mikkelwilliam/E+ via Getty Images

Investment Thesis

Despite the evident improvement in Uber Technologies’ (NYSE:UBER) financial performance since FQ2’21, its stock performance has been on a downwards spiral with a 48.9% decline from $41.81 on 04 August 2021 to $21.34 on 01 July 2022.

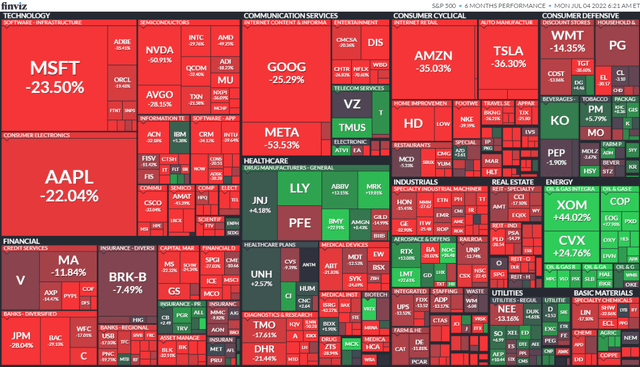

S&P 500 Index 6M Performance

S&P 500 Index 6M Performance (Finviz)

In addition, with the potential recession reining in future consumer spending, the Fed’s hike in interest rates to 3.8% in 2023, and the current record high in oil and gas prices, the whole market has been massively in the red with the S&P 500 Index falling 21.8% in the first half of 2022, with the significant exception of the healthcare and energy sectors, amongst others.

Given the macro issues, the ongoing Ukraine war, and China’s Zero Covid Policy, we are of the opinion that the bear market will not conclude in the short and intermediate term. Therefore, unfortunately, we expect more retracement ahead for the UBER stock, especially given its upcoming FQ2’22 earnings call in early August 2022. Assuming a softer guidance ahead, the stock could potentially fall to new lows nearing its all-time low of $14.82 in March 2020. Due to these factors, most UBER investors’ portfolios would probably remain underwater for some time.

UBER Is Expected To Be FCF Profitable By FY2022 & Net Income By FY2023

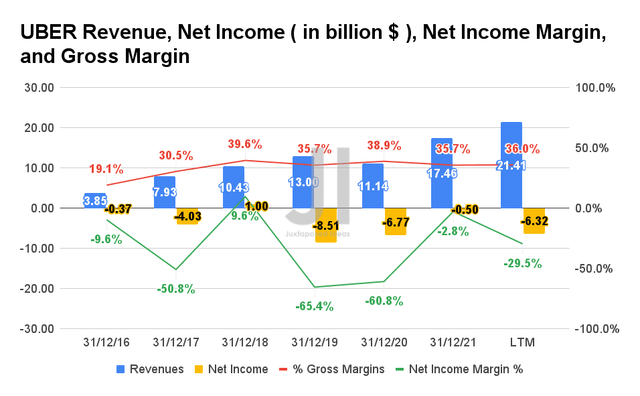

UBER Revenue, Net Income, Net Income Margin, and Gross Margin

UBER Revenue, Net Income, Net Income Margin, and Gross Margin (S&P Capital IQ)

UBER reported an excellent recovery from the COVID-19 pandemic, with record-breaking revenue of $21.41B and gross margins of 36% in the last twelve months (LTM). It represents massive revenue growth of 64.6% from FY2019 levels. However, the company remains unprofitable with net income of -$6.32B and net income margins of -29.5% in the LTM.

Nonetheless, it is also important to note that UBER recorded a $5.57B impairment charge in its investments and $0.35B of Share-Based Compensation (SBC) in the latest FQ1’22, thereby contributing to $5.93B of its net losses for the quarter. The former was related to its unrealized losses in its equity in Grab (GRAB), Aurora, and DiDi (OTC:DIDIY) accordingly. Therefore, assuming the elimination of these expenses, the company would have reported an adj. net income break-even by now.

As a result, we are relatively optimistic about UBER’s growth prospects, given the massive growth of its Gross Bookings by 35% YoY to $26.4B in FQ1’22 and its leading market share in the US at 72% in May 2022. In addition, the company reported 1.7B trips on its platform, with an increase of 18% YoY, while also recording 121M of Monthly Active Platform Consumers (MAPCs) in March 2022 with 17% YoY growth. Nonetheless, as apparent in the past few quarters, we are seeing a pronounced decoupling of UBER’s financial performance to its stock price action, thereby pointing to the bear market sentiments.

