Drew Angerer

Twilio Inc. (NYSE:TWLO) is a leading communications as a service (CaaS) provider. The company’s platform acts as the backbone communications infrastructure for 286,000 customers which include many leading companies such as Airbnb (ABNB), Netflix (NFLX), Deliveroo (OTCPK:DROOF, OTCPK:DLVEY), Salesforce (CRM), and many more. According to GrandView Research, the global unified communications as a service market was worth ~$39 billion in 2020 and is forecasted to grow at a blistering 23.6% compounded annual growth rate (CAGR) up until 2028.

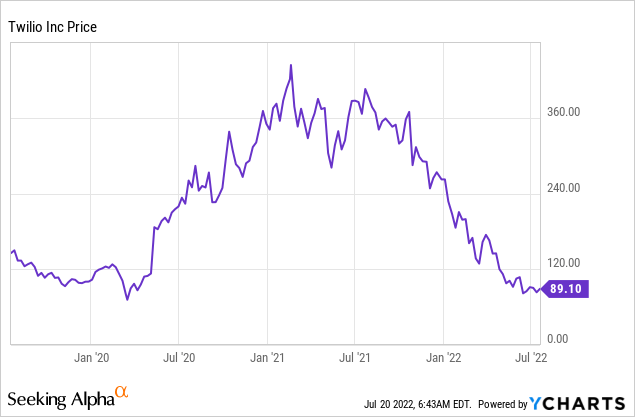

Twilio’s share price went on a monster bull run in 2020 and increased by over 450% to an all-time high of $435/share. However, once the high inflation numbers were announced from March 2021 onwards, the stock price was butchered by ~78%. Given this extreme pullback, the stock is now undervalued according to my discounted cash flow model and the company has many industry growth tailwinds ahead. Let’s dive into the Business Model, Financials, and Valuation for the juicy details.

Strong Business Model

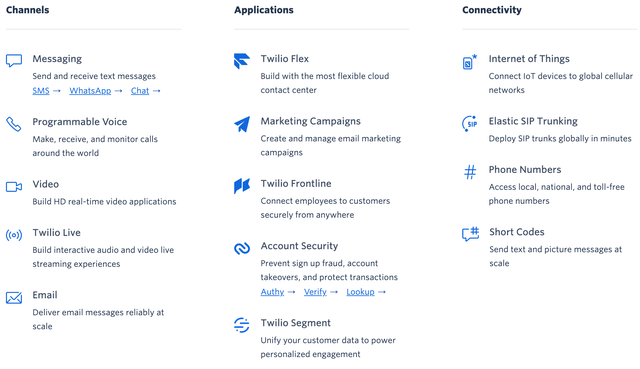

Twilio’s products can be segmented across three main areas; Channels, Applications and Connectivity. Its Communications “Channels” are what the company is most well known for. Twilio’s platform enables automated text messages, emails and even phone calls to be delivered at scale. For example, when a customer like Netflix wants to send a bulk text message offer to its 200 million subscribers, it can do this through Twilio. Another example is when your food delivery service sends you an automated text message to confirm your order is “on the way,” this can also be enabled with Twilio. Twilio is also a master of real-time video and live streaming applications.

Twilio Products (Official Website)

In terms of cloud based Applications, Twilio Flex is the company’s “Cloud Contact Center” product. Traditional brick and mortar contact or call centers have high office rental overheads and are not easily scalable to cope with growing customer demands. However, with a “Cloud Contact Center,” companies can have a distributed workforce of call center agents working remotely. They can easily scale their operations to bring more agents online when needed and don’t have to lease extra office space. Thus it’s no surprise that according to one study, the cloud-based contact center market size was worth $11.5 billion in 2020 and is forecasted to be worth over $36.1 billion by 2025, growing at a blistering 25.8% compounded annual growth rate.

