RichLegg/E+ via Getty Images

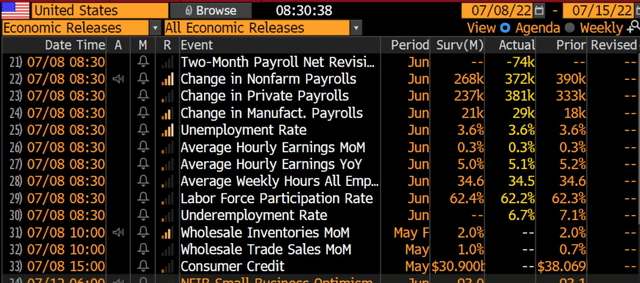

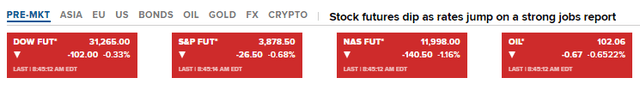

The June jobs report was good news. But in an environment where “bad news is good news,” the initial reaction in stock market futures was a bit lower as Treasury yields rose across the curve. Digging into the report, the headline +372k figure was above expectations of just 268k, according to the Bloomberg consensus. The unemployment rate was unchanged at 3.6%.

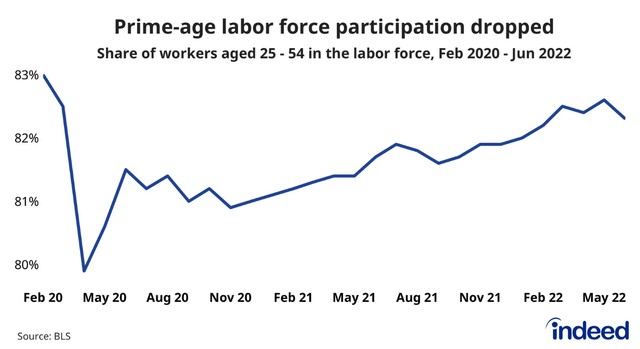

Manufacturing jobs came in strong and hourly earnings verified near to a smidgen better than forecasts. The Labor Force Participation Rate actually dipped versus the May report, missing what Wall Street economists had expected. Prior monthly revisions dinged net job growth by 74k, mainly from a 68k negative change to April’s report.

A “Good News Is Bad News Report” For Stocks

Labor Force Participation Rate Drops

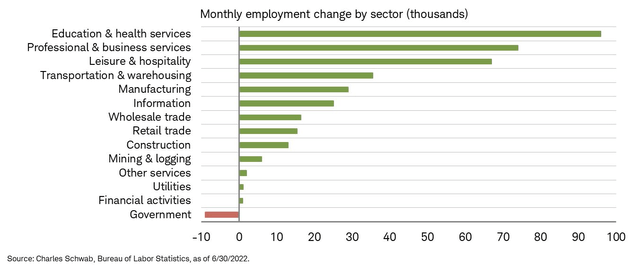

June’s report is always interesting in that estimating changes in the education workforce is tough. That sector (along with health services) had the biggest climb in jobs while government employment dropped slightly.

Education & Health Services Employment Rises

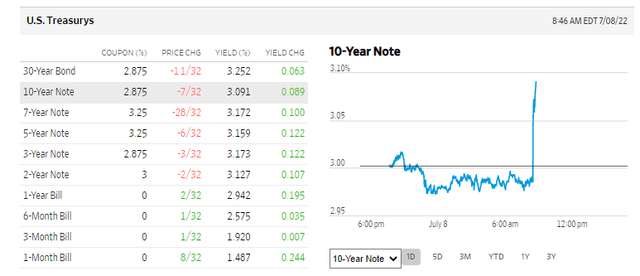

Short-term Treasury rates rose when the seemingly rosy jobs data hit the tape. The U.S. 2-Year Treasury yield climbed above 3.12% while the 10-Year rate rose more than 8 basis points to 3.09%. The yield curve had inverted earlier in the week, and the 2-Year rate remained above the 10-Year yield after the key June employment report arrived. The iShares 1-3 Year Treasury Bond ETF (SHY) looks to fall for a fourth-straight session based on the significant rise in rates across the short end of the Treasury yield curve.

