Drew Angerer

Twitter (NYSE:TWTR) is suing Elon Musk for specific performance (ie stick to the deal of buying Twitter for $54.20 per share) and injunctive relief. The first is the meat of the matter. This suit follows news that Musk is trying to terminate the merger. I shared my opinion here and I highly recommend Chris DeMuth’s take here who’s smarter and more experienced than I am. Neither of us believe it’s super likely Musk will be able to walk away from this deal.

Before I dive into the specific arguments Twitter’s lawyers are making in their filed suit, I want to say two things:

1) I’m not a lawyer but just a person trying to make money through speculation. In order to do that I’ll have to wrestle my way through this stuff.

2) I really liked this filing by Twitter and its lawyers. It’s how I imagine the work of really great lawyers. You can readily understand the arguments even if you are a layman or have little background knowledge of the case. I highly recommend just reading it through yourself.

The arguments are very simple and straightforward (ie not overly creative) because that’s what the case needs. They generally refrain from hyperbole or dragging Musk through the mud at every turn possible. Finally, the suit looks very complete to me. They touch pretty much every angle I would highlight to a party who’s not been following the proceedings and then some but almost all of it is quite relevant and the suit isn’t drowning in irrelevant details.

3) I’m biased here because I’m long Twitter shares. I believe Twitter signed a merger contract that Musk will need to uphold ultimately unless the facts change considerably. I try to check for my bias because I’m in this position to make money. I’m not in it because I want to be right, to seek justice, or because I hate Musk. If someone or something changes my mind about how I should interpret the facts here, I’m going to change my position.

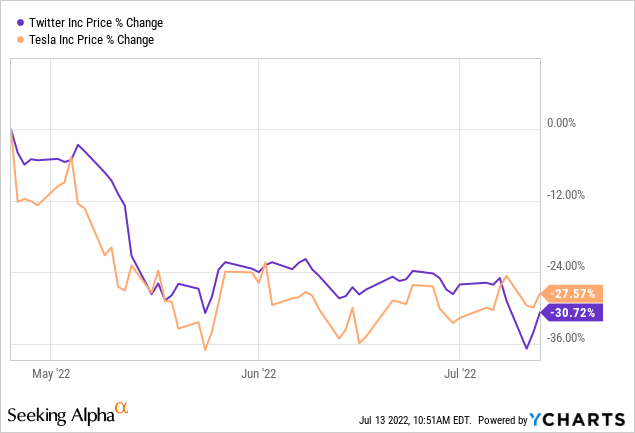

In my opinion, the “real” background here is that Musk signed a deal to buy Twitter at $54.20 on April 25, 2020, fully intending to take the company private. Shortly after Twitter and Tesla (TSLA) shares went into “freefall”:

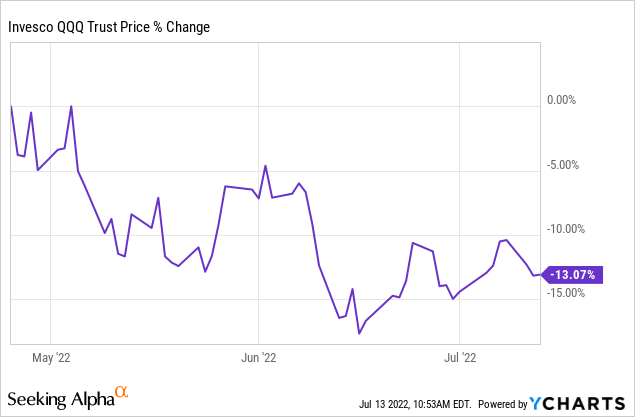

The drawdowns were significant even in context of the Nasdaq (QQQ) index drawdown from that date:

Because Musk initially margined his Tesla stock as part of the financing, Tesla traders seemed to anticipate him having to sell shares and I’m of the opinion some of his actions were designed to disabuse the market of that notion.