Marketing Campaigns is a Twilio application used for automated email marketing campaigns. There are many competitors in this market, from Mailchimp (INTU) to Adobe Marketo (ADBE) and HubSpot (HUBS). Therefore, I don’t imagine this will be a major growth driver for the company, but it can act an as upsell opportunity for existing customers. In addition, Twilio’s Marketing offering has recently improved astronomically after an acquisition of Segment a market leading Customer Data Platform (CDP).

Twilio acquired Segment for approximately $3.2 billion in Twilio Class A stock. This was a brilliantly timed move, as this acquisition was complete in November 2020, when the stock price was at an extremely high and valuable level before the crash. Thus, effectively this meant fewer shares were required to purchase it. In addition, a Customer Data Platform is becoming essential for enterprises producing tons of big data daily. In a Digital Marketing team, there might be 20+ analytics sources from Google (GOOG, GOOGL) ads, Facebook (META) ads, Google Analytics, Email automation platforms, and various other website plugins. The issue with this is the data is it’s “siloed” in each application and integrations must be programmed manually to connect them together.

However, with a “Customer Data Platform (CDP)” such as Segment, data from a plethora of analytics platforms can be brought together easily in one place and insights can be derived. This data helps to create a 360′ view of the customers journey and then Twilio Engage can be used for personalized marketing with real time data. This service also helps with localization of marketing content and helps businesses to scale with a data driven approach.

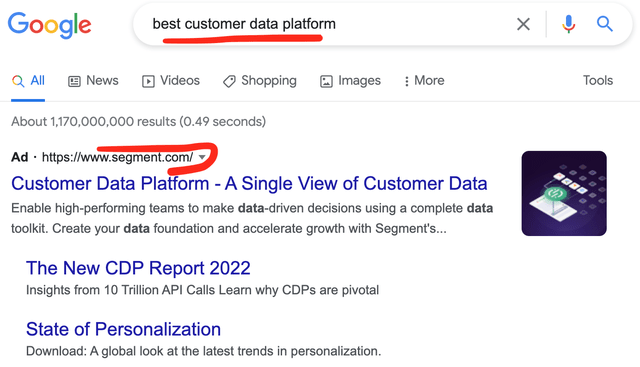

The Segment platform was ranked number one for CDP market share by IDC in 2020. In addition, a google search for “Best Customer Data Platform” shows Twilio is paying for the top spot on Google search, which is a signal they are pushing the platform.

Best Customer Data Platform (Author Google Search in Incognito mode)

Note: I completed the above search in “Incognito mode” to avoid bias from past interaction with Twilio’s website.

Other offerings by Twilio include; toll-free phone number setup, short codes, and even the ability to connect IoT (Internet of Things) devices to cellular networks. This is another game-changing application, as IoT to cellular can be used to enable a device such as an Amazon (AMZN) Alexa to make calls and texts automatically.

Growing Financials

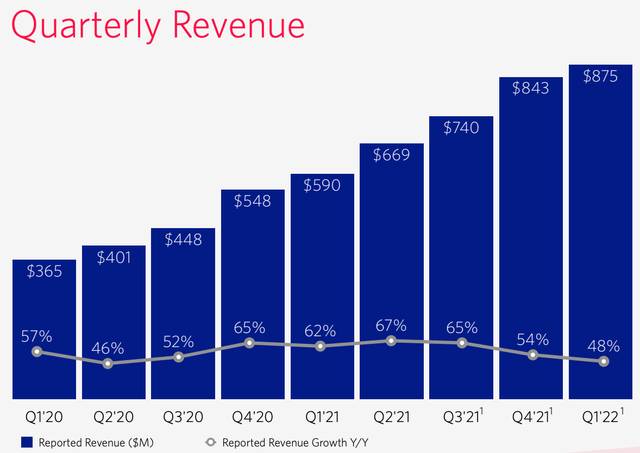

Twilio generated strong financials for the first quarter of 2022. Revenue was $875 million, up a blistering 48% compared to the same period last year. The majority of this ($780 million) was from pure organic revenue growth (not including acquisitions) and increased by 35% year over year.

