yujie chen/iStock Editorial via Getty Images

Within our banking universe coverage, UBS Group AG (NYSE:UBS) is the first one to report. We have already analyzed the Swiss entity three times this year, so today is a buy case recap. However, here are our previous articles so that our readers are well-informed of the story up to now:

- 26/04/2022: Initiation of coverage with a buy target after the Q1 performance analysis;

- 26/07/2022: Comments on UBS’s Q2 results;

- 13/09/2022: Raising the bar on capital distribution policy with a DPS increase of 10% and a new buyback program.

Q3 Results

UBS Group AG recorded a clean net profit of $1.73 billion in the three months from June to September, down 24% from $2.28 billion compared to the same period last year. Top-line sales achieved $8.24 billion, down 10% to $8.92 billion versus the third quarter of 2021. Despite the slowdown, the Zurich-based bank beat estimates of a net profit of $1.53 billion and revenues of $8.16 billion, according to analyst consensus released by the company. As interest rates rise, UBS has seen a 14% year-over-year increase in net interest income in its key wealth management division and personal and corporate banking. However, in its investment banking business, revenues fell by 19% driven by lower revenues in its capital markets unit. Looking at the division highlights: the global wealth management division recorded lower revenues, down 4% year-on-year. Personal and corporate banking turnover increased over the same period thanks to the higher rates of the Swiss National Bank. And as already mentioned, the IB division delivered a double-digit lower revenue mainly due to equity derivative performances, capital markets volatility, and cash equities. This negative result was partially offset by foreign currency revenues.

As a memo, the Swiss group had disappointing earnings in the second quarter. During our Q2 comment, we said that “both top-line sales and net income line fell short of analysts’ expectations, who expected a turnover of $9.43 billion and a net profit of $2.40 billion.” In this context, it is important to highlight the CEO’s words that confirm that “the macroeconomic and geopolitical environment has become increasingly complex. Clients remain concerned about persistently high inflation, elevated energy prices, the war in Ukraine, and residual effects of the pandemic”.

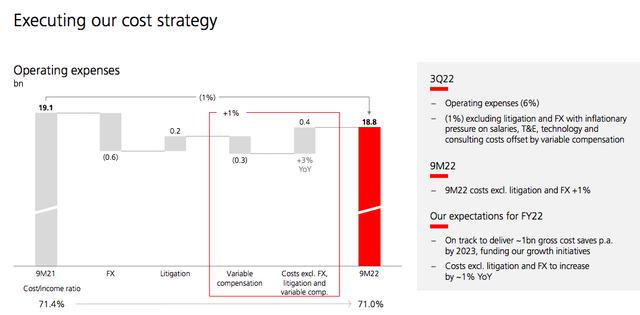

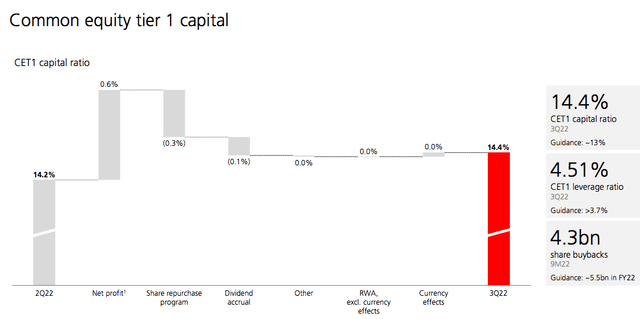

Key to consider is UBS’s cost expense evolution that fell by 6% to $5.9 billion, from $6.2 billion a year ago (Fig 1). The CET1 capital ratio was at 14.4% versus consensus estimates of 14.1%. This was driven by FX’s lower RWA of $311 billion (Fig 2).

UBS Expenses Evolution (Fig 1)

UBS’s CET1 Evolution (UBS Q3 Results Presentation (Fig 2))

Conclusion and Valuation

To sum up, UBS’s third-quarter profits and revenues decelerated from the previous quarter, but exceeded expectations in a challenging market environment, as higher interest rates partly offset the impact of the lower activity of the investment bank’s clients. In September, UBS announced its intention to increase the ordinary dividend for 2022 from $0.51 to $0.55 per share, a plus 10% compared to the previous year. The board intends to propose the dividend increase at the Annual meeting to be held in 2023. More precise indications will be given on January 31st on the occasion of the publication of the fourth quarter accounts. Regarding rate sensitivity, the Swiss banking giant indicated an incremental benefit of approximately $200 million in its Wealth and Personal & Corporate Banking division. Here at the Lab, we expect another ECB rate hike of 75 basis points in November and two additional hikes in January and February by 25 basis points each. Therefore, we reaffirm our buy target of CHF 22 per share derived based on a sustainable RoTE at an average of 14.5%.

Be the first to comment