I’m not sure whether he ever truly wanted out of the deal or get a price cut or merely stem this relentless selling.

If you make me guess – I’d say he probably would like to get out of the deal, would of course love a price cut, and definitely wanted to stem the selling in Tesla stock.

Perhaps he perceived an option to pursue all three of these goals. Pursuits that wouldn’t necessarily be successful but where he perceives little downside (except for getting ridiculed by people like me, and that’s not really a downside).

But he couldn’t outright say – I have a super bad feeling about the economy, I want to cancel this ~$40 billion deal. Because the merger contract leaves him very few and quite specific boxes that need to get ticked for him to have the option to back out. A superbad economy or having second thoughts are not boxes. So, in my opinion, Musk subsequently has been trying to engineer a sequence of events that allows him to claim the right boxes (allowing him to walk) were checked. This is my conjecture or “read” of the situation and I could be wrong.

To an extent he has succeeded as Tesla isn’t selling off as hard anymore. Likely in large part due to the Nasdaq stalling its descent but still. He also may still obtain a price cut or get away from the deal.

In my opinion, Musk being able to definitively walk away from the deal is an extremely unlikely outcome. A price cut should not happen but could happen. I expect it to be small and as we go over some paragraphs of Twitter’s suit it will become more clear why. As I’ve argued in quite a few notes now, I continue to perceive very little reason for Twitter to fear a trial against Musk.

In their suit Twitter’s lawyers lay out three reasons brought by Elon Musk as supposed grounds for termination:

1. purported breach of the information-sharing and cooperation covenants contained in Sections 6.4 and 6.11;

2. supposed “materially inaccurate representations” incorporated by reference in the merger agreement that allegedly are “reasonably likely to result in” a Company Material Adverse Effect;

3. purported failure to comply with the ordinary course covenant by terminating certain employees, slowing hiring, and failing to retain key personnel. Ex. 3.

They argue against all three. I’ll quote some highlights, starting with 1) Information sharing.

The Twitter lawyers argue the company has gone to great lengths to supply requested information. They also raise the issue Musk may be deliberately requesting information the company can’t or shouldn’t in order to tick a checkbox for termination. The suit literally states: ” From the outset, defendants’ information requests were designed to try to tank the deal.”

Here’s a longer interesting quote with emphasis by me:

In their termination notice, defendants list categories of information they claim Twitter has withheld. Most of this information does not exist, has already been provided, or is the subject of requests only made recently, in response to which Twitter had been yet again compiling responsive information when it received the termination notice. All of this information sweeps far beyond what’s reasonably necessary to close the merger. Defendants also complain about rate and query limits initially accompanying the firehose data. But those limits were part of the customary commercial terms defendants initially requested, and, as defendants acknowledge, Twitter increased the limits immediately upon request before the purported termination.

This seems a very thin line of attack (as I argued in my previous note as well) because Twitter has been quite generous about providing information. Especially if you consider it in the light of Musk sweetening his deal offer by expressly withdrawing his prior diligence condition.

In my opinion, the following piece of information shared in this suit confirms what I believe to be the most likely driving narrative here:

From the outset of this extraordinary post-signing information exchange process, Musk accused Twitter of “lax” methodologies for calculating spam or false accounts. Knowing that his actions risked harm to Twitter and its stockholders, wreaked havoc on the trading price of Twitter’s stock, and could have serious consequences for the deal, Musk leveled serious charges, both publicly and through lawyer letters, that Twitter had misled its investors and customers. But Musk exhibited little interest in understanding Twitter’s process for estimating spam accounts that went into the company’s disclosures. Indeed, in a June 30 conversation with Segal, Musk acknowledged he had not read the detailed summary of Twitter’s sampling process provided back in May. Once again, Segal offered to spend time with Musk and review the detailed summary of Twitter’s sampling process as the Twitter team had done with Musk’s advisors. That meeting never occurred despite multiple attempts by Twitter.