Quarterly Revenue (Q1 Earnings report)

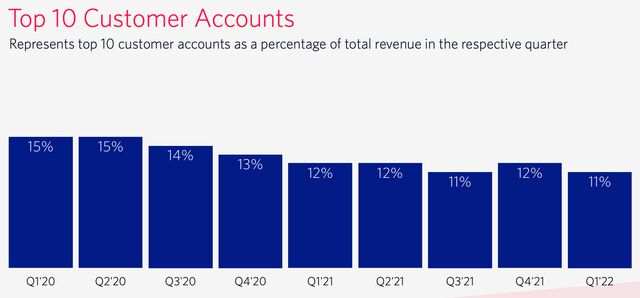

Twilio has also increased its revenue diversification with 35% of revenue generated internationally in Q122, up from 29% in the first quarter of 2021. In addition, the company’s top 10 customer accounts recently made up just 11% of revenues as opposed to 15% in the first quarter of 2020.

Top 10 Customer Accounts (Earnings Report)

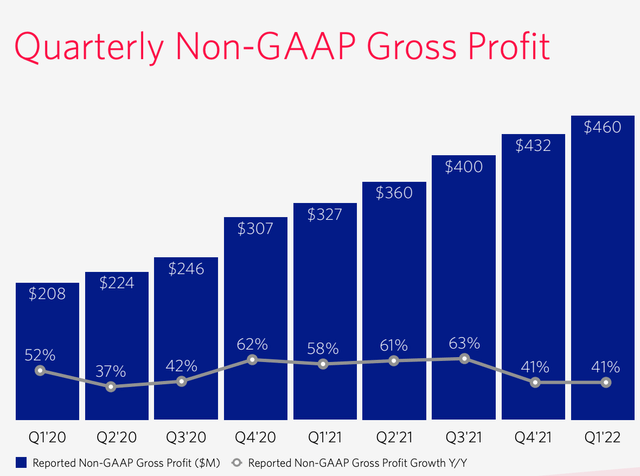

Gross profit generated strong growth of 41% in Q122 to $460 million, on a Non-GAAP Basis. Although this was lower than the figures seen between Q32020 and Q32021.

Gross Profit (created by author Ben at Motivation 2 Invest)

Twilio generated breakeven EPS (Normalized) of $0.00, which beat analyst expectations by $0.21. In addition, the company generated a fantastic dollar-based Net Expansion of 127%, which shows customers are staying with the platform and spending more through upsells and cross-sell opportunities. This figure was up 1% from the prior quarter but down from the 133% generated in the first quarter of 2021. The decline year-over-year is something to watch, but not a major issue currently given the high rate.

Twilio has a fortress balance sheet with $5.2 billion in cash and short-term investments and $1.3 billion in total debt.

Twilio is guiding for 36% revenue growth for the second quarter of 2022, with 27% to 28% of this being organic. Now, although this is lower than the 48% growth achieved in Q1, it is still strong overall.