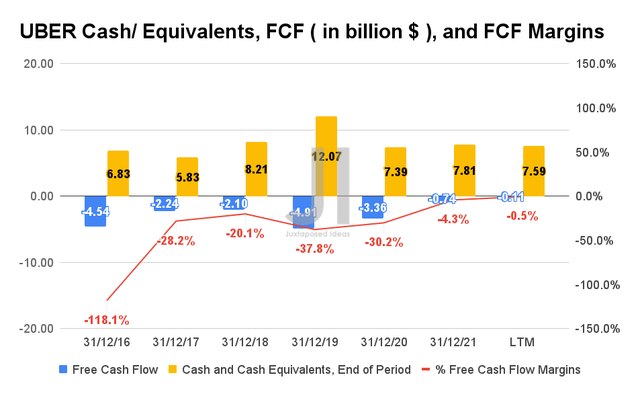

UBER Cash/ Equivalents, FCF, and FCF Margins

UBER Cash/ Equivalents, FCF, and FCF Margins (S&P Capital IQ)

Nonetheless, UBER has been improving its Free Cash Flow (FCF) generation over time, with FCF of -$0.11B and an FCF margin of -0.5% in the LTM. It represents a massive improvement from FCF of -$4.91B and FCF margins of -37.8% in FY2019. In addition, with UBER’s management’s guidance for positive FCF for FY2022, we may expect to see a healthier balance sheet moving forward. Nelson Chai, CFO of UBER, said:

With free cash flow approaching breakeven in Q1, we now expect to generate meaningful positive free cash flows for full-year 2022. ( Seeking Alpha )

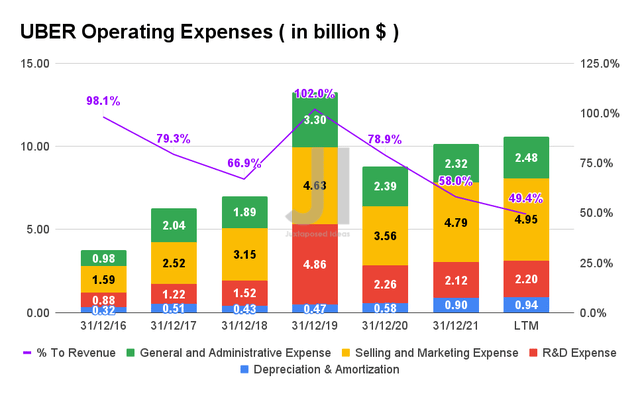

UBER Operating Expense

UBER Operating Expense (S&P Capital IQ)

UBER has proved capable in its capital management, given the moderate growth in its operating expenses. The company reported $10.57B in its operating expenses, accounting for only 49.4% of its growing revenue in the LTM, compared to 66.9% in FY2018 before its IPO in 2019.

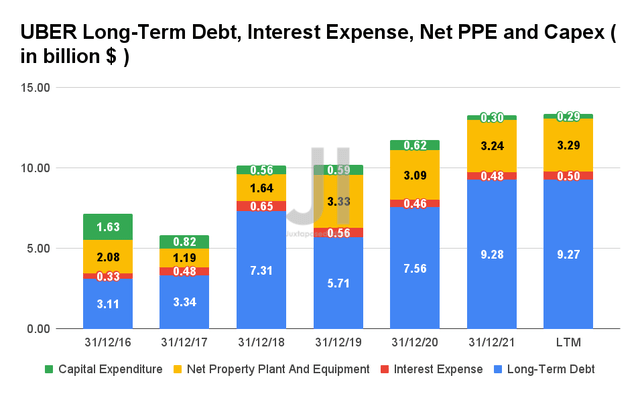

UBER Long-Term Debt, Interest Expense, Net PPE, and Capex

UBER Long-Term Debt, Interest Expense, Net PPE and Capex (S&P Capital IQ)

However, UBER has been evidently relying on more long-term debt in the past two years, given the devastating effects of the pandemic. As a result, the company reported long-term debts of $9.27B and interest expenses of $0.5B in the LTM, representing an increase of 62.3% in debt leveraging from FY2019 levels. Fortunately, UBER’s management seemed equally prudent in its asset management, given its relatively stable net PPE assets of $3.29B, in line with FY2019 levels, and capital expenditure of $0.29B in the LTM, a 50% decrease at the same time.

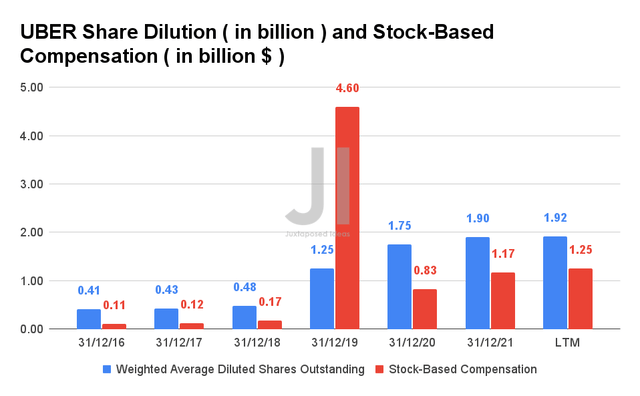

UBER Share Dilution and Stock-Based Compensation

UBER Share Dilution and Stock-Based Compensation (S&P Capital IQ)

Therefore, given its lack of net income and FCF profitability thus far, it is evident that UBER has heavily relied on SBC since FY2019. The company reported $1.25B in SBC expenses in the LTM, representing 19.7% of its net losses and 1136.3% of its negative FCF.