Musk has Twitter bending over backward to provide him all sorts of information about spam accounts. A problem he ironically initially identified as a key reason to buy Twitter. So he could go and solve it. Provided with detailed information he doesn’t bother to read it. To me, that strongly suggests he’s not really genuinely looking for answers. He’s looking for outs.

2) “Materially inaccurate representations”

In my previous note I’ve argued it seems unlikely to me that Musk can show how any of the representations (spam related) Musk is attacking are “material.” But Twitter’s legal team made very short work of the specter of “materially inaccurate representations”:

Twitter’s representations in its SEC filings supply no basis for termination…

…Nor can defendants show that Twitter has made any representation or collection of representations the inaccuracy of which is “reasonably likely to result in” a Company Material Adverse Effect. They do not even try…

The Twitter lawyers basically say that Musk’s lawyers don’t even try to bring this allegation home because they can’t.

3) Failing to retain personnel

I wasn’t surprised to read Musk’s lawyers bringing up the “ordinary course of business phrase” into their suit. This sets up a legal way to get closer to “outs” in the contract. If you buy a company and then the management of that company starts to deliberately destroy said company that’s not really fair. So, there are routes to get out of a deal if that happens. But the standards are pretty high for a judge to come to a conclusion like that. Here’s what Musk said in his termination filing:

Finally, Twitter also did not comply with its obligations under Section 6.1 of the Merger Agreement to seek and obtain consent before deviating from its obligation to conduct its business in the ordinary course and “preserve substantially intact the material components of its current business organization.” Twitter’s conduct in firing two key, high-ranking employees, its Revenue Product Lead and the General Manager of Consumer, as well as announcing on July 7 that it was laying off a third of its talent acquisition team, implicates the ordinary course provision. Twitter has also instituted a general hiring freeze which extends even to reconsideration of outstanding job offers. Moreover, three executives have resigned from Twitter since the Merger Agreement was signed: the Head of Data Science, the Vice President of Twitter Service, and a Vice President of Product Management for Health, Conversation, and Growth. The Company has not received Parent’s consent for changes in the conduct of its business, including for the specific changes listed above. The Company’s actions therefore constitute a material breach of Section 6.1 of the Merger Agreement.

I’ve argued in my previous note that Twitter firing employees is currently consistent with practices at other tech companies in the U.S. Ironically, it’s exactly what Tesla is doing. Twitter does not require Musk’s consent for decisions like the above. Things get surreal once you read the Twitter suit. Twitter alleges it has often consulted Musk about business decisions. They claim they sought his consent in excess of what the contract provided him a right to. They illustrate this with very specific examples:

…In early May, Twitter let go of two executives and announced it would be “pausing most hiring and backfills” as positions became vacant. Musk’s counsel was notified of those decisions at the time and raised no objection…

It doesn’t come across well if you get the chance to object handed to you on a silver platter but you only start complaining in termination filing (when you evidently want out). Twitter also alleges Musk constantly beat the drum to reduce headcount and was fairly unhelpful as far as retaining employees goes. These are cherry-picked fragments from the suit to illustrate this (emphasis mine):

…These decisions aligned with Musk’s own stated priorities. Days after signing, on April 28, 2022, Musk texted Twitter’s board chair to say his “biggest concern is headcount and expense growth.”…

…In a meeting with Twitter management on May 6, 2022, Musk again asserted that the company’s headcount was high and encouraged management to consider ways to cut costs…

…Musk repeated these themes in conversations with Agrawal and Segal throughout May and June…

…On June 16, Musk held a virtual meeting with Twitter employees. Asked what he was “thinking about layoffs at Twitter,” Musk responded that “costs exceed the revenue,” “so there would have to be some rationalization of headcount and expenses.“…

…In his final conversation with Segal before purporting to terminate, Musk expressed his concern about Twitter’s expenses and asked why Twitter was not considering more aggressive cost cutting…

It’s highly ironic Musk complained about Twitter’s inability to retain key employees if Twitter got its facts straight (which seems likely to me). Because Twitter alleges Musk himself did not consent to key employee retention programs:

…Most notably, Musk has unreasonably withheld consent to two employee retention programs designed to keep selected top talent during a period of intense uncertainty generated in large part by Musk’s erratic conduct and public disparagement of the company and its personnel….

