger spent $70 billion to offer a lot of B+ content.

But that’s in the past now, and I think Iger’s task to get the most out of the acquisition will not be a longer-term challenge. Unleashing the valuable IP he got out of the purchase will be critical (Avatar, X-Men, National Geographic, etc.). But he will also have to work on earning higher margins than streaming peers if Disney shareholders are to benefit from the set of unique assets the company owns. Higher margins don’t just mean higher prices, it also means staying a premium brand and shedding content assets that don’t fit that premium positioning.

Valuation

It’s unclear to me why Disney deserves a higher P/E multiple than Netflix’s 25. At that valuation the company would be worth $75 billion, or $41 a share ($3 billion in net income reported in 2022 * 25 multiple). Obviously, that is counting DTC as a negative value. But even after adding the $4 billion in DTC losses and taxing it at the 21% corporate rate you get to $150 billion, or $82 a share (approx. $6 billion of net income * 25 multiple). That valuation and multiple are reasonable in my opinion given: 1) There is execution risk in streaming in the short-term. 2) Even if streaming execution is flawless, it’s unclear if it will be incremental to profits or simply replace declining profits in legacy networks. 3) Disney’s best businesses (Parks and movie theaters) are cyclical in nature and so deserve lower multiples.

Risks

Markets are forward looking. The market acknowledged some of the issues discussed in this article following Q4 earnings and saw the stock decline to $86. It is possible however that the market overlooks these short-term challenges if Iger can deliver the right message to investors. In that case the stock could be moving higher than lower. For that reason, the stock is a hold rather than sell.

Conclusion

Disney’s board moved swiftly to axe Bob Chapek but the company’s challenges won’t leave with him. Iger will need to address long-term issues like the decline in cable and the monetization of the Fox acquisition if Disney’s ROE is to see the significant increase it needs for shareholders to be happy.

Be the first to comment