Given its projected lack of profitability for the year, we may expect UBER to continually report high SBC expenses for FY2022 and FY2023, at a potential CAGR of 40.96% based on the YoY growth rate in FY2021. According to our aggressive estimates, the company may record SBC expenses of up to $1.64B in FY2022 and $2.32B in FY2023. Massive indeed considering its minimal projected net income profitability in FY2023. The upcoming share dilution would also be disturbing, given that long-term investors have been diluted by 53.6% since UBER’s IPO in 2019.

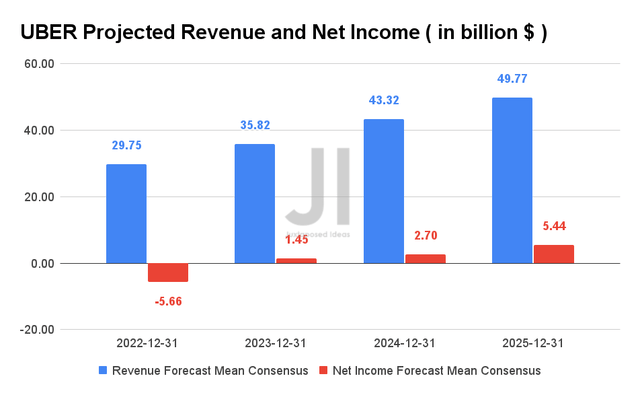

UBER Projected Revenue and Net Income

UBER Projected Revenue and Net Income (S&P Capital IQ)

UBER is expected to report revenue growth at a CAGR of 45.42% over the next four years, while also potentially reporting FCF profitability by FY2022 and net income profitability by FY2023. For FY2022, consensus estimates that the company will report revenues of $29.75B and net income of -$5.66B, representing a remarkable increase of 267.2% and 16.2% YoY, respectively, with the latter massively affected by the losses in its equity in FQ1’22.

Analysts will also be closely watching UBER’s FQ2’22 performance, given consensus revenue estimates of $7.32B and EPS of -$0.27 with the management’s guidance in gross bookings of up $29.5B, representing an increase of 86.7%, 44.8%, and 34.7% YoY, respectively. We shall see.

So, Is UBER Stock A Buy, Sell, or Hold?

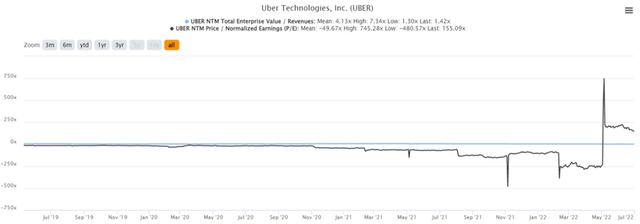

UBER 3Y EV/Revenue and P/E Valuations

UBER 3Y EV/Revenue and P/E Valuations (S&P Capital IQ)

UBER is currently trading at an EV/NTM Revenue of 1.42x and NTM P/E of 155.09x, lower than its 3Y EV/Revenue mean of 4.13x though massively elevated from its 3Y P/E mean of -49.67x. The stock is also trading at $21.34, down 58.9% from its 52 weeks high of $58.03, while nearing its 52 weeks low of $19.90.

UBER 3Y Stock Price

UBER 3Y Stock Price (Seeking Alpha)

Despite consensus estimates’ strong buy rating with a price target of $48.10, we are unconvinced of UBER’s 125.40% upside, given the potential recession and reduced consumer spending moving forward. In May 2022, inflation-adjusted spending fell for the first time in the year, suggesting the notable impacts of the rising inflation and the Fed’s hike on interest rates. Assuming that the trend continues, we may expect to see UBER’s business affected, further worsened by the near-record costs for gasoline, a bane for all private hire cars and taxi drivers. In addition, its stock has not historically performed well, since hitting its all-time highs in April 2021 at over $60s.

As a result, those still holding on to the UBER stock should prepare themselves for some unwelcomed volatility ahead, as the company reports its potentially poorer FQ2’22 earnings by early August. In contrast, we advise much patience for those who have yet to add, given the potential share dilution and the moderate stock price retracement in the next few weeks. As a result, we encourage investors to wait for more clarity from the management and an even wider margin of safety before adding more exposure.

Therefore, we rate UBER stock as a Hold for now.

Be the first to comment