This has been going on from the start, before the deal was signed:

…During negotiation of the merger agreement, Twitter had sought Musk’s consent to a broad retention plan. Musk’s team deferred decision on the matter; the plan Twitter proposed was detailed, and time for negotiation was short. But Musk indicated he was open to further discussion.

Continued after signing the deal

During a May 6, 2022 post-signing diligence session, Twitter management again broached the subject of retention, and Musk was non committal. He suggested the matter be tabled pending further clarity on the expected interval before closing the deal…

and as Twitter worked hard to try to get him to consent to a retention program which kept failing:

…Over the weeks that followed, Swan discussed with Twitter management a narrower retention plan than the one that had been discussed during the merger agreement negotiations. Consistent with those discussions, on June 20, 2022, Twitter sent defendants a formal request for consent to two tailored employee retention programs that had been vetted by the board and its compensation committee with the assistance of an outside compensation consultant.

…Musk initially failed to respond at all to the June 20 consent request. (It would soon become clear that he had fired Swan.) After a follow-up request for consent, Musk’s counsel stated tersely that “Elon is not supportive of this program and has declined to grant consent for it.” Twitter offered to arrange a meeting between Musk and Lane Fox to explain the importance and utility of the proposed programs. Musk’s counsel repeated that Musk “doesn’t believe a retention program is warranted in the current environment,” and said Musk was unwilling to consider the advice of compensation consultants, but left open the possibility of speaking with Lane Fox…

On June 28, 2022, following further stonewalling from Musk’s counsel, Twitter urged that a discussion would be fruitful. After initially suggesting Musk might be “amenable to a call next week,” Musk’s counsel replied, “Elon already gave his response but I’ll remind him of Martha’s request for a call.” The call never happened – Musk has continued to duck it – and neither retention program has been implemented due to defendants’ unexplained and unreasonable withholding of consent. Employee attrition, meanwhile, has been on the upswing since the signing of the merger agreement…

I may be biased but this comes across as a very strong defense by Twitter.

Conclusion

Twitter’s suit against Musk makes a strong and quite straightforward case why he can’t terminate the merger agreement. Twitter seeks swift remedial action in the form of specific performance and injunctive relief. I think Twitter has a good chance of being granted the first (as the facts stand). I don’t think Twitter will get very far on injunctive relief but Twitter does not come across as especially combative or aggressive. I’d almost go as far as calling the suit friendly as far as these things go. But Twitter does seem to be laying the groundwork to go on the offensive if Musk continues with his efforts to abandon the deal he’s made with them. There’s always a chance Musk will close this as soon as he can but they seem to be preparing for the contingency he will remain obstructive. That’s my read of how things are phrased in the suit and I could read Twitter’s intentions wrong.

Finally, I continue to really like Twitter as a buy at $36.81. That’s 47%-plus upside to the deal price. Even if Twitter ultimately ends up granting Musk a 10% discount, which I’d consider massive (read more here), we’re talking about 32.5% upside. The downside is substantial too. Twitter would likely fall back in the $20 – $30 range. Potentially, briefly a bit lower due to arbs exiting. However, I believe the likelihood of this deal closing is well ahead of 50%. Not just 60% but 70% and well north of that. Because I also expect Twitter to ask for an accelerated trial of some sort (and get something like that) I’m not worried about this taking years and years. The range of outcomes and the uncertainty are wide and high. But if you put me in a position like this 1000x and I get a thousand results, I’d expect the average to be highly profitable. I’ve increased my Twitter position further between ~$36.40 and ~$36.85.

Be the first to comment