Advanced Valuation

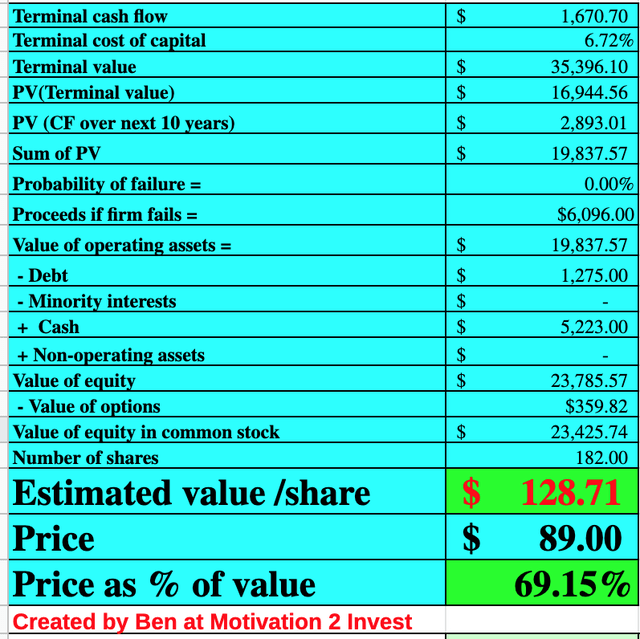

In order to value Twilio stock, I have plugged in the latest financials into my advanced valuation model, which uses the discounted cash flow (“DCF”) method of valuation. I have estimated a conservative 34% revenue growth for next year and 20% for the next 2 to 5 years.

Twilio Stock Valuation 1 (created by author Ben at Motivation 2 Invest)

In addition, I have margins to increase to 23% within the next 5 years as the company continues to scale and acquisition synergies start to come to fruition. I have also capitalized R&D investments in order to increase the accuracy of the valuation.

Twilio Stock Valuation (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $128/share. The stock is currently trading at ~$89 at the time of writing, and thus is ~30% undervalued, which represents a margin of safety.

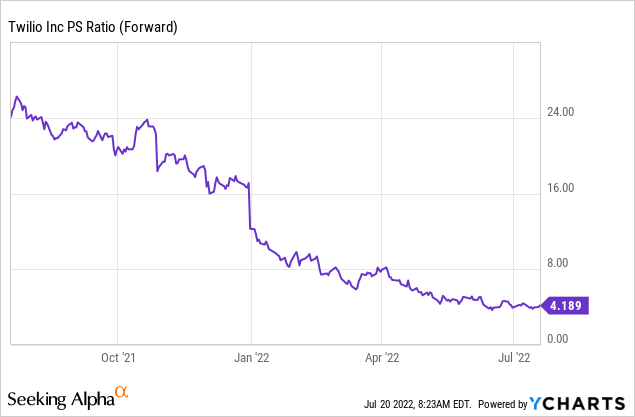

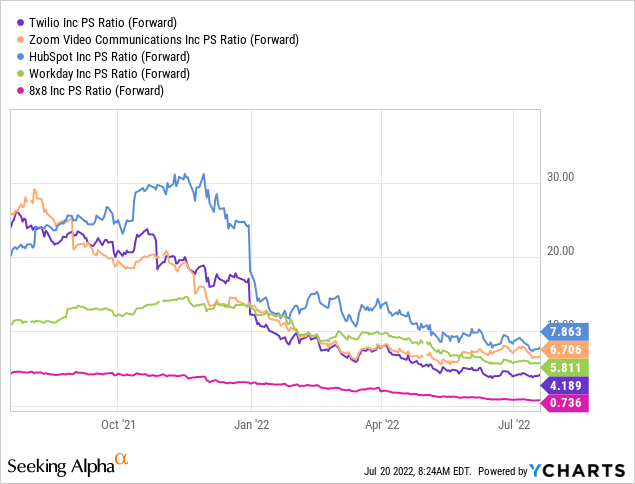

Twilio trades at a price-to-sales ratio = 4.2, which is the lowest level since 2017 and even lower than the pandemic low of P/S = 9.

Relative to a few other software as a service (“SaaS”) companies in the marketing and communications sector. Twilio trades at the lower end of the spectrum with a P/S (forward) = 4.2.

Risks

Recession Slowdown and Profitability

Morgan Stanley has recently slashed communication software stock price targets due to higher interest rate environment and temporary slowdown in IT spending. The market is increasingly focusing on strong profitability and free cash flow generation, and thus Twilio’s negative operation margin could be an issue. However, on a positive note, analysts still have a $160 price target (down from $240), still significantly higher than the share price at the time of writing.

Final Thoughts

Twilio is a tremendous company which is poised to benefit from the secular growth in communications, cloud contact centers and IoT connectively. The company is generating strong revenue growth, and even with conservative estimates the stock is now undervalued. Thus, this could be a great opportunity for the long-term investor.

Be the first to comment