U.S. Treasury Rate Rise After A Robust Jobs Report

Stock market futures, not surprisingly, fell as higher rates spooked investors. The tech-heavy Nasdaq composite index futures fell the most, down about 1% shortly after the 8:30 AM release.

Stock Market Futures Fall Initially

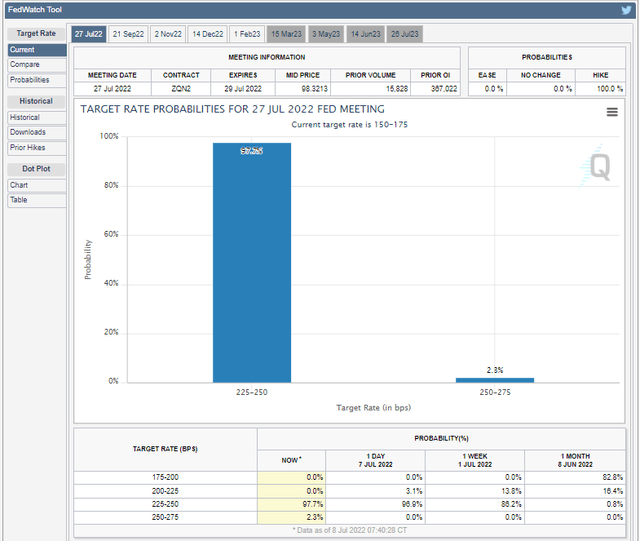

Also in wake of the economic numbers was an interesting change in the upcoming FOMC interest rate decision. As of 8:40 AM, CME Fed Funds futures show a 2% chance of a one-percentage-point rise in the Fed’s key policy rate at the July 27 meeting. The overwhelming expectation is for a 0.75-percentage point increase.

Traders Expect a 0.75% Hike Later This Month

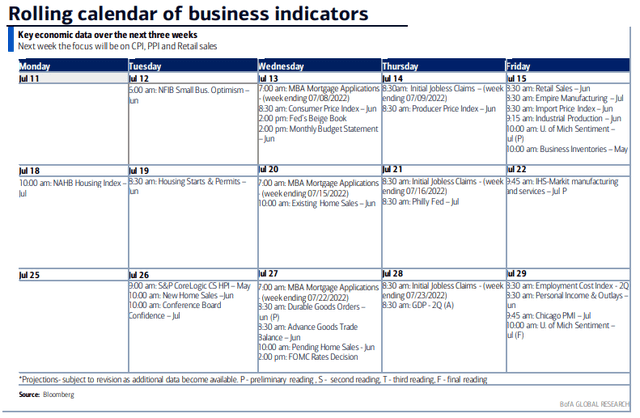

Looking ahead, next week we will get more important insights into the state of the U.S. economy. The Consumer Price Index (CPI) report crosses the wires on Wednesday morning. Advance Retail Sales, Industrial Production, and University of Michigan Consumer Sentiment come Friday morning.

Upcoming Key Economic Data

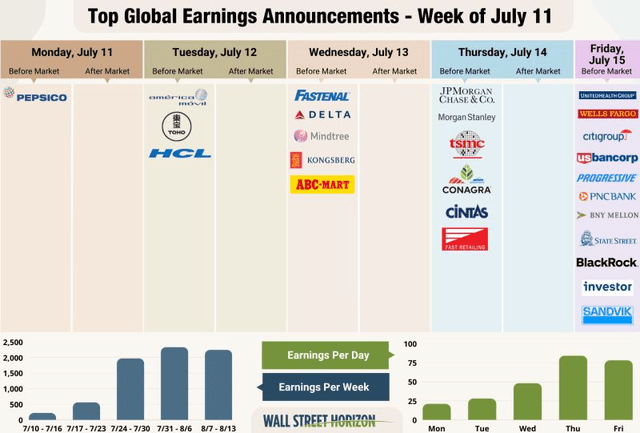

Finally, earnings season gets underway. PepsiCo (PEP) is the first big name to report Q2 results – that comes Monday BMO. JPMorgan Chase (JPM) unofficially starts the season with its profit report Thursday morning, according to Wall Street Horizon.

Be the first to comment