Scott Olson

When one door closes, another often opens. Such might be the case for investors in social network giant Twitter (NYSE:TWTR). On July 8th of this year, news broke that billionaire Elon Musk had decided to back out of his deal to purchase the business at a price of roughly $44 billion, or $54.20 per share. This move sent shares of the social network down 11.3% when the market reopened on July 11th. However, July 12th saw some recovery, with shares of the business climbing 4.3% to close out the day. What happens next will likely be decided in the court system. But considering how shares of Twitter are priced today, and the range of outcomes that could transpire, I cannot see any realistic scenario where the outcome would be negative for shareholders. More likely than not, the pain that investors experienced has already been felt. And what exists moving forward is very likely to be nothing more than upside.

The recent chain of events

Back in April of this year, news broke that Tesla (TSLA) CEO Elon Musk had agreed to purchase all of the outstanding stock in Twitter in a deal priced at $54.20 per unit, working out to roughly $44 billion inclusive of net debt. At the time, that represented a significant premium of 54% over its January 28th, 2022 closing price. While initially met with tremendous fanfare from investors and market watchers alike, many at the time doubted that a deal would ultimately be completed.

Almost immediately, the mercurial Musk began demanding information on the company that would, in his mind, help to evaluate whether the deal made sense or not. In particular, he was adamant about discovering whether Twitter’s claim that less than 5% of its accounts were bots and fake accounts was actually correct. While this is a perfectly legitimate course of action to take, it was highly irregular for him to pursue this after signing the merger agreement. Typically, such due diligence is completed before a deal is solidified. Rumors began circulating that, faced with uncertainty regarding Twitter’s claims, a deal might be agreed upon at a lower price. But ultimately, this did not come to pass. Instead, on July 8th of this year, Musk announced that he was backing out of the merger, citing a lack of compliance on Twitter’s side when it came to providing vital information that he requested of it, including the estimated bots and fake accounts topic.

This development was followed up by two others. On July 11th, the management team at Twitter released a statement saying that Musk’s decision to terminate the merger is ‘invalid’ and that, as a result, they intend to enforce the agreement. Then, on July 12th, they officially filed a lawsuit against Musk in a bid to make him complete the acquisition. Unfortunately, unless there is some sort of settlement, or unless Musk changes his mind, the legal process will take at least several months, at best, to get through. And more likely than not, it could even take years.

Nothing bad for Twitter shareholders

Although the initial downside experienced by investors in Twitter was swift and painful, it’s unlikely that any further pain will befall investors at this time. The absolute worst case that I can imagine is that the legal process reveals that Twitter misled Musk regarding certain topics that were of a material concern. Absent fraud, this would likely result in the social network missing out on both the merger and the $1 billion merger termination fee that it is entitled to. It may have to pay out some money to cover Musk’s legal expenses. Besides this sort of scenario, all likely outcomes are favorable for investors.

The best outcome in the eyes of many shareholders and market speculators would be that the court system forces Musk to pay the full price of the merger in what would ultimately mean upside for investors, from current pricing, of 59.1%. Of course, some agreement at a lower valuation could come to pass. But even that would likely represent a meaningful premium over the company’s current share price.

A more interesting outcome, in my opinion, is one where Twitter is awarded the $1 billion termination fee. According to some sources, the net cost to Musk in this event might be as little as $600 million because of tax implications. Even ignoring the potential cash payout to the company, the end result could ultimately mean more profit for investors in the long run. After all, shares of the business look quite attractive on a forward basis based on financial projections the company provided in its merger documents.

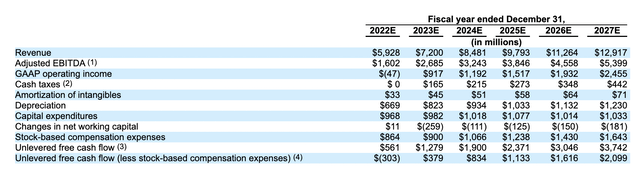

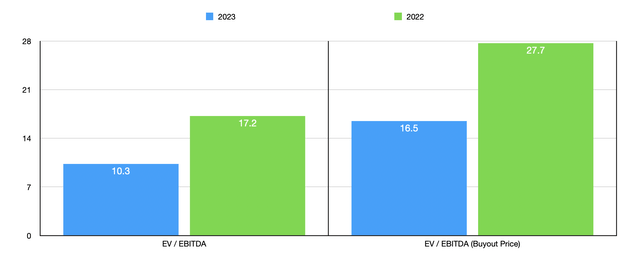

You see, at present, the company is forecasting revenue this year of $5.93 billion. This would represent a 16.8% improvement over the $5.08 billion reported in 2021. This growth is not new. In each of the past five years, the company had seen its revenue increase year over year, with an annualized growth rate in the five years ending in 2021 of 20.1%. Profitability has always been a problem for the company. But current projections call for EBITDA this year of $1.60 billion. That would translate to an EV to EBITDA multiple of 17.2. At the buyout price, this multiple rises to 27.2.

Moving forward, management has high expectations for the company. They currently anticipate revenue in 2023 of $7.20 billion. That would represent an increase of 21.5% over projected figures for 2022. This is, admittedly, down from the $7.50 billion that management had previously forecasted. That latter number was based on the assumption of the number of mDAUs (monetizable daily active users) on the platform rising to 315 million next year. By comparison, the number at the end of the latest quarter was 229 million. At 12.3 million additions per quarter, this is quite a high bar to climb. In the past six quarters, the company is averaged net additions of just under 7 million. However, in the latest quarter alone, its total additions came out to 14.3 million. If management does achieve this target, however, forecasted EBITDA should come out to $2.69 billion. This would bring the EV to EBITDA multiple for the company down considerably to 10.3, or to 16.5 based on the agreed-upon buyout price struck by Musk. Obviously, there is uncertainty about what the future holds. So for many investors, the more favorable outcome would be management successfully forcing the merger agreement. But in my mind, for the long run, I see the company remaining as a standalone publicly traded firm as a more favorable scenario, especially if they can get the termination fee paid to them.

Takeaway

Based on the data provided, I understand that there is a lot of uncertainty over what the future holds. Investors can be fickle and many of them were likely banking on this transaction working out. Certainly, a guaranteed cash payout at a lofty premium is a safe and desirable result for money. But in my view, all of the pain currently experienced is, in all likelihood, the only meaningful pain that investors will probably experience from what has transpired. Absent some massive revelation during court proceedings that would fall under the category of fraud, of which there is no evidence at all at this time, there seems to be no realistic downside for investors moving forward and, whether the deal gets completed, or the company remains a standalone enterprise and receives the termination fee, all signs point to strong catalysts that could push shares higher moving forward. Because of these factors, I have decided to rate the enterprise a ‘buy’ at this time.

Be the first to comment